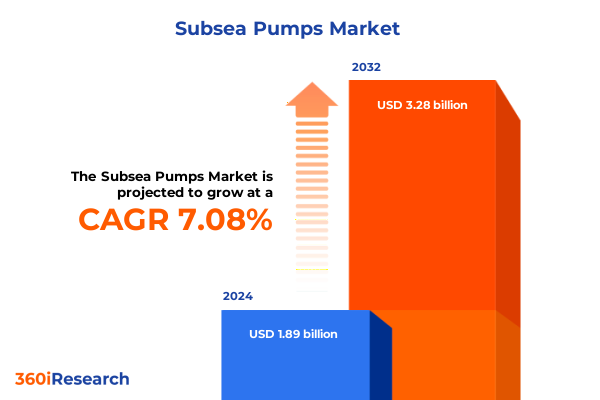

The Subsea Pumps Market size was estimated at USD 2.03 billion in 2025 and expected to reach USD 2.17 billion in 2026, at a CAGR of 7.10% to reach USD 3.28 billion by 2032.

Unveiling the Critical Role, Technological Advancements, and Strategic Importance of Subsea Pump Systems in Modern Offshore Energy Developments

In today’s rapidly evolving offshore energy environment, subsea pump systems play an indispensable role in maintaining production stability and operational efficiency in deepwater and ultra-deepwater fields. These specialized pumps must endure extreme pressures, corrosive seawater conditions, and extended service intervals without compromising reliability. Advances in materials science, extreme environment electronics, and real‐time monitoring capabilities have collectively elevated the performance thresholds of subsea pumping solutions. As energy operators push into more challenging reservoirs, the demand for robust, adaptable, and low-maintenance pump systems has never been higher.

This executive summary distills key findings from a detailed market research initiative focused on the subsea pump industry. Intended for senior decision-makers, technology strategists, and supply chain managers, it highlights transformative trends in product development, regulatory landscapes, and competitive dynamics. It offers a concise yet comprehensive overview of the forces driving change, complemented by actionable insights designed to inform capital allocation, technology partnerships, and go-to-market strategies. Readers will gain an informed perspective on emerging opportunities, potential risks, and strategic imperatives critical to securing a leadership position in the subsea pump sector.

Navigating the Transformative Technological, Operational, and Environmental Shifts Reshaping the Subsea Pump Landscape

The subsea pump landscape is undergoing a fundamental transformation driven by innovations in digitalization, advanced materials, and integrated system architectures. On one front, the integration of digital twins, wireless sensor networks, and machine learning analytics has enabled proactive maintenance strategies and reduced unplanned downtime. Engineers now overlay high-fidelity simulations with live performance data to predict component fatigue, optimize operational parameters, and extend service intervals. Simultaneously, breakthroughs in corrosion-resistant alloys and composite coatings are enabling pumps to withstand harsher environments at greater ocean depths, pushing the boundaries of subsea development.

Concurrently, operational models are shifting toward more flexible and service-oriented frameworks. Providers are bundling pumps with remote monitoring platforms and outcome-based service agreements, aligning incentives around uptime and lifecycle cost reduction. This model encourages continuous innovation in reliability engineering and post-installation support. Environmental imperatives are also reshaping the industry; sustainability targets are driving the adoption of electric drive systems powered by offshore renewables and the exploration of low-emission hydraulic fluids. These combined technological, operational, and environmental shifts are redefining the subsea pump ecosystem, presenting new opportunities for agile providers to differentiate and capture value.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Subsea Pump Supply Chains and Cost Structures

In 2025, the United States implemented a series of additional tariff measures targeting imported mechanical equipment, including subsea pump assemblies, under broader Section 232 and Section 301 authorities. These duties, which range from 10 to 25 percent on finished pump units and critical components, have added complexity to sourcing strategies for operators and OEMs. Many global suppliers have historically relied on low-cost manufacturing hubs in Asia and Europe to produce precision-engineered pump parts. The newly introduced tariffs have, however, elevated landed costs and introduced an imperative to reassess supplier footprints and inventory strategies.

The cumulative impact of these measures is most pronounced in capital expenditure planning and total cost of ownership calculations. To mitigate tariff liabilities, operators are evaluating nearshoring options for pump fabrication and exploring tariff engineering techniques, such as disaggregating modular units to qualify for lower-duty classifications. Some companies have accelerated partnerships with domestic fabricators to localize production of impellers, shafts, and electronic control modules. Although these adjustments entail initial retooling investments, they also offer long-term benefits in supply chain resilience and reduced exposure to policy volatility. Ultimately, the 2025 United States tariffs are prompting a structural realignment of subsea pump supply chains with a renewed emphasis on domestic capability and strategic diversification.

Unlocking Differentiated Market Opportunities Through Detailed Segmentation Analysis of Subsea Pump Types, Flows, Materials, and End Uses

A nuanced segmentation framework offers critical insight into competitive dynamics and unmet needs within the subsea pump market. When categorizing installations by pump type, centrifugal, reciprocating, and screw technologies each address distinct operating envelopes. Centrifugal pumps are distinguished by multi-stage machines, which deliver higher differential pressures, and single-stage designs optimized for lighter duty cycles. Reciprocating pumps segregate into piston-driven units for precise volume control and plunger-based variants suited for high-pressure injection. Meanwhile, triple screw and twin screw configurations in screw pumps provide advantages in volumetric efficiency and ability to handle viscous fluids.

Flow rate segmentation further clarifies application fit, differentiating between high-flow demands for rapid reservoir drawdown, medium-flow profiles for steady production, and low-flow scenarios in tieback or marginal field developments. Material construction is pivotal, with duplex stainless steel offering a balance of strength and corrosion resistance, nickel alloy preferred for ultra-chloride environments, and titanium reserved for the most aggressive brine conditions. Electrically driven deployments leverage subsea power umbilicals to deliver precise motor control, while hydraulically driven systems remain integral where topside power availability is constrained. End-use industries are equally varied: offshore drilling platforms-spanning drillships, jack up rigs, and semi submersibles-require ruggedized, high-capacity pumps; offshore wind farms employ fixed and floating foundations with moderate flow demands; and oil & gas exploration and production operations depend on both surface-tied and fully subsea boosting for exploration wells and field development.

This comprehensive research report categorizes the Subsea Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Flow Rate

- Material Construction

- Deployment Type

- End Use Industry

Gaining Strategic Competitive Advantage by Examining Regional Dynamics Across the Americas, EMEA, and Asia-Pacific Subsea Pump Markets

Regional dynamics underscore divergent growth trajectories and investment priorities across the Americas, Europe, the Middle East & Africa, and Asia-Pacific. In the Americas, deepwater activities in the Gulf of Mexico continue to drive demand for high-pressure centrifugal and reciprocating pumps, while emerging play economics in Brazil’s pre-salt frontier catalyze interest in titanium and nickel alloy solutions. Regulatory support for localized manufacturing in the United States is also stimulating partnerships between OEMs and domestic fabricators to develop nearshore assembly hubs and reduce tariff exposures.

In the Europe, Middle East & Africa region, aging North Sea fields are undergoing integrity upgrades to extend plateau production, leading to retrofitting opportunities for modular electrically driven units. The Middle East is investing heavily in subsea boosting for ultra-low permeability reservoirs, with large-scale subsea compression pilot projects highlighting the role of multi-stage centrifugal pumps. West African developments are prioritizing robust corrosion-resistant materials amid aggressive offshore conditions. Across Asia-Pacific, China’s offshore wind expansion is creating a sizable market for medium-flow, electrically driven pumps, while Australia’s gas-centric offshore projects emphasize heavy-duty hydraulically driven systems capable of managing high-pressure wellheads. Japan and Southeast Asian nations are similarly integrating subsea boosting to maximize late-life field recovery, driving a blended demand profile that spans the entire pump spectrum.

This comprehensive research report examines key regions that drive the evolution of the Subsea Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Market Leaders and Innovators Driving Technological Breakthroughs and Strategic Partnerships in the Global Subsea Pump Sector

The subsea pump sector is defined by a handful of global players that combine research and development prowess with extensive service networks. Baker Hughes leads with its integrated subsea boosting solutions, leveraging advanced electric motor drives, digital twin analytics, and aftermarket service agreements to secure long-term field partnerships. TechnipFMC distinguishes itself through modular pump architectures designed for rapid mobilization and de-mobilization, appealing to operators focused on short-cycle development economics.

Aker Solutions leverages its flow assurance expertise to co-develop tailored pump packages with bespoke materials and coatings, while Schlumberger’s foray into subsea boosting integrates its seismic data capabilities to optimize pump placement and reservoir management. Flowserve continues to expand its footprint via joint ventures with fabrication yards, ensuring proximity to key offshore hubs and reducing lead times. Sulzer’s emphasis on additive manufacturing and rapid prototyping has accelerated the introduction of next-generation impeller designs, enhancing volumetric efficiency across high-pressure applications. These leading incumbents are actively pursuing strategic alliances with fiber-optic sensor providers, renewable energy integrators, and aftermarket specialists to diversify revenue streams and create full-service subsea asset life-cycle solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Subsea Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Aker Solutions ASA

- Baker Hughes Company

- EPSCO Global Resources Ltd.

- Flowserve Corporation

- ITT Inc.

- Schlumberger Limited

- Siemens Energy AG

- TechnipFMC plc

- Weatherford International PLC

- Weir Group PLC

Implementing Actionable Strategies for Industry Leaders to Enhance Competitiveness, Mitigate Risks, and Fuel Sustainable Growth in Subsea Pump Market

Industry leaders should prioritize supply chain diversification to hedge against tariff volatility and geopolitical tensions. Establishing strategic partnerships with fabricators across multiple regions, including selective nearshoring and free trade zone activation, can mitigate duty risks and shorten lead times. Concurrently, organizations must invest in digital platforms that integrate pump performance data with upstream and downstream production analytics. This holistic approach enables predictive maintenance strategies that maximize operational uptime and optimize inventory management for critical spare parts.

Embracing electric drive integration and energy recovery systems will be key to meeting evolving environmental regulations and corporate sustainability goals. Operators should collaborate with renewable energy providers to power subsea compressor stations, reducing carbon intensity and leveraging emerging offshore wind potential. At the same time, standardizing interface protocols and modular pump designs can streamline offshore installation campaigns and facilitate rapid upgrades as field conditions evolve.

Collaborative research initiatives between OEMs, academic institutions, and service providers will accelerate the development of advanced materials and AI-driven control algorithms. By co-investing in pilot projects and open innovation consortia, stakeholders can share risk, validate emerging technologies at scale, and establish industry-wide best practices. Together, these strategies can fortify market resilience, drive cost efficiencies, and unlock new value pools across the subsea pump ecosystem.

Ensuring Robustness and Credibility Through a Rigorous Mixed-Method Research Methodology in Subsea Pump Market Analysis

This analysis is built on a rigorous mixed-method research framework combining primary interviews, secondary data collection, and quantitative validation. Primary research included in-depth interviews with senior engineering and procurement executives from oil majors, offshore service providers, and pump manufacturers. Insights from these discussions were complemented by site visits to key fabrication yards and technical workshops focused on material selection and seal technology.

Secondary research drew on industry publications, technical white papers, patent filings, and regulatory databases to map the evolution of subsea pump architectures and emerging tariff policies. These sources informed a detailed segmentation model that disaggregates market demand by pump type, flow rate, material construction, deployment type, and end-use industry. Quantitative estimates were triangulated through shipment data, proprietary supplier reports, and consensus checks with financial analysts.

Quality assurance protocols included multiple rounds of expert validation, where key findings were reviewed by independent technical advisors and commercial strategists. All insights were stress-tested through scenario analysis to ensure reliability under various economic, regulatory, and technological conditions. This comprehensive methodology underpins the report’s credibility, equipping decision-makers with robust, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Subsea Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Subsea Pumps Market, by Pump Type

- Subsea Pumps Market, by Flow Rate

- Subsea Pumps Market, by Material Construction

- Subsea Pumps Market, by Deployment Type

- Subsea Pumps Market, by End Use Industry

- Subsea Pumps Market, by Region

- Subsea Pumps Market, by Group

- Subsea Pumps Market, by Country

- United States Subsea Pumps Market

- China Subsea Pumps Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesis of Key Insights and Strategic Imperatives Shaping the Future Path of Subsea Pump Adoption and Innovation

As offshore energy operators and service providers navigate an increasingly complex environment, subsea pumps emerge as critical enablers of productivity, cost efficiency, and environmental stewardship. The convergence of digital transformation, advanced material science, and outcome-based service models is creating a new competitive frontier where agility and innovation define success. Companies that harness predictive analytics, modular design principles, and localized manufacturing will be best positioned to respond swiftly to market disruptions and policy shifts.

The 2025 United States tariff measures underscore the need for supply chain agility and diversified sourcing strategies, while segmentation insights reveal untapped opportunities across differing pump technologies, flow profiles, and end-use scenarios. Regional analysis highlights unique growth drivers, from deepwater exploration in the Americas to wind-powered electrification in Asia-Pacific, emphasizing the importance of tailored market approaches.

Looking ahead, strategic collaboration among OEMs, operators, regulators, and research institutions will accelerate the development of next-generation subsea pump systems capable of delivering higher efficiency, reduced emissions, and enhanced reliability. By aligning technology roadmaps with evolving field requirements and policy landscapes, stakeholders can secure competitive advantage and support the sustainable expansion of offshore energy resources.

Take the Next Step Toward Informed Investment by Consulting Our Associate Director to Acquire the Comprehensive Subsea Pump Market Research Report

To gain a competitive advantage from the insights and analyses presented in this executive summary, reach out today to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the full market research report. The comprehensive study provides in-depth perspectives on technological innovations, tariff impacts, detailed segmentation breakdowns, regional dynamics, and leading players shaping the subsea pump landscape. Empower your strategic planning with actionable data, expert forecasts, and practical recommendations designed to optimize supply chains, accelerate digital integration, and drive sustainable growth.

Connect with Ketan Rohom to discuss package options tailored to your organization’s needs, arrange a personalized briefing, or explore licensing agreements. Take the next step in strengthening your market position and making informed decisions by partnering with an experienced research team. Contact Ketan Rohom now to access the definitive guide on subsea pump market developments and unlock unparalleled strategic insights that will elevate your business performance.

- How big is the Subsea Pumps Market?

- What is the Subsea Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?