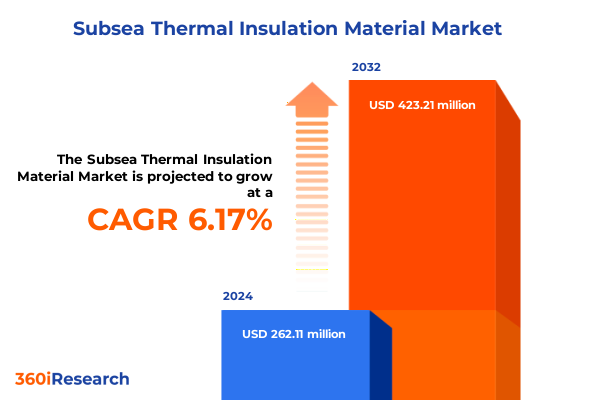

The Subsea Thermal Insulation Material Market size was estimated at USD 276.97 million in 2025 and expected to reach USD 293.62 million in 2026, at a CAGR of 6.24% to reach USD 423.21 million by 2032.

Exploring the Transformative Power of Subsea Thermal Insulation Solutions Amid Evolving Operational and Environmental Demands

Thermal insulation stands as a cornerstone of subsea engineering, providing the essential thermal barrier that enables hydrocarbon and renewable fluid transport across challenging marine environments. By preserving operational temperatures and preventing hydrate formation, insulation systems safeguard flow integrity, optimize production uptime, and mitigate integrity risks associated with wax deposition and thermal stresses. As offshore developments move into deeper and harsher waters, the demands placed upon insulation materials have intensified, driving a wave of innovation and strategic realignment across the industry.

In recent years, the push for more sustainable offshore energy solutions has heightened interest in advanced insulation technologies that deliver superior performance with reduced environmental impact. Against this backdrop, stakeholders-from materials suppliers and service providers to operators and regulators-must navigate a complex matrix of technical requirements, regulatory pressures, and supply chain considerations. This report provides a structured overview of the current subsea thermal insulation landscape, identifying critical trends, tariff implications, segmentation insights, and regional dynamics to inform strategic planning.

Through a comprehensive lens, the following sections dissect the transformative shifts reshaping material development, analyze the cumulative effects of new United States tariffs, and offer actionable recommendations. Together, these insights empower decision-makers to align investments, optimize project outcomes, and maintain a competitive edge in a rapidly evolving offshore sector.

Uncovering the Major Technological and Market Shifts Reshaping the Global Subsea Thermal Insulation Landscape

The subsea thermal insulation market has witnessed profound shifts driven by the convergence of deeper water operations, digital transformation, and heightened sustainability mandates. Material developers are increasingly prioritizing ultra-low thermal conductivity solutions such as silica-based aerogels and advanced composite elastomers, which deliver enhanced thermal retardation while reducing system weight and installation complexity. Concurrently, real-time monitoring and predictive analytics solutions are being integrated into insulation assemblies, enabling operators to detect performance deviations and optimize maintenance intervals.

In tandem, environmental regulations and carbon reduction goals have spurred demand for materials with lower embodied energy and decreased life cycle emissions. The industry is responding with innovations in bio-based elastomers and recyclable polymer matrices that maintain requisite thermal properties without compromising ecological stewardship. Moreover, as electrification gains traction for subsea pumps and control systems, insulation products are evolving to accommodate new thermal profiles, ensuring reliable performance under both high-temperature oil flow and ambient seawater exposure.

These technological and regulatory drivers have catalyzed strategic partnerships between material scientists, offshore service firms, and digital solution providers. Such collaborations are breaking down traditional silos, fostering integrated thermal management ecosystems that combine materials, monitoring hardware, and data-driven analytics for holistic flow assurance. As a result, organizations willing to embrace these transformative trends are positioned to deliver more resilient and cost-effective subsea installations.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Subsea Thermal Insulation Supply Chains and Costs

The introduction of new United States tariffs in early 2025 has reverberated across the subsea thermal insulation supply chain, compelling stakeholders to reassess sourcing strategies and cost structures. Tariffs targeting imported polymer and composite insulation materials have elevated landed costs, prompting manufacturers to revise pricing models and negotiate adjusted commercial terms with key customers. As project operators face tighter capital discipline, cost pass-through negotiations have intensified, leading to extended procurement cycles and more rigorous supplier prequalification processes.

In response, material producers have accelerated efforts to diversify manufacturing footprints, with some establishing local production hubs in Gulf Coast regions and the Caribbean to mitigate tariff exposure. This reshoring movement has improved supply chain resilience, albeit at the expense of higher fixed overhead and initial capital outlays. Meanwhile, strategic alliances with domestic specialty chemical providers have emerged as a means to secure preferential access to raw materials and co-develop tariff-exempt formulations.

Cumulatively, these tariff-driven shifts have altered competitive dynamics, favoring vertically integrated players and regional suppliers capable of local delivery without tariff markup. Forward-looking organizations are leveraging data-driven procurement platforms to model tariff impacts, optimize inventory buffers, and preemptively adjust contract terms. As the dust settles on these tariff measures, the industry’s ability to adapt supply chain architectures will prove critical in controlling total cost of ownership and ensuring seamless project execution.

Deep Dive into Diverse Market Segmentation Reveals Unique Drivers Shaping Subsea Thermal Insulation Adoption Patterns

A nuanced view of market segmentation offers vital context for understanding demand patterns and technology adoption. Segmentation by material type highlights a clear divide between legacy polymer solutions and emerging high-performance options. Aerogels command attention for ultra-low thermal conductivity, while epoxy-based composites maintain niche applications where chemical resistance and structural rigidity are paramount. Thermoplastic solutions like polypropylene and silicone rubber serve mid-tier performance requirements, and polyurethane retains dominance through its balance of cost, flexibility, and thermal performance, with the flexible variant often specified for dynamic risers and the rigid form favored in static pipe-in-pipe assemblies.

When depth becomes a differentiator, installations below 500 meters generally adopt proven polyurethane and silicone rubber systems that simplify installation and inspection. Midwater projects in the 500–3,000 meter range drive demand for hybrid composites that leverage aerogel cores encased in lightweight polymer jackets. In ultra-deep applications beyond 3,000 meters, specialized epoxy and reinforced polyurethane formulations are selected to withstand extreme hydrostatic pressures and thermal gradients.

Distribution channels also shape accessibility and speed to market. Traditional offline channels retain a strong presence for large-scale project procurement, enabling hands-on material validation and bundled service offerings. However, the rise of online platforms accelerates procurement cycles for smaller orders, aftermarket spare parts, and replacement modules, particularly among agile offshore contractors.

Different applications exhibit distinct insulation requirements. Field joints demand customizable wrap-around solutions that accommodate manifold geometries, whereas pipe coverings often leverage prefabricated modules designed for rapid on-site installation. Pipe-in-pipe configurations integrate rigid foam segments within secondary casings for dual-barrier integrity, and subsea trees require tailored insulation collars with integrated thermal monitoring capabilities.

Installation type further affects material selection and logistics planning. New installation projects favor turnkey insulation assemblies designed for minimal field modification, while replacement and upgrade scenarios prioritize retrofit-friendly materials that match existing hardware interfaces and deployment methodologies. Finally, end-user profiles reveal divergent priorities: offshore oil and gas operators emphasize long-term performance, regulatory compliance, and cost predictability, whereas renewable energy developers increasingly value lighter-weight, environmentally benign materials that align with green credential standards.

This comprehensive research report categorizes the Subsea Thermal Insulation Material market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Water Depth

- Distribution Channel

- Application

- Installation Type

- End-User

Comparative Regional Perspectives Highlight Distinct Opportunities and Challenges in Subsea Thermal Insulation Across Key Geographies

Regional dynamics exert a profound influence on subsea thermal insulation strategies, as local operational conditions and regulatory frameworks drive material choices and service approaches. In the Americas, a mature offshore oil and gas sector coexists with burgeoning renewable energy projects in South America’s deepwater basins. Operators here typically balance proven polyurethane and silicone rubber systems with targeted trials of aerogel-enhanced composites, leveraging Gulf Coast manufacturing clusters for quick-turn deliveries and localized technical support.

Moving eastward, Europe, the Middle East, and Africa present a heterogeneous mix of regulatory environments. North Sea operators adhere to stringent thermal performance standards, driving high adoption of advanced composites despite steeper unit costs. In contrast, the Middle East’s focus on ultra-deep exploration has nurtured local fabrication facilities for reinforced polyurethane modules, while African markets often rely on turnkey offshore service providers that bundle insulation supply with installation and maintenance services to reduce logistical complexity.

Across the Asia-Pacific region, expansive offshore developments in China, Australia, and Southeast Asia combine strategic emphasis on cost competitiveness with growing environmental scrutiny. Manufacturers have responded by scaling up local production of recyclable polymer options and partnering with regional OEMs to embed thermal insulation within integrated flowline assemblies. Such collaborations are accelerating technology transfer and enabling operators to meet both economic and sustainability objectives.

This comprehensive research report examines key regions that drive the evolution of the Subsea Thermal Insulation Material market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Driving Advances in Subsea Thermal Insulation Material Technology

The subsea thermal insulation arena is characterized by a blend of established conglomerates and nimble specialists, each contributing unique strengths to the value chain. Material innovators such as Cabot Corporation and Aerogel Technologies have spearheaded research into next-generation silica-based aerogels, continuously driving down thermal conductivity while improving mechanical robustness. At the same time, polymer specialists like BASF and Evonik Technologies focus on developing low-emission polyurethane and silicone rubber formulations that meet evolving environmental regulations.

On the service side, integrated oilfield providers including Baker Hughes and TechnipFMC leverage global project management capabilities to offer end-to-end insulation solutions-combining in-house manufacturing with on-site engineering support. These players benefit from economies of scale and the ability to bundle thermal insulation with comprehensive flow assurance services. Conversely, niche suppliers such as Sheico and Parker Integrated Systems emphasize customization, delivering tailor-made insulation collars and join-wrap solutions that address unconventional geometries and retrofit requirements.

Strategic partnerships between traditional material producers and digital solution vendors are also reshaping the competitive landscape. Collaborations aim to embed sensors and data platforms directly into insulation assemblies, enabling condition-based maintenance and real-time thermal performance analytics. This convergence of material science and digital technologies underscores the industry’s shift toward outcome-based service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Subsea Thermal Insulation Material market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Aerogel Technologies, LLC

- AFG Holdings, Inc.

- Armacell

- Aspen Aerogels, Inc.

- Baker Hughes Company

- Balmoral Comtec Ltd.

- BASF SE

- Benarx

- Cabot Corporation

- DeepSea Technologies, Inc.

- DuPont de Nemours, Inc.

- Guangdong Alison Hi-tech Co. Ltd.

- LFM Energy

- Nano Tech Co. Ltd

- OffshoreTechnology

- Perma-Pipe International Holdings, Inc.

- ROCKWOOL A/S

- Shawcor Ltd.

- TechnipFMC PLC

- The Dow Chemical Company

- Trelleborg Group

- Yancheng Advanced Insulation Co.,Ltd.

Action-Oriented Guidance for Industry Stakeholders to Navigate Complexity and Capitalize on Growth in Subsea Insulation Markets

Industry leaders can seize market opportunities by adopting a multifaceted strategy that blends material innovation, supply chain agility, and digital integration. First, accelerating research and development in bio-based and recyclable polymers will address regulatory pressures and differentiate offerings on sustainability credentials. Organizations should establish cross-functional R&D consortia that unite chemical engineers, offshore service experts, and environmental scientists to fast-track next-generation formulations.

Simultaneously, companies must diversify manufacturing footprints to minimize tariff exposure and improve responsiveness to regional demand fluctuations. Expanding production hubs in strategic offshore basins-coupled with localized technical support centers-will reduce lead times and strengthen client relationships. Embedding flexibility into supply contracts through dynamic sourcing agreements will enable rapid shifts between raw material suppliers as market conditions evolve.

Digital transformation must undergird these efforts. By integrating thermal performance sensors into insulation products and deploying data analytics platforms, service providers can transition from periodic maintenance schedules to predictive, condition-based service models. This shift enhances operational reliability for end users and opens recurring revenue streams tied to performance guarantees.

Lastly, forging strategic alliances with subsea equipment OEMs and engineering firms will secure early specification of advanced insulation systems in project design phases. Collaborative pilots and joint field trials will de-risk new technologies and accelerate commercial adoption. By pursuing these initiatives in concert, industry stakeholders can navigate complexity, optimize total cost of ownership, and establish leadership positions in the subsea insulation domain.

Robust Mixed-Method Research Approach Underpins Insights into Subsea Thermal Insulation Industry Dynamics and Stakeholder Perspectives

This research draws upon a mixed-methods framework designed to deliver robust, triangulated insights into the subsea thermal insulation market. Primary research included in-depth interviews with technical directors, project engineers, and procurement leads at operators, service providers, and material manufacturers. These qualitative discussions illuminated evolving performance requirements, procurement challenges, and regional supply chain dynamics.

Secondary research involved a comprehensive review of industry white papers, regulatory filings, and peer-reviewed academic journals focused on polymer science and offshore engineering. Patent analyses were conducted to map innovation trajectories and identify players at the forefront of thermal performance breakthroughs. Additionally, publicly available trade data and government tariff schedules were examined to quantify the recent impact of United States tariff measures on material flows.

Data validation entailed cross-referencing findings from multiple sources and conducting follow-up consultations to reconcile any discrepancies. Where necessary, statistical extrapolation techniques were applied to aggregate qualitative inputs into coherent thematic insights without disclosing proprietary project-level information. The resulting report reflects a balanced synthesis of technical, commercial, and geopolitical considerations, providing stakeholders with a holistic understanding of the subsea thermal insulation landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Subsea Thermal Insulation Material market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Subsea Thermal Insulation Material Market, by Material Type

- Subsea Thermal Insulation Material Market, by Water Depth

- Subsea Thermal Insulation Material Market, by Distribution Channel

- Subsea Thermal Insulation Material Market, by Application

- Subsea Thermal Insulation Material Market, by Installation Type

- Subsea Thermal Insulation Material Market, by End-User

- Subsea Thermal Insulation Material Market, by Region

- Subsea Thermal Insulation Material Market, by Group

- Subsea Thermal Insulation Material Market, by Country

- United States Subsea Thermal Insulation Material Market

- China Subsea Thermal Insulation Material Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesis of Critical Findings Emphasizes Strategic Imperatives for Subsea Thermal Insulation Stakeholders Moving Forward

Subsea thermal insulation remains a critical enabler of offshore energy production and emerging renewable initiatives, with material innovation and regulatory pressures driving continual evolution. Advanced composites and aerogel-enhanced systems are redefining thermal management capabilities, while new tariff regimes are realigning supply chains and creating opportunities for localized manufacturing. Segmentation insights underscore that adoption patterns vary significantly by material type, water depth, distribution channel, application, installation context, and end-user priorities. Regional dynamics further reinforce that strategies successful in one geography may require adaptation elsewhere.

Leading companies are responding through strategic alliances, digital integration, and targeted R&D investments, forging a path toward more sustainable and efficient subsea insulation solutions. For stakeholders, the imperative is clear: staying ahead of material performance breakthroughs, diversifying supply bases, and embedding predictive analytics into service offerings will be essential to secure future growth.

As offshore developments continue to expand into deeper and more complex environments, the ability to align technological innovation with operational execution will define market leaders. This executive summary distills the critical themes and strategic imperatives necessary for decision-makers to navigate the subsea thermal insulation landscape with confidence and precision.

Connect Directly with Ketan Rohom to Access Exclusive Subsea Thermal Insulation Market Research and Unlock Competitive Advantage Today

We appreciate your time in exploring our in-depth analysis of the subsea thermal insulation materials landscape. To secure immediate access to the complete market research report and gain a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Through a personalized discussion, you can explore tailored insights, request sample chapters, and receive a customized proposal aligned with your organization’s strategic priorities. Engage directly with Ketan to unlock exclusive data on material performance, segmentation nuances, regional dynamics, and company benchmarking. By initiating this dialogue, you position your teams to anticipate market shifts, adapt supply chains effectively, and capitalize on emerging opportunities. Elevate your decision-making process with authoritative intelligence and actionable recommendations crafted by seasoned analysts. Contact Ketan via the contact form on our website to transform insights into impact and drive growth within the subsea thermal insulation sector.

- How big is the Subsea Thermal Insulation Material Market?

- What is the Subsea Thermal Insulation Material Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?