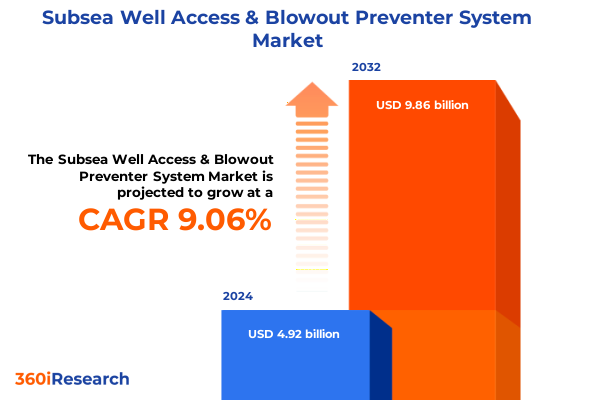

The Subsea Well Access & Blowout Preventer System Market size was estimated at USD 5.36 billion in 2025 and expected to reach USD 5.84 billion in 2026, at a CAGR of 9.09% to reach USD 9.86 billion by 2032.

Pioneering the Evolution of Subsea Well Access and Blowout Preventer Systems to Safeguard Offshore Operations and Drive Technological Leadership

The ever-expanding frontier of offshore oil and gas exploration has underscored the critical importance of dependable subsea well access mechanisms and robust blowout preventer systems. As drilling activities venture into deeper and more remote waters, operators face escalating challenges related to environmental safety, operational reliability, and cost containment. Historically, mechanical integrity and human supervision formed the bedrock of subsea safety frameworks, but the growing complexity of deepwater projects has propelled a parallel evolution in engineering design and digital control architectures. This transition not only reflects advances in material science and hydraulics but also integrates real-time monitoring and automated intervention strategies to mitigate catastrophic events.

In response to heightened regulatory scrutiny and stakeholder expectations, industry participants have adopted a more holistic approach to well containment, emphasizing end-to-end lifecycle management. The introduction of modular interfaces between wellheads and preventer stacks, coupled with enhanced redundancy protocols, has redefined performance benchmarks. Equally important, the integration of remote diagnostic tools has reduced mobilization lead times and strengthened predictive maintenance practices. Consequently, these innovations have laid the groundwork for a new era of subsea resilience, positioning operators to balance productivity gains with uncompromised safety standards.

Looking ahead, the trajectory of blowout preventer development will be shaped by a convergence of digitalization, collaborative supply chain ecosystems, and evolving environmental mandates. This report delves into the key drivers and hurdles influencing subsea well access and containment technologies, offering executive insight into the directional shifts that will determine competitive advantage. Decision-makers will find a structured analysis of technological breakthroughs, policy impacts, and strategic imperatives designed to guide investment and operational planning in the next decade.

Uncovering the Major Technological and Regulatory Transformations Reshaping Subsea Well Access and Blowout Preventer Frameworks Worldwide

The subsea sector is undergoing a fundamental shift as digitalization permeates every facet of well control infrastructure. Advanced sensor networks embedded within blowout preventer stacks now capture pressure, temperature, and flow metrics in real time, enabling centralized monitoring centers to detect anomalies before they escalate into critical incidents. Concurrently, the proliferation of machine learning algorithms has enhanced diagnostic accuracy, providing predictive insights that inform maintenance schedules and reduce unplanned downtime. This integration of cyber-physical systems within subsea environments has not only elevated operational transparency but also streamlined decision cycles, empowering engineering teams to intervene proactively rather than reactively.

Coupled with digital advancements, innovations in materials and manufacturing processes are redefining component resilience and performance. High-strength alloys and composite reinforcements have extended the lifespan of ram elements under extreme pressure cycles, while additive manufacturing techniques accelerate the production of bespoke parts for remote intervention. In parallel, remotely operated vehicles and autonomous underwater vehicles now facilitate precise installation and inspection of well access interfaces, minimizing diver risk and supporting rapid mobilization. The convergence of robotics and advanced actuation modalities offers a glimpse into a future where manned intervention becomes the exception rather than the norm.

Regulatory bodies have responded to these technological breakthroughs by tightening standards and enforcement mechanisms for subsea well containment. The latest guidelines emphasize traceable supply chains, digital record-keeping for component lifecycles, and rigorous validation of software safety integrity levels. These policy shifts are compelling operators and equipment providers to adopt harmonized frameworks that meet or exceed international standards. As a result, compliance is no longer a peripheral consideration but a core strategic objective that intersects with technology roadmaps, procurement policies, and workforce competencies.

Analyzing the Full-Scale Implications of 2025 United States Tariff Measures on Subsea Blowout Preventer Equipment Supply Chains and Costs

In 2025, the United States government extended a suite of tariffs targeting imported subsea oil and gas equipment, including critical components of blowout preventer stacks, under broader trade measures designed to protect domestic manufacturing. These levies, applied to steel fabrications and precision machined parts, aimed to address perceived trade imbalances and bolster the competitiveness of local supply firms. However, the tariffs have introduced a layer of complexity to procurement cycles, with operators facing both increased unit costs and extended lead times as international suppliers adjust their pricing models to reflect new duty structures.

As a consequence, equipment manufacturers have reevaluated their global production footprints. Some have accelerated the development of stateside fabrication facilities to circumvent import duties, while others have renegotiated with logistics partners to optimize cross-border transport. The immediate effect has been an uptick in capital expenditure for inventory stocking, as operators seek to lock in tariff-favorable rates and hedge against further policy volatility. Additionally, the pass-through of higher material costs has translated into elevated total expenditure for subsea well campaigns, prompting teams to scrutinize alternative design configurations that minimize tariff-exposed elements without compromising safety margins.

In response to this evolving trade landscape, many industry stakeholders have pursued collaborative procurement consortia to aggregate demand and secure volume-based discounts. Complementary measures include diversifying supplier portfolios to incorporate manufacturers in regions exempt from U.S. duties, as well as leveraging trade agreements to benefit from tariff exclusions and rebates. These adaptive strategies are proving essential for maintaining project economics and ensuring access to high-integrity blowout prevention solutions under an increasingly protectionist regime.

Deriving Deep Insights from Equipment Type Application Actuation Mode Water Depth and Pressure Class Segmentation Nuances and Industry Impact

Within subsea equipment portfolios, annular blowout preventers offer versatile sealing around irregular well geometries, enabling efficient well access in a variety of intervention and drilling operations, while ram blowout preventers deliver robust bore blocking capabilities that excel under high-pressure well control scenarios.

The choice of subsea well control solutions aligns closely with distinct operational phases: during drilling, robust ram systems ensure primary containment; in completion activities, the sealing versatility of annular stacks enables pressure integrity tests; and in workover campaigns, interchangeable preventer configurations support swift deployment for well intervention tasks.

Actuation modalities drive response dynamics and maintenance profiles: hydraulic actuation remains the industry stalwart for its proven reliability and field familiarity; electrohydraulic systems introduce digital feedback loops and enhanced diagnostics; and electric actuation solutions promise streamlined integration with subsea control modules and reduced hydraulic fluid dependency.

Water depth segmentation influences engineering design, with shallow water applications focusing on cost-effective shallow stack assemblies, deep water engagements demanding advanced pressure management to counter hydrostatic loads, and ultra deepwater operations leveraging specialized materials and enhanced structural reinforcement to withstand extreme subsea environments. Pressure class differentiation further dictates component specifications, as 5000, 10000, and 15000 psi ratings respectively correspond to incremental wellbore pressures and sealing force requirements.

This comprehensive research report categorizes the Subsea Well Access & Blowout Preventer System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Actuation Type

- Water Depth

- Pressure Class

- Application

Mapping Regional Dynamics across Americas Europe Middle East Africa and Asia-Pacific to Identify High-Growth Hotspots in Subsea Well Solutions

In the Americas, a resurgence of offshore capital investment along the Gulf of Mexico and Atlantic seaboard is driving demand for advanced subsea well access systems and blowout containment stacks. Operators are capitalizing on mature service ecosystems and robust support infrastructure, enabling rapid deployment of next-generation preventer assemblies while adhering to stringent safety regulations enforced by federal agencies.

Across Europe, the Middle East, and Africa, diversified offshore portfolios-from North Sea aging fields to new deepwater developments off West Africa and the Arabian Gulf-are shaping regional equipment preferences. Regulatory harmonization through bodies such as OSPAR and joint ventures among national oil companies have elevated requirements for rapid testing, traceability, and interoperability of well control equipment under varied environmental and operational conditions.

In the Asia-Pacific region, explosive growth in offshore exploration and production, particularly in Asia’s deepwater basins off Southeast China and Australia, is stimulating investments in high-capacity blowout preventers rated for ultra high pressures. Local content regulations in emerging markets are incentivizing partnerships between global manufacturers and regional service providers to localize assembly and maintenance capabilities, shortening lead times and enhancing post-sale support.

Taken together, these regional dynamics underscore divergent but complementary growth patterns. In mature markets, incremental innovation and regulatory compliance dominate, while emerging basins prioritize rapid access to high-performance subsea well control hardware. Strategic alignment with regional priorities is therefore paramount for equipment suppliers seeking to capitalize on global offshore opportunities.

This comprehensive research report examines key regions that drive the evolution of the Subsea Well Access & Blowout Preventer System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning and Innovation Pathways of Leading Manufacturers in the Subsea Blowout Preventer Equipment Ecosystem

Leading subsea blowout preventer equipment providers are distinguishing themselves through unique strategic and technological portfolios. One prominent manufacturer has prioritized modular stack architectures with integrated sensor networks, enabling faster customization and real-time diagnostic capabilities. Another key player has invested heavily in additive manufacturing partnerships to accelerate spare parts delivery and minimize supply chain disruptions in remote offshore locations. A third market leader has leveraged its deep expertise in hydraulic systems to refine sealing element geometries and extend maintenance intervals.

Strategic alliances and joint development agreements are also reshaping competitive dynamics. Collaborative frameworks between equipment suppliers, subsea robotics specialists, and service operators are giving rise to bundled offerings that encompass rental fleets, remote monitoring services, and condition-based maintenance programs. These partnerships not only broaden revenue streams but also reinforce customer retention by aligning product roadmaps with operator digital initiatives and sustainability targets.

Aftermarket support has emerged as a critical differentiator, with companies deploying extensive global service networks and advanced analytics platforms to deliver predictive maintenance solutions. Sophisticated training simulators and digital twins are being offered as part of service contracts, enabling operator crews to rehearse complex intervention scenarios before mobilization. As a result, service reliability and equipment uptime have become pivotal metrics in commercial negotiations, driving providers to further innovate in both hardware design and value-added digital services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Subsea Well Access & Blowout Preventer System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker Solutions ASA

- Baker Hughes Company

- Dril-Quip, Inc.

- Eaton Corporation plc

- Halliburton Company

- National Oilwell Varco, Inc.

- Oceaneering International, Inc.

- Parker-Hannifin Corporation

- Saipem S.p.A.

- Schlumberger Limited

- Subsea 7 S.A.

- TechnipFMC PLC

- Weatherford International plc

Strategic Imperatives and Actionable Roadmaps to Enhance Operational Resilience and Competitive Agility in Offshore Well Access and Safety Management

Offshore energy operators and equipment providers should prioritize the development and adoption of digital twin frameworks that mirror real-world blowout preventer operations under varied sea conditions. By integrating high-fidelity computational models with live sensor feeds, stakeholders can simulate failure modes, optimize intervention procedures, and refine maintenance schedules. This predictive approach will reduce unplanned downtime, extend component lifecycles, and provide quantifiable safety margins for complex subsea campaigns.

Diversification of supply chains is equally essential in an era of trade volatility and component scarcity. Decision makers are advised to cultivate relationships with multiple fabrication partners across different geographies, ensuring access to both traditional hydraulic components and emerging electric actuation modules. Complementing this strategy with strategic stockpiling of critical sealing elements and pressure housings can further hedge against tariff impacts and logistical delays, safeguarding project timelines.

Finally, industry leaders should collaborate on harmonized engineering and operational standards through consortia and regulatory working groups. Establishing common protocols for data exchange, pressure testing, and remote intervention procedures will accelerate adoption of interoperable systems and reduce barriers to entry for innovative suppliers. Coupled with targeted workforce training programs that emphasize digital competencies and cross-disciplinary troubleshooting, these measures will fortify the subsea well control ecosystem for the next generation of offshore exploration.

Outlining Robust Research Frameworks and Validation Techniques Underpinning the Insights into Subsea Well Access and Blowout Preventer Systems

This analysis is grounded in a rigorous two-tiered research framework combining comprehensive secondary sources with primary intelligence from industry practitioners. The secondary phase included a thorough review of technical standards, white papers, and public regulatory filings relevant to subsea well access and blowout preventer systems, ensuring a solid foundation of historical performance data, material specifications, and engineering best practices. These insights were augmented by an examination of recent academic publications and industry conference proceedings to capture the most current technological advancements.

The primary research phase involved structured interviews with subsea engineering managers, service technicians, and procurement leaders, providing qualitative perspectives on operational challenges, supplier dynamics, and strategic priorities. Quantitative data collection was conducted through anonymized operator surveys and aggregated equipment utilization records, enabling cross-validation of methodological assumptions. The combined dataset underwent a systematic triangulation process, incorporating peer review and expert panel validation, to ensure both the robustness of findings and the relevance of actionable insights. This structured approach underpins the analysis and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Subsea Well Access & Blowout Preventer System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Subsea Well Access & Blowout Preventer System Market, by Equipment Type

- Subsea Well Access & Blowout Preventer System Market, by Actuation Type

- Subsea Well Access & Blowout Preventer System Market, by Water Depth

- Subsea Well Access & Blowout Preventer System Market, by Pressure Class

- Subsea Well Access & Blowout Preventer System Market, by Application

- Subsea Well Access & Blowout Preventer System Market, by Region

- Subsea Well Access & Blowout Preventer System Market, by Group

- Subsea Well Access & Blowout Preventer System Market, by Country

- United States Subsea Well Access & Blowout Preventer System Market

- China Subsea Well Access & Blowout Preventer System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Reflections on the Strategic Evolution of Subsea Well Access and Blowout Preventer Technology and its Role in Future Offshore Safety

The landscape of subsea well access and blowout preventer technology is undergoing a profound transformation driven by advanced digital platforms, evolving regulatory frameworks, and shifting global trade policies. As operators navigate deeper waters and more complex reservoirs, the imperative for reliable containment solutions has never been greater. Innovations in sensing, actuation, and materials science are converging to produce preventer assemblies that not only meet rigorous safety requirements but also deliver enhanced operational efficiency across the drilling, completion, and workover cycles.

Looking forward, industry stakeholders must maintain a proactive stance by integrating predictive analytics, diversifying supply chains, and engaging in collaborative standard-setting initiatives. The convergence of regional market dynamics and corporate strategies outlined in this report underscores the need for agility and foresight. By embracing a holistic approach that spans technical innovation, workforce development, and strategic partnerships, decision makers can secure both performance excellence and resilience against future uncertainties in the offshore energy sector.

Empowering Decision-Makers to Access Comprehensive Subsea Well Access and Blowout Preventer Research with Tailored Insights from Sales and Marketing Leadership

For industry leaders seeking to capitalize on the insights presented in this analysis, tailored access to the full research report is available through direct engagement with Ketan Rohom, Associate Director of Sales & Marketing. This extended document offers in-depth coverage of subsea well access architectures, comparative performance data for ram and annular preventer designs, and comprehensive analysis of supply chain risk management strategies under evolving tariff regimes.

To explore custom executive briefings, secure licensing rights, or arrange interactive workshops that align with your organizational objectives, please reach out to Ketan Rohom. His expertise in translating technical findings into actionable business strategies will ensure your team derives maximum value from the consolidated research. Engage today to drive technological leadership and operational excellence in subsea well control and safety management.

- How big is the Subsea Well Access & Blowout Preventer System Market?

- What is the Subsea Well Access & Blowout Preventer System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?