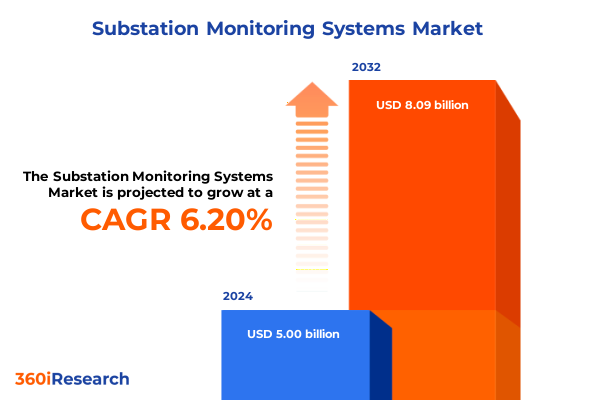

The Substation Monitoring Systems Market size was estimated at USD 5.28 billion in 2025 and expected to reach USD 5.57 billion in 2026, at a CAGR of 6.28% to reach USD 8.09 billion by 2032.

Understanding the Critical Role and Evolution of Modern Substation Monitoring Systems in Ensuring Grid Stability and Operational Efficiency

Substation monitoring systems have emerged as the backbone of modern power infrastructure, enabling unprecedented levels of visibility into asset health and operational performance. By deploying advanced sensor arrays and real-time data collection platforms, utilities and industrial operators can transition from reactive maintenance strategies to predictive and prescriptive approaches that minimize downtime and extend equipment lifespan. This shift not only safeguards critical electrical assets but also plays a pivotal role in ensuring grid stability in an era of growing demand and complexity.

Over the past decade, substation monitoring solutions have evolved from basic alarm-driven modules to fully integrated digital ecosystems that leverage Internet of Things technologies, cloud computing, and edge analytics. These enhancements facilitate continuous, granular monitoring of voltage fluctuations, temperature anomalies, partial discharge events, and vibration signatures, allowing stakeholders to detect incipient faults before they escalate into catastrophic failures. As a result, operational teams gain deeper insights into load patterns, environmental influences, and aging-related degradation, empowering more informed decision making and resource allocation.

Moreover, the strategic importance of substation monitoring extends beyond asset reliability. In an environment characterized by renewable integration and distributed generation, these systems support dynamic grid management by providing real-time visibility into power quality and system resilience. With regulators emphasizing performance metrics and service continuity, organizations that invest in robust monitoring architectures position themselves to meet stringent compliance standards while unlocking efficiency gains and cost savings over the long term.

Examining the Pivotal Technological, Regulatory, and Operational Shifts Reshaping Substation Monitoring Solutions for the Modern Power Industry

The landscape of substation monitoring is undergoing transformative shifts driven by technological breakthroughs, evolving regulatory frameworks, and changing operational imperatives. Edge computing capabilities are now embedded within sensor modules to perform preliminary data processing at the source, reducing latency and alleviating bandwidth demands on central servers. Simultaneously, artificial intelligence and machine learning algorithms have matured to accurately diagnose fault signatures, predict equipment failures, and optimize maintenance schedules based on historical and real-time performance indicators.

In parallel, stringent cybersecurity mandates have elevated the need for secure communication protocols and multi-layered defense mechanisms, ensuring that sensitive grid data remains protected against evolving threat vectors. These developments coexist with the burgeoning trend toward open standards and interoperable platforms, which facilitate seamless integration of new devices, legacy systems, and vendor-neutral software. The result is a more agile and scalable monitoring architecture that can adapt to rapid changes in grid topology and demand profiles.

Regulatory pressures and decarbonization targets are further reshaping system requirements. With the proliferation of renewable energy sources, substation monitoring solutions must now accommodate bidirectional power flows and dynamic voltage regulation. This complexity is compounded by the necessity to comply with regional performance benchmarks, grid codes, and environmental regulations. Consequently, vendors and end users alike are pivoting toward modular platforms that support incremental upgrades and deliver consistent performance validation across diverse deployment scenarios.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Equipment Supply Chains, Component Costs, and Substation Monitoring System Adoption

The imposition of new United States tariffs in early 2025 on critical electronic components, communication modules, and sensor hardware has introduced a layer of complexity to procurement planning and cost management for substation monitoring deployments. Although the specific tariff schedule targeted a range of imported devices, the broader repercussion has been an uptick in component pricing and an extension of lead times across global supply chains. As vendors recalibrate their sourcing strategies, many have opted to explore domestic manufacturing alliances or diversify production to tariff-exempt regions.

Consequently, project budgets have come under pressure, with procurement teams forced to reassess total cost of ownership models that once relied on stable pricing from established suppliers. In response, several industry participants have renegotiated long-term contracts, opted for tiered delivery schedules, and consolidated orders to mitigate the financial impact of per-unit cost increases. Meanwhile, some system integrators have absorbed portions of the tariff burden to preserve competitive contract bids, albeit at compressed margin levels.

Moreover, the tariff-driven landscape has accelerated discussions around localization and supply chain resilience. Organizations are increasingly evaluating nearshore manufacturing options and forging strategic partnerships with domestic component producers to minimize exposure to future trade policy volatility. As a result, the substation monitoring market is witnessing a gradual rebalancing of supplier portfolios, with a renewed emphasis on transparency, contract flexibility, and dual-sourcing arrangements to ensure uninterrupted project timelines and cost predictability.

Unveiling In-Depth Segmentation Insights Across Diverse Dimensions Covering Offering, Component, End User, Monitoring Type, Communication Technology, and More

A nuanced examination of market segmentation reveals distinct trajectories across multiple dimensions, each influencing solution design and adoption strategies. When viewed through the lens of offering, hardware investments remain foundational for sensor deployment and data acquisition, while software platforms continue to evolve with advanced analytics and visualization capabilities. Services, encompassing consulting engagements, routine maintenance, and specialized training programs, have become increasingly critical for maximizing system availability and driving user proficiency in leveraging new digital tools.

Component-level insights underscore the centrality of communication systems and monitoring software in enabling end-to-end visibility. Power quality analyzers deliver precise measurements of voltage disturbances and harmonic distortions, whereas sensor portfolios extend across partial discharge detection, temperature monitoring, and vibration analysis. The granularity afforded by partial discharge sensors, coupled with thermal profiling and vibration trend analysis, empowers predictive maintenance regimes that drastically reduce unscheduled outages and repair costs.

Analyzing end user categories highlights varying demand drivers. Commercial facilities prioritize uptime to avoid operational disruptions, manufacturing plants focus on process reliability and safety, while oil and gas operators emphasize remote monitoring capabilities in harsh environments. Utilities, as system operators, demand robust, scalable architectures for network-wide asset management. Renewable energy projects, spanning hydroelectric, solar photovoltaic, and wind installations, place a premium on power quality and dynamic load monitoring to optimize intermittent generation profiles.

Different monitoring types, whether acoustic sensing, gas analysis, partial discharge, temperature, or vibration, enable comprehensive assessments of switchgear, transformers, and busbars. Communication technology choices follow either wired networks, such as Ethernet, fiber optics, and power line carrier, or wireless solutions leveraging cellular networks, radio frequency links, and Wi-Fi. Deployment modes range from cloud-hosted platforms that offer rapid scalability and remote accessibility to on-premise systems favored for low-latency data processing and stringent security requirements. Within these frameworks, application scenarios diverge between distribution networks, where fault localization is paramount, and high-voltage transmission grids that demand continuous monitoring of critical conductors and transformers. Voltage level considerations span medium voltage installations in urban substations to high voltage projects on bulk transmission corridors, while installation approaches encompass both greenfield projects seeking state-of-the-art architectures and retrofit initiatives aimed at modernizing legacy infrastructures. Finally, phase configuration, whether single-phase or three-phase designs, tailors sensor arrays and data processing algorithms to accommodate specific network topologies and fault characteristics.

This comprehensive research report categorizes the Substation Monitoring Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Component

- Monitoring Type

- Communication Technology

- Deployment Mode

- Voltage Level

- Installation

- Phase

- End User

- Application

Highlighting Distinct Regional Dynamics and Demand Patterns Shaping Substation Monitoring System Implementation Across Key Global Markets

Regional dynamics play a pivotal role in shaping substation monitoring deployments, as each geography exhibits unique regulatory, economic, and infrastructural drivers. In the Americas, aging transmission and distribution networks are undergoing modernization efforts, with federal and state incentives accelerating investments in digital grid technologies. Demand for predictive asset management is particularly high in North America, where large utilities and industrial conglomerates leverage government grants and public–private partnerships to fund pilot projects and expand monitoring footprints.

Europe, the Middle East, and Africa present a complex tapestry of market maturity levels and policy frameworks. Western European nations are driven by stringent reliability mandates and decarbonization targets, leading to early adoption of AI-enabled monitoring platforms. In contrast, the Middle East focuses on large-scale renewable integration and oilfield monitoring, while African markets prioritize cost-effective, modular solutions to enhance grid resilience in regions experiencing rapid urbanization and infrastructure gaps. Cross-regional partnerships and technology transfer agreements are common, enabling standardized platforms to adapt to diverse environmental and regulatory contexts.

Asia-Pacific remains a high-growth frontier, propelled by expansive transmission outlays, electrification drives, and smart city initiatives. China and India dominate spending on smart grid implementations, emphasizing interoperability and local manufacturing content. Southeast Asian nations, such as Indonesia and Vietnam, are increasingly allocating capital toward modernizing rural substations to support distributed renewable projects and reduce technical losses. In parallel, Australia’s focus on grid-forming inverter compatibility and advanced power quality monitoring reflects the region’s commitment to integrating high penetrations of wind and solar resources.

This comprehensive research report examines key regions that drive the evolution of the Substation Monitoring Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Enterprises Driving Innovation, Strategic Partnerships, and Competitive Advantage in the Substation Monitoring Systems Market

Leading enterprises in the substation monitoring domain are distinguished by their robust R&D pipelines, strategic alliances, and comprehensive solution portfolios. Several global manufacturers have formed partnerships with telecommunications providers to embed secure, high-bandwidth connectivity into their monitoring offerings. Others have acquired specialized software firms to integrate advanced analytics and digital twin capabilities, enabling customers to simulate fault scenarios and optimize maintenance schedules.

In addition, key players are investing heavily in cybersecurity modules and compliance services, responding to the increasing convergence of operational technology and information technology. Through collaborative frameworks with government agencies and standards bodies, these companies influence interoperability guidelines and shape future regulatory requirements. Strategic joint ventures and co-development agreements further extend their market reach, delivering turnkey monitoring solutions that bundle sensors, communication networks, and managed services into cohesive, vendor-neutral ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Substation Monitoring Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Eaton Corporation plc

- Fluke Process Instruments

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- Hubbell Incorporated

- Igrid T& D

- Mitsubishi Electric Corporation

- NovaTech LLC

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens AG

- Toshiba Corporation

Providing Targeted Actionable Recommendations to Empower Industry Leaders in Enhancing Reliability, Efficiency, and Innovation in Substation Monitoring

Industry leaders should prioritize the integration of edge analytics and cloud platforms to achieve a balanced, scalable monitoring architecture that addresses both latency-sensitive applications and large-scale data aggregation needs. By adopting modular sensor kits that support multiple monitoring types-such as partial discharge, thermal imaging, and vibration analysis-organizations can future-proof their infrastructure against evolving asset management requirements. Moreover, close collaboration with cybersecurity experts is essential to implement zero-trust frameworks and encrypted communication pathways that protect critical grid data from intrusion.

Further recommendations include establishing dual-sourcing agreements for key components to mitigate supply chain disruptions and tariff impacts. Engaging in collaborative partnerships with local manufacturers and system integrators can enhance procurement agility and facilitate compliance with regional trade policies. In parallel, deploying comprehensive training curricula for operations and maintenance personnel ensures that in-house teams can fully leverage advanced analytics dashboards, optimize alarm thresholds, and execute predictive maintenance routines with confidence.

Finally, decision-makers should embrace data democratization by granting stakeholders across engineering, asset management, and executive teams access to customized dashboards and performance KPIs. This approach fosters a culture of accountability and continuous improvement, aligning maintenance priorities with profitability goals and regulatory benchmarks. By weaving together technological innovation, strategic sourcing, and robust governance models, industry leaders can transform substation monitoring from a cost center into a catalyst for reliability, efficiency, and future-ready grid modernization.

Detailing Rigorous Research Methodology Combining Primary Insights, Secondary Data, and Robust Analytical Frameworks for Market Understanding

The research foundation combines primary interviews with utility executives, system integrators, and technology vendors alongside a thorough review of regulatory filings, white papers, and technical standards documentation. Expert consultations provided qualitative perspectives on deployment challenges, integration best practices, and evolving performance metrics. Concurrently, secondary data collection encompassed academic publications, publicly available annual reports, and industry association datasets to validate emerging trends and quantify technology adoption patterns.

Data triangulation was achieved through cross-referencing vendor press releases, patent filings, and standardization roadmaps to ensure consistency and accuracy. Market segmentation frameworks were applied to classify offerings by hardware, software, and services, as well as by component, end user, and regional criteria. Analytical techniques included scenario modeling, comparative vendor assessments, and risk analysis methodologies, all of which contributed to a robust, objective understanding of market dynamics and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Substation Monitoring Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Substation Monitoring Systems Market, by Offering

- Substation Monitoring Systems Market, by Component

- Substation Monitoring Systems Market, by Monitoring Type

- Substation Monitoring Systems Market, by Communication Technology

- Substation Monitoring Systems Market, by Deployment Mode

- Substation Monitoring Systems Market, by Voltage Level

- Substation Monitoring Systems Market, by Installation

- Substation Monitoring Systems Market, by Phase

- Substation Monitoring Systems Market, by End User

- Substation Monitoring Systems Market, by Application

- Substation Monitoring Systems Market, by Region

- Substation Monitoring Systems Market, by Group

- Substation Monitoring Systems Market, by Country

- United States Substation Monitoring Systems Market

- China Substation Monitoring Systems Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings into a Cohesive Conclusion Emphasizing Strategic Imperatives and Future Directions for Substation Monitoring Solutions

This comprehensive analysis underscores the imperative for stakeholders to embrace digital transformation, adaptive regulatory compliance, and resilient supply chain strategies within the substation monitoring ecosystem. By synthesizing technological advancements-such as AI-driven analytics, edge computing, and secure communication protocols-with evolving market realities, the report delineates clear pathways for enhancing asset reliability and optimizing operational expenditures.

Looking ahead, the convergence of renewable integration mandates, cyber-resilience requirements, and advanced predictive maintenance capabilities will continue to drive innovation and shape strategic priorities. Organizations that align investment decisions with these overarching trends, while fostering cross-functional collaboration and continuous learning, will secure a competitive advantage and contribute to the sustainable evolution of global power infrastructure.

Drive Decision-Making and Secure Comprehensive Substation Monitoring Insights by Engaging with Ketan Rohom to Access the Full Analytical Report

Empower your organization with unparalleled insights and strategic guidance by reaching out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engage in a personalized consultation to explore how this market research report can address your unique challenges and drive competitive advantage. Secure your copy today and take the decisive step toward optimizing substation monitoring investments for long-term operational excellence and innovation.

- How big is the Substation Monitoring Systems Market?

- What is the Substation Monitoring Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?