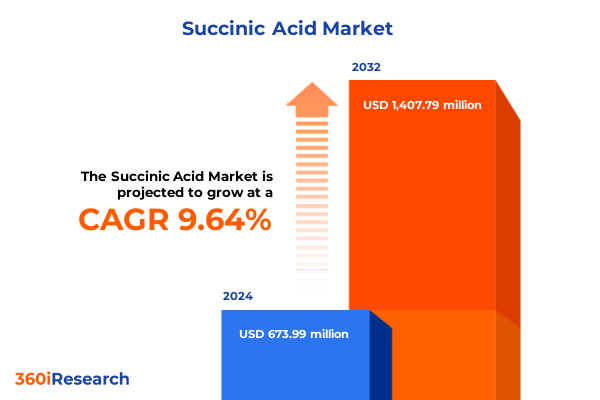

The Succinic Acid Market size was estimated at USD 739.15 million in 2025 and expected to reach USD 810.77 million in 2026, at a CAGR of 9.64% to reach USD 1,407.79 million by 2032.

Exploring the Critical Role of Succinic Acid as a Foundational Platform Chemical Catalyzing Sustainable Innovation in Polymers, Pharmaceuticals, and Food Industries

Succinic acid, commonly referred to as butanedioic acid, has emerged as a foundational platform chemical that bridges multiple industry applications ranging from biodegradable polymers and chemical intermediates to pharmaceuticals, cosmetics, and food-grade formulations. Its role extends beyond a simple acidity regulator, serving as a versatile feedstock in the synthesis of polyamide resins, polybutylene succinate, and unsaturated polyester resins, while also delivering functional benefits in drug intermediates, pesticide formulations, aroma chemicals, and flavoring compositions. Through advanced microbial fermentation processes and chemical catalysis, technology pioneers have demonstrated the technical feasibility of large-scale succinic acid production, underscoring its strategic value in supporting the shift toward sustainable, bio-based manufacturing models. Concurrently, global bioplastics production capacity is projected to climb from 2.47 million tonnes in 2024 to nearly 5.73 million tonnes by 2029, reinforcing the relevance of succinic acid as an eco-friendly building block for next-generation materials.

Amidst this backdrop, market dynamics are increasingly shaped by complex interactions between supply chain resilience, regulatory mandates, and geopolitical developments. The ongoing U.S.–China trade tensions, coupled with Arctic weather disruptions and fluctuating shipping costs, led to a notable decline in U.S. succinic acid prices in February 2025, driven by ample inventories of carryover stock and moderating demand from pharmaceutical and cosmetics sectors. As industry stakeholders navigate evolving tariff structures and production cost pressures, strategic agility and a thorough understanding of supply-demand interplays have become essential for capturing growth opportunities and mitigating downside risks.

How Bio-Based Production, Advanced Fermentation Technologies, and Circular Economy Principles Are Transforming the Global Succinic Acid Market Landscape

The succinic acid market is undergoing a paradigm shift propelled by bio-based production methods, which leverage renewable feedstocks and cutting-edge fermentation technologies to achieve both environmental and economic objectives. Commercial advances in genetically engineered microorganisms-from recombinant Saccharomyces cerevisiae strains to Candida krusei variants-have facilitated annual production capacities of over 10 kilotonnes at facilities across Europe and North America, validating the technical viability of fermentative routes. Innovations in enzyme catalysis and downstream purification, coupled with feedstock diversification strategies that incorporate corn syrup, glycerol, and agricultural waste streams, are driving down unit costs and enhancing carbon footprint profiles even as global petrochemical feedstock prices remain volatile.

In parallel, the integration of circular economy principles is reshaping value chains through licensing partnerships, contract manufacturing agreements, and sustainability certification regimes. Leading licensors have refined yeast-based technologies and extended non-assert covenants to foster sector-wide collaboration, allowing multiple producers to capitalize on low-pH fermentation know-how while avoiding patent disputes. Digital supply chain management systems and predictive analytics tools are further optimizing production planning, logistics, and quality control, enabling firms to respond rapidly to shifts in regulatory frameworks-such as the EU’s Packaging and Packaging Waste Regulation-and meet evolving customer requirements for traceability and eco-innovation.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Succinic Acid Supply Chains, Import Costs, and Downstream Industry Dynamics

In 2025, the United States embarked on a more assertive tariff strategy targeting chemical imports, intensifying reciprocal duties and recalibrating trade flows. The administration’s baseline 10 percent reciprocal tariff, designed to align U.S. rates with those imposed on American exports, coexists with selective exclusions covering bulk chemicals and critical polymers, even as investigations under Section 232 broaden the scope to pharmaceuticals and minerals. These measures reflect a strategic shift toward industrial policy-driven trade regulation, aiming to buttress domestic production but also triggering supply chain recalibrations among international exporters.

For succinic acid specifically, elevated duties on Chinese imports-initially set at 20 percent and effectively reaching 54 percent when combined with pre-existing levies-have disrupted cost structures for U.S. processors and downstream converters. February 2025 saw U.S. prices drop amid steady domestic supply and softened offtakes in the pharmaceutical and cosmetics segments, a trend exacerbated by a harsh Arctic winter and higher freight rates linked to rerouted shipping lanes. While these headwinds have moderated near-term demand, they also underscore the need for diversified sourcing strategies and flexible procurement models to manage the evolving tariff landscape.

Unlocking Strategic Market Segmentation Insights Revealing High-Value Applications, Production Technologies, and Distribution Channels for Succinic Acid

A granular segmentation analysis reveals that succinic acid’s diverse value propositions extend across multiple application domains. Agricultural uses encompass both pesticide formulations and plant growth regulators, leveraging the acid’s role in optimizing crop protection and yield. In the chemical intermediates sector, manufacturers rely on succinic acid as a precursor to solvents, lubricants, and plasticizers. The cosmetics category bifurcates into aroma chemicals and flavoring compositions, where succinic acid contributes to sensory enhancement and stability. Within the food and beverage industry, the molecule’s clean-label credentials support its function as an acidity regulator and flavor enhancer. Pharmaceutical applications further delineate between drug intermediates and excipients, underscoring the compound’s multifaceted contribution to active ingredient synthesis and formulation performance. Polymer production segments integrate succinic acid into polyamide, polybutylene succinate, and unsaturated polyester resin supply chains, while solvent markets utilize both liquid and solid forms to meet diverse processing requirements.

Complementing this application segmentation, type-based analysis distinguishes between bio-based and petroleum-based production routes, reflecting a fundamental divergence in sustainability profiles and cost structures. Form distinctions between liquid and solid grades address logistical handling and end-user preferences. Purity classifications-ranging from food grade to industrial grade and pharmaceutical grade-highlight quality thresholds essential for compliance across regulatory regimes. Technological segmentation differentiates between chemical synthesis and fermentation pathways, mapping onto distinct capital and operational expenditures. Finally, distribution channel segmentation spans direct sales relationships, networked distributors, and online platforms, each offering unique trade-off profiles in terms of margin control, market reach, and customer engagement.

This comprehensive research report categorizes the Succinic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Purity Grade

- Technology

- Distribution Channel

- Application

Evaluating Key Regional Dynamics Highlighting Americas, Europe, Middle East & Africa, and Asia-Pacific Trends Shaping Succinic Acid Demand and Production

In the Americas, North American succinic acid dynamics are shaped by a combination of domestic production hubs, tariff-driven import cost adjustments, and robust R&D initiatives. The Sarnia, Ontario facility-formerly operated by BioAmber and currently run by LCY Biosciences-has ramped capacity from 8,000 to 18,000 metric tons per annum, serving as a critical node for both U.S. and Canadian offtake requirements. U.S. domestic producers benefit from access to corn syrup feedstock and proximity to major end-user clusters in pharmaceuticals and personal care, even as elevated duties on Chinese imports compel buyers toward local or alternative‐sourcing strategies.

Within Europe, Middle East & Africa, the regulatory landscape provides enduring support for bio-based intermediates through carbon pricing schemes, extended producer responsibility mandates for packaging, and an evolving regulatory framework under the European Green Deal. Established chemical complexes in Germany, France, and Italy offer integrated production and downstream processing capabilities, enabling manufacturers to meet stringent EU quality standards and capitalize on advanced logistical networks. Meanwhile, Middle Eastern producers focus on feedstock diversification and petrochemical integration, leveraging access to low-cost energy resources for mixed-mode production approaches.

Asia-Pacific emerges as the fastest-growing region, driven by large-scale investments in biomanufacturing across China, Thailand, and India. The PTT-MCC joint venture in Rayong, Thailand, exemplifies this growth trajectory, with a 20,000 metric tonne per annum polybutylene succinate plant utilizing licensed fermentation technology to produce bio-succinic acid feedstock. China’s expansive chemical infrastructure and India’s favorable biotech policy initiatives further underpin this regional upswing, positioning Asia-Pacific as a focal point for future capacity expansion and innovation.

This comprehensive research report examines key regions that drive the evolution of the Succinic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Succinic Acid Producers and Emerging Innovators Steering Technological Advancements and Capacity Expansions in the Bio-Based Chemicals Sector

Commercial production of biobased succinic acid has encountered both pioneering successes and structural challenges. The joint venture Reverdia-initially a collaboration between DSM and Roquette-operated a 10,000 metric tonne per annum Biosuccinium™ plant in Italy before dissolving in 2019, with DSM retaining licensing rights and Roquette assuming full production responsibilities. Succinity, a BASF–Corbion partnership in Spain, ceased joint operations in 2019, leaving BASF as the solo operator of fermentative succinic acid manufacturing. LCY Biosciences’ acquisition of the Sarnia plant from BioAmber and Mitsui reconciliation has driven output toward 18,000 metric tons annually, positioning it as the dominant North American producer. Conversely, Myriant’s Lake Providence, Louisiana facility-once a 14,000 metric tonne player-halted succinic acid output in 2016 and pivoted to rhamnolipid manufacturing under Stepan Company management.

Smaller-scale deployments, such as ThyssenKrupp Uhde’s demonstration plant in Germany, underscore the breadth of technological experimentation, while regional ventures in Southeast Asia illustrate emerging market potential. The industry’s maturation is evidenced by recognition from outlets like Biofuels Digest, which honored bio-succinic acid as Chemical of the Year, underscoring the importance of licensing offerings and collaborative IP frameworks for scaling sustainability innovations. Together, this diverse ecosystem of incumbents and challengers defines the competitive contours of an evolving platform chemical market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Succinic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui BBCA Chemicals Co., Ltd.

- Anqing Hexing Chemical Co., Ltd.

- Astatech (Chengdu) Biopharmaceutical Corp.

- BASF SE

- BioAmber Inc.

- DC Chemical Co., Ltd.

- Evonik Industries AG

- Fuso Chemical Co., Ltd.

- Gadiv Petrochemical Industries Ltd.

- Jiangsu Yabang Chemical Co., Ltd.

- Kawasaki Kasei Chemicals Ltd.

- Koninklijke DSM N.V.

- Lanzatech, Inc.

- Linyi Lixing Chemical Co., Ltd.

- Mitsubishi Gas Chemical Co., Inc.

- Myriant Corporation

- Nippon Shokubai Co. Ltd.

- Reverdia B.V.

- Shandong Chemical Co., Ltd.

- Shandong Sinocycle Chemical Co., Ltd.

- Shandong Susu Biotechnology Co., Ltd.

- Shanghai Tongli Bioengineering Co., Ltd.

- Sinopec Yangzi Petrochemical Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- SRS Pharmaceuticals Pvt. Ltd.

- TCI Chemicals (India) Pvt. Ltd.

- Thirumalai Chemicals Ltd.

- Zhengzhou Tianrun Chemical Co., Ltd.

Actionable Strategic Recommendations for Industry Leaders to Enhance Competitive Positioning and Optimize Succinic Acid Value Chains in a Dynamic Market

Industry leaders must proactively invest in advanced fermentation and purification technologies to achieve superior yield efficiencies and reduce per-kilogram production costs. Securing long-term supply agreements for diverse feedstocks-including corn syrup, glycerol, sugarcane, and cellulosic waste-will mitigate raw material price volatility and strengthen sustainability credentials. Strategic licensing partnerships and non-assert IP arrangements can accelerate market entry for new producers while amplifying collective innovation efforts.

It is critical to closely monitor evolving trade policies, particularly reciprocal tariff structures and Section 232 investigations, to maintain sourcing flexibility and manage input cost fluctuations. Companies should consider establishing regional manufacturing footprints-leveraging incentives in the United States, Europe, and Asia-Pacific-to optimize proximity to key demand centers and circumvent import duties. Emphasizing high-value applications in pharmaceuticals, cosmetics, and specialty polymers will unlock premium margins and differentiate offerings in a crowded commodity landscape.

Finally, integrating digital supply chain management platforms and predictive analytics will enhance demand forecasting capabilities, reduce inventory carrying costs, and improve customer service levels. Pursuing recognized sustainability certifications and aligning with net-zero roadmaps will bolster brand reputation and meet increasingly stringent ESG criteria from end-users and regulators alike.

Comprehensive Research Methodology Outlining Data Sources, Analytical Frameworks, and Validation Techniques Underpinning This Succinic Acid Market Analysis

This analysis synthesizes a multi-tiered research methodology combining extensive secondary research with targeted primary engagements. Secondary data sources encompassed peer-reviewed scientific literature, regulatory filings, industry conference proceedings, and publicly available trade publications. Academic and technical insights were validated through the latest outputs from entities such as European Bioplastics and biotechnology research consortia.

Primary research included structured interviews with key opinion leaders across major producing companies, technology licensors, and end-user formulators. These insights were triangulated with quantitative data points-ranging from production capacity figures to tariff rate schedules-to ensure robust, actionable conclusions. Segmentation frameworks were developed using a bottom-up approach, mapping application, type, form, purity, technology, and distribution dimensions to real-world market behaviors.

Data integrity was upheld through a rigorous validation process, including cross-referencing multiple independent sources, reconciling conflicting data points, and conducting expert reviews. Visual analytics tools and statistical modeling were employed to identify trend trajectories and build scenario-based outlooks. This comprehensive methodology ensures that the findings presented herein are credible, defensible, and directly applicable to strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Succinic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Succinic Acid Market, by Type

- Succinic Acid Market, by Form

- Succinic Acid Market, by Purity Grade

- Succinic Acid Market, by Technology

- Succinic Acid Market, by Distribution Channel

- Succinic Acid Market, by Application

- Succinic Acid Market, by Region

- Succinic Acid Market, by Group

- Succinic Acid Market, by Country

- United States Succinic Acid Market

- China Succinic Acid Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Imperatives to Conclude Succinic Acid Market Trends, Challenges, and Growth Opportunities in the Evolving Bioeconomy

The succinic acid market stands at an inflection point, driven by the coalescence of sustainability imperatives, technological advances, and shifting trade dynamics. Bio-based production methods, underpinned by improved microbial strains and catalytic processes, promise to close the cost gap with petrochemical routes while delivering superior environmental performance. At the same time, evolving tariff regimes underscore the importance of geographic diversification and agile sourcing strategies.

Segmented demand across agriculture, chemical intermediates, cosmetics, flavors and fragrances, food and beverages, pharmaceuticals, polymers, and solvents highlights the molecule’s versatility and resilience against economic cycles. Regional insights reveal that North America maintains critical production capacity, Europe benefits from regulatory support and mature infrastructure, and Asia-Pacific is primed for rapid expansion fueled by targeted investments and favorable policy frameworks.

Leading companies have demonstrated the capacity to pivot, scale, and innovate through strategic alliances, licensing agreements, and IP collaborations. As the industry matures, success will hinge on the ability to integrate digital tools for supply chain optimization, secure sustainable feedstock pipelines, and capture value in high-margin end uses. By embracing these imperatives, stakeholders can harness the full potential of succinic acid as a cornerstone of the emerging bioeconomy.

Connect with Associate Director Ketan Rohom to Acquire the Full Succinic Acid Market Research Report and Stay Ahead of Emerging Industry Trends

To access a comprehensive and in-depth analysis of market drivers, segmentation nuances, regional dynamics, and competitive strategies in the succinic acid industry, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through the bespoke methodologies, proprietary data models, and actionable insights that underpin this report. By partnering with Ketan, you gain early access to custom market intelligence, risk assessments, and tailored forecasts designed to support strategic decision-making across R&D, supply chain management, and commercial planning. Contact Ketan Rohom directly to secure your organization’s competitive edge with the full succinic acid market research report and embark on a data-driven growth trajectory.

- How big is the Succinic Acid Market?

- What is the Succinic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?