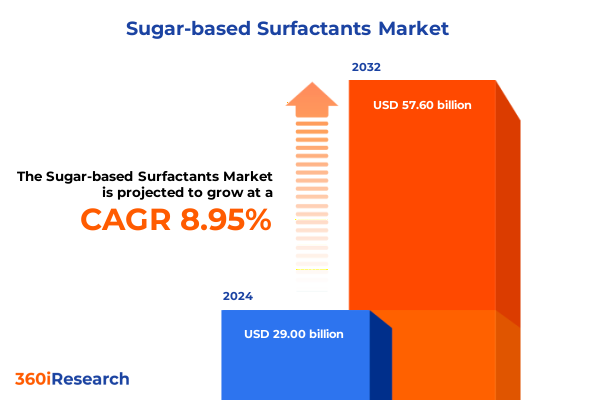

The Sugar-based Surfactants Market size was estimated at USD 31.13 billion in 2025 and expected to reach USD 33.41 billion in 2026, at a CAGR of 9.18% to reach USD 57.60 billion by 2032.

Understanding the Rise of Sugar-Based Surfactants as Sustainable and Multifunctional Solutions for Modern Industrial and Consumer Applications

Sugar-based surfactants have emerged as pivotal components in the shift toward greener chemistries, deriving their molecular backbone from renewable carbohydrates rather than petroleum-derived feedstocks. Characterized by their inherent biodegradability and low toxicity, these compounds offer superior surface-active properties, including efficient emulsification, wetting, and foaming performance. Over the past decade, formulators and manufacturers have increasingly adopted alkyl polyglucosides, lactylates, sorbitan esters, and sucrose esters due to their balanced efficacy and environmental profile. Such ingredients not only meet stringent regulatory requirements for sustainable ingredients, but also cater to growing consumer demand for safe, plant-based formulations in both household and personal care applications.

Key Market Drivers and Emerging Trends Shaping the Transformation of Sugar-Based Surfactant Innovation and Adoption Across Diverse End Uses

The surge in sugar-based surfactant adoption is driven by a confluence of regulatory reform, corporate sustainability commitments, and breakthroughs in green chemistry. Regulatory bodies worldwide are progressively tightening restrictions on synthetic surfactants linked to aquatic toxicity and bioaccumulation, thereby elevating the appeal of sugar-derived alternatives. As a result, manufacturers have prioritized research into enzymatic catalysis and precision fermentation to optimize production yields while reducing energy consumption. Consequently, emerging industry alliances are channeling investments into modular production platforms and bio-refinery integrations that enhance feedstock flexibility and decrease carbon footprints.

In parallel, consumer preferences are shifting toward ethical sourcing and transparent supply chains, prompting brand owners to differentiate through eco-labels and third-party certifications. Technological advances in high-throughput screening and molecular modeling have enabled the design of tailor-made surfactants with custom functional profiles, further accelerating market penetration. Such transformative trends underscore a broader movement toward circular economy principles, as stakeholders collaborate to valorize agricultural residues and develop closed-loop processing systems.

Assessment of 2025 United States Tariff Measures and Their Cumulative Implications for Supply Chains Production Costs and Market Accessibility

In 2025, the United States implemented additional tariff measures targeting imported specialty chemicals, including key intermediates for sugar-based surfactant synthesis. These levies, introduced under Section 301 and augmented by antidumping duties on certain fatty alcohol feedstocks, have progressively increased raw material costs for formulators reliant on imports. Companies that previously sourced high-purity fatty alcohols and glucose derivatives from Southeast Asia and Europe are now experiencing compound cost escalations, which are exerting pressure on profit margins and compelling a reassessment of supply contracts.

As a cumulative outcome, many industry participants are accelerating nearshoring initiatives and forging strategic partnerships with domestic chemical producers. This shift aims to mitigate exposure to tariff-induced volatility and shorten lead times. Meanwhile, some forward-thinking organizations are investing in integrated bioprocessing platforms that harness local agricultural feedstocks, thereby insuring against future trade disruptions. Ultimately, the new tariff landscape is catalyzing supply chain diversification and driving innovation in raw material sourcing strategies.

Insightful Analysis of Product Type Application Industry Function Distribution Channel and Form Segmentation Revealing Strategic Growth Opportunities

A nuanced examination of segmentation layers reveals how product portfolios, application requirements, industrial demands, functional performance, distribution channels, and physical form collectively shape growth pathways within the sugar-based surfactants sector. Across product types, alkyl polyglucosides remain a cornerstone due to their mildness and broad pH stability, while emerging lactylates are gaining traction for their superior emulsifying properties in cleansers. Sorbitan esters offer targeted lipophilic interactions ideal for horticultural adjuvants, and sucrose esters are prized in food-grade applications for their low taste threshold and excellent fat-dispersing characteristics.

Application-driven distinctions further underscore strategic focus areas. In agrochemical formulations, dispersant efficacy is vital for uniform spray coverage, whereas food additive applications demand emulsification and mouthfeel enhancement without imparting off-flavors. Hard surface cleaners benefit from the foaming and wetting capabilities that high-foam and low-foam agents provide, while laundry detergents-both front-load and top-load-require a balance of surfactant concentration, soil-release properties, and compatibility with builders. Personal care products such as body wash, facial cleansers, and shampoos demand formulations that optimize foam quality while ensuring mildness to skin and hair substrates.

Examining end use industries highlights cross-sector adoption patterns. In the agricultural domain, dispersant and wetting agents enable precise agrochemical delivery, whereas the food and beverage sector relies on emulsifiers to maintain texture and stability in dressings and dairy alternatives. Household care formulations leverage multifunctional performance to reduce ingredient counts, while industrial cleaning applications emphasize high-concentration liquid forms for automation in institutional settings. The personal care industry continues to expand demand for sugar-based surfactants in ready-to-use liquid cleansers and specialty micro powder exfoliants.

Functional segmentation reveals distinct R&D pathways. Dispersants focus on particle suspension, oil-in-water and water-in-oil emulsifiers drive encapsulation and controlled release, and both high-foam and low-foam agents are designed to meet specific cleaning or sensory targets. Distribution channel analysis shows a growing reliance on direct sales and distributor networks for B2B bulk transactions, alongside the rising prominence of online retail via manufacturer websites and third-party platforms for specialty and niche end users. Lastly, considerations of form-including concentrated and ready-to-use liquids, as well as granules and micro powders-underscore the importance of logistical efficiency and end-user convenience. Interdependencies across these segmentation criteria inform product development strategies and highlight where value creation can be maximized.

This comprehensive research report categorizes the Sugar-based Surfactants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End Use Industry

- Function

- Distribution Channel

- Form

Comparative Regional Dynamics in the Sugar-Based Surfactants Market Across Americas Europe Middle East Africa and Asia Pacific

Regional growth trajectories in the Americas are shaped by a mature regulatory framework and an established consumer market that values both performance efficacy and environmental stewardship. North American manufacturers have led capacity expansions and technical collaborations to serve a high-demand landscape for household care and personal hygiene. Latin American markets, by contrast, are emerging hotspots for agricultural formulations, driven by the modernization of farming practices and increased adoption of sustainable adjuvants.

Europe, the Middle East, and Africa present a mosaic of growth drivers. The European Union’s Green Deal and related chemical strategy have accelerated substitution of legacy surfactants, while Middle Eastern industrial cleaning sectors are leveraging sugar-based technologies to meet new environmental standards in oil and gas operations. African markets are in early stages of demand generation, with pilot programs demonstrating the benefits of biodegradable formulations in water-scarce regions.

In the Asia-Pacific, rapid urbanization and burgeoning personal care trends are fueling robust demand for mild, multifunctional surfactants. Regional players are investing heavily in local R&D centers and joint ventures to tailor solutions for high-volume laundry and body wash applications. At the same time, competitive dynamics are intensifying as cost-sensitive markets balance price competitiveness with growing sustainability expectations.

This comprehensive research report examines key regions that drive the evolution of the Sugar-based Surfactants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Innovators and Strategic Collaborations Redefining Competitive Dynamics and Value Chains in the Sugar-Based Surfactants Industry

The competitive landscape is defined by a mix of global chemical majors and agile specialty producers. Leading innovators have established multi-site manufacturing footprints, leveraging strategic acquisitions and partnerships to extend their technology portfolios. For instance, Clariant’s collaboration with biotechnology firms has accelerated enzyme-driven production processes, while BASF’s investment in pilot-scale biorefineries demonstrates a commitment to scalable sustainable manufacturing.

Meanwhile, regional champions such as Galaxy Surfactants are expanding greenfield plants in Asia-Pacific to serve domestic and export markets, and niche players like Biolink are differentiating through bespoke micro powder formulations that target premium personal care segments. Collaborative R&D consortia are emerging as a powerful mechanism for de-risking novel chemistries, combining the agility of startups with the market reach of established chemical companies. This dynamic interplay of strategic alliances, capacity investments, and technology licensing shapes an ecosystem where both scale and specialization are critical to maintaining a competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sugar-based Surfactants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Ashland Global Holdings Inc.

- BASF SE

- Clariant AG

- Colonial Chemical, Inc.

- Croda International Plc

- Evonik Industries AG

- Galaxy Surfactants Ltd.

- GlycoSurf, Inc.

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Innospec Inc.

- Jeneil Biotech, Inc.

- Kao Corporation

- Lonza Group AG

- Lubrizol Corporation

- Pilot Chemical Company

- Seppic S.A.

- Shanghai Fine Chemicals Co., Ltd.

- Solvay S.A.

- Stepan Company

- The Dow Chemical Company

- Unilever PLC

- Vantage Specialty Chemicals, Inc.

Actionable Strategies to Accelerate Adoption Maximize Performance and Drive Sustainable Value in the Sugar-Based Surfactants Market

Industry leaders can accelerate value creation by prioritizing targeted R&D investments in high-performance lactylates and next-generation emulsifiers, guided by insights into application-specific demands. Strengthening alliances with feedstock suppliers and academic institutions will facilitate co-innovation, enabling control over critical raw materials and fostering proprietary process efficiencies. Equally important is the optimization of supply chain resilience through a diversified sourcing strategy, harnessing both local agricultural residues and global procurement networks to mitigate trade and tariff risks.

To capture emerging opportunities, companies should develop integrated digital platforms for demand sensing and production scheduling, thus reducing inventory carrying costs and responding swiftly to market shifts. Embracing sustainability certifications and transparent reporting will reinforce brand credibility and align with consumer and regulatory expectations. Lastly, establishing cross-functional pilot programs for new formulations can accelerate time-to-market, ensuring that technical feasibility and commercial viability are validated concurrently.

Diverse Research Methodology Incorporating Primary Interviews Comprehensive Data Analysis and Robust Validation Framework for Market Integrity

This analysis synthesizes a combination of primary and secondary research methodologies designed to ensure robust and reliable insights. Primary research comprised in-depth interviews with formulation scientists, supply chain executives, and regulatory specialists across each major region. These qualitative engagements were supplemented by quantitative surveys targeting end users in the agricultural, household care, and personal care segments to validate demand drivers and technical requirements.

Secondary research involved a systematic review of patent databases, peer-reviewed journals, and industry publications, alongside analysis of customs data and trade statistics to evaluate import-export flows and tariff impacts. Data triangulation and iterative validation workshops with an expert advisory panel provided additional layers of scrutiny. Throughout the process, strict data governance protocols, confidentiality agreements, and cross-functional peer reviews were employed to maintain analytical integrity and guard against biases.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sugar-based Surfactants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sugar-based Surfactants Market, by Product Type

- Sugar-based Surfactants Market, by Application

- Sugar-based Surfactants Market, by End Use Industry

- Sugar-based Surfactants Market, by Function

- Sugar-based Surfactants Market, by Distribution Channel

- Sugar-based Surfactants Market, by Form

- Sugar-based Surfactants Market, by Region

- Sugar-based Surfactants Market, by Group

- Sugar-based Surfactants Market, by Country

- United States Sugar-based Surfactants Market

- China Sugar-based Surfactants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesis of Market Insights Emphasizing Sustainability Innovation and Resilience as Pillars for Future Growth in Sugar-Based Surfactants

The synthesis of these insights underscores the strategic importance of sugar-based surfactants in meeting evolving industrial and consumer demands. Sustainability imperatives, coupled with technological innovation, are redefining product portfolios and unlocking new application frontiers. Regulatory pressures and tariff-driven supply chain shifts highlight the need for agility in sourcing and production strategies. Segmentation analysis reveals nuanced market pockets where tailored chemistries and specialized distribution models can generate differentiated value.

In conclusion, stakeholders equipped with comprehensive, segment-specific intelligence will be best positioned to capitalize on the structural transformation of the surfactants landscape. By blending sustainability commitments with data-driven decision-making and strategic partnerships, companies can navigate current challenges and build resilient platforms for future growth.

Secure Your Competitive Edge by Connecting with Ketan Rohom to Acquire In-Depth Market Research on Sugar-Based Surfactants Today

Take advantage of in-depth insights to navigate evolving regulatory landscapes, optimize product portfolios, and identify high-potential growth avenues in the sugar-based surfactants market by securing direct access to the complete research compilation. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to arrange a personalized briefing, explore tailored data extracts, and obtain a detailed proposal outlining how this comprehensive analysis can empower strategic planning and bolster competitive advantage across your organization.

- How big is the Sugar-based Surfactants Market?

- What is the Sugar-based Surfactants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?