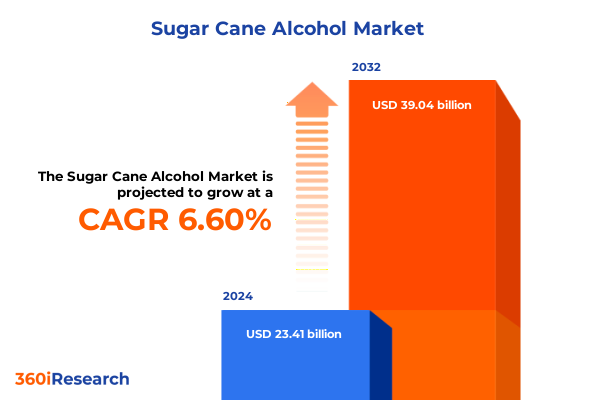

The Sugar Cane Alcohol Market size was estimated at USD 24.79 billion in 2025 and expected to reach USD 26.26 billion in 2026, at a CAGR of 6.70% to reach USD 39.04 billion by 2032.

Introduction to the dynamics shaping global sugar cane alcohol production, consumption patterns, and the pursuit of sustainability

The global sugar cane alcohol industry is undergoing a period of profound transformation as market participants navigate evolving consumer preferences, regulatory shifts, and technological breakthroughs. In recent years, rising awareness of environmental sustainability has spurred demand for lower-carbon feedstocks, with sugar cane emerging as a preferred raw material due to its high yield and renewable nature. Simultaneously, the convergence of biofuel mandates and shifting beverage trends has elevated the strategic importance of sugar cane alcohol, compelling producers to refine their supply chains and expand processing capacities.

Amidst these currents, cost structures and competitive dynamics continue to evolve. Innovations in crop genetics and agronomic practices are driving down cultivation expenses, while advancements in distillation and fermentation technologies boost productivity and resource efficiency. In parallel, an intensifying focus on circular economy principles is encouraging the integration of byproduct valorization, enabling producers to derive value from residual biomass. Collectively, these forces are recalibrating the competitive landscape, positioning sugar cane alcohol as a versatile feedstock for energy, beverages, and industrial applications.

Emerging technological advancements, policy evolutions, and sustainability imperatives redefining the sugar cane alcohol industry landscape

The sugar cane alcohol industry has witnessed several paradigm shifts that are redefining its development trajectory. Foremost among these is the accelerating adoption of digital agriculture and precision farming techniques, which harness data analytics, satellite imagery, and IoT-enabled sensors to optimize crop health and yield. By enabling real-time monitoring of soil moisture, nutrient profiles, and pest pressures, these tools allow producers to significantly enhance input efficiency and reduce environmental impacts.

Policy frameworks have concurrently evolved, with governments refining biofuel mandates and trade agreements to incentivize domestic production and favor renewable alternatives over fossil-derived alcohol. This policy momentum has spurred expansion in both emerging and mature markets, prompting strategic investments in downstream infrastructure, including distilleries and blending terminals. Moreover, growing consumer interest in craft distilled spirits and premium liqueurs has created novel value pools, encouraging producers to diversify beyond fuel-grade ethanol and capture higher-margin beverage segments.

Finally, sustainability imperatives are no longer peripheral considerations; they have become focal points in capital allocation decisions. The emergence of third-party certification standards and carbon credit mechanisms is driving increased transparency across the value chain, compelling firms to substantiate their environmental credentials. As a result, early adopters of integrated sustainability programs are gaining distinct competitive advantages, strengthening their positioning amid an increasingly conscientious stakeholder base and setting new benchmarks for industry performance.

Analyzing the comprehensive effects of recent United States tariff measures on sugar cane alcohol import dynamics and domestic industry competitiveness

In early 2025, the United States government implemented a series of tariff adjustments targeting imported sugar cane alcohol, fundamentally altering the trade calculus for international suppliers and domestic refiners alike. These measures, introduced in response to concerns over market distortions and perceived unfair trade practices, have added a layer of complexity to cross-border supply chains. Importers now face elevated duties that have eroded price competitiveness and prompted a strategic reassessment of sourcing strategies.

The cumulative effect of these tariffs has been twofold. On one hand, domestic producers of sugar cane alcohol have experienced a temporary uplift in demand as buyers seek to mitigate the cost impact of foreign imports. This protective shelter has enabled refiners in key regions to ramp up output and pursue new contractual agreements. On the other hand, the higher landed costs for imported alcohol have reverberated through downstream channels, affecting end-user industries such as automotive fuels producers, beverage manufacturers, and chemical formulators. Many of these stakeholders are now exploring alternative feedstocks or entering long-term hedging agreements to stabilize input costs.

Looking ahead, the persistence of these tariffs is expected to sustain market bifurcation between domestic and international suppliers. While U.S.-based producers may benefit from continued tariff protection, import-dependent players are under pressure to innovate around cost structures, logistical efficiencies, and value-added offerings. In this environment, strategic alliances, joint ventures, and backward integration could emerge as viable pathways for market participants seeking resilience and competitive differentiation.

Unveiling critical segmentation dimensions that expose nuanced opportunities across product, application, purity and distribution channels

A nuanced understanding of market segmentation is vital for identifying latent opportunities across diverse end-use categories. When examining product types, beverage ethanol stands out through its subdivision into distilled spirits and liqueurs, catering to premium and craft-oriented consumers. In parallel, fuel ethanol manifests through two principal pathways: use in flex fuel vehicles and integration into gasoline blends, each with distinct regulatory requirements and blending economics. The dichotomy between beverage and fuel applications underscores the importance of targeted production strategies that align capacity investments with demand profiles.

Shifting our focus to applications, the automotive fuel segment bifurcates into compression ignition engines and spark ignition engines, reflecting the divergent performance characteristics and emission standards of heavy-duty and light-duty vehicles. As for beverage ingredient uses, the distinction between distilled spirits and liqueurs highlights the role of flavor modulation and purity standards in driving formulation decisions. In the realm of chemical solvents, adhesives and sealants merge with paints and coatings, revealing opportunities to leverage alcohol’s solvent properties in industrial manufacturing. Meanwhile, pharmaceutical ingredient applications range from injectable solutions to topical preparations, where regulatory compliance and pharmacopeial purity criteria demand rigorous quality control.

Purity-based segmentation further refines the industry lens by differentiating anhydrous from hydrous grades, each advocating unique supply chain considerations. Anhydrous grades, subdivided into food and industrial grades, cater to beverage distillers and specialty chemical producers who require moisture-free specifications. Conversely, hydrous grades, also segmented into food and industrial tiers, present cost advantages for applications where trace water content is acceptable. Finally, the distribution channel dimension divides into offline and online pathways. Offline channels encompass traditional wholesale and retail networks, whereas online conduits span e-commerce platforms and manufacturer websites, reflecting growing digital procurement trends among B2B and B2C end users.

Collectively, these segmentation dimensions reveal a tapestry of market niches and competitive arenas. By aligning production, marketing, and distribution strategies with the unique drivers of each segment, industry players can optimize resource allocation and capture value from the highest-growth pockets.

This comprehensive research report categorizes the Sugar Cane Alcohol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity

- Application

- Distribution Channel

Exploring regional dynamics shaping sugar cane alcohol consumption and production trends across the Americas, EMEA, and Asia Pacific territories

Geographical dynamics profoundly influence the competitive contours of the sugar cane alcohol market. In the Americas, legacy producers in Brazil, the Caribbean, and the southern United States benefit from established sugar cane acreage, favorable agroclimatic conditions, and mature export infrastructure. This region’s producers often leverage integrated mill-distillery models to maximize feedstock efficiency and drive cost leadership. Concurrently, North American refiners are increasingly investing in advanced fermentation technologies and renewable energy integration to meet evolving biofuel mandates and sustainability benchmarks.

Europe, the Middle East and Africa present a complex mosaic of market drivers. In Europe, stringent decarbonization targets and the European Green Deal have stimulated demand for bioethanol as a low-carbon fuel substitute, while producers in the region navigate strict quality and sustainability certifications. The Middle East, with its abundant access to solar-powered processing facilities, is exploring sugar cane alcohol as a feedstock for export-oriented fuel production, capitalizing on its renewable energy infrastructure. Across Africa, emerging economies are scaling up sugar cane cultivation for both domestic energy security and export potential, although supply chain constraints and infrastructure gaps remain key challenges.

In the Asia-Pacific, rapid urbanization and industrial growth underpin robust consumption of sugar cane alcohol across automotive fuel, beverage, and chemical sectors. Major producers in India, Thailand, and Australia are ramping up capacity, driven by government incentives for rural development and biofuel adoption. As consumer preferences shift towards premium alcoholic beverages, Asia-Pacific beverage producers are also diversifying into distilled spirits and liqueur segments, elevating demand for high-purity feedstocks. In each region, the interplay between policy frameworks, feedstock availability, and end-user applications dictates the urgency of capacity expansions and technological investments.

This comprehensive research report examines key regions that drive the evolution of the Sugar Cane Alcohol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading sugar cane alcohol producers, innovators, and strategic partnerships driving competitive advantage in the evolving market ecosystem

Market leadership in sugar cane alcohol is increasingly defined by the agility to innovate across the value chain. Leading producers have established vertically integrated models that encompass sugar cane cultivation, extraction, fermentation, and distillation, thereby capturing full value from cane biomass. Some of these firms have introduced proprietary yeast strains and biocatalysts to accelerate fermentation rates and elevate ethanol yields, setting new performance standards.

Beyond internal process innovations, strategic alliances and joint ventures are reshaping competitive landscapes. Partnerships between agricultural cooperatives and technology providers have enabled the deployment of precision farming tools at scale, while collaborations with logistics companies streamline feedstock transport and reduce spoilage. On the downstream side, alliances between producers and fuel blenders have secured long-term offtake agreements, ensuring predictable demand for ethanol outputs. In the beverage sector, co-branding arrangements between distilleries and spirit conglomerates have amplified market access for craft-oriented labels.

Mergers and acquisitions have also accelerated consolidation among mid-tier producers seeking scale economies and geographic reach. By acquiring niche distilleries or regional distributors, larger players are broadening their product portfolios and enhancing bargaining power with feedstock suppliers. Collectively, these strategic maneuvers underscore a competitive environment where operational excellence, collaborative ecosystems, and portfolio diversification converge to define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sugar Cane Alcohol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Associated British Foods plc (AB Sugar)

- Bajaj Hindusthan Sugar Ltd

- Balrampur Chini Mills Ltd

- Biosev S.A.

- Copersucar S.A.

- Cosan S.A.

- Dhampur Sugar Mills Ltd

- Louis Dreyfus Company B.V.

- Mitr Phol Sugar Corporation Ltd.

- Raízen S.A.

- Shree Renuka Sugars Ltd

- São Martinho S.A.

- Südzucker AG

- Tereos S.A.

- Wilmar International Limited

Recommendations to empower industry leaders in capitalizing on sustainability, innovation, and enhancing market resilience in sugar cane alcohol sector

Industry leaders must adopt a multifaceted approach to thrive amid intensifying competition and sustainability pressures. First, optimizing feedstock supply through long-term procurement contracts and partnerships with agricultural stakeholders can mitigate raw material price volatility and enhance traceability. Investing in advanced agronomic practices, such as precision irrigation and crop monitoring, will further bolster yield resilience and reduce environmental footprints.

Simultaneously, firms should accelerate the integration of renewable energy sources within plant operations. Deploying solar- or biomass-fired energy systems to power distillation units not only diminishes carbon intensity but also insulates producers from fluctuations in grid electricity rates. This dual mandate of cost containment and sustainability advancement strengthens appeal to both regulatory authorities and eco-conscious consumers.

On the innovation front, dedicating resources to R&D for enzyme optimization and advanced fermentation technologies will unlock incremental efficiency gains. Pilot programs exploring co-processing of lignocellulosic residues can also pave the way for next-generation second-generation biofuels, expanding revenue streams and future-proofing operations.

Finally, enhancing market intelligence capabilities through digital analytics platforms will enable real-time insights into consumer trends, policy shifts, and supply chain disruptions. By harnessing big data and scenario modeling, decision-makers can swiftly adjust production allocations and navigate geopolitical uncertainties with greater confidence.

Detailed research methodology outlining data collection, analysis techniques, source validation and multi-tiered stakeholder engagement frameworks

This research employed a comprehensive framework combining primary and secondary data collection to ensure analytical rigor. Primary inputs were garnered through interviews and surveys with key stakeholders, including plantation managers, distillery operators, regulatory bodies, and end users in automotive, beverage, chemical, and pharmaceutical sectors. These interactions provided first-hand insights into operational challenges, investment priorities, and emerging market needs.

Secondary research entailed a systematic review of government publications, industry journals, trade association reports, and academic studies to validate primary findings and identify macroeconomic and policy drivers. Quality assurance protocols included cross-verification of data points across multiple sources and chronological triangulation to account for evolving regulatory landscapes.

Quantitative analysis leveraged statistical techniques to examine feedstock price trends, production efficiencies, and import-export flows. Scenario modeling tools were applied to assess the sensitivity of market outcomes to variables such as tariff changes, yield improvements, and sustainability regulations. Meanwhile, a multi-tiered stakeholder engagement process, featuring peer reviews by subject-matter experts, ensured the methodological robustness and relevance of insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sugar Cane Alcohol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sugar Cane Alcohol Market, by Product Type

- Sugar Cane Alcohol Market, by Purity

- Sugar Cane Alcohol Market, by Application

- Sugar Cane Alcohol Market, by Distribution Channel

- Sugar Cane Alcohol Market, by Region

- Sugar Cane Alcohol Market, by Group

- Sugar Cane Alcohol Market, by Country

- United States Sugar Cane Alcohol Market

- China Sugar Cane Alcohol Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Final synthesis emphasizing strategic imperatives, market opportunities and sustainable pathways for sustained growth in sugar cane alcohol landscape

In synthesizing the landscape of sugar cane alcohol, it is evident that the interplay of innovation, policy evolution, and sustainability mandates will dictate competitive trajectories. Strategic segmentation across product types, applications, and distribution channels presents clear avenues for targeted growth, while regional dynamics highlight the need for localized approaches that account for regulatory and infrastructural variations.

The 2025 tariff adjustments in the United States underscore the importance of agility in supply chain management and strategic partnerships to navigate trade disruptions. Producers and end users alike must cultivate resilience through diversified sourcing and cost-control strategies, balancing short-term demand shifts with long-term investment imperatives.

Ultimately, the future of sugar cane alcohol hinges on the ability of industry players to harmonize economic objectives with environmental and social commitments. By aligning operational excellence with transparent sustainability practices, the sector can unlock new markets, foster stakeholder trust, and pave the way for enduring, responsible growth.

Unlock comprehensive sugar cane alcohol market insights and drive strategic decisions by contacting Ketan Rohom for the full research report purchase details

To access the in-depth insights and comprehensive analysis of the sugar cane alcohol market, reach out directly to Ketan Rohom. As the Associate Director of Sales & Marketing, Ketan brings deep expertise and strategic acumen to guide prospective clients through the report’s extensive findings. By engaging with Ketan, stakeholders can tailor the research deliverables to their specific needs, ensuring alignment with organizational goals and investment priorities.

Whether you seek a customized extraction of data tables, region-specific deep dives, or personalized advisory support, Ketan will coordinate the delivery of a solution that maximizes the utility of this market intelligence. Don’t miss the opportunity to leverage this authoritative resource and secure a competitive edge in the dynamic sugar cane alcohol industry. Contact Ketan Rohom today to initiate the purchase process and unlock the full potential of your strategic decision-making.

- How big is the Sugar Cane Alcohol Market?

- What is the Sugar Cane Alcohol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?