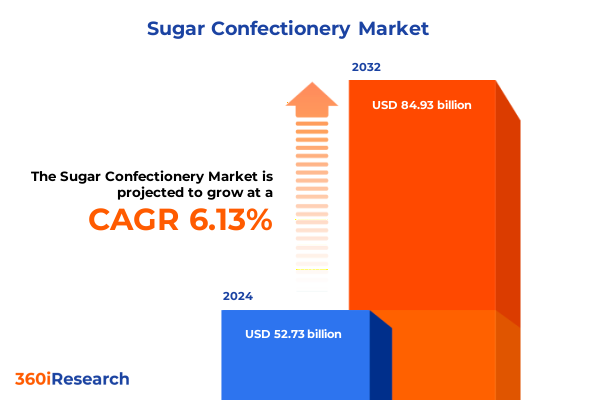

The Sugar Confectionery Market size was estimated at USD 55.98 billion in 2025 and expected to reach USD 58.64 billion in 2026, at a CAGR of 6.13% to reach USD 84.93 billion by 2032.

Exploring the Fundamental Dynamics and Emerging Opportunities Shaping the Contemporary Sugar Confectionery Market and Its Transformative Trajectories

The sugar confectionery market is characterized by a long history of indulgence that reflects evolving consumer tastes, shifting lifestyle dynamics, and continuous product innovation. From classic hard candies and licorice to the playful emergence of gummies and jellies, this industry has rooted itself deeply in global culture while consistently adapting to changing demands. In recent years, sugar confectionery brands have faced mounting pressure to balance the inherent appeal of sweetness with mounting concerns around nutrition, health awareness, and environmental sustainability. This dynamic context has spurred companies to innovate, diversify their product lines, and rethink traditional go-to-market frameworks.

Against this backdrop, several key drivers are charting the next phase of growth for sugar confectionery. Digital and e-commerce channels are redefining distribution models, enabling brands to connect directly with consumers and deliver hyper-personalized experiences. Premiumization has taken hold, as discerning shoppers seek artisanal flavors, clean-label ingredients, and unique packaging. At the same time, demand for healthier formulations and plant-based alternatives is rising, prompting investment in research and development of low-sugar, natural-sweetener and functional confectionery options. Consequently, the market landscape is being reshaped by a convergence of technological advancements, shifting consumer values, and a renewed emphasis on quality and transparency.

Unveiling the Major Transformative Forces Redefining Consumer Preferences and Operational Models Across the Sugar Confectionery Industry

Several transformative forces are actively redefining the sugar confectionery industry, from supply chain reinvention to consumer-centric product customization. One of the most significant shifts is the rise of direct-to-consumer platforms and omnichannel retail strategies, which are enabling brands to gather real-time insights, test novel flavors, and adjust production volumes in response to immediate market feedback. Simultaneously, digital marketing innovations-such as social media influencer partnerships, interactive mobile apps, and augmented reality packaging experiences-are capturing consumer attention more effectively than traditional advertising campaigns.

Another critical evolution lies in alternative ingredient integration and clean-label positioning. Companies are increasingly adopting natural sweeteners like stevia and monk fruit, as well as plant-based proteins, to cater to health-conscious consumers and flexitarian lifestyles. Beyond formulation, sustainability has become a non-negotiable criterion for packaging, with firms exploring recyclable materials, compostable wrappers, and minimalistic designs. These developments are supported by strategic partnerships with suppliers to ensure ethical sourcing of raw sugar and cocoa, as well as investments in energy-efficient manufacturing processes. Together, these transformative shifts are forging a more agile, consumer-focused, and sustainable sugar confectionery ecosystem.

Analyzing the Comprehensive Effects of New United States Tariff Measures on Sugar Confectionery Import Costs and Supply Dynamics

In 2025, the United States implemented a series of tariff adjustments targeting imported sugar confectionery, reflecting broader trade policy objectives aimed at bolstering domestic production and addressing perceived trade imbalances. These measures have cumulatively increased import duties on finished confectionery products and key raw materials sourced from Europe and Asia. The phased nature of the tariff hikes has enabled policymakers to calibrate responses to industry lobbying while mitigating sudden supply chain disruptions.

The net effect of these tariffs has been a noticeable uptick in input costs for domestic manufacturers reliant on imported ingredients, such as specialized high-intensity sweeteners, premium cocoa products, and flavor concentrates. As a result, many producers have reevaluated sourcing strategies by forging new partnerships with regional suppliers or investing in domestic processing facilities to reduce vulnerability to import levies. On the consumer front, retail prices for certain premium and niche confectionery segments have experienced moderate inflationary pressure, prompting some brands to absorb costs to maintain price competitiveness. Overall, these cumulative tariff impacts underscore the importance of supply chain resilience, diversified sourcing, and proactive engagement with trade policymakers.

Leveraging Multidimensional Segmentation Insights to Decode Varied Consumer Preferences and Distribution Strategies in Sugar Confectionery

The sugar confectionery landscape can be dissected through multiple segmentation lenses, each revealing distinct growth pockets and consumer affinities. When examined by product type, the Gummies & Jellies cohort has witnessed rapid expansion, driven by playful formats such as fruit gums, gummy bears, gummy worms, and jelly beans. Meanwhile, the Hard Candy segment remains a stalwart performer, with fruit drops, lollipops, mints, and butterscotch varieties retaining broad appeal among traditional customers. Within Licorice, the saltier profiles of salted licorice contrast sharply with the sweet licorice sub-segment, catering to both adventurous palates and classic preferences. Similarly, Marshmallow sub-categories-ranging from delicate flavored marshmallow creations to soft marshmallow confections-continue to command seasonal demand. Toffees & Caramels encompass a spectrum of textures and flavor intensities, from buttery toffee bites to chewy caramels and creamy toffees, allowing brands to tailor offerings to diverse mouthfeel expectations.

Distribution channel variations further underscore the need for channel-specific strategies. Convenience stores offer impulse purchase opportunities and localized assortment, while specialty stores curate premium and artisanal collections. Supermarkets and hypermarkets sustain reach through high-visibility shelf placement, complemented by end-aisle activations. Online channels are bifurcated between direct-to-consumer e-commerce platforms, which facilitate brand storytelling and subscription models, and third-party retailers, which provide expansive digital footfall. Packaging innovations-from cost-effective bulk formats to single-serve individual wraps and family-friendly multipacks-address varied usage occasions. Generational taste profiles also inform segmentation: children gravitate toward vividly colored, fruit-flavored variants; adults seek balanced indulgence with chocolate, fruity accents, or mint refreshment; seniors often prefer classic recipes with familiar textures. Flavor segmentation remains equally impactful, with chocolate recipes leading decadent indulgence, fruity assortments satisfying midday cravings, and mint varieties appealing to palate refresh and after-meal consumption.

This comprehensive research report categorizes the Sugar Confectionery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Consumer Age Group

- Flavor

- Distribution Channel

Uncovering Distinct Regional Differentiators and Growth Drivers Across Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional markets exhibit unique consumption patterns, regulatory landscapes, and growth drivers that demand tailored strategic responses. In the Americas, high per capita consumption is fueled by an established culture of convenience snacking and mass-retail proliferation. North American consumers demonstrate a strong appetite for low-sugar and functional confectionery, while Latin American markets remain influenced by traditional recipes, regional flavors, and locally sourced sugar. Retail infrastructure in this region supports omnichannel expansion, with e-commerce penetration steadily rising alongside the enduring dominance of supermarkets and convenience outlets.

Europe, Middle East & Africa presents a diversified mosaic of consumer preferences, regulatory environments, and economic maturity levels. Western European markets emphasize premiumization, driving demand for small-batch, ethically certified, and artisanal confections. Central and Eastern European markets balance price sensitivity with rising interest in novel formats and ingredients. In the Middle East, premium imports of seasonal and gift-oriented sugar confectionery flourish during cultural festivities, while African nations display growing potential as urbanization and retail modernization elevate confectionery accessibility. Lastly, the Asia-Pacific region is marked by rapid innovation and a pronounced demand for localized flavors, such as lychee, matcha, and regional fruit infusions. Emerging markets across Southeast Asia and India are experiencing swift retail evolution, prompting global brands to forge partnerships with national distributors and digital marketplaces.

This comprehensive research report examines key regions that drive the evolution of the Sugar Confectionery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Innovative Product Launches and Competitive Positioning of Leading Sugar Confectionery Enterprises

Market leaders have deployed varied strategies to strengthen their competitive footing in the complex sugar confectionery landscape. Major global conglomerates continue to pursue mergers and acquisitions that expand geographic reach and diversify product portfolios. Simultaneously, leading players have channeled investment into research and development, unveiling sugar-reduced recipes, plant-based alternatives, and novel textures that resonate with evolving health and wellness trends. Collaborations with ingredient innovators have facilitated the integration of functional formulations, such as vitamin-enhanced gummies and probiotics-infused marshmallows.

At the same time, nimble regional and artisanal brands have carved out competitive niches by emphasizing local heritage, limited-edition seasonal flavors, and authentic ingredient stories. These companies leverage digital storytelling and community-focused marketing to cultivate brand loyalty and drive premium price points. Packaging differentiation has become a battleground for attention, as firms experiment with sustainable wrappers, visually striking designs, and resealable convenience. Through targeted partnerships with leading retailers, co-branding initiatives, and in-store experiential activations, both established and emerging players continue to vie for shelf prominence and consumer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sugar Confectionery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- August Storck KG

- Bourbon Corporation

- Chupa Chups S.A.

- Cloetta AB

- Crown Confectionery Co. Ltd.

- Ezaki Glico Co. Ltd.

- Ferrara Candy Company

- Ferrero Group

- Haribo GmbH & Co. KG

- Impact Confections Inc.

- Just Born Quality Confections

- Lindt & Sprüngli AG

- Lotte Confectionery Co. Ltd.

- Mars Incorporated

- Meiji Holdings Co. Ltd.

- Mondelez International Inc.

- Morinaga & Co. Ltd.

- Nestlé S.A.

- Orion Corporation

- Perfetti Van Melle Group

- The Hershey Company

- Tootsie Roll Industries Inc.

- Yildiz Holding A.S.

Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Market Complexities and Capturing Emerging Opportunities

Industry leaders should prioritize a holistic set of strategic imperatives to thrive in the dynamically shifting sugar confectionery domain. First, investment in clean-label research and development is essential, enabling brands to formulate confections with natural sweeteners, fruit concentrates, and functional ingredients that address consumer health consciousness without compromising taste. Second, optimizing digital and omnichannel capabilities will be instrumental in capturing real-time consumer data, refining product assortments, and fostering direct engagement through personalized promotions and subscription models.

Third, supply chain resilience must be fortified by diversifying raw material sources, establishing regional processing hubs, and cultivating strong relationships with sustainable suppliers. This will mitigate tariff risks and logistical disruptions. Fourth, granular segmentation strategies-tailoring product design, flavor profiles, and packaging formats-to distinct age groups, consumption occasions, and regional preferences can unlock new revenue streams. Fifth, embracing sustainability across packaging, manufacturing, and ingredient sourcing will not only reduce environmental impact but also strengthen brand reputation among eco-conscious consumers. Finally, forging strategic partnerships with retailers, technology platforms, and ingredient innovators can accelerate time to market, enhance innovation pipelines, and position organizations to capitalize on emerging consumer trends.

Detailing the Rigorous Multi-Stage Research Methodology Ensuring Comprehensive Insight and Credible Analysis for Confectionery Market Study

The insights presented in this report derive from a comprehensive, multi-stage research methodology designed to ensure analytical rigor and market accuracy. Primary research included in-depth interviews with senior executives from leading confectionery manufacturers, ingredient suppliers, retail channel operators, and trade association representatives. These conversations provided nuanced perspectives on strategic priorities, operational challenges, and innovation trajectories.

Secondary research involved systematic review of industry publications, government trade statistics, company annual reports, and sustainability disclosures. Market data was triangulated with supply chain intelligence and distribution channel metrics to validate key trends. Consumer sentiment and behavioral analysis were supplemented by online focus groups and targeted surveys across demographic cohorts. Data synthesis was conducted through statistical analysis and qualitative coding to identify recurring themes, emerging patterns, and region-specific variations. All findings underwent a stringent validation process, including peer review by independent market analysts, to ensure reliability and comprehensive coverage of the global sugar confectionery sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sugar Confectionery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sugar Confectionery Market, by Product Type

- Sugar Confectionery Market, by Packaging Type

- Sugar Confectionery Market, by Consumer Age Group

- Sugar Confectionery Market, by Flavor

- Sugar Confectionery Market, by Distribution Channel

- Sugar Confectionery Market, by Region

- Sugar Confectionery Market, by Group

- Sugar Confectionery Market, by Country

- United States Sugar Confectionery Market

- China Sugar Confectionery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Key Takeaways and Emphasizing Strategic Imperatives to Guide Future Decision-Making in the Sugar Confectionery Sector

The examination of the global sugar confectionery market highlights a landscape in flux-driven by health-oriented innovation, digital transformation, and evolving consumer expectations. Regional nuances underscore the necessity for localized strategies, while segmentation analyses reveal untapped potential across product types, channels, and age cohorts. The cumulative impact of recent tariff measures further emphasizes the critical importance of supply chain agility and proactive trade management.

Moving forward, companies that excel will be those that successfully balance tradition with experimentation, leveraging clean-label expertise, channel diversification, and sustainability leadership to differentiate their offerings. By embracing data-driven decision-making, forging collaborative partnerships, and maintaining a relentless focus on consumer sentiment, industry participants can capitalize on emerging trends, mitigate regulatory and macroeconomic headwinds, and secure a competitive edge in the ever-evolving sugar confectionery arena.

Connect with an Expert Associate Director to Obtain the Comprehensive Sugar Confectionery Market Research Report and Drive Informed Strategy

To explore the full depth of the global sugar confectionery landscape, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, who is ready to provide tailored insights and guide you through every facet of the report. You will gain access to comprehensive competitive analyses, region-specific deep dives, segmentation breakdowns, and actionable recommendations designed to inform your strategic roadmap. Reach out today for a personalized consultation and secure your copy of the market research report to capitalize on emerging trends, optimize product portfolios, and drive sustainable growth across your organization.

- How big is the Sugar Confectionery Market?

- What is the Sugar Confectionery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?