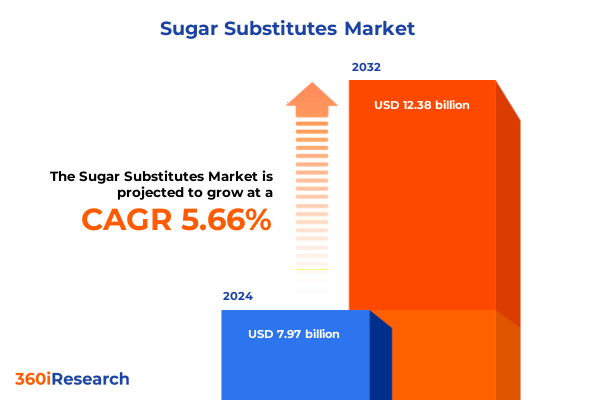

The Sugar Substitutes Market size was estimated at USD 8.39 billion in 2025 and expected to reach USD 8.83 billion in 2026, at a CAGR of 5.72% to reach USD 12.38 billion by 2032.

Overview of the Evolving Sugar Substitute Ecosystem Driven by Health Trends, Regulatory Actions, and Innovation in Sweetener Technologies

The global sugar substitute arena is at a pivotal juncture as stakeholders grapple with mounting public health concerns and an expanding pool of regulatory measures aimed at curbing added sugar consumption. International Diabetes Federation data indicate that more than 537 million adults live with diabetes today, underscoring an urgent imperative for alternative sweetening solutions that manage glycemic impact while preserving taste profiles. Concurrently, national and local sugar taxes, labeling requirements, and consumer advocacy campaigns are accelerating industry-wide reformulations, pushing manufacturers to replace traditional sucrose with a diverse portfolio of high- and low-intensity sweeteners.

As health-conscious consumers exert greater influence over product development, beverage producers are at the vanguard of this shift. Coca-Cola’s recent second-quarter results revealed a 14% gain in Coca-Cola Zero Sugar volumes globally, with revenue rising 2.5% to $12.62 billion, a clear testament to the appetite for zero-calorie formulations. These performance metrics reinforce that sugar alternatives are no longer peripheral ingredients but core drivers of top-line growth across major CPG portfolios.

Technological breakthroughs in rare sugar production and fermentation-based sweetener synthesis are broadening the horizon of possibilities. Allulose, a low-calorie monosaccharide naturally present in certain fruits, has seen substantial investment in capacity expansion by South Korean firms striving to meet rising consumer demand for sugar-like taste without caloric burden. Similarly, advanced steviol glycoside platforms such as EverSweet® have secured positive safety opinions from both EFSA and the UK FSA, paving the way for cleaner-label sweetener solutions with smaller environmental footprints. Together, these dynamics set the stage for an era defined by ingredient plurality, stringent health objectives, and rapid innovation cycles.

Navigating the Paradigm Shift in Sweetener Strategies Fueled by Health-Focused Consumer Choices and Breakthrough Ingredient Innovations

Consumer perspectives on sweeteners are undergoing a fundamental transformation, shifting the industry’s trajectory toward natural, non-nutritive options and hybrid blends. Recent research has spotlighted erythritol’s potential neurological risks, linking high intake to impaired blood clotting and stroke incidence, which has intensified scrutiny on sugar alcohols and underscored the appeal of alternatives with well-established safety profiles. This revelation amplifies pre-existing concerns about synthetic sugar substitutes and accelerates the migration toward plant-derived sweeteners perceived as more authentic.

Parallel to these health considerations, government-led initiatives and advocacy campaigns are driving substantive reformulation mandates. Under the “Make America Healthy Again” platform, Health Secretary Robert F. Kennedy Jr. has championed reduced reliance on high-fructose corn syrup and artificial sweeteners, prompting Coca-Cola to pilot a real cane sugar offering in the U.S. later this year as part of a broader product diversification strategy. Such high-profile moves by industry leaders catalyze wider shifts in ingredient sourcing, cost modeling, and marketing narratives.

At the same time, scientific innovation is rewriting the rules of sugar reduction. Harvard University’s Wyss Institute has introduced a pioneering enzyme-encapsulation technology that converts dietary sugar into nondigestible fiber in the small intestine, reducing net sugar absorption by an estimated 30% and opening a new frontier in functional sweetener design. These converging forces of health-driven consumer behavior, policy incentives, and biotechnological advances are orchestrating a transformative shift in sweetener strategies across food, beverage, and nutraceutical applications.

Assessing the Comprehensive Impact of 2025 U.S. Tariff Measures on Sweetener Supply Chains, Cost Structures, and Ingredient Formulations

U.S. tariff policy enacted in 2025 is exerting pronounced effects on global sweetener supply chains, compelling manufacturers to reassess sourcing priorities and cost structures. Stevia extracts, predominantly processed in China and India, are now subject to import duties ranging from 10% to 15%, elevating landed costs and prompting some beverage brands to reformulate or reduce stevia content to preserve flavor balance and margin targets. Similarly, monk fruit shipments from China face tariffs of up to 25%, compelling product developers to explore alternative sweeteners such as erythritol or blends with sucralose to avoid price shock and maintain clean-label positioning.

In contrast, certain high-profile sweeteners have been exempted from the new tariff regime, notably sucralose and acesulfame-K, which are classified under pharmaceutical or strategic additive categories. This selective exemption has rendered these ingredients comparatively more economical and is expected to drive incremental formulation shifts in favor of sucralose-based sweetening systems. However, non-exempt artificial sweeteners like aspartame and sugar alcohols such as xylitol now incur full ad-valorem duties, complicating global procurement and inventory management.

The U.S. Department of Agriculture’s decision to forgo allocations under the Specialty Sugar Quota for fiscal year 2026 has introduced another layer of complexity. By blocking incremental imports of organic and specialty sugars, USDA forecasts indicate over $85 million in additional high-tier duties, which will constrain supply availability for organic sugar and drive up raw material expenses for health-oriented food producers. These evolving trade measures underscore the critical need for agile sourcing strategies, tariff mitigation planning, and diversified supplier networks to sustain competitive advantage.

Unlocking Market Opportunities Through Product, Form, Sweetness Intensity, End-Use, and Channel Segmentation Insights

The sugar substitute market’s complexity is further amplified by the breadth of product types and their respective value propositions. Artificial sweeteners such as acesulfame-K, aspartame, cyclamate, saccharin, and sucralose continue to deliver high sweetness intensity at minimal inclusion rates, making them indispensable for calorie-reduction initiatives in carbonated beverages and packaged snacks. Conversely, natural sweeteners-ranging from honey and licorice root extracts to monk fruit and stevia-and an expanding portfolio of sugar alcohols, including allulose, erythritol, and xylitol, offer diverse functional attributes such as bulking, browning, and mouthfeel modulation, broadening formulation possibilities across food and beverage categories.

Form variations play a pivotal role in application-specific tailoring. Liquid formats are increasingly favored by beverage manufacturers for their rapid solubility and ease of blending, while dry granules and powdered formats dominate bakery and confectionery applications due to process stability and moisture control requirements. These format distinctions guide procurement strategies, warehouse management, and in-line handling practices to optimize product quality.

Sweetness intensity segmentation delineates the use cases for high-, moderate-, and low-intensity sweeteners. High-intensity options, often 200 to 600 times sweeter than sucrose, facilitate significant sugar reduction in beverages and tabletop applications, whereas moderate and low-intensity sweeteners-like sugar alcohols and rare sugars-are applied when sugar’s bulk, freezing point depression, and caramelization properties must be retained to preserve functional performance in bakery, frozen desserts, and dairy alternatives.

End-use industry demands further refine the market landscape. Beverages, encompassing alcoholic, carbonated, fruit-based, and plant-based drinks, represent a primary driver of innovation, with manufacturers leveraging blends of natural and synthetic sweeteners to balance taste and label claims. The food sector-spanning bakery, confectionery, dairy, and sauces-relies on sugar substitutes that deliver textural and flavor fidelity while meeting calorie-reduction targets. Pharmaceutical and nutraceutical applications call for high-purity, regulatory-compliant sweeteners to mask bitterness and enhance patient acceptability.

Finally, distribution channel dynamics-offline retail versus online platforms-impact market access and consumer education. While traditional supermarkets and wholesalers remain key conduits for mass-market adoption, the e-commerce channel has emerged as a strategic avenue for niche and premium sugar substitute products, offering manufacturers direct engagement with health-oriented consumers seeking specialized formulations.

This comprehensive research report categorizes the Sugar Substitutes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Sweetness Intensity

- End-Use Industry

- Distribution Channel

Analyzing Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Sweetener Markets

The Americas market is characterized by robust demand for low- and zero-calorie sweeteners, underpinned by strong consumer awareness campaigns and governmental sugar taxes across multiple states. North American beverage giants have led this trend, as evidenced by Coca-Cola’s rapid expansion of Coca-Cola Zero Sugar, while HFCS suppliers like ADM and Ingredion saw stock price reactions following policy pronouncements encouraging cane sugar alternatives. Meanwhile, the region’s regulatory bodies continue to tighten labeling requirements and impose sugar levies, reinforcing manufacturers’ commitments to sugar reduction.

In Europe, the Middle East, and Africa, regulatory fragmentation coexists with progressive health frameworks. The European Food Safety Authority’s recent reduction of erythritol’s acceptable daily intake to 0.5 g/kg body weight exemplifies the region’s stringent safety evaluations, while tariff exemptions for sucralose and acesulfame-K, as outlined in recent U.S. trade policy analyses, highlight the sensitivity of cross-border ingredient flows. Market participants in EMEA are navigating divergent national fortification and labeling standards, driving tailored sweetener portfolios and localized innovation efforts.

Asia-Pacific is witnessing a surge in natural sweetener adoption, particularly in markets like South Korea and Japan, where allulose has transitioned from niche ingredient to mainstream adoption powered by positive regulatory approvals and investments in production capacity. This region’s dynamic consumer base, rising health consciousness, and expanding middle class are accelerating the uptake of both traditional sugar alternatives and emerging biotech-derived sweeteners, establishing Asia-Pacific as a pivotal battleground for global sweetener suppliers.

This comprehensive research report examines key regions that drive the evolution of the Sugar Substitutes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ingredient Suppliers Driving Innovation in Low-Calorie and Natural Sweeteners Through Strategic Investments and Partnerships

Cargill, in partnership with dsm-firmenich through the Avansya joint venture, has positioned its EverSweet® stevia platform at the forefront of natural sweetener innovation. Following positive safety opinions from EFSA and the UK FSA, EverSweet® Reb M and Reb D glycosides are on track for EU and UK commercialization, offering sustainable, fermentation-based production with reduced land and water use.

Tate & Lyle has completed its strategic pivot from sugar refining to health-oriented ingredient solutions under CEO Nick Hampton’s stewardship. Bolstered by the acquisition of CP Kelco for $1.8 billion, the company’s expanded mouthfeel and fiber fortification portfolio was center stage at IFT FIRST 2025, demonstrating prototype innovations in dual-texture confectionery and high-performance citrus fibers for dairy applications. This evolution underscores Tate & Lyle’s commitment to low-calorie, clean-label solutions.

Archer Daniels Midland’s Carbohydrate Solutions segment continues to adapt to market pressures by emphasizing healthier indulgence and nutritional balance. ADM’s 2025 strategy highlights protein- and fiber-enriched sweeteners alongside new stevia products tailored to premium texture and flavor, reflecting an acute focus on consumer trust and evolving NPD requirements.

Ingredion, a key high-fructose corn syrup and texturizer supplier, experienced share price volatility when policy signals suggested a broader shift to cane sugar in U.S. beverages. This market reaction highlights the vulnerability of HFCS-dependent portfolios and underscores the necessity for diversification into higher-value sugar substitute ingredients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sugar Substitutes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Apura Ingredients, Inc.

- Archer Daniels Midland Company

- Batory Foods

- Bonumose, Inc.

- Cargill Incorporated

- Cumberland Packing Corporation

- Evonik Industries AG

- Fooditive Group

- Foodmate Co., Ltd.

- Galam Group

- Givaudan

- GLG Life Tech Corporation

- Ingredion SA

- International Flavors & Fragrances Inc.

- Irca S.p.A.

- JK Sucralose Inc by Feishang Group, Ltd

- Koninklijke DSM N.V

- Kruger Group

- Manus Bio Inc

- MORITA KAGAKU KOGYO CO., LTD.

- NOW Health Group, Inc.

- NutraEx Food Inc.

- Oobli, Inc

- Roquette Frères SA

- SweeGen, Inc

- Südzucker AG

- Tate & Lyle PLC

- Whole Earth Brands, Inc.

- Wisdom Natural Brands

Strategic Imperatives for Industry Leaders to Optimize Portfolios, Navigate Trade Policies, and Leverage Breakthrough Sweetener Innovations

Industry leaders should undertake a comprehensive portfolio diversification by blending natural and high-intensity sweeteners, mitigating tariff risks and optimizing cost structures. Incorporating tariff-exempt ingredients such as sucralose alongside lower-tariff natural options can smooth margin volatility while preserving product claims. In parallel, investments in fermentation-based production platforms, exemplified by EverSweet®, can reduce bio-resource footprints and enhance supply security.

Strategic alliances with biotechnology innovators and academic research institutions offer a gateway to next-generation sugar reduction technologies. Harvard’s enzyme-to-fiber conversion research demonstrates the potential of nanoparticle encapsulation methods to fundamentally change sugar metabolism at the physiological level. Piloting such advancements in R&D pipelines can yield disruptive product differentiators.

Proactive engagement with trade policymakers and participation in TRQ allocation forums are crucial for anticipating tariff-rate quota adjustments and specialty sugar quotas. Leveraging multi-sourcing strategies and building regional manufacturing capabilities can hedge against abrupt policy shifts, safeguarding ingredient availability and cost predictability.

Finally, embracing data-driven consumer insights to refine sweetener blends will ensure alignment with clean-label and health-driven preferences. Continuous sensory optimization, combined with transparent supply chain narratives, will bolster brand trust and facilitate deeper market penetration across demographic segments.

Transparent Research Methodology Combining Rigorous Primary Interviews, Authoritative Secondary Sources, and Comprehensive Data Verification Procedures

This study integrates a multi-method research framework combining primary and secondary data sources to ensure utmost reliability. Primary interviews were conducted with senior R&D executives, procurement managers, and regulatory affairs specialists across leading ingredient suppliers and CPG companies. Secondary research entailed rigorous analysis of U.S. government publications, including USDA Economic Research Service and USTR tariff-rate quota announcements, complemented by industry press from reputable news agencies such as Reuters and Barron’s.

Trade flow data on raw cane sugar, specialty sugar, and sugar-containing products were validated against annual USTR TRQ allocations and USDA press releases. Consumer sentiment metrics were triangulated through cross-referencing survey findings published in peer-reviewed journals and high-impact media reports. All synthesized insights were subjected to quantitative cross-checks against import/export databases and corporate financial disclosures to mitigate bias and uphold methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sugar Substitutes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sugar Substitutes Market, by Product Type

- Sugar Substitutes Market, by Form

- Sugar Substitutes Market, by Sweetness Intensity

- Sugar Substitutes Market, by End-Use Industry

- Sugar Substitutes Market, by Distribution Channel

- Sugar Substitutes Market, by Region

- Sugar Substitutes Market, by Group

- Sugar Substitutes Market, by Country

- United States Sugar Substitutes Market

- China Sugar Substitutes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing the Critical Role of Sweetener Innovation in Meeting Evolving Consumer and Regulatory Expectations in the Modern Food Landscape

In conclusion, the sugar substitutes market is undergoing a profound recalibration as public health imperatives, regulatory frameworks, and consumer expectations converge on the imperative to reduce added sugar consumption. Innovations spanning high-intensity sweeteners, rare sugars, and biotechnological interventions are reshaping product formulations while selective tariff exemptions and specialty sugar quotas influence strategic ingredient sourcing. With over 537 million adults navigating diabetes management and clean-label preferences reaching critical mass, the stakes for delivering safe, palatable, and sustainable sweetening solutions have never been higher.

Organizations that proactively align their R&D initiatives with emerging scientific breakthroughs, tariff landscapes, and segmentation strategies will be best positioned to capture incremental share and foster enduring consumer loyalty. The path forward demands agile adaptation, cross-functional collaboration, and steadfast commitment to both health and sensory excellence.

Secure Your Definitive Sugar Substitutes Market Intelligence Through Direct Engagement with Ketan Rohom, Associate Director, Sales & Marketing

Ready to transform your strategic approach to sugar substitutes? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive market research report that empowers your organization with unparalleled insights and actionable intelligence. Elevate your competitive edge by accessing deep-dive analysis, proprietary data, and expert recommendations tailored to your business needs. Contact Ketan today to discuss how our comprehensive study can inform your product development, supply chain decisions, and go-to-market strategies for sustained growth.

- How big is the Sugar Substitutes Market?

- What is the Sugar Substitutes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?