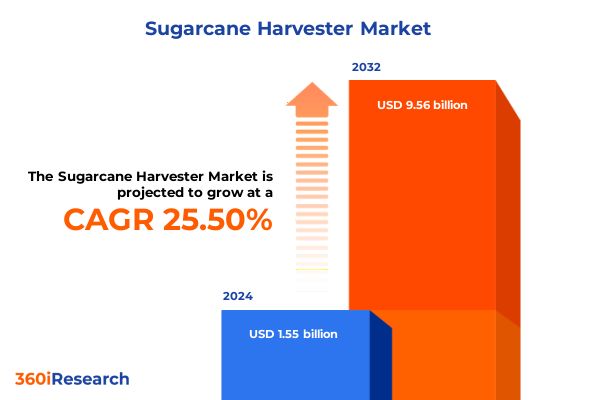

The Sugarcane Harvester Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.41 billion in 2026, at a CAGR of 25.46% to reach USD 9.56 billion by 2032.

Navigating the Modern Sugarcane Harvester Industry: Unveiling Critical Drivers, Technological Innovations, and Market Dynamics Shaping Future Growth

Sugarcane farming stands at a pivotal juncture, where traditional harvesting methods are rapidly yielding to advanced mechanization driven by economic pressures and technological breakthroughs. As global demand for sugar and bioenergy feedstocks continues to rise, growers are compelled to optimize operational efficiency, reduce labor dependency, and enhance sustainability. Against this backdrop, sugarcane harvester manufacturers are innovating across mechanical design, power systems, and digital integration to meet evolving farm requirements and stringent environmental standards.

In recent years, precision farming techniques have become a cornerstone of modern harvesting operations. Harvesters equipped with GPS guidance, real-time sensors, and yield mapping capabilities enable consistent cutting performance and minimized field losses. These technologies not only drive productivity gains but also support data-driven decision-making that aligns with broader agronomic strategies. Moreover, the integration of telematics and remote monitoring platforms is redefining equipment upkeep and fleet management, allowing operators to anticipate maintenance needs, streamline logistics, and maximize machine uptime.

Looking forward, the convergence of automation, electrification, and connectivity is poised to redefine industry norms. Early adopters of autonomous harvester prototypes have reported sustained harvesting cycles and enhanced safety by reducing manual interventions in challenging field conditions. Simultaneously, efforts to transition from diesel-powered drivetrains toward hybrid and fully electric systems reflect a growing commitment to decarbonization without compromising power or durability. As we explore the subsequent sections, this introduction will serve as the foundation for evaluating transformative shifts, tariff impacts, segmentation nuances, and regional dynamics shaping the sugarcane harvester market.

Revolutionary Technological and Operational Shifts Driving a New Era of Efficiency and Sustainability in Sugarcane Harvesting Operations

The sugarcane harvester landscape is undergoing profound change fueled by digital transformation and sustainability imperatives. Traditional hydraulic and mechanical architectures are giving way to sensor-driven automation systems capable of real-time adaptation to field variability. These advances are underpinned by artificial intelligence algorithms that optimize cutting height, ground speed, and throughput, ensuring uniformity of operations across diverse terrains. As a result, large-scale producers are witnessing improvements in fuel efficiency and reductions in cane losses during harvesting cycles.

Beyond autonomous navigation, manufacturers are investing heavily in electrified powertrains. Hybridized harvesters combine battery packs with combustion engines to lower emissions and operating costs, while fully electric prototypes demonstrate potential for silent, zero-emission harvesting in environmentally sensitive zones. The push toward electrification is further supported by partnerships between OEMs and battery technology firms to develop modular energy systems that can be rapidly swapped in field operations.

Concurrently, the proliferation of Internet of Things platforms is enabling seamless connectivity between machines, agronomic advisors, and enterprise resource planning systems. Remote diagnostics and over-the-air software updates are becoming standard, reducing downtime and improving lifecycle management. This ecosystem of connected devices is also facilitating predictive maintenance models, where sensor-derived performance patterns trigger service alerts before critical failures occur. Collectively, these transformative shifts are setting a new benchmark for productivity, cost control, and environmental stewardship within the sugarcane harvesting sector.

Assessing the Far-Reaching Consequences of 2025 United States Steel and Aluminum Tariffs on the Sugarcane Harvester Manufacturing Ecosystem

In early 2025, the United States reinstated a comprehensive 25 percent tariff on steel imports and elevated aluminum duties from 10 to 25 percent under Section 232 authorities. This policy revision eliminated all country exemptions and phased out general approved exclusions, thereby broadening the scope of raw material cost impacts across heavy equipment manufacturing.

For sugarcane harvester producers, steel and aluminum constitute core inputs for frames, cutter heads, conveyance systems, and engine components. The tariff reactivation has translated into material cost escalations that reverberate through the supply chain, compelling OEMs to renegotiate contracts with domestic mills or seek higher-cost alternative sources. Consequently, manufacturers are reevaluating their bill-of-materials strategies to mitigate margin compression, including optimizing part consolidation, enhancing yield from steel plate nesting, and exploring substitution with advanced alloys.

Moreover, the tightened tariff environment has accelerated onshoring initiatives and strategic stockpiling of key metal inputs to buffer against price volatility. While securing domestic supply enhances resilience, it also introduces logistical complexities, such as capacity constraints at regional rolling mills and longer lead times for specialty alloys. To address these challenges, leading harvester suppliers are diversifying their vendor base and investing in load-out optimization techniques that reduce inventory carrying costs without compromising production continuity.

Overall, the cumulative impact of the 2025 U.S. tariff adjustments underscores the critical need for agile sourcing strategies, close supplier collaboration, and cost-reduction engineering in sustaining competitive pricing for sugarcane harvesting equipment.

Unveiling Core Segmentation Patterns Revealing Demand Drivers Across Product Types, Power Sources, End Users, and Distribution Channels

The sugarcane harvester market demonstrates nuanced demand patterns when analyzed through product type distinctions. Pull-type harvesters continue to serve smaller, fragmented operations where tractor compatibility is paramount, while self-propelled models dominate large estates seeking higher throughput and autonomous capabilities. This dichotomy underscores the need for OEMs to tailor feature sets and pricing structures to the operational scale of end users.

Power source segmentation further reveals a tripartite trend. Diesel-driven machines retain a substantial install base due to proven reliability and fuel availability. However, electric harvesters are emerging in regions with grid stability and sustainability mandates, and hybrid systems offer a transitional pathway by integrating battery modules with conventional engines to balance environmental goals with energy density requirements.

End-user categories shape product adoption curves and service models. Commercial farms often demand premium, technologically advanced harvesters with full maintenance contracts and telematics subscriptions. In contrast, contract harvesters prioritize equipment versatility and rapid redeployment across multiple fields, driving interest in modular cutter heads and automation retrofits. Cooperative farmer groups, meanwhile, leverage collective purchasing power to access mid-range machines with flexible financing options, emphasizing total cost of ownership.

Distribution channel strategies reflect diverging pathways to market. Aftermarket providers focus on component upgrades, parts availability, and retrofit kits, addressing the needs of legacy fleets. Original equipment manufacturers, on the other hand, emphasize factory warranties, integrated digital ecosystems, and loyalty programs designed to reinforce direct customer engagement and data insights throughout the equipment lifecycle.

This comprehensive research report categorizes the Sugarcane Harvester market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- End User

- Distribution Channel

Exploring Regional Market Dynamics and Growth Opportunities in the Americas, EMEA, and Asia-Pacific for Sugarcane Harvesting Solutions

The Americas region anchors global sugarcane harvester demand through Brazil’s extensive sugarcane belt and the United States’ emerging bioenergy initiatives. In Brazil, adoption of high-horsepower, self-propelled harvesters reflects consolidation among large agribusinesses and government incentives for ethanol production. U.S. markets are increasingly prioritizing advanced automation to overcome labor shortages and to support the production of sugarcane for sweeteners and renewable diesel feedstock.

In Europe, Middle East & Africa, market growth is influenced by sustainability regulations and export dynamics. European sugar producers integrate electric and hybrid harvesters to comply with carbon reduction targets, while North African operations focus on deploying cost-effective pull-type equipment suited to smaller, irrigated plots. In sub-Saharan Africa, cooperative farming models are leveraging shared harvester services to maximize utilization rates and improve economies of scale.

Asia-Pacific registers robust investment driven by expanding sugarcane acreage and technological modernization. India’s government-led subsidy programs for mechanization accelerate the uptake of diesel-powered self-propelled harvesters, while Australia’s large-scale mills collaborate with OEMs on autonomous prototypes to enhance productivity and soil conservation. Southeast Asian plantations are piloting smart fleet management systems to optimize cross-border logistics and align with global sustainability standards.

Across all regions, infrastructure quality, financing availability, and regulatory environments consistently shape deployment strategies. Manufacturers tailor market entry approaches by partnering with regional distributors, customizing local service offerings, and aligning product specifications with end-user operational realities.

This comprehensive research report examines key regions that drive the evolution of the Sugarcane Harvester market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Equipment Manufacturers and Technology Innovators Pioneering Advances in Sugarcane Harvester Solutions and Services

Industry stalwart John Deere continues to lead through a blend of autonomy, precision agriculture integration, and digital services. Its latest CES 2025 announcement showcased next-generation autonomy kits that leverage multi-camera computer vision and AI to navigate complex terrains. These innovations are complemented by the company’s cloud-based platform, which delivers real-time performance metrics and remote diagnostics for harvesting machines.

AGCO Corporation has intensified its focus on sustainable design and powertrain diversification. Recent rollouts include Tier 4 Final diesel harvesters with emissions-reducing aftertreatment systems and R&D prototypes of hybrid-driven cutters aimed at lowering fuel consumption and soil impact. AGCO’s partnership with battery specialists positions it to introduce electric harvesting modules in pilot programs by late 2025.

CNH Industrial leverages its global scale and digital expertise through its PLM Connect telematics suite. The platform integrates yield mapping, maintenance scheduling, and remote software updates, enriching user insights across both pull-type and self-propelled harvester lines. CNH’s modular product architecture enables rapid configuration for contract harvesting services and cooperative procurement channels, reinforcing its adaptability to diverse market segments.

Emerging players such as local OEMs in India and Brazil are gaining traction by offering cost-competitive harvesters with simplified electronics and enhanced service networks tailored to regional crop cycles. These companies focus on robust mechanical reliability and aftermarket support to build credibility among price-sensitive growers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sugarcane Harvester market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- CANETEC Pty Ltd.

- Case IH

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- Deutz-Fahr

- Escorts Limited

- Grupo Jacto

- Guangxi LiuGong Group

- Jiangsu World Agriculture Machinery Co., Ltd

- Kartar Agro Industries Private Limited

- Komatsu Ltd.

- Kubota Corporation

- KUHN Group

- Mahindra & Mahindra Ltd.

- Massey Ferguson

- New Holland Agriculture

- Sampo Rosenlew Ltd.

- SDF Group

- TAGRM Co. Ltd.

- Tirth Agro Technology Private Limited

- Wuhan Wubota Machinery Co., Ltd.

- Yanmar Holdings Co., Ltd.

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Innovation, Enhance Competitiveness, and Navigate Regulatory and Supply Chain Complexities

To navigate the dynamic sugarcane harvester market, industry leaders should prioritize a balanced innovation portfolio that spans advanced automation, electrification, and digital services. By investing in modular autonomy kits, OEMs can cater to diverse farm sizes and accelerate the retrofit market for existing fleets.

Strategic partnerships with steel and aluminum suppliers will be crucial to manage input cost volatility. Engaging in long-term agreements, participating in supplier co-development initiatives, and exploring recycled steel procurement can mitigate tariff-driven price pressures while reinforcing sustainability commitments.

Enhancing regional footprints through localized assembly and service hubs will improve responsiveness to end-user requirements and reduce logistical lead times. Collaborations with financial institutions to design tailored leasing and cooperative purchasing programs can expand market reach, especially among mid-tier farms and contracting services.

Finally, embracing a platform-based approach to connectivity and data analytics will differentiate product offerings. Open APIs and interoperable software architectures enable seamless integration with third-party precision agriculture tools and foster customer loyalty through value-added services such as predictive maintenance, yield optimization algorithms, and performance-based warranties.

Comprehensive Research Framework Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Insightful Market Intelligence

This research harnessed a multi-stage methodology to ensure the credibility and depth of insights. The process commenced with exhaustive secondary research, examining trade publications, regulatory filings, patent databases, and government tariff proclamations. These sources provided foundational data on technological trends, policy impacts, and industry benchmarks.

Building on this, a series of structured interviews was conducted with over twenty executives from equipment manufacturers, component suppliers, and large-scale sugarcane producers. These primary discussions validated secondary findings, uncovered real-world supply chain strategies, and revealed emerging product adoption patterns across diverse regions.

Data triangulation was applied to reconcile discrepancies between sources and to refine segmentation analyses. Quantitative inputs such as powertrain capacities, harvester throughput rates, and regional deployment statistics were cross-checked against corporate disclosures and third-party reporting frameworks. Qualitative insights regarding customer preferences and competitive tactics were synthesized through thematic coding and scenario mapping.

Finally, a validation workshop with select industry stakeholders, including harvester operators and agricultural extension specialists, ensured that conclusions accurately reflect field realities and future trajectories. This rigorous approach underpins the actionable intelligence presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sugarcane Harvester market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sugarcane Harvester Market, by Product Type

- Sugarcane Harvester Market, by Power Source

- Sugarcane Harvester Market, by End User

- Sugarcane Harvester Market, by Distribution Channel

- Sugarcane Harvester Market, by Region

- Sugarcane Harvester Market, by Group

- Sugarcane Harvester Market, by Country

- United States Sugarcane Harvester Market

- China Sugarcane Harvester Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Critical Insights and Strategic Imperatives to Guide Decision-Makers in the Evolving Sugarcane Harvester Industry

The sugarcane harvester industry is at the forefront of agricultural mechanization, propelled by digital innovation, environmental imperatives, and shifting trade policies. Automation and electrification represent the twin pillars of operational efficiency and sustainability, while strategic segmentation reveals distinct value pools across product types, power sources, and end-user channels.

The 2025 tariff landscape has underscored the importance of agile sourcing, supplier collaboration, and materials engineering to manage raw cost inflation. Meanwhile, regional insights highlight diverse market entry tactics, from high-tech deployment in North America and Australia to cooperative models in sub-Saharan Africa and targeted electrification strategies in Europe.

Leading firms are distinguishing themselves through comprehensive digital platforms, advanced autonomy kits, and integrated service offerings that resonate with modern farm management. By aligning innovation roadmaps with end-user realities and policy contexts, manufacturers can secure competitive advantage and drive sustainable growth.

In conclusion, stakeholders equipped with a deep understanding of these critical drivers and strategic imperatives will be best positioned to capitalize on emerging opportunities and to navigate the complexities of the global sugarcane harvester market.

Engage with Associate Director Ketan Rohom to Access In-Depth Market Intelligence and Secure Your Customized Sugarcane Harvester Research Report

For decision-makers seeking a competitive edge, a clear understanding of emerging trends, supply chain dynamics, and strategic pathways is essential. I invite you to connect with Ketan Rohom, Associate Director for Sales & Marketing, to explore tailored market insights on sugarcane harvester technologies. Together, we can identify growth opportunities and secure your organization’s leadership in this evolving landscape. Reach out today to acquire the comprehensive market research report and unlock actionable intelligence that will drive your strategic planning and investment decisions.

- How big is the Sugarcane Harvester Market?

- What is the Sugarcane Harvester Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?