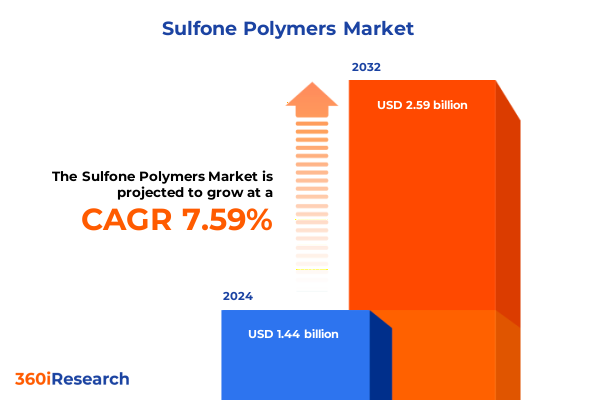

The Sulfone Polymers Market size was estimated at USD 1.54 billion in 2025 and expected to reach USD 1.66 billion in 2026, at a CAGR of 7.67% to reach USD 2.59 billion by 2032.

Setting the Stage for High-Performance Thermoplastics: Initiating an In-Depth Exploration of Sulfone Polymers Industry Dynamics and Applications

The sulfone polymers industry, encompassing engineering thermoplastics such as polysulfone, polyethersulfone and polyphenylsulfone, has become synonymous with high temperature resistance, chemical stability and superior mechanical performance. These attributes have positioned sulfone-based materials at the forefront of critical applications spanning water treatment membranes, medical devices, aerospace components and advanced electronics. As global manufacturers strive to balance ever-tightening regulatory requirements with the imperative for lightweight, durable materials, sulfone polymers have emerged as a versatile solution offering unique processing and performance benefits.

In recent years, manufacturing platforms have integrated advanced digital tools to optimize sulfone polymer production, paving the way for predictive process control and rapid iteration of compound formulations. Meanwhile, sustainability considerations have catalyzed a wave of innovation aimed at reducing carbon footprints and aligning with circular economy models. This multifaceted environment underscores the need for a thorough understanding of the forces reshaping the sector.

Against this backdrop, industry stakeholders-from resin producers and compounders to end users in healthcare, aerospace and automotive-require a consolidated view of transformative trends, tariff landscapes and segmentation insights. This executive summary delivers a structured analysis of the critical factors influencing market evolution, regional competitiveness and strategic imperatives, equipping decision-makers with the clarity needed to navigate an increasingly complex value chain.

How Technological Innovations and Sustainability Imperatives Are Driving Transformative Shifts Across the Sulfone Polymers Value Chain

Rapid digital transformation initiatives have become integral to modern chemical manufacturing, driving significant gains in operational efficiency and product consistency. Digital twin technology, by creating virtual replicas of production systems, enables real-time monitoring and predictive simulations that optimize process parameters before they affect physical assets. Recent reviews highlight how digital twins reduce material waste by up to 15 percent and improve yield by enabling iterative testing of reaction conditions without extended downtime or trial-and-error cycles. Specialized polymer producers employing digital twins can rapidly fine-tune compounding recipes, ensuring consistent molecular weight distributions and enabling the swift launch of novel grades.

Sustainability has emerged as a dominant theme, with leading resin manufacturers pioneering mass balance approaches that integrate bio-based or recycled feedstocks into high-performance chemistries. Solvay’s introduction of the first ISCC-PLUS certified circular sulfone polymers at its Marietta, Ohio facility exemplifies this shift toward closed-loop systems and traceable carbon footprints. By replacing fossil-derived inputs with certified renewable monomers, the company offers products that align with stringent Scope 3 reduction targets, enabling downstream users to claim significant carbon savings while maintaining thermal and hydrolytic performance.

Concurrently, regulatory scrutiny is intensifying, particularly in the European Union, where the upcoming REACH revision slated for Q4 2025 may bring polymers under full registration requirements for the first time. In parallel, ECHA’s classification of bis(4-chlorophenyl) sulfone as a substance of very high concern underscores the need for proactive compliance strategies and alternative chemistries to address emerging hazard criteria. This confluence of digital innovation, sustainability mandates and regulatory pressures compels industry participants to reexamine technology roadmaps, supply chain transparency and risk mitigation plans.

Evaluating the Far-Reaching Effects of 2025 United States Tariff Measures on Sulfone Polymers Supply Chains and Industry Economics

In April 2025, the United States implemented a new tranche of tariffs on selected imports, introducing 20 to 25 percent duties on various industrial products. Notably, the measures excluded many high-volume chemicals and polymers, including key sulfone resins, from immediate tariff application. This exemption reflects the critical role of advanced thermoplastics in domestic industries, but also signals potential future vulnerability if exclusions are retracted.

The USTR has indicated that additional sections of the Harmonized Tariff Schedule may be subject to review in coming quarters, with a particular focus on chemical intermediates and specialty polymers. While sulfone polymer grades currently benefit from tariff relief, industry analysts warn of a possible 0.8 percent headwind to overall chemical demand should broader duties be extended beyond initial lists. Stakeholders are monitoring this evolving policy landscape to assess supply chain resilience and cost exposure across critical applications such as medical devices and membrane filtration.

Legal challenges to the administration’s emergency tariff authority have added uncertainty, yet an appeals court decision in May 2025 upheld the majority of tariffs under Section 301, maintaining the status quo while litigation proceeds. As a result, procurement teams are advised to engage with trade counsel and evaluate alternative sourcing strategies to mitigate potential disruptions. Dynamic tariff management, combined with strategic inventory buffers, will be essential to navigating this unsettled environment without compromising production continuity or cost competitiveness.

Uncovering Key Segmentation Perspectives That Illuminate Distinct Market Niches and Product Formulations Within the Sulfone Polymers Ecosystem

The product type segmentation of the sulfone polymers market draws a clear distinction among polyethersulfone, polyphenylsulfone and polysulfone resins, each engineered for specific balance of thermal stability, chemical resistance and mechanical toughness. Polyethersulfone’s superior continuous use temperature makes it a preference in aerospace and electronics, whereas polyphenylsulfone’s enhanced hydrolytic stability positions it for repeated steam sterilization in healthcare. Polysulfone, with its combination of transparency and performance, remains the workhorse choice in water treatment membranes and general industrial components.

End use industry segmentation spans aerospace, automotive, electrical & electronics, healthcare and oil & gas, reflecting the broad utility of sulfone chemistries in applications demanding weight reduction, flame retardance and insulating properties. The aerospace sector leverages these polymers for cabin interiors and thermal shields, while automotive engineering exploits their under-the-hood resilience. Meanwhile, logistics, energy networks and medical device manufacturers rely on their dimensional stability and low extractables to meet exacting safety and regulatory benchmarks.

Within application segmentation, automotive components, electrical insulation, film & sheet, medical devices and membrane filtration delineate distinct value streams. Membrane filtration itself is subdivided into microfiltration, nanofiltration, reverse osmosis and ultrafiltration, each employing tailored sulfone grades to achieve precise pore structures and chemical compatibility. Electrical insulation applications benefit from sulfone’s dielectric properties and heat resistance, ensuring reliability in compact, high-temperature environments.

Form segmentation further categorizes market offerings into films & sheets, granules and powder, accommodating diverse processing technologies such as extrusion, injection molding and powder coating. Film formulations yield thin-gauge membranes and sheets for structural panels, while granules serve as the feedstock for injection-molded housings. Powder variants, optimized for selective laser sintering and additive manufacturing, showcase the growing intersection of high-performance polymers with 3D printing innovations.

This comprehensive research report categorizes the Sulfone Polymers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Processing Technology

- Application

Analyzing Regional Dynamics and Growth Drivers Across Americas, EMEA and Asia-Pacific in the Global Sulfone Polymers Landscape

In the Americas, robust research and development infrastructure underpins ongoing advances in sulfone polymer formulations, bolstered by strategic expansions such as Solvay’s Marietta, Ohio facility achieving ISCC-PLUS certification for circular feedstock. U.S. capacity growth, complemented by capacity additions across Canada and Mexico, satisfies rising North American demand in water treatment, life sciences and aerospace, underpinned by supportive trade policies prioritizing critical material resilience.

The Europe, Middle East & Africa region navigates a complex regulatory landscape marked by evolving REACH requirements and localized sustainability mandates. The impending 2025 REACH revision will extend obligations for certain polymer monomers, prompting European producers to invest in compliance capabilities and substitute chemistries. Meanwhile, Gulf Cooperation Council countries leverage petrochemical integration to develop niche applications for sulfone variants in energy and water desalination projects, balancing regional growth with stringent environmental standards.

Asia-Pacific remains the fastest-growing region, propelled by significant polysulfone capacity expansions in China that saw a 33.7 percent year-on-year increase to 37,700 tonnes in Q2 2024. Domestic producers are rapidly advancing technical capabilities, while collaborations with electronics and medical device manufacturers drive innovation in high-performance sulfone grades for EV battery casings and diagnostic equipment. With Asia-Pacific accounting for nearly half of global polysulfone demand, investment in local R&D and feedstock diversification is intensifying to secure market position.

This comprehensive research report examines key regions that drive the evolution of the Sulfone Polymers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Moves and Innovation Portfolios of Market Leaders Shaping the Future of Sulfone Polymeric Materials Industry

Solvay’s leadership in circular sulfone polymers is exemplified by its ISCC-PLUS mass balance certification for Udel® PSU ReCycle MB and Radel® PPSU ReCycle MB, underpinned by a 25 percent capacity expansion program in Ohio that underscores its commitment to traceable carbon footprint reduction and supply continuity. This strategic focus aligns production scale-up with sustainability targets, ensuring downstream users can integrate certified high-performance materials into regulated applications without disruption.

Sumitomo Chemical Co. maintains a strong position through its Sumikaexcel® PESU technology, which captured nearly 20 percent of the Asian polysulfone market and supports critical semiconductor and 3D-printing applications. Concurrently, regional players such as Shandong Lanshan Chemical Co. and Jiangsu Jin Sheng Long Polymer Materials Co. have scaled capacity by 40 percent and secured mandates from EV battery manufacturers, signaling a dynamic regional supply base that challenges legacy producers.

SABIC, although traditionally known for polyetherimide solutions, has extended its renewable feedstock expertise with ISCC+ certified bio-based high-performance amorphous polymers, illustrating a broader strategic thrust toward sustainable chemistries. This approach, leveraging the TRUCIRCLE™ framework, enhances SABIC’s ability to meet customer sustainability goals across electronics, automotive and aerospace sectors without compromising performance characteristics.

Syensqo’s recent 25 percent capacity boost for Udel-brand polysulfone at Marietta, Ohio demonstrates how specialized manufacturers are rapidly responding to surges in life sciences and water purification demand. By aligning capacity expansions with critical life science market growth, Syensqo fortifies its distribution network and reinforces its market agility in specialty sulfone resins.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sulfone Polymers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Celanese Corporation

- Dow Inc.

- DuPont de Nemours, Inc.

- Ensinger GmbH

- Evonik Industries AG

- Foshan Plolima Polymer Materials Co., Ltd.

- Fuhai Group Co., Ltd.

- Huainan Modern Coal Chemical Co., Ltd.

- Jiangmen Youju New Material Technology Co., Ltd.

- Jiangsu Sunplast Polymer Co., Ltd.

- Jiangxi Jinhai New Energy Technology Co., Ltd.

- Kaneka Corporation

- Lotte Chemical Corporation

- Mitsubishi Chemical Corporation

- Ningxia Shixing Technology Co., Ltd.

- PSF New Materials Co., Ltd.

- RTP Company

- Saudi Basic Industries Corporation

- Sekisui Chemical Co., Ltd.

- Shandong Horan Chemical Co., Ltd.

- Shenzhen WOTE Advanced Materials Co., Ltd.

- Sino Polymer Co., Ltd.

- Solvay SA

- Sumitomo Chemical Company, Limited

- Toray Industries, Inc.

- Westlake Plastics Company

- Yanjian Technology Group Co., Ltd.

Actionable Strategies for Industry Leaders to Enhance Competitiveness Through Innovation, Sustainability and Agile Supply Chain Frameworks

Industry leaders should prioritize the integration of digital twin frameworks into existing manufacturing footprints to harness predictive process control, reduce material variability and accelerate new grade introductions. By coupling AI-driven analytics with real-time sensor data, firms can anticipate production anomalies, optimize energy consumption and shorten development cycles substantially.

Embedding circularity within supply chains demands collaboration with feedstock suppliers to secure ISCC-certified renewable monomers while advancing mechanical or chemical recycling initiatives. Establishing mass balance systems and transparent chain-of-custody protocols will enable resin producers and compounders to differentiate offerings through verifiable sustainability credentials, driving customer loyalty and compliance alignment.

In anticipation of evolving regulatory landscapes, particularly in the European Union, companies must bolster compliance function capabilities to navigate REACH monomer registrations and SVHC listing implications. Proactive engagement with regulatory agencies, industry associations and peer alliances will facilitate early identification of emerging hazard classifications and support the evaluation of alternative chemistries.

To mitigate trade-related cost volatility, supply chain teams should implement dynamic sourcing strategies, blending domestic resin production with strategic imports from duty-exempt jurisdictions. Inventory optimization tools and tariff-scenario modelling will be crucial to maintaining margin stability in the face of potential tariff expansions or legal uncertainties.

Rigorous Research Methodology Overview Combining Qualitative Insights and Quantitative Analyses for Comprehensive Market Intelligence

The research methodology employed a dual-track approach, combining exhaustive secondary research with targeted primary engagements. Secondary sources included peer-reviewed technical literature, regulatory filings and reputable industry news outlets. Publicly available data from ISCC, USTR, ECHA and leading chemical associations supported contextual analysis of sustainability and trade policies.

Primary research comprised in-depth interviews with polymer R&D leaders, procurement directors and regulatory specialists, supplemented by an online survey of over fifty C-level executives across major sulfone polymer producers and end-use industries. Insights were validated through triangulation, cross-referencing quantitative supply-demand data with qualitative expert opinions.

Data synthesis leveraged rigorous statistical techniques, including sensitivity analysis to model tariff impact scenarios and cluster analysis to refine regional competitiveness indices. Supply chain mapping and SWOT frameworks further elucidated supplier relationships, logistical constraints and innovation hotspots. All findings underwent internal peer review and external expert validation to ensure relevance and accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sulfone Polymers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sulfone Polymers Market, by Product Type

- Sulfone Polymers Market, by Form

- Sulfone Polymers Market, by Processing Technology

- Sulfone Polymers Market, by Application

- Sulfone Polymers Market, by Region

- Sulfone Polymers Market, by Group

- Sulfone Polymers Market, by Country

- United States Sulfone Polymers Market

- China Sulfone Polymers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Insights on How Innovation, Regulatory Policy and Market Forces Will Coalesce to Define the Next Chapter for Sulfone Polymers

The convergence of digital manufacturing, circular feedstock strategies and a shifting regulatory environment is redefining competitive dynamics within the sulfone polymers sector. Companies embracing digital twins and advanced analytics gain a clear pathway to operational excellence, while those investing in mass balance certification establish a compelling value proposition centered on sustainability.

Trade policies and legal developments underscore the importance of agile supply chain architecture, ensuring resilience against potential tariff escalations and providing a buffer for critical material access. Meanwhile, granular segmentation-by product type, application, form and region-reveals targeted growth avenues in membrane filtration, medical devices and high-heat electronics.

Regional leaders in the Americas, EMEA and Asia-Pacific each face distinct imperatives, from compliance with evolving European regulations to capacity expansions in China and North American lifecycle innovation. The varied geographic landscape highlights the need for localized strategies supported by global intelligence.

As market participants navigate these multifaceted challenges, a proactive stance on technology adoption, collaborative partnerships and policy engagement will be instrumental in capturing emerging opportunities and shaping the next era of sulfone polymer innovation.

Engage with Ketan Rohom to Unlock In-Depth Market Intelligence and Secure Strategic Advantage Through Comprehensive Research Purchase

To access the full executive report and gain tailored insights into evolving market dynamics, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing) to secure your copy today. Commission a comprehensive analysis that empowers your strategic planning and investment decisions in the sulfone polymers sector by engaging with our expert team for immediate support.

- How big is the Sulfone Polymers Market?

- What is the Sulfone Polymers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?