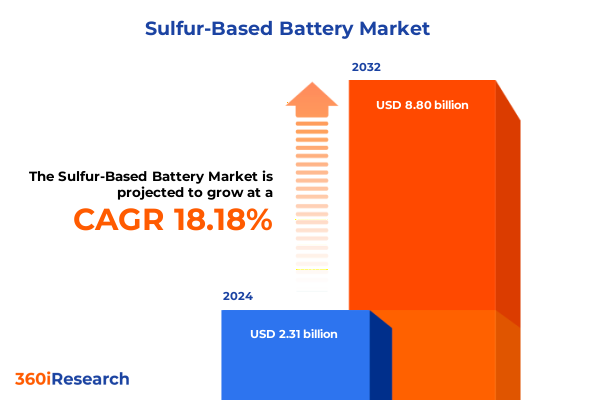

The Sulfur-Based Battery Market size was estimated at USD 2.71 billion in 2025 and expected to reach USD 3.18 billion in 2026, at a CAGR of 18.33% to reach USD 8.80 billion by 2032.

Unveiling the Potential of Sulfur-Based Batteries in Driving Next-Generation Energy Storage Solutions Across Diverse Industrial Applications

The rapidly expanding interest in sulfur-based battery chemistries heralds a new era in energy storage, driven by the need for sustainable alternatives to conventional lithium-ion systems. These emerging technologies harness the inherent advantages of sulfur, offering pathways to higher theoretical energy densities, enhanced safety profiles, and more environmentally benign end-of-life considerations. As global energy demand intensifies across industries, the unique electrochemical properties of sulfur-based cells position them as compelling candidates to supplement or even supplant incumbent solutions in critical applications.

This executive summary presents a comprehensive overview of the sulfur-based battery landscape, outlining pivotal trends, market shifts, and strategic imperatives. It sets the stage for a deep dive into transformative innovations, regional dynamics, segmentation insights, and the broader implications of policy environments. Designed for decision-makers, investors, and technology strategists, this document synthesizes complex data and qualitative analysis into a cohesive narrative that informs high-impact choices in research, development, and commercialization strategies.

Identifying Key Technological Advancements and Market Dynamics Shaping the Future Trajectory of Sulfur-Based Energy Storage Innovations

Recent advances in electrode design and electrolyte formulations are reshaping the feasibility of sulfur-based batteries for commercial deployment. Breakthroughs in encapsulating sulfur within conductive matrices have mitigated the shuttle effect, enhancing cycle life and coulombic efficiency. Concurrently, innovations in solid-state electrolytes are unlocking new avenues for safety improvements and energy density gains. These technological leaps, paired with modular manufacturing approaches, are fostering an ecosystem where pilot-scale production can rapidly scale to meet burgeoning demand.

Simultaneously, the convergence of decarbonization targets and lifecycle sustainability frameworks is intensifying pressure on legacy storage technologies. Organizations across the energy, transportation, and electronics sectors are reevaluating their supply chains, seeking chemistries that balance performance with lower carbon footprints. As a result, partnerships between material scientists, cell manufacturers, and end-use integrators are proliferating, driving a collaborative environment ripe for cross-disciplinary innovation. This synergistic momentum is catalyzing a broader shift toward battery systems that achieve new benchmarks in cost-effectiveness and environmental stewardship.

Analyzing How 2025 U.S. Trade Tariffs Influence Sulfur-Derived Battery Supply Chains, Manufacturing Costs and Strategic Sourcing Decisions

In early 2025, policy adjustments in the United States introduced tariff measures targeting raw sulfur imports and precursor chemicals critical to advanced battery production. These levies have reverberated throughout the supply chain, prompting manufacturers to reassess sourcing strategies and negotiate long-term supply agreements to buffer against cost fluctuations. The tariffs have also incentivized domestic investment in sulfur extraction and purification facilities, thereby fostering localized value creation and reducing dependency on international suppliers.

The cumulative effect of these trade actions extends beyond immediate cost implications. Downstream technology developers are exploring alternative feedstocks and recycling pathways to navigate the altered economic landscape. In parallel, multinational corporations are reevaluating their production footprints, weighing the benefits of decentralizing operations closer to evolving demand centers. As tariff frameworks continue to evolve, strategic agility in procurement and vertical integration strategies will be decisive in maintaining competitive positioning within the sulfur-based battery arena.

Navigating Market Segments Through Technical, Capacity, End-Use and Target Audience Perspectives to Drive Strategic Positioning and Growth

Segmenting the sulfur-based battery market reveals nuanced adoption patterns driven by chemical formulation, storage characteristics, industry requirements, and end-user environment. Across the spectrum of Lithium-Sulfur, Magnesium-Sulfur, and Sodium-Sulfur platforms, each pathway exhibits distinct trade-offs between energy density, material availability, and manufacturing complexity. These differences are catalyzing tailored application roadmaps rather than one-size-fits-all strategies.

Capacity considerations further refine this landscape: cells below 500 mAh are gaining traction in compact consumer devices, while those within the 501 mAh to 1,000 mAh range strike an optimal balance for mid-range portable electronics and grid-interactive modules. Designs that exceed 1,000 mAh are steering development toward electric vehicles and stationary storage solutions that demand sustained high-power delivery. Beyond technical characteristics, end-use segmentation underscores how consumer electronics, financial services infrastructure, transportation sub-sectors in aerospace and automotive, and utility-scale networks all leverage sulfur chemistries in distinct ways. This is complemented by differentiated approaches to target markets, where commercial deployment strategies diverge significantly from industrial stakeholder requirements and residential integration models.

Collectively, these segmentation insights equip executives with a detailed lens to align research priorities, go-to-market plans, and investment decisions with the specific performance, regulatory and operational demands of each sub-market.

This comprehensive research report categorizes the Sulfur-Based Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Power Capacity

- End-Use Industry

- Target Market

Unearthing Critical Regional Dynamics Impacting Sulfur-Based Battery Adoption Across the Americas, EMEA and Asia-Pacific Power Markets

Regional dynamics play a decisive role in the adoption and commercialization of sulfur-based battery technologies. In the Americas, longstanding innovation clusters in North America are benefiting from the influx of public-private partnerships that accelerate pilot demonstrations and infrastructure build-out. The market in Latin America is nascent yet promising, with mineral-rich geographies offering upstream advantages for localized sulfur production and downstream manufacturing initiatives.

Across Europe, Middle East & Africa, regulatory frameworks in European Union member states are creating compelling incentives for low-carbon energy storage, driving early adoption in transportation electrification and grid stabilization projects. Meanwhile, Gulf Cooperation Council nations are leveraging sovereign wealth allocations to explore large-scale energy storage ventures that integrate renewable generation with next-generation battery chemistries. In sub-Saharan Africa, decentralized microgrid projects are beginning to test sodium-sulfur variants for rural electrification, showcasing the technology’s adaptability.

In the Asia-Pacific region, a strong emphasis on energy security is underpinned by strategic investments in domestic supply chains across China, Japan and South Korea. National research programs are advancing material science breakthroughs, while automotive OEMs in these markets are piloting high-capacity sulfur cells in second-generation electric vehicles. Southeast Asian economies, positioned as manufacturing hubs, are emerging as critical nodes for mass production and export-oriented strategies.

This comprehensive research report examines key regions that drive the evolution of the Sulfur-Based Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Partnerships and Value Chain Integration in the Sulfur-Based Battery Ecosystem

The competitive landscape of sulfur-based batteries is characterized by a spectrum of players ranging from specialized battery innovators to established chemical conglomerates and integrated system providers. Pure-play cell developers are pushing the boundaries of active material loading and electrode architecture, while traditional chemical manufacturers are scaling purification and precursor development to meet quality thresholds. Simultaneously, automotive and aerospace OEMs are forging strategic alliances and joint ventures to accelerate in-house prototyping and testing protocols.

Smaller, venture-backed startups are carving niches through proprietary electrolyte blends and patent portfolios focused on mitigating polysulfide dissolution. These companies often act as technology scouts for larger industrial partners seeking to augment their R&D pipelines. Across the board, successful organizations are distinguishing themselves through vertically integrated operations that span raw material extraction, advanced cell fabrication, and systems-level integration. By combining in-house testing facilities with collaborative consortiums, these leading entities are minimizing time-to-market and capturing first-mover advantages in high-growth applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sulfur-Based Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- BioLargo, Inc.

- Gelion PLC

- Giner Inc.

- Graphene Batteries AS

- GS Yuasa Corporation

- Hybrid Kinetic Group Ltd.

- Idemitsu Kosan Co.,Ltd

- Iolitec Ionic Liquids Technologies GmbH

- LG Energy Solution Ltd.

- Li-S Energy Limited

- Lyten, Inc.

- Navitas System, LLC Corporate

- NEI Corporation

- NexTech Batteries Inc.

- NGK Insulators, Ltd.

- PolyPlus Battery Company

- Rechargion Energy Private Limited

- Robert Bosch GmbH

- Saft Groupe SAS by TotalEnergies SE

- Sion Power Corporation

- Sionic Energy

- Solid Power, Inc.

- Steatite Limited by Solid State PLC

- Stellantis NV

- The Mercedes-Benz Group AG

- Theion GmbH

- Toyota Motor Corporation

- VTC Power Co.,Ltd

- Zeta Energy Corporation

Implementing Actionable Strategies for Manufacturers, Supply Chain Stakeholders and Policy Makers to Capitalize on Sulfur-Based Battery Opportunities

To capitalize on emerging opportunities, industry leaders must elevate R&D investments that emphasize scalable manufacturing processes and robust material sourcing agreements. Establishing long-term partnerships with sulfur producers and recycling firms will hedge against feedstock volatility and reinforce circular economy models. Concurrently, engaging with regulatory bodies and standards organizations to shape safety protocols and performance benchmarks can accelerate market acceptance and reduce time-to-commercialization.

Operationally, diversifying pilot production sites across multiple geographic regions will mitigate tariff exposure and logistical bottlenecks. Organizations should also consider forming cross-industry consortiums to share test data and de-risk early-stage deployments in critical applications such as aerospace and utility grids. By integrating advanced analytics into supply chain management and leveraging digital twins for process optimization, manufacturers can enhance yield, reduce waste, and achieve superior cost-performance parity.

Outlining Rigorous Research Methodologies Employed to Deliver Robust Insights into the Sulfur-Based Battery Market Landscape and Competitive Environment

This analysis is grounded in a multi-pronged research methodology integrating primary and secondary sources, expert interviews, and quantitative data triangulation. Primary research included structured interviews with material scientists, battery engineers, and procurement leaders, complemented by site visits to pilot production facilities. Secondary research encompassed a thorough review of scholarly articles, patent filings, technical white papers, and policy documents to map innovation trajectories and regulatory landscapes.

Quantitative insights were derived from anonymized procurement data, supplier cost structures, and technology performance matrices. Benchmarking exercises compared key metrics across sulfur-based and incumbent battery chemistries. Expert panels convened to validate assumptions, challenge findings, and ensure objectivity in assessing market readiness. Finally, scenario analysis was employed to model the potential impact of tariff fluctuations, raw material price shifts, and regulatory changes on strategic planning horizons.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sulfur-Based Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sulfur-Based Battery Market, by Type

- Sulfur-Based Battery Market, by Power Capacity

- Sulfur-Based Battery Market, by End-Use Industry

- Sulfur-Based Battery Market, by Target Market

- Sulfur-Based Battery Market, by Region

- Sulfur-Based Battery Market, by Group

- Sulfur-Based Battery Market, by Country

- United States Sulfur-Based Battery Market

- China Sulfur-Based Battery Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Core Findings and Industry Implications to Provide a Cohesive Perspective on the Sulfur-Based Battery Market Evolution

Sulfur-based batteries are rapidly emerging as pivotal components in the next generation of energy storage solutions. The convergence of material science breakthroughs, evolving regulatory frameworks, and strategic collaborations is setting the stage for commercial viability across a spectrum of applications. While challenges related to feedstock availability, manufacturing scale-up, and cost optimization remain, the industry’s trajectory points toward incremental performance gains and broader adoption.

Stakeholders that strategically align their R&D roadmaps with evolving policy incentives and regional market dynamics will be best positioned to capture value. By harnessing segmentation-specific insights and leveraging research-driven action plans, companies can navigate the complexities of supply chain management and technological maturation. As the ecosystem matures, a balanced approach that integrates innovation, sustainability, and operational excellence will determine long-term success and unlock the transformative potential of sulfur-based energy storage.

Discover How Ketan Rohom Can Facilitate Your Access to In-Depth Insights and Enable Data-Driven Decisions in the Sulfur-Based Battery Arena

Embarking on the journey toward comprehensive market expertise begins with a single step toward a detailed research report. By partnering with Ketan Rohom at the helm of sales and marketing, organizations gain personalized guidance on leveraging the report’s insights, ensuring their strategic initiatives in the sulfur-based battery space are underpinned by reliable data and expert interpretation. Engaging directly with Ketan Rohom opens avenues for tailored briefings, sample chapters, and custom data extracts that align precisely with unique business questions and operational priorities.

This collaboration empowers stakeholders to streamline their decision-making processes, reducing time to market for new battery technologies and optimizing resource allocation. With Ketan Rohom’s support, clients can transform high-level analysis into actionable roadmaps and competitive strategies that capitalize on evolving market dynamics. Reach out today to secure your copy of the definitive sulfur-based battery market research report and position your organization at the forefront of energy storage innovation.

- How big is the Sulfur-Based Battery Market?

- What is the Sulfur-Based Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?