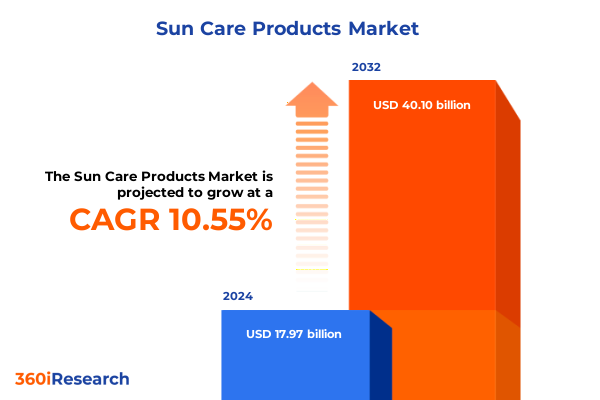

The Sun Care Products Market size was estimated at USD 19.70 billion in 2025 and expected to reach USD 21.61 billion in 2026, at a CAGR of 10.68% to reach USD 40.10 billion by 2032.

Exploring the Evolution of Sun Care as a Daily Skin Health Ritual Fueled by Education Influencers and Dermatological Advocacy

Consumers today recognize sun protection as an indispensable element of their daily skincare routine, elevating sunscreen from an occasional safety measure to a foundational beauty and wellness practice. Driven by educational campaigns from dermatologists and amplified by social media influencers, SPF application has transcended its utilitarian roots to become an essential ritual that supports long-term skin health and prevention of photoaging. This cultural shift underscores heightened awareness of ultraviolet risks and illustrates the critical role that sun care solutions play in both aesthetic and medical contexts.

Discover How Multifunctional Formulations Digital Engagement and Sustainability Imperatives Are Redefining Sun Care Dynamics

The sun care landscape has undergone remarkable evolution as modern formulations blend multifunctional benefits with heightened sensory experiences. Consumers now expect sunscreens that not only shield against UVA and UVB rays but also hydrate, prevent aging, and even complement makeup routines, reflecting a broader demand for hybrid products that deliver comprehensive skin solutions. Concurrently, digital innovation has transformed the way consumers discover and evaluate sun care offerings; interactive content such as UV camera demonstrations and TikTok tutorials have empowered users to assess efficacy firsthand, strengthening brand engagement through transparent testing practices.

Beyond product innovation and digitization, sustainability considerations are reshaping market priorities. The rise of reef-safe mineral formulations and eco-conscious packaging reflects growing consumer advocacy for environmental stewardship, driving brands to invest in biodegradable materials and transparent sourcing practices. Meanwhile, younger cohorts such as Generation Alpha are entering the beauty market with unique demographics, influencing product development toward inclusive, skin-friendly SPF options tailored to diverse tones and preferences. As these converging forces redefine expectations, leading players must demonstrate agility in blending science, experiential design, and ethical responsibility to remain relevant.

Examine the Comprehensive Rippling Effects of Recent U.S. Tariff Adjustments on Sun Care Supply Chains Ingredient Sourcing and Import Compliance

In 2025, the U.S. sun care industry is navigating a complex tariff landscape that impacts supply chains, pricing structures, and competitive positioning. The Biden administration’s proposed revisions to the “de minimis” threshold now require all products subject to specific trade remedies, including Section 301 and Section 232 tariffs, to clear customs duties, effectively closing a loophole for low-value shipments that previously entered duty-free. This regulatory adjustment aims to level the playing field for domestic manufacturers and strengthen oversight of e-commerce imports, though it has introduced additional compliance obligations for brands and distributors.

Further complicating the scenario, prevailing reciprocal tariffs on key cosmetics ingredients vary by country of origin, with mineral sunscreen filters such as zinc oxide and titanium dioxide remaining exempt while other critical inputs face levies of up to 20 percent on goods from the EU and higher rates from non-EU European partners. Industry leaders report that these collective duties have prompted a reassessment of sourcing strategies, with many companies accelerating nearshoring initiatives to mitigate cost volatility and ensure uninterrupted access to essential raw materials.

Unpacking the Intricately Layered Segmentation Covering Formulation Delivery Channels and End-User Specificities That Drive Sun Care Offerings

The sun care market’s granular segmentation encompasses distinct product types tailored to diverse usage occasions and consumer preferences. Cream, foam, gel, lotion, oil, spray, and stick formats each provide differentiated textures and application experiences, allowing brands to cater to everything from daily facial protection to water-resistant formulations for outdoor recreation. Within lotion offerings, subcategories of non-water-resistant, very water-resistant, and water-resistant variants address needs ranging from lightweight daily wear to prolonged exposure in aquatic environments. Similarly, spray applications span aerosol and non-aerosol delivery systems, balancing convenience and environmental considerations in equal measure.

Distribution channels further refine how sun care products reach end users through online platforms, pharmacy and drugstore networks, professional clinics, and retail outlets. Within retail stores, convenience, specialty, and supermarket hypermarket formats serve distinct shopper segments-from impulse buyers seeking travel sizes to family shoppers prioritizing value packs. Formulation approaches, classified as chemical, hybrid, or physical, reflect consumer attitudes toward ingredient safety and eco-friendliness. Spanning SPF categories from below 30 through the 30 to 50 range to above 50, brands calibrate protection levels against specific sun exposure scenarios. Finally, end-user segmentation into adults, children, and infants underscores the importance of tailored UV filter profiles, hypoallergenic criteria, and application formats optimized for delicate or sensitive skin.

This comprehensive research report categorizes the Sun Care Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation Type

- Spf Rating

- Distribution Channel

- End User

Analyzing How Regional Distinctions in Regulation Distribution and Consumer Priorities Shape the Global Sun Care Ecosystem

Geographically, the sun care market reveals stark contrasts in consumer behavior, regulatory frameworks, and category maturity across key regions. In the Americas, robust public health campaigns champion the preventive benefits of sunscreen, reinforced by widespread pharmacy networks and growing e-commerce adoption. Brands here emphasize broad-spectrum formulas and SPF sticks for active lifestyles, while digital outreach via social media and teledermatology services fuels year-round awareness.

Across Europe, the Middle East, and Africa, diverse regulatory regimes, from the EU’s stringent ingredient approvals to localized reef-safe mandates in coastal nations, require nuanced compliance strategies. Specialty brands in Western Europe often lead in advanced filter technologies and luxury formulations, whereas emerging markets in the Middle East and Africa show rising demand for affordable yet high-performance suncare, driving innovation in cost-efficient physical sunscreens.

In Asia-Pacific, where intense UV exposure and strong beauty traditions converge, consumers gravitate toward lightweight, cosmetically elegant SPF offerings that double as skincare. Korean and Japanese manufacturers set trends with ultralight textures and multi-benefit serums, while the Asia-Pacific region’s rapid digital transformation accelerates direct-to-consumer models and live-stream commerce initiatives.

This comprehensive research report examines key regions that drive the evolution of the Sun Care Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Key Market Participants Driving Innovation Sustainability and Inclusive Solutions in the Sun Care Competitive Landscape

Leading conglomerates and challenger brands alike are shaping the competitive dynamics within sun care through strategic sourcing, innovation, and marketing prowess. Procter & Gamble leverages its global supply chain to integrate advanced UV filter technologies into mass-market Olay formulations, while The Estée Lauder Companies invest heavily in research partnerships to develop next-generation mineral actives that resonate with clean-beauty consumers. Meanwhile, Unilever uses its sustainability credentials to position its flagship sunscreen lines as eco-responsive and socially conscious, prioritizing biobased packaging and reef-safe certifications.

At the same time, digitally native brands like Supergoop! and Coola have cultivated loyal followings through targeted online engagement, launching SPF sticks, mists, and serums that meet demands for convenience and multifunctionality. Black Girl Sunscreen has carved out a unique niche with formulations designed for darker skin tones, demonstrating the power of inclusive product development to drive market penetration. Emerging innovators such as Ultra Violette continue to push envelope with patented filter blends and influencer-led product launches, underscoring the importance of brand storytelling and digital communities in capturing consumer attention.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sun Care Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arbonne International, LLC

- Australian Gold LLC

- Avalon Natural Products, Inc. by The Hain Celestial Group, Inc.

- Bath & Body Works Direct, Inc.

- Beiersdorf AG

- BioRepublic

- Christian Dior SE

- Elta MD by Colgate-Palmolive Company

- Estee Lauder Companies, Inc.

- Green Leaf Naturals

- InSpec Solutions, LLC

- Johnson & Johnson Consumer Inc.

- Kao Corporation

- L'Oréal S.A.

- Mustela by Laboratoires Expanscience

- Peter Thomas Roth Labs LLC

- Quest Products, Inc.

- Safetec of America, Inc.

- Shiseido Co., Ltd.

- The Procter & Gamble Company

- Tropical Products, Inc.

- TY Cosmetic

- Unilever PLC

- Vichy Laboratoires

- Vigon International, LLC

Implementing Data-Driven Innovation Supply Chain Resilience and Digital Engagement to Capitalize on Emerging Sun Care Opportunities

To succeed in this dynamic environment, industry leaders must prioritize agile innovation, data-driven decision-making, and resilient supply chains. Brands should accelerate development of hybrid sun care solutions that integrate skincare benefits with UV protection, employing consumer insights gleaned from social listening platforms and clinical feedback to tailor formulations for specific skin concerns. Strengthening partnerships with ingredient suppliers closer to key manufacturing hubs can mitigate tariff exposure and logistical disruptions, while strategic nearshoring initiatives reinforce supply security.

Furthermore, communication strategies must evolve to embrace digital-first engagement, leveraging interactive content, influencer collaborations, and teledermatology endorsements to build trust and foster ongoing consumer education. Robust sustainability frameworks, underpinned by credible third-party certifications and transparent reporting, will help brands differentiate amid growing eco-consciousness. By aligning product innovation with omni-channel distribution and compelling brand narratives, sun care organizations can capture emerging opportunities and navigate geopolitical complexities with confidence.

Detailing a Rigorous Mixed-Methods Research Framework Integrating Primary Interviews Secondary Analysis and Consumer Sentiment to Ensure Robust Insights

This research leverages a comprehensive multi-tiered approach combining primary and secondary methodologies. We conducted in-depth interviews with executives, formulators, and distribution partners to capture firsthand insights into evolving strategies and operational challenges. Simultaneously, a thorough review of trade publications, regulatory filings, and patent databases ensured balanced coverage of ingredient innovations and policy developments. In addition, consumer sentiment analysis drawn from social media and e-commerce platforms provided real-time indicators of preference shifts and adoption patterns.

Quantitative data were validated through triangulation across multiple reputable sources, including industry journals, expert panels, and proprietary databases. Regional case studies were developed to illustrate localized market dynamics, while scenario analyses examined the potential impacts of tariff changes and sustainability trends. This rigorous methodology underpins the credibility and actionability of the findings presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sun Care Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sun Care Products Market, by Product Type

- Sun Care Products Market, by Formulation Type

- Sun Care Products Market, by Spf Rating

- Sun Care Products Market, by Distribution Channel

- Sun Care Products Market, by End User

- Sun Care Products Market, by Region

- Sun Care Products Market, by Group

- Sun Care Products Market, by Country

- United States Sun Care Products Market

- China Sun Care Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing How Science Sustainability and Strategic Agility Are Shaping the Future Trajectory of the Sun Care Landscape

The sun care market stands at the intersection of science, sustainability, and consumer empowerment. As hybrid formulations evolve, digital engagement deepens, and regulatory landscapes shift, brands must navigate complexity with strategic foresight and operational agility. The collective influence of tariffs underscores the need for supply chain innovation, while consumer expectations for multifunctionality and eco-responsibility continue to drive product differentiation. By embracing data-driven decision-making, leveraging regional strengths, and fostering authentic brand connections, organizations are well positioned to thrive in an increasingly competitive and conscientious market environment.

Secure a Competitive Advantage with Personalized Guidance from an Industry Expert for Your Sun Care Market Intelligence Needs

For organizations seeking to fortify their strategies with deep insights into the sun care market, partnering with Ketan Rohom, Associate Director of Sales & Marketing, unlocks tailored support and access to exclusive market intelligence. Ketan combines extensive industry experience with a consultative approach, ensuring stakeholders receive precise guidance on product positioning, distribution optimization, and formulation innovation. By engaging with Ketan, decision-makers gain direct line access to thought leadership, bespoke data analysis, and priority briefings on emerging trends. Reach out today to secure your competitive edge and drive sustainable growth with actionable research that transforms market complexity into clear strategic advantage.

- How big is the Sun Care Products Market?

- What is the Sun Care Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?