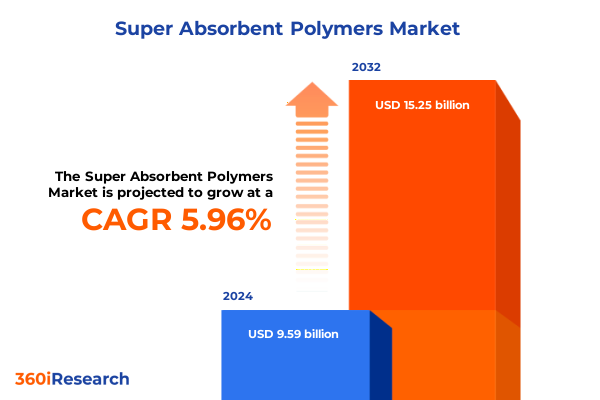

The Super Absorbent Polymers Market size was estimated at USD 10.14 billion in 2025 and expected to reach USD 10.73 billion in 2026, at a CAGR of 5.99% to reach USD 15.25 billion by 2032.

Super Absorbent Polymers Market Introduction Illuminating Key Drivers, Technological Advances, and Emerging Opportunities in High-Performance Applications

Super absorbent polymers (SAPs) represent a cornerstone technology in modern absorbent materials, renowned for their exceptional liquid uptake and retention capabilities. These hydrophilic networks can absorb several hundred times their own weight in fluids, making them indispensable in hygiene products such as baby diapers, feminine sanitary goods, and adult incontinence products. The growing pediatric population worldwide, especially in regions such as China and India, has led to a heightened demand for baby care essentials, driving substantial SAP usage in this segment. Concurrently, aging demographics in major economies including the United States, Japan, and several European nations have escalated the need for adult incontinence solutions, further solidifying SAPs as critical components in personal hygiene applications

Beyond personal care, SAPs have found significant traction in agriculture, where their ability to enhance soil moisture retention addresses pressing water scarcity challenges. By forming hydrogels in the soil matrix, these polymers reduce irrigation frequency, conserve water resources, and improve crop resilience amid increasingly erratic weather patterns

Evolving Dynamics Redefining the Super Absorbent Polymers Landscape Through Sustainability, Digital Integration, and Innovative Material Science Breakthroughs

The SAP landscape is undergoing a paradigm shift toward sustainability, with bio-based polymers emerging as fastest-growing variants. Derived from renewable resources like starch and cellulose, these bio-based SAPs combine high water absorption with improved biodegradability, aligning with corporate sustainability mandates and regulatory pressure to reduce environmental footprints. Industry stakeholders are investing in green chemistry pathways to develop next-generation hydrogels that satisfy both performance and ecological criteria

Simultaneously, digital integration in agriculture and environmental monitoring is redefining end-use applications for SAP materials. Advanced IoT sensor networks now incorporate biodegradable polymer substrates, enabling real-time soil moisture and nutrient tracking while minimizing electronic waste. Projects like the University of Glasgow’s TESLA initiative demonstrate how compostable sensors can seamlessly embed in agricultural operations, triggering precise irrigation and fertilizer release that synergize with SAP-enhanced soils to optimize resource utilization

Material science breakthroughs continue to expand the functional range of SAPs. Innovations in crosslinking chemistries, such as ethylene maleic anhydride and novel copolymer blends, have led to formulations with tailored swelling kinetics and enhanced mechanical stability. These advances enable thinner, more reliable hygiene products and open avenues in niche sectors like spill control, industrial water treatment, and advanced medical dressings

Assessing the Compounded Effects of United States Trade Tariffs Introduced in 2025 on Raw Material Costs, Supply Chains, and Industry Competitiveness

In early 2025, the United States implemented a comprehensive tariff regimen impacting a broad array of imported chemicals. While bulk commodities like polyethylene and polypropylene were largely exempted, key inputs such as monoethylene glycol, ethylene oxide derivatives, and specialty resins now face levy increases that directly affect super absorbent polymer production. Industry analysis indicates underlying chemical prices could rise by 33 to 37 percent as a consequence of these trade measures

This escalation in raw material costs has filtered through supply chains, compelling manufacturers to reprice hygiene and agricultural products or absorb margin contractions. Transportation and logistics expenses have also climbed, as freight carriers pass on higher duties and compliance costs, adding upward pressure of up to 10 to 20 percent on landed polymers from major exporting nations

As a result, global supply routes are being recalibrated. Exporters in China and Southeast Asia are diversifying into European and Middle Eastern markets, while North American producers accelerate domestic capacity expansions to mitigate import reliance. The threat of future tariff adjustments continues to drive strategic sourcing reviews and the establishment of alternative supplier networks to safeguard continuity of supply

Deep Dive into Super Absorbent Polymers Segmentation Revealing Product, Material Form, Application, and Polymer Type Trends Driving Sectoral Growth

The super absorbent polymers market can be dissected through several intersecting lenses that reveal nuanced performance dynamics and growth levers. When examined by base polymer type, distinctions emerge between ethylene maleic anhydride copolymers and polyacrylamide copolymers, each offering unique absorption rates and crosslinking profiles. Natural polymer variants, including cellulose-based and starch-based SAPs, are gaining traction as sustainability imperatives drive an appetite for renewably sourced materials.

Form factor further differentiates market behavior, as granular, powder, and liquid SAP formulations cater to specific handling and application requirements. Applications span a wide spectrum, from baby diapers and adult incontinence products in the personal care domain to advanced medical dressings, agricultural soil conditioners, and industrial spill control systems. By integrating these product, polymer type, material form, and application insights, stakeholders can pinpoint high-value segments and tailor product development strategies to address exacting end-user needs

This comprehensive research report categorizes the Super Absorbent Polymers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Product Type

- Material Form

- Application

- Sales Channel

Unveiling Regional Variations in Super Absorbent Polymers Demand and Development Patterns Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

In the Americas, the hygiene segment dominates SAP consumption, propelled by a robust personal care industry and strategic capacity enhancements. Notably, a major North American producer completed a $19.2 million upgrade at its Texas facility in late 2024, boosting throughput by 20 percent and reducing carbon emissions through optimized rail logistics. Such investments underscore the region’s emphasis on supply resilience and lean manufacturing practices

Across Europe, Middle East, and Africa, regulatory drivers are catalyzing innovation. The European Commission’s Chemicals Industry Action Plan articulates measures to fortify competitiveness and decarbonization, while emerging biodegradability criteria for agricultural polymers are reshaping R&D agendas. Companies are aligning product portfolios with EU mandates on PFAS restrictions and harmonized chemicals legislation to secure market access and lead in sustainability benchmarks

Asia-Pacific is experiencing rapid adoption of SAP-enabled solutions in agriculture and personal care, driven by urbanization, water stress, and rising consumer standards. Governments across China, India, and Southeast Asia have introduced incentives for water-efficient farming practices, amplifying demand for polymer-amended soils capable of reducing irrigation frequency by up to half. The region’s expanding manufacturing footprint is responding with new production lines and localized formulation centers to supply burgeoning domestic consumption

This comprehensive research report examines key regions that drive the evolution of the Super Absorbent Polymers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Super Absorbent Polymers Providers and Their Strategic Moves Shaping Market Leadership, Technological Innovation, and Sustainability Pursuits

BASF has solidified its North American leadership through significant facility enhancements at its Freeport, Texas site. A $19.2 million investment has yielded a 20 percent increase in production capacity, faster polymer swelling performance, and a substantial reduction in logistics-related carbon emissions by leveraging rail transport efficiencies

Evonik is reinforcing its global footprint via strategic debottlenecking initiatives in its German production sites. Incremental capacity expansions projected to add approximately 40,000 metric tons annually are being deployed in phased rollouts at Krefeld and Rheinmünster. This agile approach allows the company to align output with market demand while controlling capital expenditure and upholding sustainable growth objectives

SNF has pursued horizontal integration and geographic diversification, marked by the acquisition of PfP Industries and Ace Fluid Solutions, alongside a $250 million self-financed expansion plan in Oman. These moves expand its polyacrylamide portfolio and reinforce its presence in strategic high-growth regions, enabling supply chain redundancy and service excellence for industrial and personal care customers

This comprehensive research report delivers an in-depth overview of the principal market players in the Super Absorbent Polymers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuro Organics Limited

- APROTEK Group

- Aushadh Limited

- BASF SE

- Bharat Petroleum Corporation Limited

- Chase Corporation

- Chinafloc

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- FUJIFILM Wako Pure Chemical Corporation

- Gelok International

- Harnit Polychem

- High Smart Commodity Co., Ltd.

- Innova Corporate (India)

- Kao Corporation

- LG Chem, Ltd.

- Maple Biotech Pvt. Ltd.

- Nagase Viita Co., Ltd.

- Nippon Shokubai Co., Ltd.

- SABIC

- Sanyo Chemical Industries, Ltd.

- Satellite Chemical Co., Ltd.

- SONGWON Industrial Group

- Sumitomo Seika Chemicals Co., Ltd.

- Tramfloc, Inc.

- Vedic Orgo LLP

- Xitao Polymer Co., Ltd.

- Yixing Bluwat Chemicals Co., Ltd.

Strategic Imperatives for Super Absorbent Polymers Industry Leaders to Enhance Resilience, Foster Innovation, and Capitalize on Emerging Market Opportunities

To bolster resilience, industry leaders should diversify raw material sources and explore partnerships with regional suppliers to mitigate the impact of trade policy volatility. Establishing dual sourcing agreements and investing in domestic polymerization capacities can reduce import dependency and enhance supply chain agility

Innovation remains paramount; allocating R&D resources toward next-generation biodegradable and high-performance SAP formulations can unlock new application horizons. Collaborative research initiatives with academic institutions and start-ups focused on sustainable crosslinking chemistries and responsive hydrogel systems will drive differentiation and long-term competitive advantage

Furthermore, industry participants should engage proactively with regulatory bodies to shape favorable policy frameworks and anticipate compliance requirements. Early alignment on emerging biodegradability standards and digital reporting protocols will ensure uninterrupted market access and reinforce corporate sustainability credentials

Comprehensive Research Methodology Employed to Deliver Robust and Actionable Insights into the Super Absorbent Polymers Market Dynamics

This report is the culmination of a hybrid research methodology that integrates primary interviews, secondary data collection, and triangulation techniques to ensure rigor and reliability. Extensive interviews were conducted with senior executives across SAP producers, end-user companies, and regulatory stakeholders to capture firsthand perspectives on market drivers, challenges, and strategic initiatives.

Secondary research drew on a wide array of proprietary and public sources, including industry publications, technical journals, policy documents, and leading trade associations. Data validation and cross-verification were performed through a triangulation framework, aligning quantitative inputs with qualitative insights to mitigate bias and enhance the accuracy of findings.

Our comprehensive approach also incorporated supply chain mapping, patent landscape analysis, and regulatory tracking to deliver actionable intelligence. Quality checks and peer reviews by subject matter experts were embedded throughout the research lifecycle, guaranteeing that the resulting insights are both robust and highly relevant for decision-makers

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Super Absorbent Polymers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Super Absorbent Polymers Market, by Product

- Super Absorbent Polymers Market, by Product Type

- Super Absorbent Polymers Market, by Material Form

- Super Absorbent Polymers Market, by Application

- Super Absorbent Polymers Market, by Sales Channel

- Super Absorbent Polymers Market, by Region

- Super Absorbent Polymers Market, by Group

- Super Absorbent Polymers Market, by Country

- United States Super Absorbent Polymers Market

- China Super Absorbent Polymers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Perspectives on the Super Absorbent Polymers Sector Highlighting Strategic Priorities, Emerging Trends, and the Roadmap Forward for Stakeholders

As the super absorbent polymers sector continues to evolve, strategic priorities will hinge on balancing performance enhancement with sustainability imperatives. Market leaders are poised to capitalize on growth opportunities by adopting circular economy principles, advancing bio-based polymer technologies, and leveraging digital tools for precision application in agriculture and hygiene.

Regulatory landscapes present both challenges and catalysts, with initiatives in Europe and beyond driving compliance-driven innovation. Companies that proactively align product portfolios with emerging standards-ranging from biodegradability criteria to PFAS restrictions-will gain early-mover advantage and fortify their market positions.

Ultimately, success in this dynamic environment will depend on integrated strategies that encompass flexible manufacturing, collaborative R&D, and stakeholder engagement. By harnessing the insights and recommendations detailed in this summary, industry participants can navigate complexity, optimize resource allocation, and deliver superior solutions that meet the evolving needs of global end-users

Unlock In-Depth Super Absorbent Polymers Market Intelligence by Engaging with Ketan Rohom for Tailored Insights and Bespoke Research Solutions

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to access a comprehensive and customized market research report tailored to your specific strategic objectives. By consulting with Ketan, you gain the opportunity to delve deeper into proprietary insights on super absorbent polymers, encompassing detailed analyses of raw material dynamics, regional developments, and competitive landscapes. This tailored engagement ensures that you receive targeted recommendations designed to support investment decisions, product development roadmaps, and market entry strategies. Connect with Ketan today to secure access to actionable intelligence that will empower your organization to navigate the complexities of the SAP market and drive sustainable growth

- How big is the Super Absorbent Polymers Market?

- What is the Super Absorbent Polymers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?