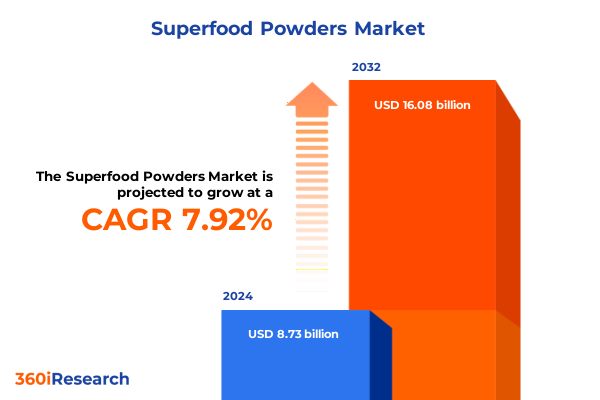

The Superfood Powders Market size was estimated at USD 9.41 billion in 2025 and expected to reach USD 10.15 billion in 2026, at a CAGR of 7.94% to reach USD 16.08 billion by 2032.

Exploring the Transformative Power of Superfood Powders in Driving Health and Wellness Market Dynamics Across Diverse Consumer Segments

The superfood powder industry has emerged as a dynamic nexus between traditional nutrition wisdom and cutting-edge food science, captivating both health-conscious consumers and forward-thinking product developers. Over the past decade, these concentrated nutrient sources have transcended their origins as niche wellness ingredients, evolving into mainstream pantry staples. From antioxidant-rich berry blends to protein-fortified green formulations, the diversity of product offerings reflects an ongoing quest to blend efficacy with convenience. Consumer demand is being shaped by multiple vectors, including rising awareness of preventative health measures, an acceleration of plant-based dietary trends, and an unprecedented appetite for personalization in daily nutrition routines.

Consequently, manufacturers and retailers are exploring novel formats and value propositions to differentiate their offerings in a rapidly maturing market. Clean label credentials are now table stakes, while collaborations with nutrition experts and influencers are driving credibility and consumer trust. Simultaneously, the ubiquity of digital platforms has enabled direct interactions, fostering rapid feedback loops that inform product reformulations and new launches. As a result, the competitive landscape has grown more sophisticated, with legacy food companies, specialized wellness brands, and emerging digital-native startups all jockeying for visibility and market share.

This executive summary provides a structured overview of the market’s evolution, highlights transformative shifts shaping its trajectory, analyzes the impact of recent tariff measures, and distills critical segmentation, regional, and competitive insights. It culminates in actionable recommendations for industry leaders and an explanation of the rigorous research methodology underpinning these findings, equipping decision-makers with a concise yet comprehensive roadmap for navigating the future of superfood powders.

Unveiling the Key Transformative Trends in Clean Label Demands Sustainability and Digital Innovations Reshaping the Superfood Powder Landscape

The superfood powder sector is undergoing a profound metamorphosis as consumer expectations and regulatory frameworks evolve in tandem. First and foremost, the clean label movement has accelerated demand for formulations free from artificial colors, flavors, and preservatives. Manufacturers are responding by sourcing heirloom grains, single-origin botanical extracts, and traceable fruit concentrates, thereby elevating both product transparency and perceived value. At the same time, the digital revolution is empowering direct-to-consumer channels, enabling brands to cultivate communities, leverage data analytics, and refine their offerings with unprecedented agility. This shift has not only disrupted traditional retail models but also amplified the importance of customer engagement and brand storytelling.

Moreover, personalization is rapidly redefining the standard for nutritional relevance: consumers now seek bespoke blends tailored to specific lifestyle goals, whether that be immune support, cognitive performance, or muscle recovery. To meet these demands, several players have introduced diagnostic tools and subscription-based platforms that deliver customized superfood powder regimens. Sustainability has emerged as another cornerstone, with eco-friendly packaging innovations, regenerative agriculture partnerships, and carbon offset commitments becoming key differentiators.

Collectively, these transformative trends are exerting a dual influence: they are both expanding addressable consumer segments and raising the bar for product authenticity and corporate responsibility. For stakeholders across the value chain, understanding and embracing these dynamics is essential to securing competitive advantage and future-proofing their market positions.

Evaluating the Multifaceted Impact of 2025 United States Tariff Measures on Superfood Powder Supply Chain Resilience and Cost Structures

In early 2025, the United States implemented a series of tariff adjustments on imported plant-based ingredients, with an emphasis on powders derived from fruits, vegetables, and grains. These measures, designed to protect domestic agriculture and stimulate local processing, have had ripple effects across the superfood powder market. Supply chain stakeholders have encountered elevated per-unit costs for select inputs, prompting both larger manufacturers and artisanal producers to reevaluate sourcing strategies. Consequently, some entities have turned to domestic suppliers, engaging in long-term contracts to secure price stability and mitigate the risk of future trade policy shifts.

However, this pivot has not been seamless. Domestic yields for certain exotic botanicals remain limited, leading to intermittent shortages and occasional reformulation challenges. Those companies with diversified ingredient portfolios and in-house blending capabilities have fared better, leveraging flexible production frameworks to absorb cost hikes. At the same time, forward-thinking organizations have explored forward purchase agreements and strategic inventory buffering to smooth procurement cycles and maintain consistent product availability.

Overall, while the tariffs have exerted upward pressure on price points and reignited conversations around vertical integration, they have also catalyzed investment in local cultivation and processing infrastructure. These developments are strengthening the domestic superfood powder ecosystem, albeit at the expense of near-term margin compression for firms unable to swiftly adapt. Looking ahead, continued dialogue between industry associations and policymakers will be vital to balance supply security, cost competitiveness, and innovation incentives.

Unlocking Critical Segmentation Insights to Navigate Distribution Channels Product Types Applications Sources and End User Dynamics in the Superfood Powder Market

A nuanced examination of market players reveals that varying distribution channel strategies significantly influence performance outcomes. Hypermarkets and supermarkets continue to anchor mass-market penetration, but growth rates have plateaued as premium positioning gains traction. Online retail has emerged as a linchpin for agility and consumer interaction, with brand websites providing higher margin direct sales, e-commerce platforms delivering scale, and third-party marketplaces offering expansive reach and cross-sell opportunities. Meanwhile, pharmacies and drug stores, led by national chains and complemented by independent outlets, are carving out a niche for scientifically validated formulations, while specialty stores, from health food emporiums to dedicated vitamin boutiques, cater to discerning shoppers prioritizing curated selections.

Product type segmentation underscores a diverse competitive arena. Fruit-based powders leverage familiarity and flavor appeal, whereas greens and vegetable powders differentiate through detoxification and micronutrient density narratives. Protein-enriched blends, including plant-derived isolates and amino-acid-fortified formulations, target active lifestyles and sports nutrition. Applications also exhibit marked heterogeneity: animal feed producers are incorporating nutrient-dense powders into livestock and pet food to enhance growth metrics and overall vitality. Meanwhile, the cosmetic industry has embraced botanical extracts for haircare and skincare serums, and functional food and beverage brands are infusing bakery goods, dairy offerings, snacks, and beverages with wellness benefits.

Source and end-user segmentation further delineate market contours. Firms specializing in organic ingredients command premium pricing, while conventional powders remain preferred for cost-sensitive applications. Adult consumers anchor overall volume, but dedicated product lines for athletes, children, and elderly cohorts reveal intricate demand patterns driven by life-stage and performance considerations. Collectively, these segmentation insights illuminate how strategic portfolio alignment with specific channels, product types, applications, sources, and end-user needs can unlock differentiated value across the superfood powder industry.

This comprehensive research report categorizes the Superfood Powders market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Distribution Channel

- Application

- End User

Examining Regional Nuances and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific Superfood Powder Markets

Regional dynamics underscore the heterogeneous nature of superfood powder adoption and innovation. In the Americas, the fusion of health and convenience has propelled e-commerce expansion, supported by robust logistics networks and high consumer digital literacy. This region has witnessed rapid uptake of subscription-based models, with personalized blends gaining prominence among urban professionals and fitness enthusiasts. In contrast, Europe, the Middle East, and Africa exhibit a bifurcated landscape: Western European markets are characterized by stringent regulatory oversight and a strong emphasis on organic certification, while emerging markets in the Middle East and Africa are gradually embracing functional nutrition as disposable incomes rise and urbanization accelerates.

Across the Asia-Pacific region, the superfood powder market is experiencing double-digit growth rates underpinned by traditional dietary practices and modern wellness trends converging. Countries such as Japan and South Korea are leading the charge with technologically advanced extraction techniques and premium positioning, whereas markets like India and Southeast Asia are leveraging indigenous botanicals to develop cost-effective formulations for mass markets. Each region’s distribution infrastructure and regulatory environment shape consumer access and trust, making local partnerships and compliance investments critical for market entry and expansion.

Collectively, understanding these regional nuances enables manufacturers and distributors to calibrate strategies for pricing, product development, and channel prioritization. By aligning offerings with local taste preferences, certification requirements, and logistics capabilities, stakeholders can harness untapped demand and optimize resource allocation across the global superfood powder landscape.

This comprehensive research report examines key regions that drive the evolution of the Superfood Powders market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players Highlighting Strategic Initiatives Product Innovation and Competitive Positioning in the Superfood Powder Industry

The competitive arena for superfood powders is distinguished by a blend of established food conglomerates, specialized nutrition brands, and agile startups. Leading players are pursuing differentiated strategies that encompass premium ingredient sourcing, proprietary extraction methods, and high-impact marketing collaborations. Strategic partnerships with agricultural co-operatives and botanical research institutes are enabling firms to secure unique raw materials and innovate novel nutrient profiles. Concurrently, investments in automation and scale-up capabilities have strengthened operational resilience, particularly in the face of supply chain disruptions and tariff-induced cost fluctuations.

Innovative product launches remain a central pillar of competitive positioning. Some companies are integrating adaptogenic herbs and nootropic compounds to cater to cognitive wellness trends, while others are emphasizing multi-sensory experiences through flavor layering and textural complexity. Additionally, forward-looking market actors are deploying digital engagement platforms, augmented reality experiences for virtual product trials, and community-driven co-creation initiatives to foster deeper consumer loyalty. On the mergers and acquisitions front, select players have pursued bolt-on acquisitions of niche brands to rapidly expand their product portfolios and penetrate specialized market segments.

These strategic imperatives underscore an evolving competitive paradigm, where agility, authenticity, and end-to-end traceability are increasingly decisive. As consumer expectations continue to ascend, companies that seamlessly integrate sustainability, scientific validation, and digital-native engagement will be best positioned to capture incremental value and drive long-term growth in the superfood powder space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Superfood Powders market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aduna Ltd.

- AG1, Inc.

- Aloha, LLC

- Anima Mundi Apothecary, Inc.

- Archer-Daniels-Midland Company

- Banyan Botanicals, Inc.

- Country Farms, Inc.

- Creative Nature Ltd.

- Four Sigmatic, Inc.

- Glanbia plc

- Herbalife Nutrition Ltd.

- Imlak’esh Organics, LLC

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Kuli Kuli, Inc.

- Minvita, LLC

- Nature’s Superfoods, LLP

- Naturya Ltd.

- NOW Health Group, Inc.

- NOW Health Group, Inc.

- OMG Superfoods, LLC

- Organic India Pvt. Ltd.

- Surthrival Nutritional Technologies, Inc.

- The Hain Celestial Group, Inc.

- USANA Health Sciences, Inc.

Strategic Recommendations for Industry Leaders to Accelerate Growth Enhance Competitiveness and Capitalize on Emerging Opportunities in Superfood Powders

To capitalize on the accelerating demand for superfood powders, industry leaders must pursue a multi-pronged approach. First, deepening investments in product innovation is paramount. This entails leveraging emerging extraction technologies to preserve nutrient integrity, exploring synergistic ingredient combinations, and developing modular formulations that can be customized via digital platforms. By continually refreshing product portfolios with scientifically backed claims and experiential differentiators, companies can maintain consumer engagement and justify premium positioning.

Second, amplifying omnichannel distribution capabilities will be critical. Stakeholders should integrate direct-to-consumer channels with traditional retail, using data insights to personalize marketing outreach and streamline fulfillment. Strategic alliances with e-commerce marketplaces and specialty retail partners can amplify reach, while pilot programs in emerging digital ecosystems can uncover new growth pathways.

Third, forging resilient supply chains through supplier diversification, long-term procurement agreements, and domestic cultivation partnerships will mitigate the impacts of trade policy volatility. Coupled with transparent sustainability reporting and regenerative sourcing commitments, these actions can reinforce brand integrity and foster stakeholder trust.

Finally, executives should deploy advanced analytics and consumer feedback mechanisms to anticipate evolving preferences, optimize pricing tactics, and refine go-to-market strategies. By embedding agility into organizational workflows and governance structures, industry leaders can rapidly pivot in response to emerging trends and competitive movements, ensuring sustained relevance and profitability.

Detailing the Comprehensive Research Methodology Employed for Data Collection Analysis and Validation in Developing the Superfood Powder Market Insights

The insights presented in this report are underpinned by a rigorous research framework that combines both primary and secondary data sources. Primary research comprised in-depth interviews with key executives across manufacturing, distribution, and retail segments, alongside surveys of end consumers to capture usage patterns, purchase motivations, and unmet needs. Secondary research involved systematic reviews of industry publications, regulatory filings, academic journals, and relevant trade association reports to verify market developments and competitive activities.

Data triangulation was employed to reconcile discrepancies between various information sources, enhance data reliability, and ensure robust conclusions. Quantitative data was subjected to validation through cross-referencing umbrella industry datasets and publicly available corporate disclosures. Qualitative assessments were enriched by thematic analysis of expert opinions, facilitating the identification of emerging themes and potential market inflection points.

Furthermore, a geospatial and segmentation analysis was conducted to map regional growth differentials and channel performance metrics. Rigorous peer-review checkpoints were integrated into the research process to maintain analytical integrity and minimize bias. While every effort has been made to ensure comprehensiveness and accuracy, the dynamic nature of trade policies and evolving consumer trends constitutes an inherent limitation, and readers are encouraged to supplement these findings with ongoing market monitoring.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Superfood Powders market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Superfood Powders Market, by Product Type

- Superfood Powders Market, by Source

- Superfood Powders Market, by Distribution Channel

- Superfood Powders Market, by Application

- Superfood Powders Market, by End User

- Superfood Powders Market, by Region

- Superfood Powders Market, by Group

- Superfood Powders Market, by Country

- United States Superfood Powders Market

- China Superfood Powders Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Reflections on Market Dynamics Strategic Imperatives and Future Prospects Shaping the Evolving Superfood Powder Industry Landscape

In summary, the superfood powder market stands at the nexus of consumer demand for health optimization, digital innovation, and sustainable sourcing. Clean label preferences and personalized nutrition are reshaping product development imperatives, while tariff dynamics are triggering a recalibration of supply chain strategies. Segmentation analysis reveals that tailoring offerings by distribution channel, product type, application, source, and end-user cohort is essential for capturing differentiated value. Regionally, market maturation varies, with the Americas and select Asia-Pacific markets leading in innovation adoption, and EMEA demonstrating strong demand for certified organic and functional formulations.

Competitive intensity is escalating, driven by a diverse mix of legacy food giants, specialized wellness brands, and nimble startups. Companies that excel in end-to-end traceability, experiential product innovation, and digital engagement are carving out sustainable growth trajectories. To navigate this complex environment, industry players must embrace agile supply chain frameworks, invest in consumer insights infrastructure, and cultivate strategic partnerships that reinforce both product authenticity and market reach.

Ultimately, the future of superfood powders will be defined by the ability to seamlessly integrate cutting-edge science, transparent provenance, and personalized consumer experiences. Stakeholders that proactively adapt to evolving regulatory landscapes and leverage data-driven decision-making will be best positioned to thrive in this fast-evolving segment of the broader health and wellness arena.

Connect with Ketan Rohom to Secure Comprehensive Superfood Powder Market Intelligence and Drive Informed Strategic Decisions Starting Today

For inquiries and to gain exclusive access to the full superfood powder market research report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, and embark on an informed strategic journey. With personalized guidance and expert support, you can leverage in-depth insights to shape product innovation, optimize distribution strategies across digital and retail channels, and proactively address regulatory and tariff challenges. Don’t miss the opportunity to partner with a trusted industry analyst and secure the competitive advantage your organization needs. Contact Ketan today to schedule a consultation and receive a tailored proposal that aligns with your vision and growth objectives

- How big is the Superfood Powders Market?

- What is the Superfood Powders Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?