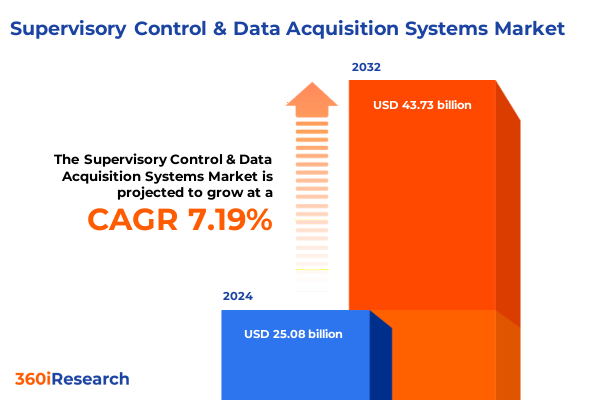

The Supervisory Control & Data Acquisition Systems Market size was estimated at USD 26.87 billion in 2025 and expected to reach USD 28.68 billion in 2026, at a CAGR of 7.20% to reach USD 43.73 billion by 2032.

Unveiling the Strategic Imperatives and Market Dynamics Shaping Modern Supervisory Control & Data Acquisition Technology in Critical Infrastructure

Supervisory Control & Data Acquisition systems have evolved beyond foundational infrastructure components to become critical enablers of digital transformation across industrial sectors. As operational networks converge with enterprise IT environments, stakeholders face mounting pressure to optimize system reliability, scalability, and security concurrently. The growing complexity of process automation combined with stringent regulatory requirements has elevated SCADA from a specialized control technology to a strategic pillar underpinning business resilience and competitive differentiation.

This report synthesizes the trends, challenges, and growth vectors defining the modern SCADA landscape. Drawing upon primary expert interviews and a rigorous analytical framework, it distills the imperatives that organizations must address to harness emerging technologies and mitigate evolving risks. By understanding the contextual factors driving vendor roadmaps and end-user adoption, decision-makers can align investments with future-proof architectures that support both incremental enhancements and transformative initiatives.

Mapping the Fundamental Industry Disruptions Redefining Next Generation Control Systems and Data Acquisition Architectures in a Digitally Convergent Age

The SCADA ecosystem is undergoing a profound metamorphosis fueled by the confluence of digital convergence and operational modernization. Edge computing now decentralizes processing power, enabling real-time analytics at remote substations and process plants. This shift reduces latency and enhances decision-making at the point of data capture, while alleviating bandwidth burdens on central servers. Simultaneously, artificial intelligence and machine learning algorithms are increasingly integrated into control loops to predict equipment failures, optimize energy usage, and automate regulatory compliance tasks with unprecedented precision.

Moreover, cyber-physical security has ascended to the forefront of design considerations, driving investments in anomaly detection, encryption, and identity and access management frameworks. Protocols such as IEC 62443 set the benchmark for secure system architectures, compelling both incumbents and new entrants to embed robust safeguards from inception. Cloud-native SCADA platforms complement on-premise solutions by offering scalable analytics and collaboration capabilities, thereby fostering closer alignment between operational technology and enterprise IT roadmaps. Together, these transformative shifts chart a course for ecosystems that are more resilient, interconnected, and intelligent than ever before.

Assessing the Aggregated Consequences of New United States Tariff Measures on Hardware Supply Chains and the SCADA Market Ecosystem in 2025

In 2025, the implementation of new US tariff policies on electronic components and industrial control equipment has introduced notable cost pressures for the SCADA market. Components such as programmable logic controllers and specialized sensors, often manufactured offshore, now incur higher import duties, prompting end users to reassess sourcing strategies. Many organizations have accelerated conversations around supplier diversification and reshored manufacturing to mitigate the financial impact of escalating trade barriers.

This tariff-driven realignment has also influenced vendor pricing models, encouraging a pivot toward subscription-based licensing and managed service options that bundle hardware, software, and support. By integrating service revenues, suppliers aim to insulate cash flows and maintain predictable revenue streams despite variable component costs. End-users correspondingly benefit from reduced capital outlays and enhanced lifecycle support. Collectively, these adjustments reflect a market recalibration that balances cost mitigation with the imperative to maintain operational continuity and technological competitiveness.

Unraveling Core Segmentation Perspectives to Illuminate Communication Channels Deployment Models Components End Users and Application Verticals in SCADA Markets

Analysis of market segmentation reveals that communication infrastructures underpinning control networks now span both wired protocols renowned for reliability and wireless technologies that facilitate remote monitoring across expansive geographies. Deployment formats encompass cloud-based environments, where scalability and cross-site visibility are paramount, as well as on-premise architectures preferred by organizations requiring stringent data governance and minimal latency. Within these deployment frameworks, a layered composition of components drives system functionality: foundational hardware such as industrial computers, programmable logic controllers, remote terminal units, and a diverse array of sensors and actuators serve as the physical interface with the process world.

Complementing hardware are specialized software solutions addressing data management workflows, human-machine interface operations, core SCADA control logic, and cybersecurity enforcement. These offerings are supported by a robust services ecosystem comprising consulting engagements, system integration, preventive maintenance, and end-user training. Across industry verticals, end-user profiles range from high-regulation sectors like chemicals and pharmaceuticals to large-scale utilities in energy and water treatment, each with tailored performance and compliance imperatives. The breadth of real-world deployments extends across building automation, energy management systems, industrial automation lines, oil and gas management frameworks, and water and wastewater management networks, highlighting the technology’s essential role in sustaining operational excellence and regulatory adherence.

This comprehensive research report categorizes the Supervisory Control & Data Acquisition Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Communication Type

- Deployment Type

- Component

- Application

- End-User

Interpreting Regional Divergences and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific in Supervisory Control and Data Acquisition Markets

Geographical dynamics play a pivotal role in shaping demand and solution preferences within the SCADA domain. In the Americas, aging infrastructure modernization programs and utility grid resilience initiatives have spurred investments in advanced control systems that integrate renewable energy sources and smart grid functionalities. Multi-stakeholder collaborations between private enterprises and public agencies accelerate digitalization roadmaps, particularly in regions grappling with extreme weather events and the imperative to bolster operational reliability.

Europe, the Middle East, and Africa present a heterogeneous landscape driven by regulatory harmonization in the European Union, which emphasizes cybersecurity and decarbonization mandates, alongside significant oil and gas projects in the Gulf states that leverage SCADA systems for remote asset management. Africa’s incremental rollout of water treatment and power transmission networks is generating new opportunities for modular, cost-effective control platforms.

Across Asia-Pacific, rapid industrial expansion in Southeast Asia and the widespread adoption of smart manufacturing frameworks in countries such as Japan and South Korea have catalyzed demand for end-to-end automation solutions. Market growth is further underpinned by government initiatives promoting Industry 4.0, which encourage localized production of hardware and the development of regional ecosystems for system integrators and software developers.

This comprehensive research report examines key regions that drive the evolution of the Supervisory Control & Data Acquisition Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Maneuvers and Innovation Portfolios of Leading Global Stakeholders Shaping the Competitive Landscape of SCADA Solutions and Services

The competitive landscape is characterized by established global vendors and agile niche providers, each pursuing differentiated strategies to capture share. Leading multinational corporations have consolidated their portfolios through strategic acquisitions, integrating cybersecurity specialists and analytics platform providers to augment their SCADA suites. These alliances enable a comprehensive value proposition encompassing edge-to-cloud connectivity, predictive analytics, and governance frameworks that address regulatory and operational risk.

At the same time, regional and boutique vendors leverage domain expertise to deliver specialized solutions tailored to discrete industry segments, such as water utilities or pharmaceutical manufacturing. This blend of global scale and local customization has led to increasingly interoperable ecosystems, where adherence to open standards and cross-vendor collaboration accelerates deployment cycles. Software-as-a-service models and enhanced remote support platforms further differentiate offerings, providing organizations with flexible consumption options and rapid scalability aligned to evolving production volumes and regulatory requirements.

This mosaic of strategic approaches underscores the vitality of partnerships, continuous R&D investment, and responsive service delivery in maintaining a competitive edge within the SCADA marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Supervisory Control & Data Acquisition Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advantech Co. Ltd.

- AVEVA Group PLC

- Azbil Corporation

- Beckhoff Automation GmbH

- Control Solutions Inc.

- COPA-DATA GmbH

- Deegit Inc.

- Emerson Electric Co.

- Endress+Hauser Group

- Fanuc Corporation

- General Electric Company

- Hitachi Ltd.

- Honeywell International Inc.

- Inductive Automation LLC

- Mitsubishi Electric Corporation

- Omron Corporation

- PSI Software AG

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

- Trihedral Engineering Limited

- Yokogawa Electric Corporation

Formulating Pragmatic Strategic Initiatives to Elevate Operational Resilience Digital Transformation and Security Posture for SCADA Industry Leadership

Industry leaders seeking to fortify their market position should prioritize cybersecurity as a foundational design principle rather than a retrofitted afterthought. Embedding end-to-end encryption, microsegmentation, and zero-trust frameworks within control architectures will not only reduce vulnerability but also satisfy increasingly stringent compliance mandates. Collaborative partnerships between cybersecurity specialists and control system integrators are essential to develop threat models and real-time response protocols that align with operational requirements.

Simultaneously, embracing edge computing and wireless networking technologies can unlock new data streams and augment remote operations, reducing the dependency on centralized infrastructure and enabling predictive maintenance at scale. Supply chain diversification-through nearshoring and multi-regional sourcing agreements-will mitigate tariff-related cost volatility and reinforce business continuity. Organizations should also consider transitioning to subscription-based licensing and managed services to transform capital expenditures into predictable operating expenses, thereby simplifying budgeting and enhancing lifecycle support.

Investing in workforce skill development through targeted training programs will ensure that operational teams are equipped to leverage advanced analytics and automation tools. By aligning strategic investments across security, edge intelligence, and human capital, leaders can achieve a resilient, adaptable posture in an increasingly complex marketplace.

Detailing Rigorous Research Approaches Combining Primary Expert Insights and Secondary Data Triangulation to Deliver Comprehensive SCADA Market Analysis

This research employed a hybrid methodology combining extensive secondary data review with a structured primary research program. The secondary phase involved the systematic analysis of industry publications, regulatory filings, white papers, and manufacturer collateral, providing a foundational understanding of technological trends and market regulations. Concurrently, the primary phase comprised in-depth interviews with control system engineers, plant operations managers, and C-level executives across major end-user segments, enriching the study with practical insights into deployment challenges and strategic priorities.

Quantitative data was triangulated across multiple sources to ensure consistency, while qualitative inputs were coded to identify recurring themes related to cybersecurity adoption, deployment preferences, and investment drivers. A detailed segmentation framework was applied to dissect market dynamics by communication type, deployment model, component category, end-user industry, and application area. Regional analyses were conducted to highlight geographic variances in regulatory environments, infrastructure maturity, and digital transformation initiatives. Collectively, this multilayered approach yielded a robust, unbiased perspective on the SCADA market’s current state and future trajectory.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Supervisory Control & Data Acquisition Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Supervisory Control & Data Acquisition Systems Market, by Communication Type

- Supervisory Control & Data Acquisition Systems Market, by Deployment Type

- Supervisory Control & Data Acquisition Systems Market, by Component

- Supervisory Control & Data Acquisition Systems Market, by Application

- Supervisory Control & Data Acquisition Systems Market, by End-User

- Supervisory Control & Data Acquisition Systems Market, by Region

- Supervisory Control & Data Acquisition Systems Market, by Group

- Supervisory Control & Data Acquisition Systems Market, by Country

- United States Supervisory Control & Data Acquisition Systems Market

- China Supervisory Control & Data Acquisition Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Consolidating Key Findings and Forward-Looking Perspectives to Empower Decision Making in Rapidly Evolving Supervisory Control and Data Acquisition Environments

In consolidating the insights from this study, it is evident that SCADA systems are at an inflection point where digital innovation, regulatory imperatives, and supply chain considerations converge. The market’s growth will be driven by the integration of edge analytics, the migration toward cloud-hybrid deployments, and the embedding of cybersecurity protocols as an intrinsic feature of system design. Regional divergences will persist, but overarching trends toward open architectures and managed service adoption are unifying growth trajectories.

Decision-makers should anchor their strategies in a clear understanding of segmentation dynamics-across communication channels, deployment formats, component ecosystems, and end-user verticals-to tailor solutions that yield operational efficiencies and compliance assurance. The competitive landscape will reward those vendors and integrators that balance global scale with local responsiveness, leveraging partnerships to deliver end-to-end value. As SCADA technologies continue to underpin critical infrastructure and industrial automation, the ability to adapt to tariff environments, digital threats, and evolving regulatory frameworks will determine long-term success.

This study equips stakeholders with the strategic clarity required to navigate complexity and seize market opportunities in an increasingly autonomous and data-driven operational environment.

Empowering Your Organizational Strategy with Tailored SCADA Market Intelligence Engage with Our Expert Sales Leadership to Secure the Comprehensive Research Report

To access unparalleled depth and strategic clarity in the Supervisory Control & Data Acquisition systems market, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through our comprehensive research offerings, enabling you to secure insights that align precisely with your operational challenges and growth objectives. Engaging with our expert sales leadership ensures you receive the bespoke intelligence required to navigate evolving industry pressures and capitalize on emerging opportunities.

By partnering with our research authority, you gain priority access to detailed analyses, executive summaries, and custom data sets tailored to your specific end-user segments and application areas. This collaborative engagement streamlines the acquisition process and accelerates your time to actionable insights. Reach out to Ketan Rohom to embark on a data-driven journey that empowers your organization to make informed strategic decisions with confidence.

- How big is the Supervisory Control & Data Acquisition Systems Market?

- What is the Supervisory Control & Data Acquisition Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?