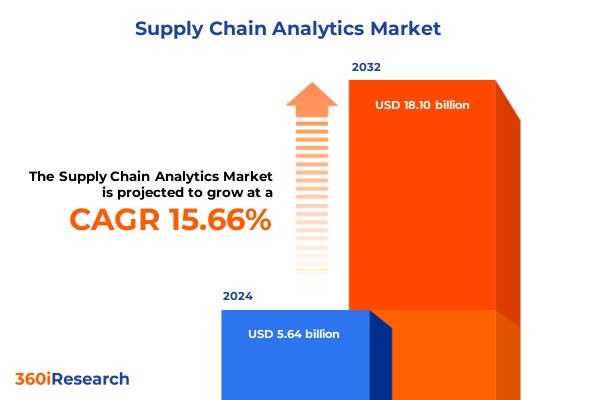

The Supply Chain Analytics Market size was estimated at USD 6.49 billion in 2025 and expected to reach USD 7.47 billion in 2026, at a CAGR of 15.77% to reach USD 18.10 billion by 2032.

Exploring the Transformative Power of Supply Chain Analytics in Orchestrating Resilient Agile Insight-Driven End-to-End Operational Excellence

The relentless pace of global commerce coupled with evolving technological landscapes has thrust supply chain analytics into the forefront of corporate strategy. Across industries, executives and operational leaders are increasingly recognizing that harnessing data-driven insights is no longer a competitive luxury but an operational imperative. By integrating structured and unstructured data sources, organizations can illuminate hidden inefficiencies, anticipate disruptions, and optimize end-to-end processes with unprecedented precision.

Furthermore, the convergence of advanced analytics, artificial intelligence, and real-time visibility tools has unlocked new realms of supply chain resilience and agility. As market dynamics fluctuate, the ability to rapidly interpret trends and simulation outputs empowers decision-makers to pivot strategies dynamically, mitigating risk and capturing emerging opportunities. Consequently, supply chain analytics has evolved from a niche functional capability to a strategic cornerstone, directly influencing margin expansion, customer satisfaction, and sustainable growth trajectories.

Evolving Dynamics and Disruptive Technologies Redefining the Global Supply Chain Analytics Landscape with Strategic Implications and Competitive Advantages

Over the last decade, the supply chain analytics realm has undergone profound transformation driven by converging digital technologies and shifting market imperatives. Traditional descriptive approaches, which focused on historical performance metrics, are increasingly supplanted by prescriptive and cognitive analytics methodologies. Machine learning algorithms now evaluate complex, multi-dimensional datasets to generate scenario-based recommendations, while digital twin models simulate potential outcomes under varied conditions. These advances enable companies to move beyond reactive troubleshooting toward proactive optimization.

Simultaneously, the proliferation of Internet of Things sensors and edge computing solutions has generated a continuous influx of real-time data from manufacturing floors, distribution centers, and transportation networks. Consequently, analytics platforms are being designed with enhanced streaming capabilities and distributed processing architectures to handle high-volume, high-velocity data streams. In tandem, cloud-native SaaS offerings are lowering the barrier to entry for small and medium enterprises, accelerating the democratization of advanced analytics across supply chains of all scales. Together, these disruptive shifts are redefining how organizations anticipate demand fluctuations, manage inventory buffers, and orchestrate multi-modal logistics networks.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on Supply Chain Analytics Cost Structures and Strategic Sourcing Decisions

The 2025 tariff adjustments implemented by the United States have introduced new layers of complexity into supply chain cost structures and strategic sourcing decisions. As duties on select imported components and raw materials increased, organizations have been forced to reevaluate network footprints, vendor portfolios, and inventory strategies. In particular, sectors dependent on high-precision sensors and automation hardware have confronted elevated landed costs, prompting renewed interest in supplier diversification and nearshoring initiatives.

Against this backdrop, supply chain analytics platforms have become indispensable for stress-testing various tariff scenarios and quantifying their profit-leakage impacts. By integrating tariff schedules into total cost of ownership models, analytics solutions provide real-time visibility into cost drivers, enabling procurement teams to negotiate more effectively and explore alternative supply routes. Moreover, scenario-planning capabilities allow leadership teams to assess the financial consequences of cross-border trade adjustments and to identify threshold points at which reshoring or insourcing initiatives become financially advantageous. As a result, analytics-enabled decision frameworks are now central to corporate strategies aiming to navigate ongoing trade policy uncertainties.

Unveiling Critical Segmentation Insights to Illuminate Component Deployment Organizational Application and Industry-Based Dimensions of Supply Chain Analytics

A nuanced understanding of supply chain analytics requires dissecting the market through multiple interrelated dimensions. When examining components, hardware solutions encompass automation systems that drive process efficiency, IoT devices that capture real-time operational metrics, and sensors that feed granular performance data into analytics engines. Consulting services guide implementation and change management, managed services maintain ongoing system performance, and support and maintenance functions ensure continuous uptime. Software offerings range from cloud-based platforms that deliver scalability and rapid deployment to integrated software suites designed to unify analytics, planning, and execution layers.

Deployment preferences also diverge between cloud-based environments, which offer elastic capacity and subscription-based pricing, and on-premise installations favored by enterprises with stringent data sovereignty requirements. Organization size further influences adoption strategies: large enterprises often deploy comprehensive, multi-module analytics stacks integrated with existing ERP ecosystems, whereas small and medium enterprises prioritize modular, easy-to-use analytics tools that address immediate pain points without extensive customization.

Application-specific analytics capabilities extend across inventory management functions such as demand forecasting and order management, procurement activities including contract negotiation analytics and supplier relationship metrics, and transportation management tasks encompassing freight rating optimization and dynamic route planning. Finally, industry verticals shape analytics requirements in unique ways: food and beverage companies rely on traceability and spoilage reduction insights, healthcare organizations need compliance-centric distribution analytics, aerospace and automotive manufacturers focus on predictive maintenance and production scheduling, and retail and e-commerce players leverage customer behavior data to refine replenishment algorithms for both brick-and-mortar outlets and online channels.

This comprehensive research report categorizes the Supply Chain Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- Application

- Industry

Dissecting Key Regional Dynamics Across Americas Europe Middle East & Africa and Asia-Pacific to Uncover Unique Market Drivers and Barriers

Regional dynamics play a pivotal role in shaping supply chain analytics deployment and functionality. In the Americas, mature digital infrastructures and sophisticated data ecosystems drive rapid adoption of real-time visibility platforms and advanced predictive capabilities. North American manufacturing and retail giants leverage analytics to integrate omni-channel distribution networks and to synchronize cross-border flows, while Latin American entities often prioritize scalable cloud solutions to circumvent legacy IT limitations and to compensate for regional infrastructure variability.

Conversely, Europe, Middle East, and Africa markets exhibit a patchwork of regulatory regimes and technological maturity levels. Western European organizations benefit from strong data governance frameworks and concentrated innovation hubs, fostering collaboration between industry consortia and technology vendors. In contrast, Middle Eastern and African supply chains are increasingly investing in analytics to manage complex import dependencies and to support rapid urbanization-driven demand growth. This EMEA region’s diversity necessitates analytics platforms that can adapt to multilingual interfaces, varying data privacy mandates, and heterogeneous infrastructure environments.

Across Asia-Pacific, the region’s manufacturing powerhouses and burgeoning e-commerce ecosystems have accelerated demand for high-throughput analytics engines capable of processing massive volumes of transaction and sensor data. In markets such as China and Southeast Asia, companies prioritize integration with local logistics networks and regulatory reporting systems, while maturity levels in emerging markets drive adoption of managed services to bridge talent gaps and to fast-track digital transformation initiatives.

This comprehensive research report examines key regions that drive the evolution of the Supply Chain Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Shaping the Supply Chain Analytics Sector Through Innovation Partnerships and Strategic Growth Initiatives

Within the supply chain analytics arena, established technology conglomerates and innovative pure-play vendors are jockeying for leadership through strategic alliances, product expansions, and global rollouts. Legacy enterprise software providers have embedded advanced analytics modules into their broader ERP suites, enabling clients to leverage familiar interfaces and existing integration pathways. At the same time, specialist analytics firms continue to refine machine learning algorithms and to invest in low-code platforms that expedite model development and deployment.

Collaborations between technology vendors and logistics service providers are also intensifying, resulting in end-to-end managed analytics offerings that encompass data collection, visualization, and predictive maintenance services. Furthermore, emerging startups are leveraging blockchain and federated learning techniques to offer enhanced data privacy assurances and cross-enterprise collaboration capabilities. These diverse competitive dynamics are shaping a vibrant ecosystem in which open architectures, microservices frameworks, and ecosystem playbooks are critical differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Supply Chain Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIMMS B.V.

- Amazon Web Services, Inc.

- BearingPoint Europe Holdings B.V.

- Birst, Inc.

- Blue Yonder Group, Inc.

- Capgemini SE

- Descartes Systems Group Inc.

- Genpact Ltd.

- Google LLC

- IBM Corporation

- Infor Inc.

- Kinaxis Inc.

- Manhattan Associates Inc.

- Microsoft Corporation

- MicroStrategy Incorporated

- o9 Solutions, Inc.

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

Actionable Strategic Roadmap for Industry Leaders to Harness Advanced Analytics Enhance Resilience and Capitalize on Emerging Supply Chain Opportunities

Industry leaders must adopt a multifaceted strategic roadmap to fully capitalize on supply chain analytics advancements. First, prioritizing the establishment of a unified data platform is essential; by consolidating disparate data sources-ranging from IoT feeds to financial records-organizations will foster a single source of truth that underpins reliable analytics outputs. Next, cross-functional collaboration between IT, operations, procurement, and finance stakeholders must be formalized to ensure analytics insights translate into coordinated action.

Moreover, embedding AI-driven forecasting engines into inventory and demand management processes can reduce working capital requirements while improving service levels. To strengthen resilience, scenario-planning frameworks should be operationalized, enabling rapid evaluation of disruption impacts and contingency measures. Concurrently, organizations need to deepen supplier collaborations via analytics-based scorecards that incentivize performance improvements and risk visibility. Finally, cultivating analytics literacy through targeted upskilling programs and fostering a culture of continuous improvement will ensure that insights drive sustainable value creation.

Comprehensive Research Methodology Underpinning the Analysis of Supply Chain Analytics Market Trends Sources and Analytical Frameworks

The research underpinning this analysis combined rigorous secondary data review with structured primary engagements. Initially, a comprehensive literature survey was conducted, spanning industry white papers, regulatory publications, and technology reports to outline the conceptual framework. This phase was followed by interviews with senior supply chain executives and technology providers to validate trends and to gather insights on adoption challenges and success cases.

Quantitative data from proprietary performance benchmarks and select public disclosures were triangulated with qualitative inputs to ensure balanced perspectives. Analytical frameworks-including strength-roadmap matrices, scenario-planning models, and technology maturity assessments-were applied to systematically evaluate market dynamics. Throughout the methodology, peer reviews and expert panel sessions were utilized to corroborate findings, address potential biases, and refine strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Supply Chain Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Supply Chain Analytics Market, by Component

- Supply Chain Analytics Market, by Deployment Mode

- Supply Chain Analytics Market, by Organization Size

- Supply Chain Analytics Market, by Application

- Supply Chain Analytics Market, by Industry

- Supply Chain Analytics Market, by Region

- Supply Chain Analytics Market, by Group

- Supply Chain Analytics Market, by Country

- United States Supply Chain Analytics Market

- China Supply Chain Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings to Highlight Implications Strategic Priorities and Future Outlooks for Supply Chain Analytics Stakeholders

In summation, supply chain analytics has transitioned from a support function to a strategic enabler, driven by innovations in AI, IoT, and cloud computing. The evolving tariff landscape underscores the criticality of analytics for navigating geopolitical shifts, while segmentation insights reveal the diverse technology and service requirements across component types, deployment modes, organizational scales, application areas, and industry verticals. Regionally, the Americas lead in digital sophistication, EMEA presents a mosaic of regulatory and infrastructure challenges, and Asia-Pacific continues to drive high-volume transactional analytics demand.

As key vendors and specialized startups intensify competition, industry leaders must prioritize unified data strategies, cross-functional governance, and AI-powered forecasting to sustain resilience and maximize value. This executive summary sets the stage for a deeper exploration of specific market nuances and detailed company profiles, equipping decision-makers with actionable insights to drive growth in an increasingly complex global supply chain.

Empower Your Organization with In-Depth Supply Chain Analytics Insights—Connect with Associate Director Ketan Rohom to Secure Your Market Research Access

To explore how these comprehensive supply chain analytics insights can catalyze your operational transformation and strategic growth, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with an expert who understands the nuances of advanced analytics adoption, you will gain bespoke guidance on selecting the right analytics platforms and services to meet your unique requirements. Embark on a deeper conversation that will reveal untapped opportunities, clarify investment priorities, and align your leadership team behind a data-driven roadmap. Position your organization at the forefront of supply chain innovation by securing full access to our in-depth market research report today

- How big is the Supply Chain Analytics Market?

- What is the Supply Chain Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?