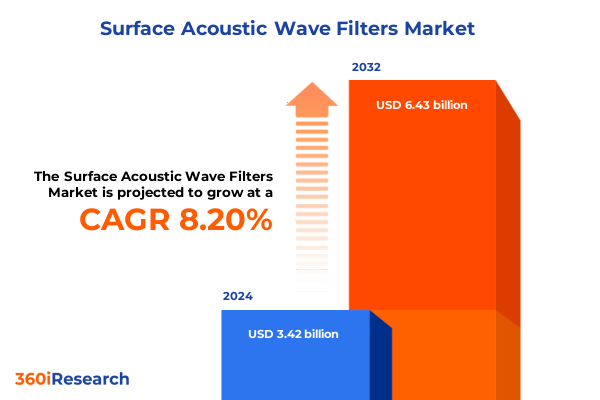

The Surface Acoustic Wave Filters Market size was estimated at USD 3.68 billion in 2025 and expected to reach USD 3.97 billion in 2026, at a CAGR of 8.28% to reach USD 6.43 billion by 2032.

An authoritative introduction to the pivotal role of Surface Acoustic Wave Filters in enabling high-precision signal control across diverse electronic applications

Surface Acoustic Wave Filters serve as foundational components in modern electronic systems enabling precise control of high-frequency signals across a broad spectrum of applications. By leveraging acoustic waves that propagate along the surface of piezoelectric materials these filters offer exceptional selectivity and low insertion loss critical for maintaining signal fidelity in communication and sensing applications. Their compact form factor and compatibility with planar manufacturing processes make them well suited for integration into mobile devices wireless infrastructure instruments and automotive electronics.

As an introduction to this dynamic market it is essential to understand that the performance capabilities of Surface Acoustic Wave Filters have evolved in tandem with advances in fabrication techniques and materials science. Innovations such as interdigital transducer design and specialized substrate engineering have progressively improved bandwidth performance temperature stability and power handling. These advances have driven the adoption of SAW filters from early cellular handsets to emerging high speed wireless protocols and multifunctional sensor arrays. Through this lens the reader gains perspective on the enduring relevance of SAW filter technology as it adapts to continuously rising frequency demands and stringent performance requirements.

Examining transformative shifts that have redefined the Surface Acoustic Wave Filter landscape from technological innovation to changing end-user demand dynamics

The landscape of Surface Acoustic Wave Filters has undergone transformative shifts driven by the convergence of next-generation wireless standards heightened demand for connectivity and diversified end-user applications. At the core of this transformation lies the transition from narrowband radio frequency front ends toward multifunctional front ends capable of supporting simultaneous wideband operations. This evolution has been propelled by the rollout of high frequency communications protocols which require filters capable of attenuating spurious signals across broader bandwidths.

Concurrently the Internet of Things revolution and the proliferation of sensor networks have expanded the requirements for low power high stability filtering solutions in compact form factors. These shifting requirements have driven material innovations in lithium tantalate and lithium niobate substrates to improve temperature coefficient characteristics without compromising insertion loss. Meanwhile the industry has embraced advanced packaging techniques such as embedded wafer level packaging to meet miniaturization demands and enhance thermal performance. Ultimately these converging trends underscore a fundamental transformation in how Surface Acoustic Wave Filters are designed manufactured and deployed across evolving technological ecosystems.

Assessing the cumulative impact of recent United States tariffs on the Surface Acoustic Wave Filter supply chain and market competitiveness

Recent United States tariffs have introduced notable implications for the global supply chain of Surface Acoustic Wave Filters influencing cost structures procurement strategies and competitive positioning. In response to trade policy measures targeted at imported electronic components manufacturers and distributors have adjusted sourcing and inventory management practices to mitigate the financial impact. The levies have been particularly impactful for filters utilizing specialized piezoelectric materials where alternative domestic suppliers remain limited.

These duties have fostered a reassessment of supplier relationships as companies prioritize dual sourcing strategies to preserve continuity of supply. In addition equipment designers are revisiting filter integration approaches such as hybrid multichip modules to fine tune cost versus performance trade offs. Despite the immediate headwinds tariff adjustments have also catalyzed investment in regional manufacturing capabilities aimed at reducing exposure to trade fluctuations. Over time these structural shifts may yield enhanced resilience in the Surface Acoustic Wave Filter industry as stakeholders diversify supply chains and optimize production footprints in response to evolving policy landscapes.

Uncovering key segmentation insights by type frequency materials applications and end-user verticals shaping Surface Acoustic Wave Filter deployment strategies

The Surface Acoustic Wave Filter ecosystem can be delineated through a series of intersecting classifications reflecting the diversity of technology and application requirements. When exploring the type dimension the contrast between intermediate frequency SAW Filters and intermediate radio SAW Filters yields insights into performance tradeoffs for narrowband filtering versus broadband communications front ends. Frequency range further stratifies the market into low mid and high frequency bands where each band addresses unique propagation characteristics and power handling needs.

Material selection plays a pivotal role in balancing temperature stability insertion loss and fabrication costs as lithium niobate substrates offer enhanced bandwidth performance while lithium tantalate and quartz provide alternative pathways for cost sensitive or high precision applications. Application segmentation reveals that broadcasting infrastructures demand high linearity filters for signal integrity whereas GPS systems prioritize low phase noise and signal stability in mobile environments. Within signal processing domains filter designs cater to diverse signal chains in instrumentation and measurement systems. End‐user verticals in aerospace defense require robust filters with extended temperature ranges while automotive telematics and advanced driver assistance systems drive the adoption of high performance SAW Filters. Healthcare devices emphasize biocompatibility and miniaturization and telecommunications networks continue to be the principal driver for ongoing filter innovation.

This comprehensive research report categorizes the Surface Acoustic Wave Filters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Frequency Range

- Material

- Application

- End-User

Analyzing critical regional dynamics across the Americas Europe Middle East Africa and Asia Pacific in driving Surface Acoustic Wave Filter adoption trends

Regional dynamics play a significant role in shaping the advancement and adoption of Surface Acoustic Wave Filters across the global marketplace. In the Americas region focus on expanding 5G infrastructure and automotive electrification has driven increased demand for high performance filters optimized for millimeter wave frequencies and rugged operational environments. Collaboration between local semiconductor fabs and filter specialists has accelerated time to market for next-generation radio frequency front ends.

In Europe the Middle East and Africa ecosystems the convergence of defense modernization programs and satellite communication initiatives has underscored the importance of filters with stringent reliability qualifications. Regional research consortia and standards bodies collaborate to align filter specifications with emerging requirements in aerospace telemetry and broadband wireless backhaul networks. The Asia Pacific region remains the primary center for manufacturing expertise characterized by high volume production of both substrates and filter assemblies. Strong government support for semiconductor self-sufficiency coupled with robust electronics industry clusters has cemented the region’s leadership in cost-efficient production and rapid technology rollouts.

This comprehensive research report examines key regions that drive the evolution of the Surface Acoustic Wave Filters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading companies in the Surface Acoustic Wave Filter sector and highlighting competitive strategies that drive innovation and market positioning

A cohort of innovative companies continues to shape the Surface Acoustic Wave Filter market through strategic product roadmaps and collaborative R&D initiatives. Leading semiconductor manufacturers sustain competitive edge by integrating acoustic wave filters within monolithic radio frequency front end modules while emerging specialists focus on niche applications requiring ultralow insertion loss and extreme miniaturization. Joint ventures between material science pioneers and electronic component firms are advancing novel piezoelectric substrates that extend operational temperature ranges and simplify packaging environments.

Competitive differentiation is further driven by investments in advanced lithography techniques and precision etching processes to achieve uniformity at the nanometer scale. Companies adopting flexible manufacturing frameworks enhance responsiveness to fluctuating demand allowing them to accelerate product customization for specific end-user segments. Strategic partnerships along the supply chain facilitate co-development of next-generation filter architectures and enable alignment of roadmaps to overarching technology shifts in wireless communications and sensing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surface Acoustic Wave Filters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abracon LLC

- Akoustis Technologies, Inc.

- Avnet, Inc.

- Bliley Technologies Inc.

- Broadcom Inc.

- Crystek Corporation

- ECS, Inc. International

- Golledge Electronics Ltd.

- Kyocera Corporation

- Microchip Technology Inc.

- Microsaw Oy

- Murata Manufacturing Co., Ltd.

- Nisshinbo Micro Devices Inc.

- Qorvo, Inc

- Qualcomm Incorporated

- Raltron Electronics Corporation by RAMI TECHNOLOGY GROUP

- Skyworks Solutions, Inc.

- Spectrum Control, Inc.

- TAI-SAW TECHNOLOGY CO., LTD.

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Token Electronics Industry Co., Ltd.

Delivering actionable recommendations for industry leaders to navigate evolving Surface Acoustic Wave Filter market challenges and capitalize on emerging opportunities

Industry leaders can navigate the evolving landscape by undertaking targeted actions that balance innovation with supply chain resilience. Mitigating risks associated with trade policy fluctuations requires development of multi-source procurement channels and exploration of in-region manufacturing collaborations. Simultaneously innovation roadmaps should prioritize advanced filter designs capable of supporting emerging high frequency wireless protocols and multifunctional transceiver architectures.

Investing in material research partnerships can accelerate the introduction of next-generation substrates that offer superior thermal stability and reduced signal loss. Cross-functional teams should align R&D milestones with customer pilot programs to ensure accelerated validation cycles and to capture feedback critical for product refinement. Additionally companies should engage with standards bodies and industry consortia to influence filter specifications and secure early visibility into evolving technical requirements. By coupling strategic supply chain measures with forward-looking technology investments organizations will be well positioned to capitalize on the continued expansion of high-performance filtering solutions.

Outlining a robust research methodology that underpins the Surface Acoustic Wave Filter market analysis through rigorous data gathering and validation

The research methodology underpinning this analysis integrates rigorous data collection frameworks and expert validation techniques to ensure robustness and credibility. Initial stages encompassed extensive secondary research leveraging technical journals trade publications and patent databases to map technological trajectories and material innovations. This foundational work informed a structured series of interviews with industry stakeholders including filter designers system integrators and component distributors to capture primary insights and verify market dynamics.

Analytical approaches employed include qualitative thematic analysis to identify emerging trends and quantitative cross-validation of supplier performance metrics. Triangulation of data sources ensured that findings reflect both macroeconomic influences and microlevel operational considerations. Throughout the process transparent documentation protocols governed data handling and confidentiality agreements upheld participant anonymity. The outcome of this methodology is a comprehensive synthesis of strategic market intelligence that supports high-confidence decision making for filter technology stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surface Acoustic Wave Filters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surface Acoustic Wave Filters Market, by Type

- Surface Acoustic Wave Filters Market, by Frequency Range

- Surface Acoustic Wave Filters Market, by Material

- Surface Acoustic Wave Filters Market, by Application

- Surface Acoustic Wave Filters Market, by End-User

- Surface Acoustic Wave Filters Market, by Region

- Surface Acoustic Wave Filters Market, by Group

- Surface Acoustic Wave Filters Market, by Country

- United States Surface Acoustic Wave Filters Market

- China Surface Acoustic Wave Filters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Drawing conclusions on the strategic outlook for Surface Acoustic Wave Filters and synthesizing key takeaways for decision makers in the electronics industry

As the demand for high-performance signal filtering continues to accelerate across telecommunications sensing and automotive electronics the strategic importance of Surface Acoustic Wave Filters remains unquestionable. The convergence of advanced materials engineering and novel packaging technologies has set the stage for a new era of filter solutions capable of meeting the stringent demands of next-generation wireless communication and mission-critical sensing applications.

Looking ahead companies that successfully integrate material innovation supply chain diversification and collaborative development models will be best positioned to lead in this competitive landscape. Strategic emphasis on high frequency filtering technologies and miniaturized form factors aligned with global regional deployment priorities will drive differentiated value propositions. Ultimately the insights presented in this executive summary serve as a roadmap for stakeholders seeking to harness the full potential of Surface Acoustic Wave Filter technologies and to make informed strategic decisions in an evolving market environment.

Engaging with industry experts for further insights and securing the comprehensive market research report through collaboration with our sales leadership team

To explore the full depth of insights into Surface Acoustic Wave Filters and to secure a strategic advantage in your market planning engage directly with Ketan Rohom Associate Director Sales & Marketing to request the comprehensive report tailored to your business needs. His expertise will guide you through an overview of advanced filter technologies including detailed competitive benchmarks and regional analyses ensuring your team leverages the latest intelligence for product development and go to market execution. Connect now with Ketan Rohom to discuss how this granular research can inform your next steps and drive actionable results that align with your organization’s growth objectives.

- How big is the Surface Acoustic Wave Filters Market?

- What is the Surface Acoustic Wave Filters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?