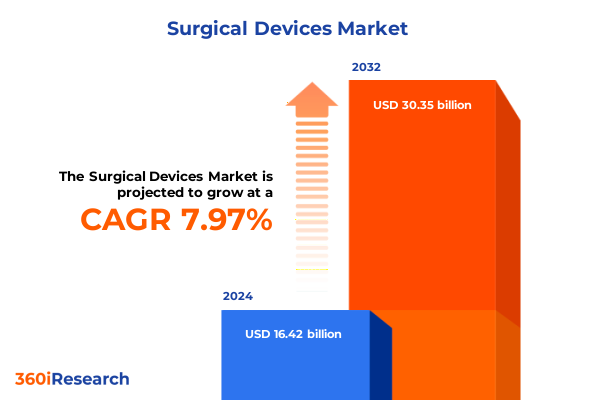

The Surgical Devices Market size was estimated at USD 17.71 billion in 2025 and expected to reach USD 19.05 billion in 2026, at a CAGR of 7.99% to reach USD 30.35 billion by 2032.

Pioneering Advances in Surgical Technology Set the Stage for Unprecedented Opportunities and Challenges in the Global Healthcare Landscape

The landscape of surgical devices has never been more dynamic, driven by continuous advancements in technology, evolving regulatory frameworks, and shifting patient expectations. From the emergence of next-generation robotics to the refinement of minimally invasive tools, medical professionals now have a suite of highly sophisticated instruments that enhance procedural precision and patient safety. In parallel, healthcare systems worldwide are under mounting pressure to contain costs while delivering superior outcomes, compelling device manufacturers to innovate rapidly and demonstrate clear value in every product iteration.

Against this backdrop, this executive summary distills the critical trends, market forces, and strategic imperatives shaping the surgical devices industry today. It offers a clear orientation for stakeholders seeking to navigate complexity, capitalize on growth opportunities, and mitigate emerging risks. By synthesizing insights across technological breakthroughs, trade policies, market segmentation, regional dynamics, and competitive intelligence, this introduction sets the stage for a comprehensive understanding of where the sector stands now and where it is headed.

Radical Technological Disruptions and Strategic Realignments Propel Surgical Device Industry into a New Era of Precision, Efficiency, and Collaboration

In recent years, an array of transformative shifts has propelled the surgical devices sector into uncharted territory. Breakthroughs in artificial intelligence now underpin advanced imaging systems, guiding surgeons with real-time analytics that anticipate tissue properties and critical anatomical variations. Robotics platforms have evolved beyond standardized toolsets, integrating haptic feedback and machine learning to adapt to surgeon preferences and patient-specific complexities. These converging innovations are driving a broader embrace of data-driven operating suites, where interoperability across devices and electronic health records forms the backbone of a connected procedural ecosystem.

Simultaneously, value-based care models have reshaped purchasing criteria, placing emphasis on lifecycle costs, patient throughput, and long-term clinical outcomes rather than capital expenditure alone. Providers are forging strategic partnerships with device developers to co-create solutions that align clinical protocols with performance benchmarks. At the same time, sustainability imperatives are steering manufacturers toward eco-conscious materials and energy-efficient production processes, acknowledging that environmental stewardship is now integral to corporate responsibility and market differentiation. Together, these trends are rewriting the playbook for how surgical devices are designed, deployed, and scaled.

Escalating Trade Measures and Tariff Escalations Reshape Cost Structures and Supply Strategies for Surgical Device Manufacturers in the United States

The implementation of new trade measures and tariff adjustments in the United States during 2025 has introduced a fresh layer of complexity for surgical device manufacturers. Building on previous Section 301 actions, additional levies on components, raw materials, and finished products have elevated procurement costs and extended lead times for imports that are crucial to assembly lines. This cost inflation has prompted many organizations to reevaluate sourcing strategies and explore nearshoring alternatives to maintain operational continuity and safeguard profit margins.

In response, manufacturers are intensifying their engagement with domestic suppliers and investing in localized assembly operations, aiming to offset tariff burdens and reduce logistical risk. At the same time, procurement teams are renegotiating contracts to include price-adjustment clauses that account for tariff volatility, while finance departments are modeling the cumulative impact of added duties on total landed costs. Although these adjustments entail significant transitional investment, they ultimately foster more resilient value chains. As trade policies continue to evolve, the ability to adapt sourcing frameworks and mitigate tariff exposure will remain a critical competitive imperative.

Multi-Faceted Examination of Product, Application, Technology, End User, Material, Portability, and Distribution Segments Uncovering Strategic Growth Pathways

A comprehensive examination of product segmentation reveals that endoscopes, energy-based devices, surgical implants, surgical instruments, and surgical robots each present distinct innovation trajectories and revenue potential. Within energy-based devices, electrosurgical units continue to see upgrades in precision energy delivery even as radio frequency applications expand into new tissue modalities, while ultrasound platforms leverage enhanced focal accuracy for both therapeutic and diagnostic procedures. Cardiovascular implants are benefiting from novel biomaterials, and dental, neurological, and orthopedic implant niches are likewise advancing through additive manufacturing techniques and bioresorbable polymers. Access devices, endoscopic instruments, and general-purpose tools further diversify offerings, creating a mosaic of device portfolios that address a wide array of clinical scenarios.

Application segmentation underscores the varied demands across cardiovascular, general, gynecology, neurological, orthopedic, and urology procedures, each governed by unique procedural workflows and reimbursement landscapes. Meanwhile, the technological lens highlights the rapid adoption of high-intensity focused ultrasound and laser surgery systems, complemented by the growth of minimally invasive methods including endoscopic, laparoscopic, and robot-assisted approaches. Open surgery remains a foundation in complex interventions but coexists with these less invasive options to accommodate surgeon preference and patient condition.

Exploring end user segmentation uncovers differentiated purchasing patterns among ambulatory surgical centers, clinics, hospitals, and specialty surgical centers, influenced by case mix, procedural volume, and CAPEX cycles. Materials such as composites, polymers, stainless steel, and titanium each deliver specific advantages in durability, biocompatibility, and weight, while portability considerations drive design iterations between mobile carts and immobile platforms. Finally, distribution channels-through direct sales forces, independent distributors, and online platforms-shape market access strategies, requiring manufacturers to tailor their go-to-market models to regional regulatory requirements and buyer behaviors.

This comprehensive research report categorizes the Surgical Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Material

- Portability

- Application

- End User

- Distribution

Regional Market Variations in the Americas Middle East Africa and Asia-Pacific Illuminate Unique Demand Patterns Supply Challenges and Growth Catalysts

The Americas region benefits from world-class clinical infrastructure, robust funding mechanisms, and streamlined regulatory processes that collectively drive demand for cutting-edge surgical devices. Strong collaboration between public and private payers accelerates market adoption, while an expansive network of ambulatory centers and specialty hospitals fosters niche device development. However, pricing pressures and competitive reimbursement frameworks compel manufacturers to demonstrate clear value propositions and invest in post-market surveillance to sustain uptake.

Europe, the Middle East, and Africa present a complex mosaic of regulatory environments, from the stringent conformity assessments in the European Union to evolving health system reforms across emerging markets. In Western Europe, device approval pathways continue to harmonize under the new medical device regulations, prompting companies to reevaluate technical documentation and clinical evaluation strategies. Meanwhile, nations in the Gulf Cooperation Council and Africa are enhancing procurement frameworks and domestic manufacturing incentives, creating pockets of rapid growth that attract targeted investments.

Asia-Pacific features some of the fastest-growing healthcare markets globally, driven by expanding patient populations, rising surgical volumes, and increasing public healthcare expenditure. Localized production hubs in East and South Asia now offer cost advantages, while digital health initiatives support tele-mentoring and remote procedure planning. At the same time, evolving reimbursement schemes in key markets such as China, India, and Southeast Asia encourage device standardization and open new corridors for multinational manufacturers.

This comprehensive research report examines key regions that drive the evolution of the Surgical Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Manufacturers Reveal Innovation Priorities Collaborative Alliances and Competitive Positioning in Surgical Device Sector

Leading firms in the surgical device arena are prioritizing cross-disciplinary innovation to capture emerging clinical trends. One global pioneer continues to expand its robotic surgery portfolio through strategic acquisitions and by integrating next-generation haptic feedback systems, ensuring that its platforms remain at the forefront of minimally invasive interventions. A major diversified healthcare company has deepened its commitment to energy-based therapies, channeling R&D investment into multifunctional generators that support electrosurgical, ultrasound, and radio frequency applications from a single console.

At the same time, a specialist in orthopedic and neurological implants is leveraging additive manufacturing to produce patient-specific devices, reducing lead times and enhancing post-operative outcomes. Another key player, renowned for its endoscopic solutions, is forging partnerships with software developers to introduce AI-driven image analysis, delivering augmented visualization and real-time guidance. Across the sector, nimble new entrants are focusing on digital services, bringing cloud-enabled procedure planning and outcome analytics that integrate with existing hospital infrastructure. This competitive mosaic underscores the importance of collaborative alliances and differentiated capabilities in securing market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surgical Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acumed LLC

- Arthrex, Inc.

- B. Braun Melsungen AG

- CONMED Corporation

- Corin Group plc

- DePuy Synthes, Inc.

- Enovis Corporation

- Exactech, Inc.

- Globus Medical, Inc.

- Integra LifeSciences Holdings Corporation

- Medtronic plc

- MicroPort Scientific Corporation

- NuVasive, Inc.

- Orthofix Medical Inc.

- Paragon 28, Inc.

- SeaSpine Holdings Corporation

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Össur hf.

Proactive Strategic Actions and Operational Tactics Industry Leaders Can Implement to Navigate Market Volatility and Capitalize on Emerging Opportunities

To thrive amid ongoing disruption, industry leaders should proactively diversify their supply chains by qualifying multiple tier-one suppliers and establishing regional manufacturing footprints. By doing so, they can mitigate geopolitical risks and ensure consistent delivery of critical components. Concurrently, investing in modular product architectures enables faster customization and reduces time-to-market for emerging trends such as AI-augmented visualization and sensor-enabled instruments.

Engaging early with regulatory bodies and payer organizations is essential to shaping favorable reimbursement pathways and accelerating market entry. Companies should assemble dedicated cross-functional teams that align clinical, regulatory, and commercial experts to anticipate policy changes and influence standards development. Additionally, fostering open innovation through partnerships with academic research centers and digital health start-ups can inject fresh perspectives into product roadmaps.

Finally, cultivating talent with hybrid skill sets-combining device engineering acumen with data analytics and software development-will empower organizations to lead in an era of convergent technologies. Comprehensive training programs and rotation schemes can accelerate capability building, while performance metrics tied to patient outcomes and system efficiency will reinforce a culture of value creation.

Robust Research Framework Detailing Multi-Source Data Collection Triangulation and Analytical Processes Ensuring Comprehensive Insight Integrity

The research underpinning this report began with an extensive review of publicly available regulatory filings, scientific publications, patent databases, and company disclosures. This secondary research established a foundational understanding of technological trends, policy environments, and competitive landscapes. To validate and enrich these insights, primary interviews were conducted with a diverse panel of experts including surgeons, supply chain directors, health system administrators, and senior R&D executives from leading device manufacturers.

Data triangulation ensured the consistency and reliability of findings, as quantitative input from industry associations and health economic analyses was cross-referenced with qualitative perspectives from thought leaders. A structured segmentation framework was applied to categorize devices by product, application, and technology, while regional dynamics were mapped against healthcare infrastructure indicators and trade policy developments. Rigorous quality checks and peer reviews by an independent advisory committee further strengthened the credibility of conclusions. This multi-source approach delivers both breadth and depth, offering a robust evidence base for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surgical Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surgical Devices Market, by Product

- Surgical Devices Market, by Technology

- Surgical Devices Market, by Material

- Surgical Devices Market, by Portability

- Surgical Devices Market, by Application

- Surgical Devices Market, by End User

- Surgical Devices Market, by Distribution

- Surgical Devices Market, by Region

- Surgical Devices Market, by Group

- Surgical Devices Market, by Country

- United States Surgical Devices Market

- China Surgical Devices Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesized Conclusions Highlighting Critical Insights Trends and Strategic Imperatives Shaping the Future of Surgical Device Innovation and Delivery

This executive summary has illuminated how cutting-edge technologies, evolving trade measures, and nuanced market segmentation collectively shape the future of surgical devices. Precise energy delivery systems and AI-enhanced robotics are redefining procedural standards, while tariffs are prompting a strategic reevaluation of global supply chains. Segmentation insights highlight the diverse needs spanning product categories, clinical applications, and end-user environments, underscoring the importance of tailored solutions.

Regional analyses reinforce that growth trajectories differ markedly across the Americas, Europe, Middle East, Africa, and Asia-Pacific, each presenting unique regulatory, reimbursement, and infrastructure considerations. Competitive profiles reveal that sustained investment in R&D, coupled with strategic alliances, is critical for leadership in the sector. Finally, actionable recommendations emphasize supply chain resilience, regulatory engagement, and talent development as core pillars for navigating uncertainty.

Together, these synthesized conclusions underscore a clear imperative: companies must adopt agile, innovation-driven strategies that align technological capabilities with evolving healthcare needs. Only through such integrated approaches can stakeholders unlock the full potential of surgical devices to deliver improved patient outcomes and drive sustainable growth.

Engaging Call to Connect with Associate Director of Sales Marketing to Secure Your Comprehensive Surgical Devices Market Research Report Purchase

Engaging directly with an experienced sales and marketing professional accelerates your access to the in-depth data, expert analysis, and strategic guidance encapsulated within this comprehensive market intelligence offering. By reaching out to Ketan Rohom, whose leadership in sales and marketing has empowered decision-makers to transform insights into action, you gain tailored support in selecting the right pricing tier and customization options for your organization’s needs. His consultative approach ensures that you receive not only the full report but also personalized briefings, executive summaries, and implementation roadmaps that translate market dynamics into competitive advantages.

Contacting Ketan Rohom opens the door to an efficient procurement process and positions your team to extract maximum value from this rigorous study. Whether you seek add-on modules, regional deep dives, or bespoke workshops, he stands ready to facilitate every step toward acquiring visionary intelligence that propels growth. Take the next step toward informed strategic planning by connecting with Ketan Rohom to secure your copy of the surgical devices market research report and elevate your organization’s ability to navigate tomorrow’s challenges today.

- How big is the Surgical Devices Market?

- What is the Surgical Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?