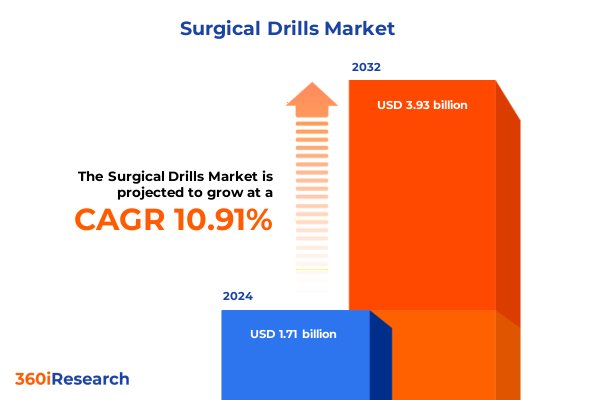

The Surgical Drills Market size was estimated at USD 1.90 billion in 2025 and expected to reach USD 2.10 billion in 2026, at a CAGR of 10.92% to reach USD 3.93 billion by 2032.

Setting the Stage for Precision and Progress in the Surgical Drill Market with a Comprehensive Overview of Core Dynamics Shaping Industry Evolution

The surgical drill market stands at the forefront of medical device innovation, propelled by the confluence of technological breakthroughs, evolving clinical demands, and heightened regulatory scrutiny. In the wake of growing procedure volumes across dental, ent, neuro, and orthopedic specialties, the performance and reliability of drill systems have become critical determinants of patient outcomes and operational efficiency. Precision engineering, coupled with advanced material science, is enabling the development of instruments that not only enhance cutting accuracy but also minimize thermal damage and vibration during procedures. As a result, healthcare providers are increasingly prioritizing equipment that integrates seamlessly with digital surgical platforms and supports a broad spectrum of minimally invasive techniques.

In parallel, stakeholders across the value chain-from component suppliers to device manufacturers-are navigating a complex landscape characterized by global supply chain disruptions and tariff fluctuations. These external pressures underscore the importance of strategic sourcing and robust quality assurance processes. Beyond cost considerations, manufacturers are accelerating investments in research and development to differentiate through ergonomic design, intuitive controls, and customizable settings. Transitioning from analog to smart devices, the market is witnessing the advent of connected drill systems capable of data capture and analytics, signaling a trend toward the convergence of surgical instruments and software ecosystems.

Against this backdrop, this executive summary synthesizes the critical dynamics shaping the surgical drill market. It offers an authoritative foundation for decision-makers seeking to understand transformative shifts, assess the implications of regulatory measures, and identify strategic opportunities. By mapping out segmentation nuances, regional variations, and leading industry strategies, this document provides actionable insights to inform investment, product development, and market entry decisions.

Unveiling Groundbreaking Technological and Operational Transformations Driving Unprecedented Change in the Surgical Drill Ecosystem Across Key Domains

The surgical drill sector is undergoing transformative shifts driven by both technological innovation and evolving clinical workflows. High-speed drills, long the backbone of bone-cutting procedures, have evolved into subtypes such as electric and pneumatic variants, each offering distinct advantages in torque control and thermal management. Simultaneously, low-speed counterparts powered by battery or mains electricity are redefining access in ambulatory settings, enabling less invasive interventions with heightened maneuverability. Meanwhile, piezoelectric drill technologies have surged to the forefront, leveraging ultrasonic vibrations to deliver unparalleled precision in delicate procedures, particularly within maxillofacial and neurosurgical applications.

Technological diversification has been complemented by the emergence of cordless designs, which liberate surgical teams from the constraints of traditional cabling while preserving power and performance. Corded systems remain prevalent for high-intensity use cases, yet the cordless alternative is gaining momentum in clinics and ambulatory surgical centers seeking streamlined instrument sterilization and rapid turnover. Furthermore, smart instrumentation-characterized by integrated sensors, haptic feedback, and wireless connectivity-is poised to redefine surgeon-device interactions, facilitating real-time monitoring of drill speed, torque, and thermal load.

Operationally, the integration of digital platforms into surgical suites is reshaping preoperative planning and intraoperative guidance. Navigation systems now often interface directly with drill heads, enabling image-guided interventions that boost accuracy and reduce collateral tissue damage. In tandem, cloud-based data analytics are being harnessed to track device utilization, maintenance schedules, and procedural outcomes, supporting predictive maintenance and quality improvement initiatives. As a result, manufacturers and healthcare organizations are collaborating on interoperability standards to ensure seamless data exchange and enhanced clinical decision support.

These dual forces of technological advancement and digital integration are fundamentally altering the competitive landscape, compelling stakeholders to pivot toward innovation-led strategies. By aligning product roadmaps with emerging clinical needs and regulatory expectations, industry players can maintain relevance and capitalize on growth opportunities inherent in this dynamic environment.

Assessing the Multifaceted Consequences of the 2025 United States Tariff Measures on Innovation, Supply Chain Resilience, Cost Structures in Surgical Drills

The introduction of new tariff measures by the United States government in early 2025 has exerted a pronounced influence on the surgical drill supply chain, cost structures, and innovation pipelines. Raw materials such as surgical-grade stainless steel alloys and high-performance polymers, often sourced from international suppliers, have experienced elevated import duties. Consequently, manufacturers have encountered increased landed costs, prompting a reassessment of procurement strategies and downstream pricing models. Many organizations have responded by diversifying their supply bases and accelerating nearshoring initiatives, thereby reducing exposure to tariff-related volatility and enhancing logistical resilience.

Beyond material inputs, tariffs have also affected the flow of critical components, including precision bearings and micro-motor assemblies. These elements, essential for maintaining the rotational stability and power density of drill systems, have traditionally been produced in concentrated manufacturing hubs overseas. The added financial burden has stimulated investments in domestic production capabilities and joint ventures aimed at localizing component fabrication. While such efforts demand upfront capital commitments, they are anticipated to yield long-term benefits in terms of lead time reduction and quality oversight.

Tariff-induced cost pressures have rippled through research and development budgets as well. With unit economics under strain, some manufacturers have opted to reallocate R&D spend toward modular platform designs and cross-application toolsets, thereby maximizing return on investment across multiple clinical segments. Simultaneously, collaborations between device makers and academic research centers have intensified, facilitating knowledge sharing and co-development pathways. Regulatory agencies, recognizing the critical importance of maintaining innovation momentum, have signaled a willingness to expedite review processes for technologies that address clear unmet medical needs.

Overall, the cumulative impact of the 2025 tariff adjustments has prompted a strategic recalibration across the surgical drill ecosystem. By fostering supply chain diversification, embracing domestic manufacturing partnerships, and prioritizing modular innovation, industry participants are positioning themselves to thrive amid shifting trade dynamics and cost structures.

Insights into Product, Technology, Application, End User, and Sales Channel Dynamics Guiding Strategic Positioning in the Surgical Drill Market Segmentation

In the surgical drill market, segmentation reveals nuanced pathways for product differentiation and targeted go-to-market strategies. Based on product type, the landscape encompasses high-speed drills, which subdivide into electric units offering precise speed control and pneumatic systems revered for robust torque delivery, and low-speed drills, which split into battery-powered designs optimized for portability and mains-powered configurations suited to high-demand surgical suites. Piezoelectric drills, operating on ultrasonic technology, carve a distinct niche by enabling micrometric bone cuts with minimal collateral impact.

When viewed through a technology lens, corded and cordless options present complementary value propositions. Corded systems deliver uninterrupted power for extended procedures, while cordless innovation prioritizes flexibility and rapid sterilization cycles. Application-based segmentation further refines market focus: dental professionals leverage high-speed electric drills for implantology and oral surgery; ear, nose, and throat specialists apply low-speed units for mastoidectomies and sinus procedures; neurosurgeons depend on piezoelectric precision to safeguard critical neural structures; orthopedic surgeons utilize a blend of high- and low-speed instruments for joint reconstruction and fracture management.

End users shape demand patterns through their distinct operational priorities. Ambulatory surgical centers emphasize cost efficiency and turnover speed, driving interest in cordless solutions with minimal setup. Clinic environments, whether dental or specialty, favor compact drill assemblies that balance performance with ease of maintenance. Hospitals, both private and public, maintain diverse equipment inventories to support high procedure volumes across multiple specialties, requiring versatile platforms that can be adapted through modular attachments and software upgrades.

Finally, sales channels bifurcate into offline and online pathways. Traditional distributor networks and direct sales teams play a dominant role in establishing clinical relationships and providing hands-on product demonstrations, whereas online platforms facilitate rapid procurement cycles for standard drill components and accessories, particularly in regions where digital marketplaces have gained regulatory approval for medical device transactions. This layered segmentation underscores the importance of aligning value propositions with the specific needs of each user group.

This comprehensive research report categorizes the Surgical Drills market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Sales Channel

Analyzing How Regional Variations across the Americas, Europe, Middle East & Africa, and Asia-Pacific Shape Demand and Strategic Priorities in Surgical Drills

Regional dynamics in the surgical drill market exhibit distinctive characteristics that influence both demand and competitive strategy. In the Americas, established healthcare infrastructure and widespread adoption of minimally invasive procedures drive consistent demand for advanced drill systems. Innovation hubs in North America fuel ongoing product enhancements, while distribution networks extend into Latin America, where emerging markets are increasingly investing in modern surgical capabilities. This region’s emphasis on reimbursement frameworks and regulatory harmonization underscores the need for compliance-ready devices that integrate smoothly into hospital workflows.

Across Europe, Middle East & Africa, market heterogeneity is pronounced. Western Europe’s mature healthcare systems prioritize precision and safety, fostering high receptivity to piezoelectric and smart drill solutions. In contrast, Central and Eastern Europe balance cost considerations with performance requirements, creating a two-tiered environment for both premium and value-focused products. Meanwhile, the Middle East & Africa region is witnessing rapid expansion of private hospital networks and ambulatory centers, catalyzing demand for versatile and reliable drill systems. Strategic partnerships and training programs have become vital as manufacturers navigate diverse regulatory landscapes and address variable clinical competencies.

Asia-Pacific represents a dynamic growth frontier characterized by divergent market maturity levels. In developed Asia-Pacific markets, such as Japan, Australia, and South Korea, a strong focus on digital integration and robotics is fostering early adoption of connected surgical drill platforms. Conversely, emerging economies in Southeast Asia and South Asia are prioritizing basic access to quality surgical equipment, creating opportunities for low-cost, high-performance drills designed for reliability and ease of maintenance. Localization strategies, joint ventures with domestic OEMs, and scalable service networks are key for market entrants seeking to capture share in this expansive region.

These regional insights highlight the importance of tailoring portfolio strategies to local preferences, reimbursement mechanisms, and regulatory requirements. By leveraging region-specific go-to-market models and forging collaborative alliances, manufacturers can optimize their presence across the Americas, EMEA, and Asia-Pacific landscapes.

This comprehensive research report examines key regions that drive the evolution of the Surgical Drills market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Collaborative Innovations, and Market Positioning Employed by Leading Manufacturers in the Surgical Drill Industry Landscape

Leading companies in the surgical drill market are differentiating through a blend of R&D, partnerships, and post-market support strategies. Several established device manufacturers have reinforced their portfolios by acquiring niche technology firms specializing in piezoelectric and digital-enabled instruments. Such consolidations have enabled seamless integration of ultrasonic modules and connectivity features into legacy product lines, creating comprehensive solutions for multi-specialty use cases.

Collaborations with academic and clinical research centers have become a hallmark of forward-leaning organizations, fostering co-development initiatives that accelerate the translation of novel materials and motor designs into commercial devices. In parallel, companies are forging alliances with navigation platform providers, embedding drill heads within image-guided surgery ecosystems to enhance procedural accuracy. These symbiotic relationships not only bolster product differentiation but also support subscription-based service models that generate recurring revenue through software licenses and maintenance contracts.

On the operational front, leading manufacturers are investing heavily in digital service platforms that facilitate remote diagnostics, performance monitoring, and predictive maintenance scheduling. By leveraging telematics and IoT-enabled drill systems, companies can offer outcome-based contracts and managed equipment services to high-volume clinics and hospitals. This shift toward outcome-centric business models underscores a broader industry trend toward aligning device performance incentives with clinical efficacy and patient satisfaction.

Additionally, aftermarket strategies, such as modular refurbishment programs and supply contracts for consumables, are reinforcing customer loyalty and driving lifetime value. Companies with expansive global distribution networks are capitalizing on their logistical prowess and regulatory expertise to expedite market entry and ensure localized support. These comprehensive competitive approaches exemplify how industry leaders are shaping the future trajectory of the surgical drill domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surgical Drills market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Brasseler USA

- CONMED Corporation

- De Soutter Medical Limited

- DePuy Synthes, Inc.

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- Medtronic plc

- NuVasive, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Delivering Targeted Strategic Initiatives and Operational Tactics to Empower Industry Leaders in Advancing Growth, Efficiency, and Competitive Advantage

To navigate the evolving surgical drill market, industry leaders should consider a series of strategic and operational actions designed to sustain growth and enhance competitive advantage. First, diversifying supply chains by cultivating partnerships with regional component manufacturers can mitigate the impact of future tariff alterations and logistical disruptions. Establishing dual-source agreements and investing in localized production facilities will shore up resilience and support just-in-time delivery models.

Second, prioritizing research and development investments in ultrasonic and smart drill technologies can differentiate offerings in high-value clinical segments. By integrating sensor-based feedback and data analytics capabilities, manufacturers can deliver solutions that meet emerging demands for precision and connectivity. Collaborative consortia with academic institutions and software developers can accelerate innovation cycles and shorten time to market while ensuring clinical validation and regulatory compliance.

Third, developing modular platform architectures can maximize return on R&D spend and simplify the introduction of new attachments and software upgrades. A standardized base unit that accommodates interchangeable drill heads, battery packs, and navigation interfaces will streamline manufacturing processes and facilitate scalable service offerings. Such flexibility aligns with hospitals’ growing preference for capital-efficient, adaptable equipment portfolios.

Fourth, expanding digital service portfolios through remote monitoring, predictive maintenance, and outcome-based contracting will deepen customer engagement and unlock recurring revenue streams. Leveraging IoT-enabled drill systems to capture usage data can inform continuous improvement initiatives and support value-based reimbursement discussions with payers and healthcare systems.

Finally, tailoring go-to-market strategies to regional and end-user preferences-whether by designing low-cost variants for emerging markets or premium, software-integrated platforms for advanced centers-will ensure market alignment and drive adoption. Investing in targeted training programs, local regulatory expertise, and patient-centric service models will reinforce brand trust and accelerate penetration across diverse market segments.

Outlining Rigorous Mixed-Method Research Approaches, Data Validation Procedures, and Analytical Frameworks Underpinning the Surgical Drill Market Study

This market study employed a rigorous mixed-method research design, integrating both primary and secondary data sources to ensure comprehensive and reliable insights. The secondary phase involved a systematic review of scientific publications, regulatory filings, and technical whitepapers to establish baseline understanding of surgical drill technologies, material innovations, and regulatory landscapes. In parallel, industry reports and company disclosures were analyzed to map competitive dynamics, product portfolios, and merger-acquisition activities.

During the primary research phase, in-depth interviews were conducted with a spectrum of stakeholders, including orthopedic and neurosurgeons, dental practitioners, biomedical engineers, procurement specialists, and supply chain executives. These interviews provided qualitative perspectives on clinical requirements, adoption drivers, and operational challenges. Additionally, structured surveys captured quantifiable data on device utilization rates, maintenance practices, and procurement criteria across ambulatory centers, clinics, and hospitals.

Data validation procedures included triangulation of interview findings with survey results and cross-referencing against publicly available regulatory approvals and patent filings. An expert panel review further refined the analytical framework, ensuring alignment with current industry standards and emerging best practices. Quantitative analysis employed statistical tools to identify significant correlations between device attributes, end-user preferences, and regional market variations. The resulting insights were synthesized through thematic clustering, enabling the articulation of strategic levers and segmentation dynamics.

Overall, this methodology ensures that the study’s conclusions are grounded in robust evidence and reflective of on-the-ground realities. It provides a transparent and replicable approach to understanding the multifaceted surgical drill market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surgical Drills market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surgical Drills Market, by Product Type

- Surgical Drills Market, by Technology

- Surgical Drills Market, by Application

- Surgical Drills Market, by End User

- Surgical Drills Market, by Sales Channel

- Surgical Drills Market, by Region

- Surgical Drills Market, by Group

- Surgical Drills Market, by Country

- United States Surgical Drills Market

- China Surgical Drills Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Implications to Illuminate the Future Trajectory and Value Creation Opportunities within the Surgical Drill Sector

Synthesizing the varied insights from market segmentation, regional dynamics, and competitive analyses reveals a coherent narrative of opportunity and challenge. The proliferation of advanced technologies-ranging from piezoelectric drilling to data-driven smart instruments-is poised to redefine procedural standards and elevate patient outcomes. However, external factors such as trade policies and supply chain complexities necessitate proactive strategic planning to preserve cost structures and maintain innovation pipelines.

Segmentation analysis underscores the importance of flexible product architectures capable of addressing the distinct needs of dental, ENT, neuro, and orthopedic clinicians. Regional considerations further reinforce the need for localized strategies that account for reimbursement frameworks, regulatory requirements, and clinical competencies. In parallel, leading companies are demonstrating that success lies in orchestrating R&D collaboration, robust aftermarket support, and digital service offerings that extend value beyond the point of sale.

As the market matures, actionable recommendations-from supply chain diversification to modular platform development-provide a roadmap for industry leaders to capture growth and solidify their competitive positioning. By aligning investments with evolving clinical demands and regulatory landscapes, stakeholders can unlock new avenues for differentiation and value creation.

Looking ahead, the surgical drill domain will continue to evolve at the intersection of engineering excellence and clinical application. Organizations that anticipate emerging trends, leverage data-driven insights, and cultivate partnerships across the ecosystem will be best positioned to shape the future of surgical instrumentation.

Engage Directly with Associate Director Ketan Rohom to Unlock Exclusive Market Intelligence and Propel Strategic Decision-Making in the Surgical Drill Domain

To obtain the comprehensive insights and strategic guidance outlined in this summary, reach out today to Associate Director Ketan Rohom at 360iResearch. Ketan Rohom brings extensive expertise in sales and marketing within the medical device sector and can guide you through the nuances of the surgical drill landscape, ensuring you secure the tailored data and actionable recommendations your organization needs. Engaging with him will connect you to an exclusive suite of market intelligence, sophisticated analytical frameworks, and expert consultations designed to accelerate your strategic initiatives and competitive positioning. Don’t miss the opportunity to leverage his deep industry knowledge, enrich your decision-making process, and drive tangible outcomes in your surgical drill endeavors. Contact Ketan Rohom to purchase the full market research report and unlock the next level of precision-driven growth and innovation.

- How big is the Surgical Drills Market?

- What is the Surgical Drills Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?