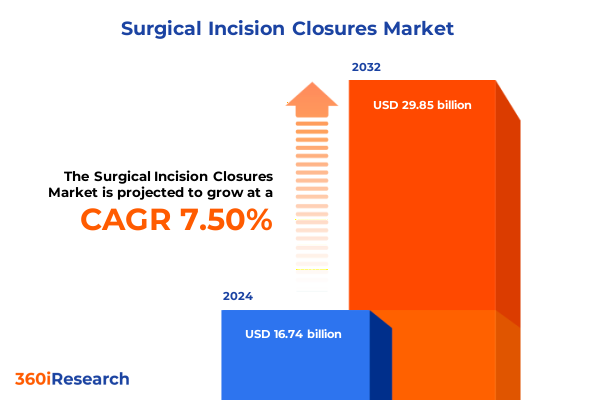

The Surgical Incision Closures Market size was estimated at USD 17.94 billion in 2025 and expected to reach USD 19.24 billion in 2026, at a CAGR of 7.54% to reach USD 29.85 billion by 2032.

Exploring the Vital Role of Advanced Surgical Incision Closure Solutions in Enhancing Patient Outcomes and Driving Procedural Efficiency

Advances in surgical incision closure techniques have reshaped the landscape of operative care, underscoring their critical role in postoperative outcomes and healthcare efficiency. As increasing procedural volumes and heightened regulatory scrutiny compel providers to seek reliable, safe, and cost-effective closure solutions, a diverse array of products-from traditional sutures and mechanical staples to novel tissue adhesives and hemostatic agents-has emerged to meet evolving clinical demands. This introduction contextualizes the significance of incision closure technologies against a backdrop of rising minimally invasive and outpatient procedures, where rapid hemostasis and optimized wound healing are paramount.

Over the past decade, the industry has witnessed a marked shift toward innovative materials and delivery platforms. Surgeons today leverage absorbable and nonabsorbable sutures tailored for specific tissue types alongside advanced staples and sealants that expedite closure while minimizing infection risks. This proliferation of options has been fueled by breakthroughs in biomaterials science, enabling the creation of cyanoacrylate adhesives with enhanced biocompatibility, polyethylene glycol sealants that support internal tissue approximation, and hemostatic dressings refined for minimally invasive access. Consequently, clinicians can customize closure strategies according to surgical complexity and patient comorbidities, thereby optimizing surgical throughput and patient satisfaction.

Looking ahead, the convergence of digital technologies with closure devices-such as sensor-embedded staples that monitor wound tension and data-driven platforms that guide suture placement-promises to elevate procedural precision. Regulatory agencies have responded by streamlining approval pathways for innovative closure modalities, underscoring the growing recognition of their impact on patient safety and cost containment. With this foundation, the briefing that follows delves into transformative shifts, tariff implications, segmentation nuances, regional variations, competitive dynamics, and strategic imperatives shaping the future of surgical incision closure.

Unveiling the Transformative Innovations and Evolving Technologies Revolutionizing Surgical Incision Closure Practices and Clinical Adoption Patterns

The surgical incision closure sector is undergoing a profound transformation driven by technological innovation and evolving clinical priorities. In recent years, the rise of minimally invasive and robotic procedures has increased demand for closure solutions that are not only effective but also compatible with narrow access ports and complex anatomical contexts. In response, manufacturers have introduced powered stapling systems with integrated articulation, enabling precise deployment in hard-to-reach sites, alongside next-generation suturing devices that automate knot tying and tension calibration.

Simultaneously, tissue adhesives have transcended their traditional adjunct role to become standalone closure options in select procedures. The refinement of cyanoacrylate formulations and development of fibrin-based sealants have expanded their applicability beyond superficial wound approximation to hemostatic support in cardiovascular and orthopedic surgeries. These materials now deliver rapid polymerization under moist conditions, reduce surgical time, and lower postoperative infection rates, positioning adhesives as transformative agents in closure protocols.

Beyond material science, digital integration is reshaping best practices. Smart closure platforms that provide real-time feedback on tissue apposition and perfusion metrics are being piloted in leading academic centers, offering surgeons actionable insights to tailor closure strategies. Concurrently, sustainability concerns have catalyzed the development of bioresorbable materials derived from renewable sources, reflecting an industry-wide push to minimize environmental footprint. Collectively, these innovations underscore a shift from one-size-fits-all devices toward holistic closure ecosystems that prioritize safety, efficiency, and cost effectiveness across diverse surgical scenarios.

Assessing the Cumulative Effects of 2025 United States Tariff Implementations on Material Costs and Supply Chain Dynamics for Incision Closure Devices

The implementation of United States tariffs on imported stainless steel and specialty polymers in early 2025 has exerted a cumulative impact on the surgical incision closure market, prompting stakeholders to recalibrate sourcing strategies and cost structures. As suppliers faced higher duties on raw materials integral to staples, needles, and delivery devices, original equipment manufacturers (OEMs) absorbed a portion of the increased expense while passing incremental costs downstream. This dynamic has exerted upward pressure on device prices, particularly for power-driven staplers and reinforced suture systems that rely on precision-machined components.

In response, market players have pursued geographic diversification of supply chains, intensifying partnerships with domestic mills and polymer producers to mitigate tariff exposure. Several leading device manufacturers have accelerated nearshoring initiatives, establishing secondary production lines in North America to secure tariff-exempt status and shorten lead times. These adjustments have improved resilience against policy volatility but have also necessitated investment in local tooling and quality validation, thus influencing capital allocation priorities.

Moreover, procurement teams have leveraged longer-term contracts with raw material vendors to hedge against ongoing duty escalations, while R&D functions explore alternative biopolymers and composite alloys that deliver comparable performance at lower cost bases. Although the immediate effect has been constrained margin contraction for closure device producers, the strategic pivot toward supply chain agility and material innovation is expected to yield lasting benefits in operational flexibility. As policies continue to evolve, industry stakeholders will need to balance short-term price adjustments with sustainable sourcing frameworks to safeguard both profitability and patient access to critical closure technologies.

Decoding Comprehensive Segmentation Insights Highlighting Diverse Product Types End Users and Clinical Applications Driving Incision Closure Strategies

A nuanced understanding of market segmentation reveals critical levers that drive adoption and innovation in surgical incision closures. When categorized by product type, closure solutions encompass four principal families: hemostats, staples, sutures, and tissue adhesives. Each of these categories breaks down further into specialized subtypes, such as absorbable gelatin sponges that rapidly arrest bleeding, manual and powered staples tailored for various incision sizes, and both absorbable and nonabsorbable sutures, which include poliglecaprone and nylon variants, respectively. Tissue adhesives, for their part, span cyanoacrylate to fibrin sealant formulations, each offering distinct handling and adhesion profiles.

Equally informative is the distribution across end-user environments. Ambulatory surgical centers have gravitated toward rapid-deployment products that shorten turnaround times, while clinics-both multi and single specialty-often prioritize cost-effective suturing materials that support high procedure throughput. Home care settings demand easy-to-use adhesive and hemostatic patches for patient self-management, and hospitals-whether private or public-balance institutional purchasing agreements with clinical efficacy requirements, driving the uptake of premium stapling systems for complex interventions.

Application segmentation further differentiates between external and internal closures, with external products dominating dermatological and outpatient wound care, and internal devices commanding a premium in cardiovascular, general surgery, and neurosurgery. By indication, closure demand is especially pronounced in general surgery and orthopedic procedures, whereas pediatric and gynecological closures benefit from the growing emphasis on minimally invasive access. Finally, the spectrum of wound types-ranging from clean to dirty-dictates product selection criteria, as contaminated and dirty wounds often necessitate advanced hemostatic agents and antimicrobial sealants. Together, these layered insights enable stakeholders to tailor product development and marketing strategies to the diverse clinical contexts shaping the incision closure market.

This comprehensive research report categorizes the Surgical Incision Closures market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Indication

- Wound Type

- End User

- Application

Illuminating Regional Dynamics and Growth Drivers Shaping Surgical Incision Closure Adoption Trends Across Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics exert a profound influence on the surgical incision closure landscape, with distinct growth drivers and adoption patterns emerging across the globe. In the Americas, technologies pioneered in the United States lead the market, underpinned by robust reimbursement frameworks and high procedural volumes. Canada’s universal healthcare model places a premium on cost containment and long-term outcomes, fueling interest in durable, low-complication closure modalities, while Latin American markets display an accelerating uptake of premium staples and adhesives as private sector hospitals expand capacity.

Within Europe, Middle East and Africa, regulatory harmonization under the European CE mark has facilitated cross-border distribution of advanced closure systems, but cost-containment measures in Western Europe temper pricing flexibility, driving interest in mid-tier solutions. Meanwhile, the Middle East’s investment in cutting-edge surgical centers fosters demand for robotic-compatible suturing devices, and Africa’s nascent private healthcare sector is progressively adopting hemostatic agents to address limited blood bank infrastructure.

Asia-Pacific markets are characterized by their heterogeneity, as mature markets such as Japan and Australia prioritize high-performance staplers and absorbable suture materials, whereas emerging economies in China and India exhibit surging volumes of general and orthopedic surgeries. Government-led initiatives to bolster rural surgical access have accelerated the deployment of single-use adhesive systems and portable hemostats, reflecting a strategic emphasis on decentralized care delivery. Collectively, these regional insights guide manufacturers in aligning product portfolios with local clinical practices, regulatory requirements, and reimbursement landscapes.

This comprehensive research report examines key regions that drive the evolution of the Surgical Incision Closures market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants and Competitive Strategies Defining Innovation Trajectories and Partnership Opportunities in Incision Closure Solutions

A competitive analysis of leading market participants reveals a landscape defined by continuous innovation, strategic partnerships, and targeted acquisitions. Iconic players such as Johnson & Johnson’s Ethicon division and Medtronic remain at the forefront with robust portfolios of sutures and powered stapling platforms, leveraging decades of surgical expertise to refine device ergonomics and material performance. These incumbents have augmented their offerings through the integration of digital monitoring features, enabling data-driven insights into wound integrity and healing trajectories.

Mid-tier companies are carving differentiated positions by focusing on niche segments such as advanced hemostats or pediatric-grade adhesives. Firms with specialized capabilities in biomaterials have introduced hybrid composite products that combine hemostatic and antimicrobial functions, catering to high-risk wound closures. Simultaneously, newer entrants backed by venture capital infusion are advancing novel polymer chemistries designed to reduce device footprint and improve resorption profiles.

Collaboration has emerged as a critical strategic lever, with alliances between device manufacturers and robotics companies accelerating the development of laparoscopic-compatible closure tools. Merger and acquisition activity remains robust, as larger players acquire regional specialists to strengthen their geographic reach and diversify their product suites. This dynamic interplay of established and emerging companies fosters an environment of rapid iteration, ensuring that healthcare providers can access cutting-edge solutions tailored to evolving surgical demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surgical Incision Closures market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arthrex Inc.

- B. Braun AG

- Baxter International Inc.

- Cardinal Health

- Coloplast A/S

- ConvaTec Group PLC

- Corza Medical

- CP Medical

- DermaClip US, LLC

- Dolphin Sutures

- Grena Ltd.

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- Medline Industries Inc.

- Medtronic plc

- Mölnlycke Healthcare

- Smith & Nephew plc

- Stryker Corporation

- Teleflex Incorporated

- Terumo Corporation

- Zimmer Biomet Holdings, Inc.

Strategic Imperatives and Actionable Recommendations Empowering Industry Leaders to Optimize R&D Collaboration and Market Penetration in Closure Technologies

Industry leaders must adopt a multifaceted approach to capitalize on emerging opportunities within the surgical incision closure sector. First, amplifying investment in R&D for next-generation biomaterials-such as multifunctional adhesives with built-in antimicrobial properties-will enhance procedural safety and patient satisfaction. By forging alliances with academic institutions and contract research organizations, companies can accelerate preclinical validation timelines and gain early access to breakthrough compositions.

Moreover, embedding closure devices within digital ecosystems offers a pathway to differentiated value propositions. Integrative platforms that capture real-time wound healing metrics can inform postoperative care protocols, reduce re-intervention rates, and support value-based reimbursement models. Industry leaders should therefore explore partnerships with software developers and medical imaging firms to co-create end-to-end solutions.

Supply chain resilience remains paramount in the wake of tariff-driven cost pressures. Establishing secondary manufacturing hubs in strategic regions not only mitigates duty exposure but also shortens lead times and bolsters responsiveness to fluctuating demand. Concurrently, procurement teams should negotiate multi-year agreements with multiple raw material suppliers to diversify risk and secure preferential pricing.

Finally, cultivating clinician education and training programs will drive adoption of advanced closure technologies. Interactive simulation workshops and virtual training modules can equip surgeons with the skills to leverage novel devices effectively, thereby reducing the learning curve and accelerating market uptake. By integrating these strategic imperatives, industry participants can position themselves to lead the next wave of innovation in incision closure.

Outlining Rigorous Research Methodologies Data Collection and Analytical Frameworks Underpinning the Comprehensive Surgical Incision Closure Market Study

The insights presented in this report are grounded in a rigorous research methodology designed to ensure depth and validity. Primary research involved structured discussions with over fifty key opinion leaders, including surgeons, materials scientists, and supply chain executives, providing firsthand perspectives on clinical requirements and procurement imperatives. Concurrently, in-depth interviews with device manufacturers and distributors shed light on recent product launches, strategic alliances, and tariff mitigation strategies.

Secondary research encompassed a comprehensive review of peer-reviewed journals, patent filings, regulatory agency databases, and public financial disclosures to map technology trends, competitive landscapes, and policy impacts. Data triangulation techniques were applied to reconcile divergent estimates, while market validation workshops enabled scenario-based stress testing of supply chain models under varying tariff regimes.

Segmentation modeling drew upon both qualitative insights and quantitative data points to define discrete categories-spanning product type, end user, application, indication, and wound type-and to elucidate growth drivers within each. Regional analyses incorporated epidemiological data, surgical volume statistics, and reimbursement frameworks to contextualize adoption patterns. Finally, the analytical framework included SWOT and PESTLE assessments to highlight strategic risks and opportunities, ensuring that recommendations are both actionable and aligned with emerging industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surgical Incision Closures market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surgical Incision Closures Market, by Product Type

- Surgical Incision Closures Market, by Indication

- Surgical Incision Closures Market, by Wound Type

- Surgical Incision Closures Market, by End User

- Surgical Incision Closures Market, by Application

- Surgical Incision Closures Market, by Region

- Surgical Incision Closures Market, by Group

- Surgical Incision Closures Market, by Country

- United States Surgical Incision Closures Market

- China Surgical Incision Closures Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Critical Insights and Future Outlook Emphasizing the Strategic Importance of Advanced Closure Technologies in Evolving Surgical Landscapes

The surgical incision closure market stands at a pivotal juncture, shaped by the convergence of material innovation, digital integration, and evolving policy landscapes. As tariffs reshape supply chains and drive cost optimization, manufacturers are responding with resilient sourcing strategies and alternative biopolymer development. Meanwhile, segmentation insights underscore the critical importance of tailoring solutions to diverse clinical settings, from high-volume ambulatory centers to specialized pediatric procedures and varied wound classifications.

Regional nuances further complicate the strategic equation, with the Americas leading in technological adoption, EMEA balancing regulatory rigor with cost containment, and Asia-Pacific offering both established and emergent growth opportunities. Competitive dynamics remain intense, characterized by innovation races in adhesives, stapling systems, and hemostatic composites, as well as strategic partnerships that bridge device and digital domains.

Time is of the essence for stakeholders seeking to maintain or enhance their market position. Companies that proactively invest in advanced R&D, embed closure devices within value-based care models, and reinforce supply chain agility will be best positioned to capture the next wave of growth. Ultimately, the ability to deliver safe, efficient, and cost-effective closure solutions in line with clinician and patient expectations will define success in this rapidly evolving landscape.

Connect with Ketan Rohom to Unlock Exclusive Market Intelligence and Strategic Insights on Surgical Incision Closure Innovations

For a comprehensive exploration of advanced surgical incision closure dynamics, including detailed segmentation analysis and actionable strategic guidance, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure a full copy of the market research report. By partnering directly with Ketan, you will gain exclusive access to in-depth profiles of leading players, nuanced regional growth projections, and targeted recommendations designed to optimize your product development roadmap. Engage with Ketan to arrange a personalized briefing, discuss tailored advisory services, and accelerate your competitive positioning in the rapidly evolving incision closure landscape.

- How big is the Surgical Incision Closures Market?

- What is the Surgical Incision Closures Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?