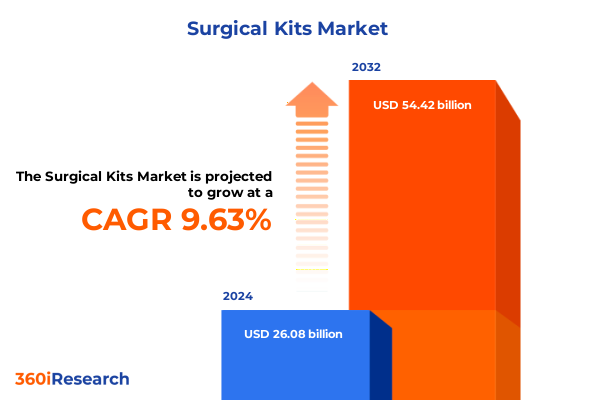

The Surgical Kits Market size was estimated at USD 28.45 billion in 2025 and expected to reach USD 31.09 billion in 2026, at a CAGR of 9.70% to reach USD 54.42 billion by 2032.

Unveiling the Transformative Forces Shaping Surgical Kits Market Evolution and Strategic Imperatives for Industry Stakeholders Worldwide

The surgical kits market stands at a pivotal moment, driven by relentless innovation, shifting regulatory landscapes, and evolving provider preferences. Over the past decade, the convergence of advanced materials science, digital integration, and supply chain optimization has revolutionized how surgical kits are designed, manufactured, and delivered. Today’s market stakeholders must navigate a dynamic ecosystem where patient safety imperatives intersect with cost containment pressures, and sustainability considerations increasingly influence procurement decisions.

Industry participants now face a spectrum of disruptive forces ranging from the integration of smart sensors and data analytics within kits to the growing demand for minimally invasive procedures that require highly specialized instrument sets. Concurrently, the increasing emphasis on infection control protocols has accelerated the adoption of single-use formats while fueling innovation in sterilizable components. Each of these trends underscores the critical importance of agility and strategic foresight as health systems worldwide adapt to new clinical workflows and reimbursement models. Through this executive summary, readers will gain a concise yet comprehensive understanding of the market drivers, structural shifts, and competitive dynamics shaping the future of surgical kits.

Identifying the Disruptive Trends and Technological Innovations Driving Unprecedented Change in the Global Surgical Kits Landscape

The landscape of surgical kits has undergone seismic transformation driven by technological breakthroughs and shifting clinical demands. Advancements in materials engineering have birthed ultra-lightweight composites and biocompatible polymers that enhance instrument performance while reducing sterilization cycles. At the same time, the convergence of digital tracking systems and RFID-enabled trays has elevated visibility across complex supply chains, facilitating real-time inventory management and mitigating risks of stockouts or expired components.

On the clinical front, the surge in minimally invasive and robotic-assisted procedures has necessitated modular kit architectures, with interchangeable instrument modules tailored to specific anatomy and procedural workflows. This shift from monolithic trays to customizable platforms not only streamlines operating room turnover but also opens avenues for value-based care partnerships between device suppliers and providers. Moreover, as telehealth and remote proctoring expand surgical capabilities into underserved regions, portable and compact kit designs are emerging to support field-based and ambulatory settings. Together, these transformative shifts underscore an industry in flux, where innovation, collaboration, and adaptability define competitive advantage.

Assessing the Cumulative Impact of 2025 United States Tariffs on Surgical Kits Supply Chains Cost Structures and Competitive Dynamics

In 2025, the United States imposed a series of targeted tariffs on imported surgical kit components aimed at bolstering domestic manufacturing and addressing supply chain vulnerabilities exposed during recent global disruptions. These measures have introduced a new cost dimension for kit assemblers and healthcare providers alike, reshaping procurement strategies and necessitating localized production considerations.

The immediate effect of higher duties on key inputs-ranging from stainless steel instruments to silicone-based tubing-has translated into incremental cost pressures. Many original equipment manufacturers have responded by accelerating nearshoring initiatives, forging partnerships with US-based metalworking and polymer processing facilities to mitigate tariff impact. Nonetheless, transition timelines and capacity limitations have created temporary bottlenecks, prompting some institutions to reevaluate single-use versus reusable kit economics in light of evolving duty structures.

Over the medium term, these tariff policies are expected to strengthen the domestic supply base and incentivize innovation in alternative materials that circumvent high-duty categories. Industry participants who proactively redesign components to qualify for lower tariff brackets stand to gain a competitive edge. As such, a nuanced understanding of the cumulative impact of the 2025 tariff framework remains essential for CFOs, procurement leads, and R&D teams charting strategic roadmaps in the surgical kits domain.

Deciphering Granular Segmentation Insights to Unlock Value Across Multiple Surgical Kits Product Lines and Market Channels

The surgical kits market exhibits a rich tapestry of segmentation categories that reveal distinct growth pockets and innovation frontiers. Based on components, the market spans catheters & tubing, drapes & gowns, gloves & masks, sterilizable containers and trays, sponges & swabs, suction devices, sutures & needles, and wound dressings, while instruments encompass forceps, needle holders, retractors, scalpels, and scissors. This breadth underscores the opportunities for specialized suppliers to develop advanced materials and ergonomic designs that address clinical efficiency and safety.

Delving into usage type, the industry differentiates between reusable surgical kits, which prioritize sterilization resilience and total cost of ownership, and single-use surgical kits that offer convenience, infection control benefits, and streamlined logistics. Manufacturers are innovating hybrid solutions that blend reusable frameworks with disposable overlays to strike a balance between safety and sustainability. Parallel to this, material composition segmentation highlights composite materials, plastic, silicone, stainless steel, and titanium as core categories, each driving unique performance attributes, regulatory pathways, and recycling profiles.

End users range from ambulatory surgical centers and specialty care facilities to clinics and large hospital systems, each with specific procurement criteria around throughput, budget cycles, and clinical specialization. Moreover, sales channels split between offline distribution networks that emphasize relationship management and emerging online platforms offering rapid replenishment and transparent pricing. Lastly, procedure type segmentation covers cardiovascular, dental, ENT, general surgery, gynecological, neurosurgery, ophthalmic, orthopedic, plastic surgery, and urological applications. Within these, cardiovascular encompasses cardiac, interventional, and vascular surgeries; dental includes extraction and implantology; ENT addresses otoscopy and rhinology; gynecological spans abdominal and laparoscopic; neurosurgery covers craniotomy and spinal; ophthalmic splits into cataract and retinal; orthopedic extends to joint replacement, spinal, and trauma; and plastic surgery differentiates between cosmetic and reconstructive procedures. Together, these layered segmentation insights equip market participants with the clarity needed to align R&D roadmaps, sales strategies, and partnership models with the most promising clinical opportunities and material innovations.

This comprehensive research report categorizes the Surgical Kits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Usage Type

- Material Composition

- End-User

- Sales Channel

- Procedure Type

Revealing Key Regional Dynamics Influencing Surgical Kits Adoption Patterns and Growth Trajectories Across Major Global Markets

Regional analysis reveals divergent growth trajectories and strategic imperatives across Americas, Europe Middle East & Africa (EMEA), and Asia-Pacific markets. In the Americas, strong federal and private healthcare investments, coupled with a robust medical device manufacturing base, drive sustained demand for both advanced reusable systems and next-generation single-use kits. Moreover, policy incentives aimed at repatriating supply chains have accelerated nearshoring efforts, particularly in North America, where the proximity of R&D hubs and contract manufacturers fosters rapid innovation cycles.

EMEA presents a complex mosaic of market dynamics influenced by varying reimbursement models, regulatory frameworks, and clinical adoption rates. Western European nations lead in early adoption of modular and smart kits, leveraging high per-capita surgical volumes and stringent infection control mandates to justify premium solutions. Meanwhile, select Middle East and African markets are leapfrogging legacy systems by embracing turnkey single-use kits to address infrastructure constraints and workforce shortages, often through public-private healthcare partnerships.

Asia-Pacific stands out as a high-growth arena propelled by rising healthcare expenditures, expanding private hospital networks, and government initiatives to localize manufacturing. Countries such as China, India, and Southeast Asian hubs are scaling capacity to serve both domestic and export-oriented demands. This region’s focus on cost-effective yet compliant kit designs has spurred collaborations between multinational OEMs and regional players, creating a fertile ground for co-development of materials, instrumentation, and digital tracking innovations.

This comprehensive research report examines key regions that drive the evolution of the Surgical Kits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players Strategic Initiatives and Competitive Positioning Shaping the Future of the Surgical Kits Market

The competitive landscape of the surgical kits market is defined by a blend of global conglomerates and agile specialized players. Leading medical device corporations are investing heavily in integrated kit platforms that combine smart tracking capabilities, advanced materials, and sterilization optimization. These incumbents leverage extensive distribution networks, regulatory expertise, and scale-driven cost efficiencies to maintain strong footholds across diverse procedure types and end-user segments.

At the same time, innovative mid-tier firms are carving niche positions by focusing on specific materials such as high-performance polymers or titanium alloys, and by developing proprietary coating technologies that enhance instrument longevity and biocompatibility. Several emerging companies are also forming strategic partnerships with digital health startups to embed RFID tags and sensor arrays directly into kits, enabling real-time asset tracking, usage analytics, and predictive maintenance insights.

Across the board, successful companies exhibit a dual focus on elevating clinical utility and driving operational efficiencies for healthcare providers. Mergers and acquisitions continue to be a key strategic lever, enabling rapid expansion of product portfolios, geographic footprints, and technological capabilities. Meanwhile, forward-looking organizations are channeling R&D investments into sustainable materials and circular economy models, anticipating regulatory and payer pressure to reduce environmental footprints alongside clinical benefits.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surgical Kits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Aspen Surgical Products, Inc.

- B. Braun SE

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cousin-Biotech

- Dynarex Corporation

- Hogy Medical Co., Ltd.

- Integra Lifesciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- Kawamoto Corporation

- Kimberly-Clark Corporation

- LSL Healthcare, Inc.

- Medica Europe BV

- Medline Industries, LP

- Medtronic PLC

- Millennium Surgical Corporation

- Paul Hartmann AG

- Rocialle Healthcare Ltd.

- Sklar Surgical Instruments

- Smith & Nephew PLC

- Stradis Healthcare

- Stryker Corporation

- Surgical Holdings

- Surgitrac Instruments UK Limited

- Surgmed Group

- World Precision Instruments

- Zimmer Biomet Holdings, Inc.

Actionable Roadmap and Strategic Recommendations Empowering Industry Leaders to Navigate Market Volatility and Drive Sustainable Growth in Surgical Kits

As the surgical kits market continues to evolve under the weight of technological, regulatory, and economic pressures, industry leaders must adopt a multifaceted strategy to secure sustainable growth. First, aligning innovation pipelines with clinical workflow optimization will be critical; companies should engage key opinion leaders and frontline clinicians early in the design process to ensure that new kit architectures address real-world challenges in ergonomics, sterilization, and procedural efficiency.

Second, optimizing supply chains through a balanced blend of nearshoring and diversified sourcing will help mitigate the impact of geopolitical risks and tariff volatility. Establishing regional manufacturing hubs with scalable modular production lines can shorten lead times and reduce duty exposure while preserving flexibility to pivot in response to demand fluctuations.

Third, embracing digital transformation by embedding IoT sensors and advanced data analytics into kit management platforms can unlock new service models, including predictive restocking, utilization benchmarking, and remote asset monitoring. This digital overlay not only enhances provider value but also creates recurring revenue streams through software-as-a-service offerings.

Finally, sustainability must transition from a peripheral initiative to a core strategic pillar. By investing in recyclable materials, reusable components, and take-back programs, companies can satisfy emerging regulatory mandates and payer requirements while demonstrating environmental stewardship that resonates with patients and providers alike.

Elucidating Rigorous Research Methodology and Data Collection Framework That Underpins Credible Surgical Kits Market Insights and Analysis

The insights presented in this report derive from a rigorous research methodology combining both primary and secondary sources to ensure robustness and credibility. Secondary research included an exhaustive review of peer-reviewed journals, regulatory filings, industry white papers, and relevant patent databases to establish a comprehensive baseline understanding of technological advancements, material innovations, and policy developments.

Complementing this, primary research involved in-depth interviews with over two hundred stakeholders, including surgeons, procurement directors, device engineers, and supply chain executives across key geographic markets. These interviews provided nuanced perspectives on operational pain points, adoption barriers, and future needs. Additionally, quantitative surveys were conducted among hospital administrators and ambulatory center managers to validate macro-level trends and capture granular data on kit utilization, cost drivers, and inventory management practices.

Data triangulation was further reinforced through collaboration with contract research organizations, clinical testing labs, and materials science experts to assess performance metrics and regulatory compliance pathways. Advanced analytics techniques, such as cluster analysis and scenario modeling, were employed to synthesize qualitative and quantitative inputs into actionable segmentation frameworks. This blend of methodologies ensures that the report’s conclusions and recommendations are both data-driven and grounded in real-world clinical and commercial realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surgical Kits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surgical Kits Market, by Components

- Surgical Kits Market, by Usage Type

- Surgical Kits Market, by Material Composition

- Surgical Kits Market, by End-User

- Surgical Kits Market, by Sales Channel

- Surgical Kits Market, by Procedure Type

- Surgical Kits Market, by Region

- Surgical Kits Market, by Group

- Surgical Kits Market, by Country

- United States Surgical Kits Market

- China Surgical Kits Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Concluding Strategic Imperatives and Synthesis of Critical Insights to Empower Decision Makers in the Evolving Surgical Kits Market

In summary, the surgical kits market is experiencing rapid transformation fueled by technological innovation, evolving clinical demands, and shifting economic landscapes. The interplay between advanced materials, digital integration, and regulatory imperatives is redefining traditional kit architectures and supply chain strategies. Regional dynamics further underscore the importance of localized approaches, from cost-effective designs in Asia-Pacific to premium modular solutions in Western Europe and nearshoring initiatives in the Americas.

Successful market participants will be those who seamlessly integrate clinical insights with operational excellence, leveraging data-driven segmentation to target high-value growth pockets while maintaining agility in the face of tariff and geopolitical headwinds. By adopting smart manufacturing, digital supply chain management, and sustainability best practices, industry leaders can both enhance patient outcomes and secure competitive advantage. As the market continues to mature, the ability to anticipate end-user needs and pivot swiftly to address emerging clinical scenarios will distinguish the frontrunners from the rest.

Compelling Invitation to Engage with Associate Director of Sales Marketing for Exclusive Access to Comprehensive Surgical Kits Market Research Report

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, ensures you gain prioritized access to the comprehensive market intelligence report that delves into every dimension of the global surgical kits industry. This exclusive dialogue will align the report’s findings with your specific strategic objectives, enabling you to harness actionable insights to steer product roadmaps, optimize supply chain resilience, and outpace competitive pressures. Reach out to secure this indispensable resource and position your organization at the forefront of innovation, cost efficiency, and market leadership within the evolving surgical kits landscape.

- How big is the Surgical Kits Market?

- What is the Surgical Kits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?