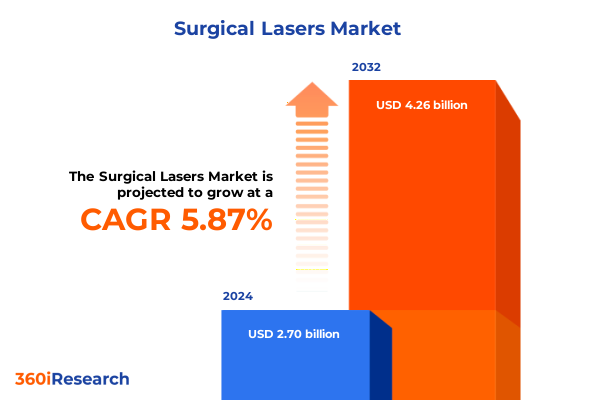

The Surgical Lasers Market size was estimated at USD 2.80 billion in 2025 and expected to reach USD 2.90 billion in 2026, at a CAGR of 6.19% to reach USD 4.26 billion by 2032.

Laying the Foundation of Surgical Laser Technologies with Essential Market Trends Fueling Medical Innovation and Expanding Clinical Applications Globally

The evolution of surgical laser technologies has transformed modern medicine by introducing finely tuned, minimally invasive techniques that improve patient outcomes and reduce recovery times. As healthcare systems worldwide confront increasing cost pressures and demand for efficiency, laser-based treatments offer unparalleled precision across a wide range of clinical applications. An overview of this landscape reveals a convergence of technological innovation, regulatory adaptation, and shifting clinical needs that together are reshaping how practitioners and healthcare institutions approach surgical intervention.

In this context, an in-depth analysis of emerging dynamics is critical for stakeholders seeking to navigate market complexities. This executive summary outlines key factors influencing the adoption and advancement of surgical lasers, including technological breakthroughs in diode and YAG systems, shifts in reimbursement and regulatory frameworks, and the growing role of end users such as ambulatory surgical centers. By examining underlying trends and strategic imperatives, readers will gain a clear understanding of how developments in device capabilities and clinical practices are driving the next generation of surgical laser applications.

Through a structured examination of market drivers, segmentation nuances, regional landscapes, and competitive initiatives, this report equips decision-makers with actionable insights. It is designed to facilitate strategic planning, identify growth opportunities, and anticipate challenges in a rapidly evolving environment. Whether you are a product developer, healthcare provider, or investor, this foundational perspective will enable you to align resources and efforts with the critical success factors shaping the future of surgical laser technologies.

Exploring How Cutting Edge Technological Breakthroughs Strategic Collaborations and Regulatory Evolutions Are Revolutionizing the Surgical Laser Landscape

Advances in core technologies are driving a paradigm shift in the surgical laser arena. Recent breakthroughs in diode laser miniaturization have enabled the development of handheld devices that offer practitioners enhanced maneuverability and precise energy delivery. Similarly, emerging platforms that integrate real-time imaging and robotic guidance are redefining the scope of laser-assisted procedures, enabling clinicians to perform complex interventions with greater accuracy and safety.

Analyzing the Far Reaching Consequences of Recent United States Tariff Measures on Surgical Laser Supply Chains Manufacturing and Market Dynamics

The imposition of new tariffs on imported laser components and raw materials in 2025 has created multifaceted challenges for manufacturers and end users alike. Increased duties on semiconductor substrates and precision optics have led to manufacturing cost pressures that many suppliers are mitigating through strategic sourcing initiatives. Companies are forging partnerships with domestic component producers to secure more stable input supplies while investing in process efficiencies to offset rising import-related expenses.

Revealing In Depth Segmentation Insights That Illuminate Trends Across Laser Types Technology Modalities Product Systems End Users and Clinical Applications

A detailed segmentation analysis reveals distinct patterns of adoption and growth within the surgical laser market. Among the spectrum of laser types, carbon dioxide systems remain integral for soft tissue ablation, whereas diode and Nd:YAG platforms are experiencing accelerated uptake in dermatologic and ophthalmologic settings due to their targeted energy profiles. Erbium YAG and holmium YAG variants continue to gain traction in urology and gynecology for their favorable tissue interaction characteristics, while emerging KTP and excimer devices are carving out specialized niches in periodontal and retinal applications.

Product form factors also shape usage scenarios. Handheld laser systems, valued for their flexibility in outpatient environments, are increasingly preferred by ambulatory surgical centers seeking cost-effective solutions. Conversely, stationary installations remain the backbone of hospital operating rooms, offering higher power and thermal management for extensive procedures. Technology type delineation further clarifies market dynamics: continuous wave modalities dominate established protocols, whereas pulsed systems draw interest for their ability to minimize collateral tissue damage in delicate surgeries.

End users exhibit varying requirements that inform technology selection. Ambulatory surgical centers prioritize compact, versatile systems for dentistry and dermatology, whereas large hospital networks demand integrated platforms with multiwavelength capabilities. Research centers drive innovation by collaborating with manufacturers to test novel beam delivery methods across dentistry, dermatology, ophthalmology, gynecology, and urology. Within dentistry, laser applications span endodontic cleaning, oral surgery incision control, and periodontal tissue regeneration. Dermatology practitioners leverage aesthetic laser configurations for cosmetic rejuvenation alongside surgical dermatology tools for lesion removal. Ophthalmologists adopt refractive lasers for vision correction and retinal photocoagulation devices to manage retinal disorders.

This comprehensive research report categorizes the Surgical Lasers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Laser Type

- Product Type

- Technology Type

- End User

- Application

Examining Regional Variations in Adoption Innovation and Growth Drivers of Surgical Laser Technologies Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the surgical laser sector reflect a tapestry of regulatory environments, healthcare infrastructure maturity, and reimbursement frameworks. In the Americas, well-established approvals and clear reimbursement pathways have fostered rapid clinical adoption, particularly in North America where both hospitals and ambulatory surgical centers integrate advanced laser modalities to address a range of applications from cosmetic dermatology to urology. Latin American markets are following suit, albeit at a more gradual pace, as reimbursement clarity evolves and local training programs expand.

In Europe, Middle East and Africa, harmonization with CE marking standards has streamlined device introductions within the European Union, supporting innovation diffusion across major markets such as Germany, France and the United Kingdom. Regulatory pathways in the Middle East leverage international reference approvals, while North Africa and sub-Saharan regions are increasingly exploring local manufacturing partnerships to reduce costs and promote wider access to laser-based therapies.

Asia-Pacific markets exhibit a dual trajectory of rapid urban adoption in mature economies like Japan and South Korea and accelerated growth in emerging economies such as China and India. Government initiatives to bolster domestic medical device industries have led to increased manufacturing capabilities, supporting both export activities and lower-cost solutions for local hospitals and clinics. In tandem, rising patient awareness and expanding private healthcare networks are driving demand for minimally invasive laser treatments across dermatology, gynecology and ophthalmology applications.

This comprehensive research report examines key regions that drive the evolution of the Surgical Lasers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Strategic Initiatives and Competitive Dynamics Shaping the Surgical Laser Technology Market Landscape

The competitive landscape of surgical laser technologies is shaped by established medical device conglomerates and specialized laser producers alike. Leading firms are intensifying investments in next generation platforms, leveraging acquisitions to broaden their product portfolios. Strategic partnerships with academic institutions and research organizations are fostering co-development of innovative beam delivery and imaging systems, enhancing procedural precision.

Product differentiation strategies center on multiwavelength compatibility and user-friendly interfaces, as companies strive to address the diverse needs of dermatologists, ophthalmologists and other clinical specialists. Some industry participants are extending their service offerings to include comprehensive training programs, equipment leasing models and digital support platforms, thereby creating stronger customer relationships and recurring revenue streams. Collaborative initiatives with healthcare providers to conduct clinical trials are helping to validate new applications and support accelerated market entry across global regions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surgical Lasers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.R.C. Laser GmbH

- Alcon

- Allengers Medical Systems Ltd.

- Alma Lasers Ltd.

- Alna-Medicalsystem AG & Co. KG

- AMD Lasers

- Asclepion Laser Technologies GmbH

- Bausch & Lomb Corpoartion

- Biolase, Inc.

- Biolitec AG

- Bison Medical Co., Ltd.

- Boston Scientific Corporation

- Candela Corporation

- Carl Zeiss AG

- Coherent Corp.

- Cutera, Inc.

- Cynosure LLC

- El.En. S.p.A.

- Fotona d.o.o.

- IPG Photonics Corporation

- Johnson & Johnson Service, Inc.

- KLS Martin Group

- Koninklijke Philips N.V.

- Lumenis Be Ltd.

- Lutronic Corporation

- Quanta System S.p.A.

Implementing Actionable Strategies for Industry Leaders to Navigate Disruption Capitalize on Emerging Opportunities and Strengthen Market Positioning

To fortify market positions and capture emerging opportunities, industry leaders should prioritize agile product development processes that integrate real world clinical feedback. Allocating resources to cross functional teams encompassing engineering, regulatory and clinical affairs will enable faster iteration cycles and smoother regulatory submissions. Furthermore, diversifying supply chains through dual sourcing strategies and regional partnerships can mitigate risks associated with geopolitical disruptions and tariff fluctuations.

Leaders must also pursue data driven engagement models, leveraging procedural outcome analytics to demonstrate clinical and cost effectiveness to payers and healthcare administrators. Investing in digital platforms that facilitate remote monitoring, training and maintenance enhances customer satisfaction and builds long term brand loyalty. Finally, establishing targeted regional strategies that align product configurations with local regulatory and reimbursement landscapes will ensure efficient market penetration and sustained growth in both mature and emerging markets.

Detailing Robust Research Methodology Combining Primary Expert Interviews Secondary Data Analysis and Rigorous Validation Techniques

The research underpinning this analysis combines primary and secondary methodologies to ensure robust and reliable insights. In depth interviews were conducted with a diverse panel of clinicians, biomedical engineers and regulatory experts to capture firsthand perspectives on technology adoption barriers, emerging clinical needs and future innovation pathways. These qualitative inputs were complemented by a thorough review of peer reviewed journal articles, patent filings and regulatory documents to validate trends and benchmark global best practices.

Data triangulation techniques were applied throughout the study, incorporating multiple sources to cross verify critical findings. A systematic framework guided the synthesis of input from professional societies, conference proceedings and industry databases. Rigorous validation sessions with subject matter experts served to refine interpretations and identify potential blind spots. The methodology emphasizes transparency, traceability and reproducibility, ensuring that conclusions and recommendations are grounded in a comprehensive evidence base.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surgical Lasers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surgical Lasers Market, by Laser Type

- Surgical Lasers Market, by Product Type

- Surgical Lasers Market, by Technology Type

- Surgical Lasers Market, by End User

- Surgical Lasers Market, by Application

- Surgical Lasers Market, by Region

- Surgical Lasers Market, by Group

- Surgical Lasers Market, by Country

- United States Surgical Lasers Market

- China Surgical Lasers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights Emphasizing the Strategic Imperatives Industry Disruption and Future Trajectories of Surgical Laser Technology Innovation

The analysis of surgical laser technologies highlights a landscape characterized by rapid innovation and evolving clinical practices. Technological advancements in beam delivery, system miniaturization and digital integration are expanding the therapeutic potential of laser systems across dermatology, ophthalmology, gynecology and beyond. Concurrently, shifting regulatory frameworks and market structures are creating both challenges and opportunities, underscoring the importance of strategic agility.

Key imperatives for stakeholders include strengthening supply chain resilience, tailoring products to end user needs and engaging collaboratively with regulatory bodies to streamline approvals. As new applications emerge and treatment paradigms shift toward minimally invasive approaches, the competitive playing field will reward organizations that can align innovation with real world clinical impact. The future trajectory of surgical lasers will be defined by the ability to deliver precision, safety and cost effectiveness in equal measure.

Encouraging Decision Makers to Engage Directly with the Associate Director of Sales Marketing to Secure Comprehensive Insights and Drive Strategic Growth

To gain a comprehensive understanding of current and future dynamics in the surgical laser landscape and to discover actionable insights tailored to your organization’s strategic objectives, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in facilitating access to in-depth research and customized analyses will ensure your team has the data and recommendations needed to make informed decisions. Reach out today to secure your organization’s competitive advantage and unlock the full potential of surgical laser technologies.

- How big is the Surgical Lasers Market?

- What is the Surgical Lasers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?