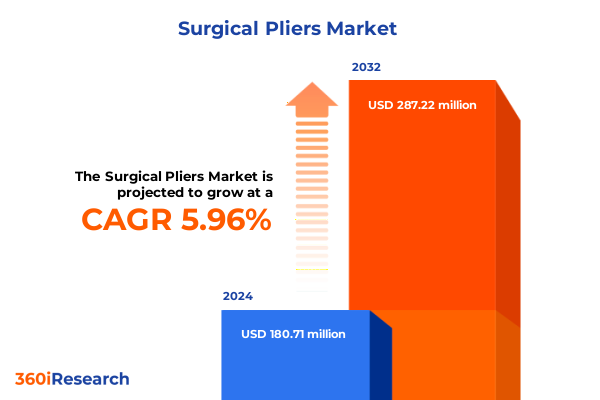

The Surgical Pliers Market size was estimated at USD 191.62 million in 2025 and expected to reach USD 203.84 million in 2026, at a CAGR of 5.95% to reach USD 287.22 million by 2032.

Transforming Surgical Outcomes through Precision Instruments and the Vital Role of High-Quality Surgical Pliers in Modern Healthcare

The landscape of surgical procedures has undergone a profound evolution in recent years, underscoring the indispensable role of instruments that marry precision with reliability. Within this context, surgical pliers have emerged as foundational components that directly influence procedural efficiency and patient outcomes. As minimally invasive techniques continue to gain traction, the demand for specialized pliers that accommodate nuanced manipulations of bone, tissue, and sutures has intensified. These tools must not only withstand rigorous sterilization protocols but also deliver consistent performance across diverse clinical settings.

Against this backdrop, an executive summary detailing the dynamics of the surgical pliers market is essential for stakeholders seeking actionable intelligence. By examining technological advancements, regulatory influences, and shifting end-user requirements, this analysis provides a holistic understanding of how high-caliber pliers are reshaping operative workflows. Furthermore, insights into varied product configurations and applications elucidate how different segments converge to drive industry momentum and innovation.

Navigating Technological Evolution as Advanced Materials and Robotic Compatibility Redefine Surgical Pliers for Modern Operating Rooms

The surgical pliers market is witnessing transformative shifts propelled by the integration of advanced materials and digital manufacturing techniques. Following the proliferation of additive manufacturing, bespoke plier designs tailored for patient-specific anatomies are becoming a clinical reality. This progression aligns with the broader trend toward personalized medicine, wherein custom instruments optimize engagement with unique surgical contexts. Concurrently, advancements in coating technologies and surface treatments are enhancing corrosion resistance and tactile feedback, thereby elevating practitioner confidence and procedural accuracy.

Moreover, the robotics revolution in surgery has introduced new performance benchmarks for hand-held tools. As robotic-assisted platforms deliver unparalleled dexterity, surgical pliers must be engineered with compatibility in mind. Consequently, manufacturers are reimagining instrument geometries to ensure seamless integration with robotic end effectors. These strategic adaptations underscore a broader industry pivot: from standardized toolkits toward adaptive systems capable of interfacing with both manual and robotic workflows.

Assessing the Ramifications of Revised United States Medical Device Tariffs on Supply Chains and Market Dynamics in 2025

In 2025, the United States government enacted revised tariffs on imported medical devices, aiming to bolster domestic manufacturing and secure supply chains for critical healthcare instruments. These levy adjustments have introduced significant cost fluctuations for companies reliant on offshore production of high-grade stainless steel and titanium pliers. While domestic producers stand to benefit from enhanced price competitiveness, import-dependent organizations are grappling with escalated procurement expenses, prompting a reassessment of supplier networks and production strategies.

In response, leading manufacturers have accelerated plans to repatriate portions of their supply chains and expand in-country tooling capabilities. This strategic shift mitigates exposure to tariff-induced margin pressures and aligns with broader regulatory emphasis on reshoring critical medical device components. However, the transition remains complex, requiring sustained investment in facility upgrades, workforce development, and quality assurance to replicate the precision benchmarks historically achieved abroad.

Unveiling Deep Segmentation Insights Across Product Types Applications Materials End Users and Sales Channels Shaping Surgical Pliers Market

A nuanced understanding of the surgical pliers market emerges when evaluating its segmentation across product type, application, end user, material, and sales channel. Based on product type, offerings span bone holding, needle holder, tissue, and wire bending, with bone holding instruments further differentiated to serve both minimally invasive and open surgery protocols. Shifting to application, cardiovascular, dental, neurological, and orthopedic procedures present divergent requirements, as fracture repair demands robust pliers engineered for high-torque leverage while joint replacement benefits from slender, precision-oriented designs tailored for arthroplasty.

Examining end user profiles reveals the market’s breadth, encompassing ambulatory surgical centers, hospitals, and specialty clinics, with hospitals subdivided into private and public institutions. Material selection also plays a critical role, as stainless steel instruments maintain cost-effectiveness and corrosion resistance, while titanium alloy variants offer lightweight durability and biocompatibility advantages. Finally, sales channel dynamics underscore the importance of direct sales relationships, distributorships-encompassing both specialized medical distributors and pharmaceutical wholesalers-and evolving e-commerce platforms, which are increasingly facilitating rapid order fulfillment and aftermarket support.

This comprehensive research report categorizes the Surgical Pliers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Material

- Sales Channel

Mapping Regional Drivers and Dynamics Impacting Surgical Pliers Adoption across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics are pivotal in shaping the surgical pliers market, as each geography reflects distinct regulatory, technological, and infrastructural characteristics. In the Americas, robust healthcare spending and well-established reimbursement frameworks drive adoption of cutting-edge instrument variants, while reshoring initiatives in the United States are fostering enhanced local production capabilities. Transitioning to Europe, Middle East & Africa, stringent regulatory harmonization across the European Union and accelerated telehealth infrastructure development in Middle Eastern markets have collectively fueled demand for instruments compatible with advanced surgical suites.

Meanwhile, in the Asia-Pacific region, burgeoning healthcare investments and rapid expansion of hospital networks in China and India are catalyzing growth, with government-led programs emphasizing rural healthcare access further amplifying the need for cost-effective, durable pliers. Moreover, the Asia-Pacific market benefits from a mature manufacturing ecosystem, positioning regional producers to scale exports and compete on both price and quality in global markets.

This comprehensive research report examines key regions that drive the evolution of the Surgical Pliers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Competitive Strategies and Collaborations Driving Innovation and Differentiation in the Surgical Instrument Market

Key industry participants are navigating a complex competitive landscape marked by continuous innovation and strategic collaborations. Established global surgical instrument manufacturers are leveraging comprehensive product portfolios and in-house R&D centers to launch next-generation pliers featuring ergonomic handles, optimized jaw geometries, and proprietary surface finishes. These incumbents are also engaging in partnerships with academic medical centers to validate performance enhancements through clinical studies.

Simultaneously, emerging specialized players are carving niche positions by focusing exclusively on titanium alloy instruments or digital prototyping services that accelerate instrument customization. Additionally, several mid-sized businesses are forging alliances with logistics providers and software developers to offer bundled solutions that integrate instrument tracking, maintenance scheduling, and compliance documentation. This collaborative approach not only differentiates their offerings but also reinforces long-term customer relationships through enhanced value delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surgical Pliers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- B. Braun Melsungen AG

- Blacksmith Surgical

- Boston Scientific Corporation

- ConMed Corporation

- IndoSurgicals Private Limited

- Integra LifeSciences Holdings Corporation

- Jain Surgical Traders Private Limited

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- KLS Martin Group

- Medtronic plc

- Novo Surgical Inc.

- Olympus Corporation

- Romsons Group Private Limited

- Sklar Surgical Instruments

- Smith & Nephew plc

- Stryker Corporation

- Surgico Industries

- Zimmer Biomet Holdings, Inc.

Strategic Investments and Collaborative Initiatives to Enhance Material Innovation Supply Chain Resilience and Customer Engagement

To maintain leadership and capitalize on emerging opportunities, industry decision-makers should prioritize investment in advanced materials research and digital manufacturing capabilities. By forging alliances with material science laboratories and additive manufacturing experts, companies can accelerate the development of lighter, more durable pliers tailored for complex procedures. Furthermore, integrating data analytics and IoT-enabled instrument tracking into product portfolios will enhance post-market surveillance and support predictive maintenance models, thereby strengthening customer trust.

In parallel, executives must cultivate agile supply chain architectures that can swiftly adapt to regulatory shifts and tariff fluctuations. Establishing dual-source agreements with both domestic and global suppliers and investing in regional assembly hubs will mitigate risks while optimizing lead times. Finally, targeted engagement programs with healthcare providers-ranging from hands-on training workshops to digital simulation platforms-will reinforce brand loyalty and facilitate the adoption of next-generation instruments within high-volume surgical centers.

Employing a Robust Multistage Research Framework Combining Primary Interviews Secondary Analysis and Expert Validation

This analysis draws upon a multifaceted research framework to ensure depth and rigor. Primary research was conducted through structured interviews with orthopedic and cardiovascular surgeons, procurement managers at major hospital networks, and instrument design engineers from leading manufacturers. These qualitative insights were complemented by secondary data gathered from peer-reviewed journals, regulatory filings, and recognized industry publications.

Supporting this foundation, competitive intelligence was obtained by analyzing corporate financial reports, patent databases, and conference proceedings. Additionally, supply chain dynamics were examined through interviews with logistics providers and raw material suppliers to identify cost drivers and lead-time constraints. The synthesis of these diverse data points was validated through iterative consensus workshops with domain experts to ensure the findings accurately reflect current market realities and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surgical Pliers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surgical Pliers Market, by Product Type

- Surgical Pliers Market, by Application

- Surgical Pliers Market, by End User

- Surgical Pliers Market, by Material

- Surgical Pliers Market, by Sales Channel

- Surgical Pliers Market, by Region

- Surgical Pliers Market, by Group

- Surgical Pliers Market, by Country

- United States Surgical Pliers Market

- China Surgical Pliers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Insights on Innovation Supply Chain and Clinical Engagement for a Sustainable Competitive Edge in Surgical Instruments

As the surgical pliers market continues to evolve, success will hinge upon a harmonious convergence of material innovation, digital manufacturing, and resilient supply chains. Stakeholders equipped with a clear vision of segmentation nuances and regional dynamics will be best positioned to anticipate demand shifts and deliver tailored solutions. Moreover, proactive engagement with healthcare practitioners and strategic investments in advanced prototyping will serve as catalysts for long-term differentiation.

Ultimately, embracing a holistic perspective-one that integrates clinical feedback, technological capabilities, and regulatory foresight-will be critical for navigating the complexities of the global surgical instrument landscape. Decision-makers who internalize these insights and translate them into coherent action plans will secure a competitive edge and drive transformative outcomes in operating rooms worldwide.

Connect with Our Expert to Unlock Exclusive Insights and Propel Your Strategic Initiatives in the Surgical Pliers Market

For personalized guidance on leveraging these findings to optimize strategic initiatives and operational efficiencies, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to learn more about purchasing the comprehensive market research report and accessing tailored insights that can propel your organization ahead of competitors in the evolving landscape of surgical pliers.

- How big is the Surgical Pliers Market?

- What is the Surgical Pliers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?