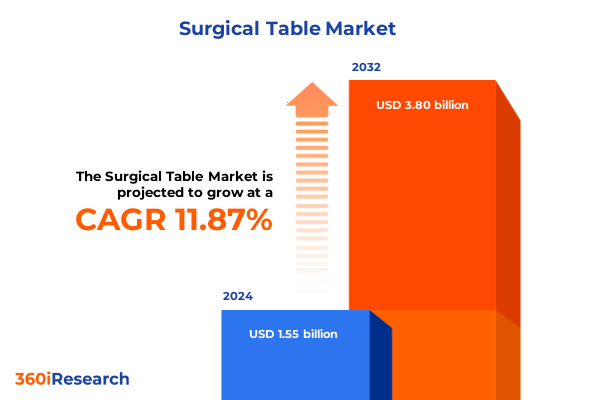

The Surgical Table Market size was estimated at USD 1.73 billion in 2025 and expected to reach USD 1.94 billion in 2026, at a CAGR of 11.88% to reach USD 3.80 billion by 2032.

A comprehensive introduction outlining the critical role of surgical tables in enhancing operative efficiency patient safety and procedural versatility

In the complex environment of modern operating rooms, surgical tables serve as a foundational element that directly influences procedural efficiency and patient outcomes. These platforms accommodate a wide spectrum of clinical needs, ranging from minimally invasive interventions to intricate open surgeries, by offering customization of positioning, imaging compatibility and ergonomic support. As such, understanding the nuances of surgical table performance and configuration has become a strategic imperative for hospital administrators, surgical teams and procurement leaders seeking to maximize resource utilization and clinical capabilities.

This executive summary distills critical findings from an extensive analysis of the surgical table market, examining technological innovations, regulatory influences and competitive forces that are redefining sector dynamics. It offers an integrative perspective on how evolving power sources, application-specific designs and end-user requirements converge to shape purchasing criteria and deployment strategies across diverse care settings.

By framing the key drivers of demand alongside the latest shifts in supply chain structures, tariff environments and regional adoption patterns, this overview equips decision-makers with a clear roadmap for navigating complexity. It sets the stage for deeper exploration of segmentation insights, standout corporate activities and practical recommendations aimed at optimizing product portfolios, strategic partnerships and market positioning throughout the reporting period.

An in-depth analysis of transformative shifts reshaping technological design integration and patient care delivery paradigms within the evolving surgical table ecosystem

The surgical table landscape is undergoing a fundamental transformation driven by converging forces of digital integration, advanced materials engineering and interdisciplinary collaboration. Once designed solely for static support and basic articulation, today’s platforms integrate intelligent sensors, automated positioning algorithms and remote monitoring interfaces that enhance precision, reduce staff fatigue and mitigate risk. These innovations are not isolated; they interlock with emerging imaging modalities, robotics systems and data-driven asset management solutions to create a seamless workflow that spans preoperative planning through postoperative recovery.

From the rise of imaging compatible surfaces that facilitate real-time C-arm and fluoroscopy applications to the onset of smart tables that leverage embedded actuators and connectivity protocols, the sector is moving towards holistic ecosystems rather than standalone devices. Simultaneously, evolving clinical guidelines and value-based care models are placing a premium on modularity and quick-change accessories that support multiple specialties without compromising safety or sterility. This shift is prompting original equipment manufacturers and distributors to reimagine their R&D roadmaps, supply chain architectures and aftermarket support services.

As these transformative shifts continue to unfold, stakeholders must reconcile innovation-driven differentiation with cost containment pressures and interoperability requirements. The ability to anticipate future procedural trends-such as the proliferation of robotic-assisted interventions and the decentralization of surgical services-will determine which entrants secure sustained competitive advantage in this dynamic arena.

An examination of the cumulative impact of recent United States tariffs on supply chain dynamics manufacturing costs and market accessibility across the surgical table industry

In 2025, newly enacted United States tariffs on key raw materials and imported components have exerted a pronounced influence on the surgical table sector. Steel and aluminum levies, along with duties on hydraulic pump assemblies and electronic modules, have heightened pressure on manufacturing costs and prompted a reevaluation of global sourcing strategies. As tariffs increase landed expenses for imported finished goods, market participants have accelerated efforts to qualify domestic suppliers, negotiate cost-sharing arrangements and redesign components to minimize reliance on tariff-exposed inputs.

This cumulative impact extends beyond direct unit pricing; it has also altered contract negotiation tactics, with original equipment manufacturers passing through a portion of cost escalations to end users while seeking incremental volume commitments. At the same time, distributors are revising their inventory planning and warehousing footprints to reduce cross-border transit and mitigate exposure to future policy volatility. These adaptations have reshaped working capital cycles and supplier risk profiles, particularly for smaller vendors with limited hedging capacity.

Looking ahead, tariff-driven supply chain realignments are likely to persist as governments around the world reassess trade policies amid economic uncertainty. Manufacturers that proactively invest in localized production lines, component standardization and tariff-sensitive procurement analytics will be better positioned to stabilize margins and maintain delivery consistency. Conversely, those that remain tethered to high-duty import channels may face constricted growth prospects and diminished responsiveness to evolving clinical demands.

Key segmentation insights revealing how power source application end user and mobility considerations drive differentiated value propositions and stakeholder decision-making processes

A nuanced understanding of surgical table segmentation reveals how distinct power source configurations shape performance attributes and purchasing rationales. Electric variants-categorized into fixed and mobile systems-offer sophisticated control through imaging compatible, smart and standard table variants that integrate seamlessly with C-arm and fluoroscopy units. In contrast, hydraulic platforms leverage robust lifting capacity via either fixed or mobile configurations, delivering smooth articulation for high-load orthopedic and trauma procedures. Manual tables, available in both fixed and mobile formats, cater to environments where simplicity and cost efficiency take precedence, offering reliable positioning without electronic dependencies.

Application-specific differentiation further accentuates market diversity, as cardiovascular procedures demand minimally invasive cardiac surgery, open heart surgery and vascular surgery tables engineered for fine angulation and rapid tilt adjustments. Otolaryngology applications encompass audiology procedures, comprehensive otolaryngology and specialized rhinology tables, each tailored to microdissection and endoscopic workflows. General surgery spans laparoscopic, open and robotic-assisted formats that accommodate rapid surgical transitions, whereas gynecological interventions benefit from dedicated laparoscopic, open and robot-assisted gynecology tables engineered for gynecologic imaging and enhanced lower-body support. Neurosurgical configurations focus on brain surgery, pediatric procedures and spinal interventions, prioritizing ultra-fine articulation and headrest compatibility.

End user segmentation underscores how ambulatory surgical centers-both multispecialty and orthopedic-dedicated-opt for streamlined platforms that maximize turnover, while private and public hospitals emphasize comprehensive feature sets and service agreements to support diverse case mixes. Specialty clinics, including diagnostic centers and outpatient facilities, require adaptable tables that integrate advanced imaging and ergonomic positioning within constrained footprints. Mobility considerations further define market choices: ceiling and floor mounted fixed tables offer unparalleled stability and clearance, whereas track-mounted and wheeled mobile systems deliver rapid redeployment between rooms, catering to facilities with variable case loads and multi-theater layouts.

This comprehensive research report categorizes the Surgical Table market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Power Source

- Mobility

- Application

- End User

Regional market dynamics uncovering how Americas Europe Middle East Africa and Asia-Pacific trends influence surgical table demand innovation adoption and competitive positioning

In the Americas region, demand for advanced surgical tables is driven by the expansion of ambulatory surgical centers and growing investments in outpatient procedural capacity. Stakeholders face increasing pressure to balance acquisition costs with long-term service agreements and to integrate imaging compatible and motorized positioning features to meet the needs of cardiovascular and orthopedic specialties. Reimbursement frameworks that incentivize same-day procedures have accelerated adoption of mobile electric and hydraulic tables, enabling rapid turnover and operational efficiency.

Across Europe, the Middle East and Africa, stringent regulatory standards and hospital accreditation requirements are steering procurement toward smart tables with integrated safety sensors, digital record-keeping and connectivity with hospital information systems. Public health initiatives in EMEA are also enhancing demand for modular platforms that can support a spectrum of applications, from general and robotic-assisted surgery to specialized gynecology and neurosurgery workflows. Suppliers with localized manufacturing footprints and robust regulatory expertise are benefiting from accelerated tender cycles and volume contracts.

Asia-Pacific markets are characterized by rapid healthcare infrastructure build-out in emerging economies alongside increasing adoption of high-end surgical platforms in developed countries. Hospitals in the region are adopting floor-mounted electric tables and mobile hydraulic configurations to support trauma centers and multispecialty surgical suites. At the same time, cost pressures have sustained demand for manual tables in lower-acuity settings, prompting manufacturers to offer tiered feature sets that balance essential functionality with affordability.

This comprehensive research report examines key regions that drive the evolution of the Surgical Table market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into leading companies shaping the surgical table market through technological innovation strategic partnerships and targeted portfolio expansions driving competitive advantage

Leading players in the surgical table market are deploying a range of strategies to strengthen their positions, from targeted acquisitions to strategic alliances with imaging and robotics innovators. Established medical device companies have expanded their portfolios by acquiring specialty table manufacturers and integrating advanced control systems that interface directly with imaging modalities. At the same time, niche entrants are carving out market share through focused investments in modular, lightweight designs and intuitive user interfaces.

Strategic partnerships have emerged as a vital route to accelerate adoption, with prominent table providers collaborating with C-arm and fluoroscopy OEMs to deliver preconfigured bundles that streamline installation and validate compatibility. Concurrently, several market participants have forged relationships with digital health firms to embed predictive maintenance algorithms, remote diagnostic capabilities and real-time performance analytics into their offerings.

Product pipeline differentiation is underscored by the introduction of ultra-low profile tables optimized for robotic-assisted interventions and multi-axis motorization for enhanced tilt speed and precision. Companies that invest in service network expansion and hands-on training programs for clinical end users are also realizing higher retention rates and incremental revenue from consumables and accessories. As the competitive landscape continues to evolve, those that can harmonize product innovation with an end-to-end customer experience will sustain leadership advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surgical Table market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anetic Aid Limited

- Baxter International Inc.

- Getinge AB

- Integra LifeSciences Holdings Corporation

- Merivaara Oyj

- Midmark Corporation

- Skytron, LLC

- STERIS plc

- Stryker Corporation

- Trumpf Medical GmbH + Co. KG

Actionable recommendations for industry leaders to capitalize on emerging trends optimize product portfolios and strengthen market positioning within the surgical table landscape

Industry leaders should prioritize the integration of intelligent automation and embedded connectivity to differentiate their surgical table offerings and deliver demonstrable clinical and operational value. By aligning research and development roadmaps with emerging procedural trends-such as robotics and extended reality guidance-manufacturers can preemptively address the evolving requirements of specialty practices and hybrid operating suites. In parallel, cultivating partnerships with imaging and robotics providers will ensure seamless interoperability and reduce deployment timelines for end users.

Supply chain resilience is another strategic imperative; organizations must diversify component sourcing to mitigate tariff exposure and geopolitical risks, while investing in advanced analytics to forecast material requirements and optimize inventory levels. Embracing modular design principles can accelerate time-to-market and allow end users to tailor configurations without extensive capital outlays, thereby expanding addressable market segments.

Finally, developing comprehensive training and service programs that equip surgical teams with the knowledge to fully leverage advanced table functionalities will enhance customer satisfaction and drive recurring revenue from maintenance contracts, consumables and software upgrades. By forging closer relationships with clinicians and aligning commercial models with value-based care metrics, companies can secure long-term adoption and reinforce their reputation as trusted innovation partners.

A transparent research methodology outlining data sources analytical frameworks and validation techniques employed to deliver robust and credible surgical table market insights

This analysis draws on a rigorous, multi-method research framework combining detailed secondary data review with primary qualitative and quantitative engagement. Secondary sources included peer-reviewed journals, regulatory filings, patent databases and industry white papers to establish macroeconomic context, identify technological trajectories and benchmark competitive activity. These insights were supplemented by publicly available financial statements, supplier catalogs and government publications to construct a comprehensive view of market dynamics.

Primary research consisted of in-depth interviews with a diverse panel of stakeholders, including surgical chiefs, biomedical engineers, procurement managers and clinical educators, enabling the capture of first-hand perspectives on functional requirements, budget constraints and service expectations. Quantitative surveys provided statistical validation of preference hierarchies across power sources, applications, end user profiles and mobility configurations.

Data triangulation and validation were achieved through cross-referencing interview findings with installation data, distributor shipment records and select anonymized end user feedback. Analytical frameworks, such as SWOT and PESTEL analyses, were applied to systematically assess internal capabilities and external drivers. Quality control measures included peer reviews by subject matter experts and consistency checks against historical market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surgical Table market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surgical Table Market, by Power Source

- Surgical Table Market, by Mobility

- Surgical Table Market, by Application

- Surgical Table Market, by End User

- Surgical Table Market, by Region

- Surgical Table Market, by Group

- Surgical Table Market, by Country

- United States Surgical Table Market

- China Surgical Table Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3498 ]

A compelling conclusion synthesizing key findings reinforcing strategic implications and outlining future directions for stakeholders in the surgical table domain

In summary, the surgical table market is being reshaped by technological convergence, regulatory evolution and shifting procurement paradigms. Intelligent automation, imaging compatibility and modular design have emerged as key differentiators that address both clinical demands and operational efficiency targets. Meanwhile, tariff-induced supply chain realignments and regional adoption variances underscore the need for strategic agility and localized execution capabilities.

Segmentation insights reveal that power source preferences, application-specific customizations, end user requirements and mobility considerations collectively inform value propositions and purchasing decisions. Regional dynamics in the Americas, EMEA and Asia-Pacific further influence market trajectories, highlighting the importance of tailored go-to-market strategies. Competitive intensity is escalating as established companies and agile disruptors invest in product innovation, strategic alliances and expanded service networks.

Stakeholders equipped with a clear understanding of these drivers and armed with actionable recommendations are well-positioned to navigate complexity and capture growth opportunities. The insights synthesized in this summary offer a strategic roadmap for aligning investment priorities, enhancing product portfolios and forging partnerships that will define leadership in the surgical table domain.

Gain exclusive access to comprehensive surgical table market research insights by engaging with our Associate Director for tailored strategic support

Engaging with Ketan Rohom, an experienced Associate Director of Sales and Marketing, provides you with direct access to a wealth of expertise across product innovation competitive intelligence and go-to-market strategies tailored for the surgical table domain.

By partnering with Ketan, you gain insider perspectives on emerging trends regulatory nuances and procurement best practices that will inform critical decisions and accelerate your time to market.

Secure exclusive entry to proprietary data sets detailed feature comparisons and quantitative analyses that are not available through public channels, empowering your team to outmaneuver competitors and identify high-potential growth opportunities.

Reach out to Ketan today to discuss customized licensing options for the comprehensive market research report, ensuring you have the strategic clarity and actionable guidance needed to transform insights into tangible results.

- How big is the Surgical Table Market?

- What is the Surgical Table Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?