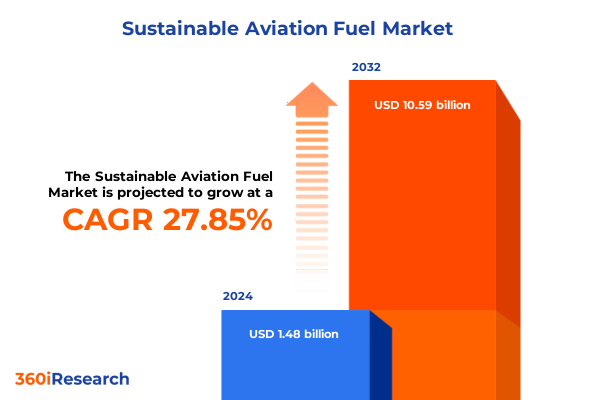

The Sustainable Aviation Fuel Market size was estimated at USD 1.87 billion in 2025 and expected to reach USD 2.37 billion in 2026, at a CAGR of 27.50% to reach USD 10.27 billion by 2032.

Emerging Horizons in Aviation Decarbonization Driven by Breakthrough Carbon-Neutral Fuel Pathways and Strategic Stakeholder Collaboration

The aviation industry stands at a pivotal moment as it grapples with the imperative to reduce carbon emissions and embrace cleaner energy alternatives. As environmental mandates intensify and stakeholder expectations evolve, sustainable aviation fuel has emerged as a key enabler of deep decarbonization, poised to redefine traditional jet propulsion and reshape supply chain dynamics. Through the lens of technological innovation, policy momentum, and cross-sector collaboration, this summary illuminates the strategic drivers, market catalysts, and emerging challenges influencing the trajectory of low-carbon jet fuel solutions.

Against the backdrop of ambitious net-zero commitments, airlines, regulatory bodies, and fuel producers are forging partnerships to accelerate the deployment of advanced feedstocks, from bio-based oils to renewable power-to-liquid processes. Meanwhile, infrastructure adaptation and logistical integration remain crucial to bridging the gap between pilot-scale demonstrations and commercial-scale production. This document synthesizes the latest developments in feedstock diversification, policy incentives, and investment flows, offering decision-makers a clear view into the forces propelling the sustainable aviation fuel revolution and framing the choices that will define competitiveness in a carbon-constrained future.

Seismic Shifts Shaping the Aviation Fuel Ecosystem with New Regulations, Advanced Technologies, and Commercial Market Drivers

The sustainable aviation fuel landscape has undergone seismic transformations, driven by a convergence of regulatory actions, private-sector commitments, and breakthroughs in production methods. Policymakers worldwide have rolled out blending mandates and tax incentives, spurring airlines to integrate renewable fuels into their operations and forging a clear path for market acceleration. Simultaneously, major carriers and corporate purchasers have pledged significant offtake volumes, underpinning capital flows into new refining capacity and bolstering confidence among technology developers.

On the technological front, advancements in Fischer-Tropsch and Alcohol-to-Jet pathways have improved yields and lowered production costs, while power-to-liquid platforms are leveraging declining renewable electricity prices to expand scale. Emerging feedstocks such as municipal waste and industrial CO₂ have further diversified the supply base, reflecting a broader shift toward circular carbon economies. Together, these trends have catalyzed a virtuous cycle of innovation, infrastructure investment, and policy reinforcement that is reshaping the economics and accessibility of sustainable aviation fuel around the globe.

Assessing the Far-Reaching Consequences of the 2025 United States Tariff Regime on Sustainable Aviation Fuel Supply Chains and Economics

In 2025, the United States introduced a revised tariff regime targeting imported feedstocks and intermediate products critical to sustainable aviation fuel production. By imposing levies on key inputs such as certain vegetable oils, alcohol precursors, and catalytic materials sourced from select regions, these measures aimed to protect domestic producers and stimulate local investment. The immediate effect has been a recalibration of supply chains, prompting producers to explore alternative feedstock sources or to increase on-shore refining capabilities to mitigate cost pressures.

Over time, the tariff adjustments have spurred a wave of capital commitments within domestic production hubs, catalyzing joint ventures between airlines and local refiners to secure supply chain resilience. Although short-term raw material costs saw an uptick, the longer-term landscape is now characterized by enhanced technological collaboration, infrastructure upgrades, and deeper integration of vertically aligned feedstock partnerships. This shift underscores the strategic balance between trade policy and the broader goal of securing sustainable fuel supply within a competitive global environment.

Dissecting Critical Sustainable Aviation Fuel Market Dimensions Revealing Insights across Fuel Types, Blending, Processes, and Application Verticals

The sustainable aviation fuel market can be further understood through four distinct lenses encompassing fuel classification, blending thresholds, conversion pathways, and end-use segments. Examining the fuel taxonomy, one observes a spectrum from traditional biofuels to cutting-edge power-to-liquid technologies, where wind- and sun-derived synthetic fuels represent the vanguard of renewable energy integration. The blending dimension outlines the critical thresholds between low-percentage admixtures, mid-range blends up to half the fuel mix, and advanced configurations exceeding a majority share, each reflecting progressively stringent decarbonization targets.

From a processing standpoint, three primary technological streams-alcohol-to-jet, Fischer-Tropsch synthesis, and hydroprocessed esters & fatty acids-define the conversion architecture. The alcohol-to-jet subset reveals divergent pathways between ethanol-to-jet and methanol-to-jet, each offering unique feedstock compatibility and conversion efficiencies. Lastly, the application domain delineates commercial operations across cargo and passenger services, general aviation via charter and private jet operations, and military aviation, where specialized fuel specifications and security considerations drive procurement strategies. This multi-dimensional segmentation framework illuminates the nuances of production costs, supply chain complexity, and end-user adoption patterns shaping the the broader sustainable aviation fuel ecosystem.

This comprehensive research report categorizes the Sustainable Aviation Fuel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Blending Capacity

- Conversion Technology

- Application Type

- Distribution Channel

Unveiling Key Regional Dynamics Driving Sustainable Aviation Fuel Adoption Trends across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics have emerged as defining factors in the global adoption of sustainable aviation fuel. In the Americas, supportive federal incentives and state-level emission reduction targets have galvanized feedstock cultivation and processing investments, positioning North America as both a consumer and exporter of next-generation jet fuels. Latin American stakeholders, leveraging abundant biomass resources, are forging pilot projects to integrate agricultural residues into the supply chain, highlighting a growing south-north trade nexus.

Across Europe, the Middle East, and Africa, blended mandates and carbon taxes have accelerated integrated production, particularly within refinery hubs in northern Europe and investment zones in the Gulf. Collaborative frameworks such as cross-border offtake agreements and research consortia have driven technological convergence, enabling greater feedstock diversity. Meanwhile, in Asia-Pacific, the combination of rapid aviation sector growth and national decarbonization roadmaps has spurred partnerships between airlines and energy majors to develop ethanol-to-jet and lipid-to-jet capacities, shaping a dynamic market where policy incentives and resource availability converge to accelerate sustainable fuel deployment.

This comprehensive research report examines key regions that drive the evolution of the Sustainable Aviation Fuel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing the Strategic Positions and Innovation Trajectories of Leading Players in the Evolving Sustainable Aviation Fuel Industry

Several leading organizations have distinguished themselves through strategic investments, proprietary technologies, and collaborative ventures. Pioneers in hydroprocessed esters and fatty acids are leveraging established oil refining infrastructure to scale production, while innovators in Fischer-Tropsch synthesis are forging partnerships with major carriers to secure long-term offtake agreements. Alcohol-to-jet specialists have formed consortiums with agricultural and waste management firms to secure feedstock continuity and optimize conversion yields.

Technology companies focusing on renewable power-to-liquid processes have achieved notable milestones in pilot plant throughput and process efficiency by tapping renewable energy auctions and forming cross-sector collaborations. Integrators working across multiple pathways have adopted modular plant designs to accommodate fluctuating feedstock profiles, demonstrating a strategic balance between flexibility and capital efficiency. Collectively, these corporate models underscore the competitive interplay between scale, innovation, and strategic partnerships that will shape the leadership landscape within the sustainable aviation fuel industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sustainable Aviation Fuel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abu Dhabi National Oil Company

- Aemetis, Inc.

- Amyris, Inc.

- Axens SA

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation

- CleanJoule

- DGFuels, LLC

- ENEOS Group

- Enertrag SE

- Eni S.p.A.

- Exxon Mobil Corporation

- Fulcrum BioEnergy, Inc.

- Gevo, Inc.

- HIF Global

- Honeywell International Inc.

- Indian Oil Corporation Limited

- INERATEC GmbH

- KBR, Inc.

- LanzaTech Global, Inc.

- Linde PLC

- Lummus Technology LLC

- Maire Tecnimont S.p.A.

- Mitsubishi Corporation

- Montana Renewables, LLC by Calumet Specialty Products Partners, L.P.

- Neste Corporation

- Norsk e-Fuel AS

- Nova Pangaea Technologies Ltd

- ORLEN S.A.

- OxCCU Tech Limited

- Phillips 66

- Praj industries Ltd.

- Preem Holdings AB

- Raven SR Inc.

- Red Rock Biofuels Holdings

- RWE AG

- Sasol Limited

- Saudi Arabian Oil Company

- Shell PLC

- Siemens Energy AG

- SkyNRG B.V.

- Sumitomo Heavy Industries, Ltd.

- Sunfire GmbH

- Swedish Biofuels AB

- Synhelion SA

- Technip Energies N.V.

- Topsoe A/S

- TotalEnergies SE

- Twelve Benefit Corporation

- World Energy, LLC

- Yokogawa Electric Corporation

- Zero Petroleum Limited

Actionable Strategies Empowering Industry Leaders to Accelerate Adoption of Advanced Sustainable Aviation Fuel Solutions and Market Expansion

Industry leaders should prioritize the establishment of vertically integrated supply chains by forming equity partnerships with feedstock suppliers and technology licensors to ensure consistent fuel availability and cost stability. Simultaneously, investing in modular and scalable production facilities will allow firms to adapt to evolving feedstock inputs and take advantage of economies of scale as policy incentives and carbon pricing mechanisms mature. Aligning research efforts with government-backed demonstration programs can further de-risk advanced pathways while generating critical performance data for regulatory approval.

To strengthen market positioning, airlines and fuel producers should engage in long-term offtake agreements that not only underpin new capital expenditures but also signal confidence to investors. Exploring co-investment models and consortium bids for regional blending infrastructure will mitigate cost burdens associated with distribution and storage. Moreover, companies are encouraged to adopt robust measurement, reporting, and verification systems to enhance transparency, satisfy emerging sustainability criteria, and drive stakeholder trust. By implementing these strategies, industry participants can accelerate commercial deployment, optimize returns, and reinforce their competitive edge in the transition to low-carbon aviation operations.

Comprehensive Research Framework Outlining Methodologies, Data Sources, and Validation Techniques Underpinning This Sustainable Aviation Fuel Analysis

This analysis is grounded in a comprehensive methodology combining primary and secondary research. Primary inputs were garnered through detailed interviews with executives across airlines, refiners, feedstock producers, regulators, and technology providers, offering nuanced perspectives on operational challenges and growth catalysts. Simultaneously, secondary resources-including peer-reviewed publications, policy white papers, and industry conference proceedings-provided quantitative and contextual data to validate emerging trends and technology readiness levels.

The research framework employed data triangulation to reconcile divergent source estimates and enhance reliability, while scenario analysis illuminated potential supply-demand trajectories under varying policy regimes and technological maturity. Cross-verification of findings through expert panels ensured alignment with real-world developments, and ongoing monitoring of regulatory filings and patent activity offered visibility into innovation pipelines. Together, these rigorous techniques guarantee that the insights presented herein reflect an accurate, up-to-date portrayal of the sustainable aviation fuel ecosystem and its strategic inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sustainable Aviation Fuel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sustainable Aviation Fuel Market, by Fuel Type

- Sustainable Aviation Fuel Market, by Blending Capacity

- Sustainable Aviation Fuel Market, by Conversion Technology

- Sustainable Aviation Fuel Market, by Application Type

- Sustainable Aviation Fuel Market, by Distribution Channel

- Sustainable Aviation Fuel Market, by Region

- Sustainable Aviation Fuel Market, by Group

- Sustainable Aviation Fuel Market, by Country

- United States Sustainable Aviation Fuel Market

- China Sustainable Aviation Fuel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Implications from the Sustainable Aviation Fuel Landscape for Industry Stakeholders to Consider

The synthesis of regulatory reforms, technological breakthroughs, and strategic partnerships reveals a sustainable aviation fuel market approaching a transformative inflection. Policy mandates and financial incentives are converging to de-risk production investments, while advances in processing pathways are narrowing cost differentials with conventional jet fuels. Concurrently, evolving corporate commitments and cross-sector alliances signal a collective drive toward meaningful emission reductions and energy security.

The ramifications for industry stakeholders are profound: early movers who navigate the intricate interplay of feedstock diversity, production scalability, and commercialization risk stand to secure preferential access to offtake volumes and technology licenses. Conversely, organizations that delay strategic alignment may face supply constraints and heightened cost exposure. Ultimately, this dynamic landscape will be defined by the capacity to balance innovation with pragmatic execution, ensuring that sustainable aviation fuel delivers on its promise as a cornerstone of global decarbonization efforts.

Engage with Our Associate Director to Unlock Exclusive Insights and Secure Your Comprehensive Sustainable Aviation Fuel Market Research Report Today

This research synopsis represents a cornerstone for industry players seeking a deeper understanding of the sustainable aviation fuel system and its transformative potential. To gain full access to the detailed market analysis, data-driven insights, and strategic guidance, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who will provide customized solutions to align this intelligence with your organizational objectives. Secure this indispensable resource today to position your firm at the forefront of decarbonization efforts, refine your growth strategies, and capitalize on emerging opportunities across the global aviation fuel landscape

- How big is the Sustainable Aviation Fuel Market?

- What is the Sustainable Aviation Fuel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?