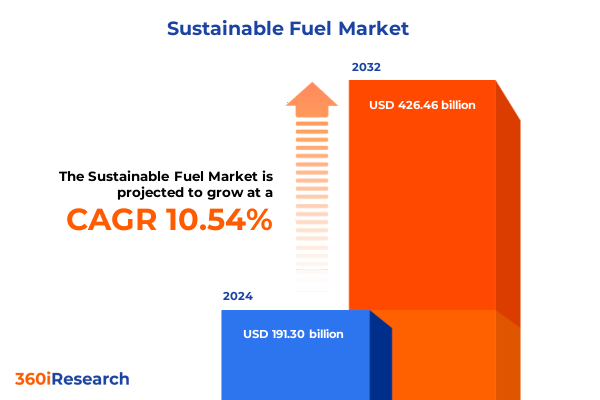

The Sustainable Fuel Market size was estimated at USD 210.39 billion in 2025 and expected to reach USD 231.68 billion in 2026, at a CAGR of 10.62% to reach USD 426.46 billion by 2032.

Unveiling the Critical Role of Sustainable Fuels in Accelerating Decarbonization and Transforming Global Energy Systems for a Net Zero Future

The transition from fossil fuels to sustainable energy carriers has emerged as a defining priority for global economies and industries alike. As the world confronts escalating climate risks, sustainable fuels have become instrumental in reducing greenhouse gas emissions across hard-to-abate sectors such as aviation, shipping, heavy transport, and industrial processes. These next-generation energy solutions, which include advanced biofuels, electro-fuels, and low-carbon hydrogen, offer the dual benefit of leveraging existing infrastructure while opening new pathways for decarbonization. António Guterres’ declaration that 2024 was a breakthrough year for clean energy underscores the urgency and momentum behind this shift, with renewable sources accounting for the majority of new electricity capacity additions globally.

Simultaneously, energy security concerns and supply chain disruptions have intensified the strategic value of domestically produced fuels derived from waste streams, agricultural residues, and novel feedstocks. Investment in renewable fuels soared by nearly 30% year-on-year, reflecting a growing confidence among investors and policymakers in the resilience and economic viability of low-carbon alternatives. This surge signifies a foundational shift from pilot-scale projects to commercial-scale deployments, bringing sustainable fuels to the heart of corporate strategies and government agendas. Consequently, industry leaders are reimagining their portfolios, forging partnerships, and accelerating research and development to secure competitive advantage in a decarbonizing global marketplace.

How Policy Innovations, Technological Breakthroughs, and Investment Surges Are Reshaping the Sustainable Fuel Landscape for Widespread Adoption

Over the past year, a confluence of policy momentum, technological breakthroughs, and capital inflows has altered the sustainable fuel landscape in unprecedented ways. Governments across major economies have introduced or refreshed mandates and incentives that underpin demand for biofuels, e-fuels, and low-carbon hydrogen. The European Union’s Renewable Energy Directive III and aviation fuel mandates, for instance, have catalyzed investment into sustainable aviation fuel production and blending infrastructure. Likewise, the United States’ Inflation Reduction Act and advanced fuel tax credits have produced a cascade of project announcements and public-private partnerships aimed at scaling production capacity.

From a technological standpoint, advances in electrolysis efficiency and catalyst development are driving down the cost of green hydrogen, while next-generation fermentation and gasification processes are enabling the conversion of diverse feedstocks into drop-in fuels. These innovations are rapidly transitioning from laboratory validation to demonstration farms and industrial parks. Consequently, venture capital and corporate R&D budgets devoted to sustainable fuels have grown substantially, signaling confidence in the scalability and reliability of these pathways. Moreover, as companies align their net-zero commitments with pragmatic roadmaps, sustainable fuels have become essential components of decarbonization strategies, reinforcing their role as a key lever for achieving emission reduction targets by 2030 and beyond.

In parallel, cross-sector collaborations-linking agriculture, logistics, and technology providers-are forming integrated value chains that ensure robust supply, quality control, and traceability. This cooperative ecosystem fosters resilience against feedstock volatility and regulatory shifts, further solidifying sustainable fuels as essential elements of the future energy matrix.

Assessing the Broad Repercussions of New US Trade Barriers on Sustainable Fuel Supply Chains and Market Dynamics

In 2025, a series of new United States tariffs has profoundly influenced the cost structure and competitive dynamics of sustainable fuel supply chains. The administration’s decision to impose tariffs of up to 54% on used cooking oil imports and broader energy goods has notably increased the landed cost of critical feedstocks for biodiesel and renewable diesel production. For many operators, this elevated cost base undermines margin stability and challenges the economics of existing biorefinery projects.

Beyond feedstocks, tariffs levied on equipment and components essential for e-fuel and green hydrogen production-such as electrolyzer modules and catalyst precursors-have disrupted procurement strategies and prolonged project timelines. Companies that relied on specialized imports from Asia and Europe are now reevaluating their sourcing models, with some opting to localize manufacturing or qualify alternative suppliers. These adjustments, while beneficial to domestic industry over the long term, have introduced short-term operational friction and capital reallocation.

Moreover, the cumulative impact of Section 232 and Section 301 measures on steel, aluminum, and advanced materials has raised the cost of building infrastructure, notably pipeline systems and storage tanks for hydrogen and syngas. As a result, anticipated enhancements in fuel distribution networks face potential delays, while cost overruns force project developers to reassess viability thresholds. Industry participants argue that this environment risks hampering the scale-up required to meet aggressive decarbonization targets, especially in sectors where fuel switching is contingent on robust logistical infrastructure.

Nonetheless, these trade barriers have also driven a strategic pivot toward domestic feedstock cultivation and equipment manufacturing. While this shift promises to strengthen regional value chains and spur innovation hubs, stakeholders emphasize the need for policy coherence to mitigate supply chain bottlenecks and safeguard the continuity of low-carbon fuel deployment.

Uncovering Deep Market Structures through Comprehensive Segmentation Analysis across Fuel Types, States, Feedstocks, Distribution Channels, and End-Users

Deep segmentation analysis reveals the nuanced market structures underpinning the sustainable fuel sector. Based on fuel type, the market encompasses biofuels including biodiesel, biogas, ethanol, and renewable diesel alongside e-fuels such as e-ammonia, e-diesel, e-gasoline, e-kerosene, e-methane, and e-methanol, in addition to hydrogen variants like blue, green, and turquoise hydrogen and syngas & natural gas. Segmentation by type differentiates low‐carbon fossil fuels from renewable fuels, highlighting the intersection of conventional energy with emerging low‐emission alternatives. The state classification spans gaseous and liquid products, underscoring technical considerations such as storage, transport, and application compatibility.

Furthermore, feedstock segmentation captures a spectrum of inputs, including agricultural and plant residues, algal feedstocks, forest-based materials, industrial residues like black liquor, CO₂ emissions-derived streams, novel synthetic biomass, and waste-based categories comprising animal fats, food waste, municipal solid waste, sewage sludge, and used cooking oil. This layered perspective elucidates the drivers of raw material availability, cost variability, and sustainability credentials. Distribution channels, from marine shipping and pipeline systems to rail and truck transport, delineate the logistical frameworks that facilitate global and regional movements. Lastly, end-user segmentation spans agriculture and farming, industrial, residential and commercial building, and transportation sectors - the latter further distinguished by automotive, aviation, marine, and railways - reflecting diverse consumption patterns and regulatory mandates across industries. Together, these segmentation insights enable stakeholders to pinpoint high-value niches, optimize supply chains, and align product portfolios with sector-specific requirements.

This comprehensive research report categorizes the Sustainable Fuel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Type

- State

- Feedstock Types

- Distribution

- End-User

Mapping Diverse Growth Trajectories and Strategic Imperatives across the Americas, Europe Middle East Africa, and Asia-Pacific Sustainable Fuel Markets

Regional dynamics in sustainable fuels are defined by distinct policy frameworks, resource endowments, and market demand curves. In the Americas, the confluence of supportive federal tax credits, state‐level clean fuel standards, and robust agricultural feedstock supply has positioned North America as a leader in renewable diesel, biodiesel, and sustainable aviation fuel. The region’s infrastructure investment, including pipeline expansions and port-based blending terminals, further strengthens distribution capabilities. Latin American nations, notably Brazil, continue to advance bioethanol and biodiesel mandates, reinforcing the hemisphere’s preeminence in liquid biofuel production and export flows.

Europe, Middle East and Africa present a mosaic of regulatory ambition and logistical challenges. The European Union’s Fit for 55 package and ReFuelEU Aviation regulation drive demand for renewables and e-fuels, while Africa’s emerging market status offers untapped feedstock potential and nascent policy frameworks. Middle Eastern hubs, with abundant solar resources and petrochemical expertise, are exploring green hydrogen and e-ammonia projects to diversify energy portfolios. However, fragmented infrastructure and financing gaps can impede large-scale deployment.

Asia-Pacific remains the fastest-growing region, characterized by rapid industrialization, escalating energy demand, and evolving policy landscapes. China’s expansive renewable hydrogen and bioenergy programs, combined with Southeast Asia’s feedstock diversity, are catalyzing project pipelines. Japan and South Korea’s commitment to hydrogen economy roadmaps has spurred imports of low-carbon hydrogen and ammonia. While logistical complexities and regulatory harmonization remain hurdles, the region’s innovation ecosystems and growing investor interest make it a pivotal arena for sustainable fuel advancement.

This comprehensive research report examines key regions that drive the evolution of the Sustainable Fuel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation in Renewable Diesel, Sustainable Aviation Fuel, Green Hydrogen, and Circular Feedstock Solutions

Leading companies are shaping the sustainable fuel evolution through strategic investments, technology partnerships, and pipeline expansions. One prominent example is Neste, which despite a challenging market environment announced a performance improvement program aimed at securing cost competitiveness while advancing its Rotterdam renewable refinery expansion. The company is targeting a production capacity of 2.7 million tons of renewable products annually, including sustainable aviation fuel, and has secured substantial green bond financing to support this growth trajectory. Neste’s collaboration with agricultural partners on novel feedstock ecosystems, such as winter canola, underscores its commitment to resilient supply chains and circular economy principles.

Global energy majors are also ramping up their sustainable fuel portfolios. Shell’s energy and chemicals park in Rotterdam is slated to deliver its first sustainable aviation fuel volumes in 2025, leveraging HEFA technology and extensive supply agreements to meet airline demand. The company has set an ambition to produce around 2 million metric tons of SAF per year by 2025 and maintains a diversified pipeline of biofuels production facilities across Europe, Asia, and North America.

In parallel, industrial gas providers such as Linde are cementing their role in decarbonization by investing over $1.8 billion to supply clean hydrogen to blue ammonia and ethylene cracker projects on the U.S. Gulf Coast and in Alberta. These large-scale hydrogen projects, supported by carbon capture technologies and long-term off-take agreements, demonstrate how multidisciplinary players can anchor the low-carbon fuel ecosystem by integrating production, transport, and end-user delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sustainable Fuel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Alder Energy, LLC

- Alto Ingredients, Inc.

- Archer-Daniels-Midland Company

- Bangchak Corporation Public Company Limited

- BP PLC

- Cargill, Incorporated

- Chevron Corporation

- Clariant International Ltd.

- Gevo, Inc.

- Green Plains Inc.

- Hindustan Petroleum Corporation Limited

- Honeywell International Inc.

- Indian Oil Corporation Limited

- INEOS Group Holdings S.A.

- Jivoule Biofuels

- LanzaJet, Inc.

- Marathon Petroleum Corporation

- Neste Oyj

- Novozymes A/S

- ORLEN Group

- Preem AB

- Red Rock Biofuels

- Shell PLC

- Sinopec Corporation

- SkyNRG B.V.

- TotalEnergies SE

- Valero Energy Corporation

- Velocys PLC

- Verbio SE

- Wilmar International Ltd.

Actionable Strategies for Industry Executives to Enhance Competitiveness, Accelerate Decarbonization, and Secure Strategic Partnerships in Sustainable Fuels

To navigate the evolving sustainable fuel landscape, industry leaders must adopt strategic imperatives that drive resilience, growth, and impact. First, fostering collaborative ecosystems with feedstock suppliers, technology developers, logistics providers, and regulators is essential to secure reliable inputs and optimize supply chains. By establishing multi-stakeholder consortia, companies can mitigate feedstock volatility and create transparent sustainability frameworks.

Second, prioritizing modular and scalable project designs enables rapid adaptation to regulatory changes and market fluctuations. Investments in flexible infrastructure, such as multi-product biorefineries and mobile hydrogen refueling units, reduce capital intensity and enhance responsiveness to emerging demand centers. Additionally, embedding digital tools and data analytics into operations supports predictive maintenance, real-time quality control, and optimized logistics.

Third, engaging proactively with policymakers to shape transparent incentive structures and long-term mandates is critical. Companies should leverage data-driven advocacy to articulate investment requirements and de-risk policy landscapes. Finally, integrating sustainability metrics and circularity principles into corporate governance fosters credibility and attracts environmental, social, and governance (ESG)-focused capital. By aligning business strategies with global decarbonization objectives, leaders can unlock new revenue streams and reinforce their competitive differentiation in an increasingly decarbonized economy.

Illustrating Rigorous Research Methodology Combining In-Depth Primary Interviews, Secondary Data Analysis, and Expert Validation for Unbiased Market Insights

This research adopts a rigorous methodology, blending primary and secondary sources to ensure comprehensive and unbiased insights. Primary data collection involved in-depth interviews with key stakeholders, including feedstock producers, technology licensors, project developers, and regulatory authorities, providing firsthand perspectives on market drivers and operational challenges. These insights were systematically validated through an expert panel comprising academic researchers and industry veterans.

Secondary analysis synthesized a wide spectrum of publicly available information, including government publications, industry association reports, company financial disclosures, and trade journals. Renowned sources such as the International Energy Agency and leading financial news outlets were cross-referenced to corroborate quantitative and qualitative findings. Data triangulation techniques were employed to reconcile conflicting information and enhance reliability.

Geospatial mapping and supply chain modeling tools were leveraged to illustrate regional flows and logistical constraints, while scenario analysis assessed the implications of policy shifts and technology adoption rates. Sustainability criteria followed recognized frameworks, ensuring that environmental and social considerations were integrated into every stage of the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sustainable Fuel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sustainable Fuel Market, by Fuel Type

- Sustainable Fuel Market, by Type

- Sustainable Fuel Market, by State

- Sustainable Fuel Market, by Feedstock Types

- Sustainable Fuel Market, by Distribution

- Sustainable Fuel Market, by End-User

- Sustainable Fuel Market, by Region

- Sustainable Fuel Market, by Group

- Sustainable Fuel Market, by Country

- United States Sustainable Fuel Market

- China Sustainable Fuel Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Emphasize the Critical Path Forward for Stakeholders in the Sustainable Fuel Revolution

The trajectory of sustainable fuels is defined by accelerating technological maturation, deepening policy frameworks, and expanding capital deployment. By synthesizing segmentation nuances and regional dynamics, stakeholders can identify high-growth segments, establish resilient supply chains, and adapt to evolving regulatory landscapes. The interplay of feedstock diversity, distribution infrastructure, and end-user demand will dictate the pace of adoption, particularly in sectors where decarbonization imperatives are most urgent.

The strategic responses of leading companies underscore how integrated value chains, anchored by innovation and collaboration, will shape competitive leadership. Meanwhile, the cumulative effect of trade barriers and incentives highlights the critical need for coherent and predictable policy environments that balance industrial competitiveness with sustainability objectives.

Ultimately, the sustainable fuel transition represents both a formidable challenge and a singular opportunity. Organizations that proactively align their strategies with emerging standards, invest in scalable technologies, and nurture collaborative partnerships will unlock new markets and reinforce their role as catalysts for a decarbonized future.

Connect with Associate Director Ketan Rohom to Gain Exclusive Access to the Comprehensive Sustainable Fuel Market Research and Drive Strategic Growth

Ready to Transform Your Sustainable Fuel Strategy with Exclusive Market Insights

Positioning your organization at the vanguard of the sustainable fuel industry requires access to granular analysis, strategic foresight, and actionable intelligence. Ketan Rohom, Associate Director of Sales & Marketing, extends a personalized invitation to engage with our comprehensive report on sustainable fuels. With deep expertise in market dynamics and customer-centric insights, Ketan will guide you through tailored findings that align with your unique business objectives.

Our research equips you with an unparalleled understanding of evolving regulations, emerging feedstock innovations, competitive landscapes, and regional opportunities. By partnering with Ketan, you can secure strategic recommendations designed to optimize your investment roadmap and strengthen your market position. This is a unique opportunity to leverage premium data and expert interpretation to inform critical decisions and accelerate your sustainable fuel initiatives.

Contact Ketan Rohom today to explore customized data packages, schedule a one-on-one briefing, and unlock exclusive pricing options. Empower your team with the insights needed to navigate uncertainties, capitalize on emerging trends, and drive measurable growth in the rapidly evolving sustainable fuel arena.

- How big is the Sustainable Fuel Market?

- What is the Sustainable Fuel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?