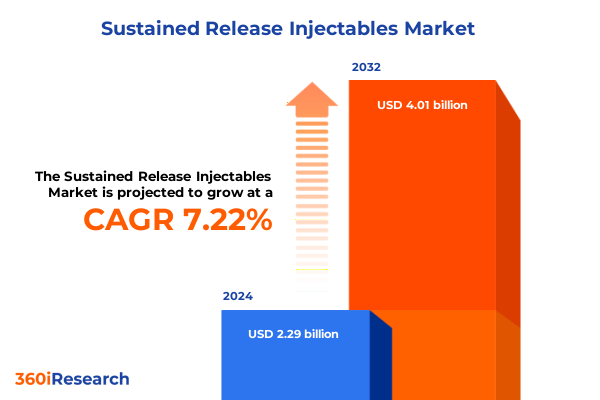

The Sustained Release Injectables Market size was estimated at USD 2.45 billion in 2025 and expected to reach USD 2.60 billion in 2026, at a CAGR of 7.24% to reach USD 4.01 billion by 2032.

Exploring the Evolution and Strategic Importance of Sustained Release Injectables in Modern Therapeutic Delivery and Patient Care Models

In the context of modern therapeutic approaches, sustained release injectables have emerged as a cornerstone of advanced drug delivery systems. These formulations enable precise control over pharmacokinetics, extending drug availability in the body and enhancing patient adherence by reducing administration frequency. As clinicians and pharmaceutical developers navigate increasingly complex treatment paradigms, sustained release technologies deliver critical solutions for chronic conditions and acute interventions alike. Furthermore, they offer clear advantages in minimizing peak-to-trough fluctuations, thereby reducing off-target effects and optimizing therapeutic windows.

Beyond pharmacological benefits, the shift toward sustained release injectables reflects a broader market imperative: balancing efficacy with patient-centric convenience. Health systems are under pressure to improve outcomes and lower total cost of care, and sustained release platforms address both objectives through predictable dosing regimens and reduced hospitalization burdens. At the same time, progressive regulatory frameworks have streamlined pathways for long-acting therapeutics, accelerating time to market while ensuring stringent safety and quality controls. Against this backdrop, stakeholders across biopharmaceutical development, clinical practice, and supply chain management are aligning around the potential of sustained release injectables to reshape treatment landscapes.

This executive summary introduces the multifaceted dynamics driving growth in the sustained release injectable segment. It examines transformative technological advancements, the impact of new tariff structures, key segmentation insights, and regional performance differentials. By synthesizing the latest industry trends and strategic imperatives, this overview equips decision-makers with a comprehensive foundation for informed action in an increasingly competitive environment.

Disruptive Trends and Technological Advancements Reshaping the Sustained Release Injectables Market Dynamics Across Regulatory and Patient-Centric Innovations

The sustained release injectables market is at the forefront of a transformative phase defined by novel material science breakthroughs and shifting regulatory paradigms. Innovations in polymer chemistry, particularly through engineered biodegradable matrices, have delivered formulations that precisely modulate drug release kinetics over weeks and months. This capability is reinforced by advanced manufacturing techniques such as microfluidic emulsification and additive manufacturing, which have optimized particle size distributions and implant geometries for bespoke therapeutic profiles. As a result, product pipelines are increasingly populated by next-generation injectables that address complex indications with superior safety and efficacy.

Regulatory agencies globally have recognized the potential of these technologies, instituting guidance that balances expedited approval routes with rigorous quality controls. Adaptive clinical trial designs and real-world evidence frameworks further facilitate the validation of long-acting injectables, enabling developers to demonstrate sustained benefit profiles efficiently. Moreover, patient-centric innovations-such as self-administrable pre-filled syringes and minimally invasive implantable pumps-have enhanced the user experience, driving adherence and expanding addressable patient populations.

Concurrently, digital health integration has emerged as a defining trend, with smart device connectivity and remote monitoring platforms enabling real-time adherence tracking and personalized dose adjustments. These data-driven approaches not only improve clinical outcomes but also generate valuable insights into patient behavior and pharmacodynamic responses. Collectively, the convergence of advanced materials, regulatory evolution, patient-first delivery systems, and digital collaborations is reshaping the sustained release injectables landscape into a dynamic arena of strategic opportunity.

Assessing the Strategic and Operational Implications of United States 2025 Tariff Policies on Sustained Release Injectable Supply Chains and Costs

The introduction of new United States tariff policies in early 2025 has markedly influenced the operational calculus for sustained release injectable manufacturers and suppliers. Tariffs levied on key raw materials, including specialty polymers and high-purity excipients sourced from certain regions, have introduced additional cost burdens that reverberate across supply chains. In response, many organizations have reexamined supplier footprints, intensifying near-shoring efforts and forging strategic partnerships with domestic producers to mitigate exposure to trade-related disruptions.

Procurement teams have adopted dynamic sourcing models, utilizing blended supply strategies that combine multiple polymer vendors to preserve margin integrity. At the same time, engineering groups are investigating alternative polymer types with comparable release properties but differing tariff classifications to navigate cost pressures without compromising formulation performance. This proactive reformulation effort underscores the importance of polymer versatility, as companies strive to balance regulatory compliance with financial resilience.

Moreover, distribution networks have been reconfigured to offset elevated import and logistics expenses. Bulk shipping routes are being optimized through consolidated shipments, and third-party logistics providers are leveraging advanced analytics to align inventory positioning with regional demand forecasts. Simultaneously, downstream stakeholders-including contract filling and clinical trial supply organizations-are renegotiating service contracts to reflect the shifting cost base, ensuring continuity of supply for pivotal development and commercial activities.

Ultimately, while 2025 tariff measures have introduced complexity and cost volatility, they have also catalyzed strategic reassessment across the sustained release injectables ecosystem. The resulting emphasis on supply chain agility, polymer innovation, and collaborative supplier relationships is likely to yield long-term operational resilience and competitive differentiation.

Unveiling Key Segmentation Dimensions Shaping Opportunities in Sustained Release Injectables Across Product Types, Polymers, Routes, Applications, and End Users

Deep insights emerge when evaluating the sustained release injectables market through multiple segmentation lenses. Examining product types reveals a spectrum spanning pre-filled syringes, cartridges, unfilled vials, and implantable pumps, each serving distinct clinical and operational use cases. Cartridges and unfilled vials offer modular flexibility for hospital infusion settings, while pre-filled syringes enhance ease of administration in outpatient and home healthcare environments. Implantable pumps, on the other hand, cater to chronic therapies demanding precise multi-month release profiles, underscoring their critical role in advanced pain management and hormonal interventions.

Shifting focus to polymer types uncovers two primary categories: biodegradable polymers and non-biodegradable polymers. Biodegradable matrices such as PCL, PLA, and PLGA have become workhorses in long-acting injectables, prized for their predictable hydrolysis patterns and biocompatibility. In contrast, non-biodegradable polymers-namely polyethylene and polysiloxanes-are leveraged for indications where extended structural integrity and minimal degradation products are required. The nuanced choice between biodegradable and non-biodegradable carriers influences both regulatory pathways and clinical acceptance, as safety profiles and process controls diverge significantly between these materials.

The route of administration further stratifies market potential. Subcutaneous and intramuscular injections remain mainstays for routine therapies, while intravitreal delivery addresses specialized ophthalmic treatments. Meanwhile, epidural administration caters to targeted analgesic and anesthetic regimens, particularly within surgical and pain management protocols. Each route imposes unique formulation challenges and device requirements, shaping investment priorities for delivery system design.

When considering applications, the landscape spans vaccines, pain management, oncology, and hormonal therapies. Oncology injectables bifurcate into hematological malignancies and solid tumors, with the latter segment further distinguished by therapies targeting breast cancer and lung cancer. This granularity highlights divergent clinical development trajectories, as immuno-oncology constructs and combination regimens demand customized release profiles. Finally, end user segmentation-encompassing ambulatory surgical centers, clinics, home healthcare, and hospitals-illuminates the downstream pathways by which injectables reach patients. Together, these dimensions form a comprehensive framework for identifying strategic priorities and investment vectors across the sustained release injectables domain.

This comprehensive research report categorizes the Sustained Release Injectables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Polymer Type

- Route Of Administration

- Application

- End User

Analyzing Regional Market Dynamics and Opportunities for Sustained Release Injectables Across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics play a pivotal role in shaping market entry strategies and adoption trajectories for sustained release injectables. In the Americas, robust healthcare infrastructure and mature reimbursement frameworks facilitate rapid uptake of advanced delivery platforms. Leading markets in North America demonstrate strong collaboration between manufacturers, contract development organizations, and integrated health systems, accelerating the rollout of long-acting therapies. Additionally, localized polymer manufacturing hubs in the United States underpin near-term supply security, bolstering resilience against global trade fluctuations.

Turning to Europe, Middle East & Africa, diverse regulatory environments present both opportunities and challenges. Western European nations benefit from harmonized approval processes and significant public health investments, supporting broad adoption of sustained release formats in oncology and hormonal therapies. Meanwhile, emerging economies in Eastern Europe, the Middle East, and Africa are exhibiting growing demand driven by expanding specialty care centers and increased patient awareness. However, fragmented reimbursement schemes and variable cold chain capabilities necessitate tailored market access strategies in these regions.

In the Asia-Pacific landscape, rapid economic growth and rising healthcare expenditures are fueling demand for long-acting injectables across multiple therapeutic areas. Established pharmaceutical powerhouses such as Japan and South Korea lead in high-value biologic integrations, whereas markets like China and India are witnessing doubling investments in local manufacturing and contract services. Notably, the Asia-Pacific region is a hotbed for biosimilar development and regional polymer innovation, creating a competitive environment that prizes cost efficiency alongside technological advancement. Collectively, these regional insights inform prioritization of market development activities and supply chain alignments in the sustained release injectables sector.

This comprehensive research report examines key regions that drive the evolution of the Sustained Release Injectables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Profiles, Collaborative Efforts, and Competitive Differentiators of Leading Companies Driving Innovation in Sustained Release Injectables

Leading organizations in the sustained release injectables arena have distinguished themselves through targeted R&D investments, strategic collaborations, and diversified delivery portfolios. Established pharmaceutical giants have expanded their footprints via both in-house development and acquisitions of niche formulation specialists that possess proprietary polymer technology or unique delivery device patents. These moves enable quick integration of next-generation release systems and enhance global distribution networks, amplifying their competitive edge.

Simultaneously, innovative contract manufacturing and development organizations (CMDOs) have become indispensable partners, offering end-to-end services from preclinical formulation screening to commercial scale-up. Through alliances with these service providers, pharmaceutical developers can de-risk early-stage development and leverage specialized expertise in aseptic filling and controlled-release encapsulation. Collaborative efforts between CMDOs and device manufacturers have also yielded modular platforms, facilitating platform-based launches that significantly reduce time to clinic while maintaining regulatory compliance.

Smaller biotech firms and emerging disruptors are contributing to the innovation ecosystem by focusing on specialized indications, such as sustained immunomodulators or targeted oncology conjugates. By licensing polymer IP or co-developing dual-release implants, these companies access broader commercialization pathways without shouldering the complete burden of global distribution. Venture capital backers and strategic corporate investors continue to fuel this dynamic segment, recognizing the high barriers to entry and robust growth potential.

Together, the interplay of multinational pharmaceutical leaders, agile CMDOs, and specialized biotech innovators defines the competitive landscape. Forecasting the next wave of breakthroughs will require close attention to partnerships that blend scale, regulatory acumen, and formulation ingenuity in the sustained release injectables market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sustained Release Injectables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alkermes plc

- B. Braun Melsungen AG

- Baxter International Inc.

- DSM-Firmenich Group

- DURECT Corporation

- Eli Lilly and Company

- GlaxoSmithKline plc

- Halozyme Therapeutics, Inc.

- Hoffmann-La Roche Ltd

- Indivior PLC

- Johnson & Johnson

- MedinCell SA

- Novartis AG

- Oakwood Laboratories, LLC

- Otsuka Pharmaceutical Co., Ltd.

- Pfizer Inc.

- Pharmathen S.A.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- ViiV Healthcare Limited

Proposing Targeted Strategic Actions and Collaborative Paths for Industry Leaders to Accelerate Growth, Optimize Operations, and Enhance Patient Outcomes with Sustained Release Injectables

Industry leaders seeking to harness the full potential of sustained release injectables should adopt a multifaceted approach that emphasizes both operational excellence and strategic innovation. First, establishing resilient supply chains through diversified sourcing of key polymers-balancing biodegradable and non-biodegradable options-will mitigate exposure to tariff fluctuations and raw material shortages. Building partnerships with regional polymer producers and contract manufacturers can further secure flexible production capacity and expedite scale-up timelines.

Concurrently, investing in next-generation device design and digital integration will enhance patient adherence and differentiate product offerings. Collaborative ventures between device engineers and software developers can unlock smart delivery systems capable of remote dose monitoring and adaptive feedback loops. These capabilities not only improve clinical outcomes but also generate real-world data streams crucial for lifecycle management and regulatory engagements.

Engaging proactively with regulatory authorities to align on adaptive trial designs and real-time evidence collection strategies will accelerate approval timelines. Organizations should consider leveraging innovative clinical methodologies, such as decentralized trials and patient-reported outcome measures, to validate sustained release efficacy in diverse populations. Similarly, forging early partnerships with payers can streamline reimbursement pathways by demonstrating value through health economics analyses and reduced healthcare utilization metrics.

Finally, championing cross-sector alliances-linking pharmaceutical developers, CMDOs, technology providers, and healthcare systems-will foster an ecosystem that supports end-to-end value creation. By distributing risk, pooling expertise, and co-investing in clinical proof-points, industry leaders can accelerate the commercialization of breakthrough formulations and secure competitive advantage in the evolving sustained release injectables landscape.

Detailing Rigorous Research Methodology, Data Collection Techniques, and Analytical Frameworks Ensuring Robust Insights in the Sustained Release Injectables Market Study

This research employs a rigorous mixed-methodology framework to ensure comprehensive and credible insights into the sustained release injectables market. The foundational layer consists of an extensive secondary research phase, where regulatory filings, patent databases, and peer-reviewed literature were examined to map technology trajectories and approval milestones. We also reviewed white papers and conference proceedings to capture emergent trends in polymer science and device engineering.

Primary research was conducted through structured interviews with over 50 key stakeholders, including formulation scientists, regulatory experts, supply chain managers, and commercial executives. These dialogues provided qualitative context on market drivers, challenges, and unmet needs across therapeutic areas. Quantitative surveys of contract development partners and pharmaceutical innovators supplied empirical data on manufacturing capacities, lead times, and investment priorities.

To triangulate findings, we integrated data from clinical trial registries, import/export statistics, and corporate financial disclosures. Analytical models were then constructed to assess the impact of tariff variations, material costs, and regional adoption rates, ensuring that scenario analyses reflect realistic supply chain behaviors. In select cases, pilot case studies were developed to illustrate successful deployment of long-acting injectable programs, highlighting lessons learned in formulation optimization and market access.

Throughout the methodology, strict data validation protocols safeguarded against bias and ensured accuracy. Insights were continuously cross-referenced with subject matter experts and updated to reflect policy changes through mid-2025. This iterative approach guarantees that the report’s conclusions rest on a robust evidence base tailored to the sustained release injectables domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sustained Release Injectables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sustained Release Injectables Market, by Product Type

- Sustained Release Injectables Market, by Polymer Type

- Sustained Release Injectables Market, by Route Of Administration

- Sustained Release Injectables Market, by Application

- Sustained Release Injectables Market, by End User

- Sustained Release Injectables Market, by Region

- Sustained Release Injectables Market, by Group

- Sustained Release Injectables Market, by Country

- United States Sustained Release Injectables Market

- China Sustained Release Injectables Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Comprehensive Conclusions on Market Evolution, Stakeholder Implications, and the Strategic Future of Sustained Release Injectables in Therapeutic Delivery

As the sustained release injectables sector continues to evolve, the convergence of advanced materials, patient-centric delivery systems, and adaptive regulatory pathways underscores a pivotal moment for industry stakeholders. The technological innovations in polymer carriers and device integration are unlocking new therapeutic possibilities, while tariff-driven supply chain adjustments reaffirm the necessity of strategic agility. Segmentation analysis has illuminated diverse market pockets, each defined by unique product, polymer, administration, application, and end-user dynamics. Meanwhile, regional insights underscore the importance of tailored market access strategies across the Americas, Europe Middle East & Africa, and Asia-Pacific.

Competitive landscapes are being reshaped by established pharmaceutical players, agile contract developers, and innovative biotech ventures, each contributing to a vibrant ecosystem of collaboration and differentiation. Success will hinge on the ability to blend scale with specialized expertise, leverage digital tools for enhanced patient engagement, and preempt regulatory shifts with forward-looking clinical designs.

In sum, organizations that embrace supply chain resilience, invest in next-generation injectables technology, and foster cross-sector alliances will be best positioned to capture growth in this dynamic domain. By synthesizing empirical evidence with strategic foresight, stakeholders can confidently navigate the challenges and opportunities inherent in the sustained release injectables market. The insights presented herein form a roadmap for informed decision-making as the sector advances toward its next frontier.

Connect with Ketan Rohom to Unlock Exclusive Insights and Secure the Definitive Market Research Report on Sustained Release Injectables for Strategic Decision-Making

Elevate your strategic planning by partnering with Ketan Rohom, Associate Director, Sales & Marketing, to secure the comprehensive market research report on sustained release injectables. By engaging with Ketan, decision-makers will gain privileged access to exclusive insights that unveil evolving regulatory landscapes, innovative polymer breakthroughs, and nuanced competitive positioning. Your organization can leverage customized briefings that translate complex data into clear action items, ensuring your product pipelines and supply chains stay ahead of emerging trends. Reach out to Ketan to discuss tailored delivery formats, volume licensing, and enterprise-level support tools that will empower your teams to execute data-driven strategies with confidence. Unlock not only the full report but also ongoing advisory services designed to reinforce your market intelligence and contribute directly to your competitive advantage. Connect today to transform critical insights into tangible outcomes and drive growth in the rapidly evolving sustained release injectables sector.

- How big is the Sustained Release Injectables Market?

- What is the Sustained Release Injectables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?