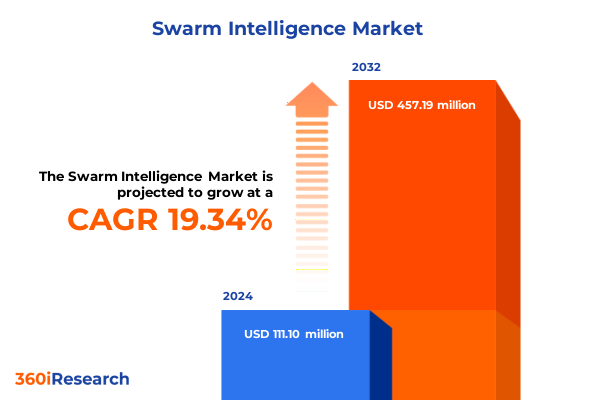

The Swarm Intelligence Market size was estimated at USD 131.29 million in 2025 and expected to reach USD 156.62 million in 2026, at a CAGR of 19.51% to reach USD 457.18 million by 2032.

Exploring the Catalytic Impact of Swarm Intelligence on Next-Generation Automation and Adaptive Decision-Making in Critical Industries

Swarm intelligence has emerged as a transformative paradigm, harnessing the collective behaviour of autonomous agents to solve complex real-world challenges across industries. Inspired by natural phenomena such as ant colonies and bird flocks, this approach leverages decentralized coordination to enable robust, scalable, and adaptive systems. Today, enterprises are exploring swarm-based solutions in contexts ranging from cooperative robotics in manufacturing to distributed sensor networks that optimize environmental monitoring. This report opens by articulating how swarm intelligence transcends traditional automation models, offering a new blueprint for resilient and self-organizing architectures.

As we delve into the core tenets of swarm intelligence, it becomes evident that the convergence of artificial intelligence, miniaturized hardware, and high-speed connectivity has catalyzed a surge in real-world deployments. Decision-makers are embracing the potential for real-time responsiveness and fault tolerance that emerges when individual nodes collaborate without centralized control. By framing the executive summary with this foundational perspective, readers gain clarity on why swarm intelligence represents not just a technological innovation but a strategic imperative for organizations seeking to navigate increasingly dynamic operational landscapes.

Unpacking Major Disruptions in Swarm Intelligence Evolution Driven by Edge Computing, AI Convergence, and Cross-Sector Collaboration

The landscape of swarm intelligence has undergone remarkable shifts driven by breakthroughs in edge computing and artificial intelligence convergence. Edge architectures have enabled distributed agents to process data locally, reducing latency and bandwidth demands while enhancing the autonomy of individual nodes. Simultaneously, advancements in machine learning algorithms have empowered swarms to learn behaviours dynamically, refining their coordination capabilities through reinforcement learning and bio-inspired heuristics. This convergence has created fertile ground for cross-sector collaborations, where technology providers and end users co-develop specialized applications that leverage domain knowledge and algorithmic ingenuity.

Another critical driver reshaping the market is the rapid democratization of hardware platforms and open-source frameworks. Miniaturization trends have produced sensor nodes with integrated processors, communication modules, and power management systems at an unprecedented scale. Parallel to this, the growing ecosystem of open-source simulation environments and development toolkits has lowered barriers to entry, enabling startups and academic labs to prototype swarm solutions more efficiently. These collective dynamics have accelerated innovation cycles and fostered competitive differentiation based on both algorithmic sophistication and system integration expertise.

Finally, regulatory and ethical considerations have begun to influence the trajectory of swarm intelligence adoption. Policymakers and standards bodies are assessing frameworks for safe and transparent deployment, addressing concerns such as cybersecurity, privacy, and operational accountability. As a result, industry stakeholders are increasingly incorporating risk mitigation measures-ranging from encrypted communications to fail-safe protocols-into their design methodologies. This proactive stance not only bolsters trust among prospective adopters but also positions leading vendors to shape emerging standards that will govern swarm-driven ecosystems in the years ahead.

Assessing the Broad-Spectrum Consequences of 2025 United States Tariffs on Supply Chains, Technology Adoption, and Industry Partnerships

The 2025 US tariffs imposed on critical components-most notably processors, optical devices, and sensor modules-have introduced a new layer of complexity for swarm intelligence developers. Supply chain costs have risen as vendors seek alternative sourcing strategies, prompting many to reevaluate partnerships and pursue nearshoring to mitigate exposure. These shifts have ripple effects: longer lead times for hardware deliveries, increased inventory overheads, and higher operational expenditure for pilot programs. Consequently, technology adopters are adjusting implementation timelines and prioritizing modular architectures that can accommodate intermittent supply disruptions without jeopardizing overall system performance.

In parallel, the tariffs have accelerated investments in domestic R&D and component fabrication. Government incentives and private funding are channeling resources into local semiconductor foundries and optics manufacturing facilities, aiming to reduce strategic dependencies. While these initiatives strengthen long-term supply resilience, they require substantial upfront capital and extended development cycles. Until these localized capabilities mature, many organizations will face trade-offs between accelerated deployment and cost containment, underscoring the need for flexible procurement strategies and phased rollouts that align with fluctuating market conditions.

Revealing Deep-Dive Segmentation Perspectives Across Components, Deployment Models, Applications, and End User Domains to Unearth Strategic Growth Pathways

Analyzing the market through a component lens reveals differentiated growth trajectories for hardware, services, and software offerings. Hardware systems-encompassing optical devices, processors, and sensor nodes-are becoming more compact and energy efficient, driving adoption in contexts that demand high reliability under constrained form factors. Meanwhile, services such as integration and deployment as well as support and maintenance are increasingly valued for the expertise they bring in orchestrating complex multi-agent systems and ensuring continuous uptime. On the software side, the maturation of biologically inspired frameworks and simulation platforms is empowering organizations to model emergent behaviors in virtual environments before field deployment, thus de-risking capital investments.

Turning to application insights, defense and security use cases are experiencing a bifurcation between civilian infrastructure protection and specialized military operations. Critical infrastructure monitoring is leveraging swarm sensors to detect anomalies across vast perimeters, while aerial and ground naval platforms are exploiting cooperative behaviors for reconnaissance and logistics support. In healthcare, patient monitoring and telemedicine are tapping into swarms of wearable sensors to deliver real-time diagnostics and remote care coordination. Similarly, material handling and logistics applications are integrating swarm-equipped fleets in both warehouse and fleet management scenarios, optimizing throughput and reducing human intervention. Surveillance and border control systems now incorporate intrusion detection swarms coupled with advanced video analytics, enhancing situational awareness across remote zones. Traffic management is entering a new phase as autonomous traffic control nodes and smart transportation networks collaborate dynamically to reduce congestion and improve safety.

Evaluating deployment modes highlights the dichotomy between cloud and on-premises solutions. Cloud-hosted platforms offer unparalleled scalability and AI-driven analytics capabilities, yet raise concerns about data sovereignty and network dependency. Conversely, on-premises deployments boast tighter security controls and lower latency at the edge, appealing to defense, healthcare, and government entities that manage sensitive data. Lastly, end user domains-including defense & aerospace, government, healthcare, and transportation-demonstrate distinct requirements in terms of regulatory compliance, integration complexity, and total cost of ownership. Within transportation, both freight transport operators and public transit agencies are evaluating swarm-based systems to enhance operational efficiency and passenger safety through coordinated asset management and real-time route optimization.

This comprehensive research report categorizes the Swarm Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment Mode

- End User

Comparative Regional Dynamics Highlighting Market Drivers and Barriers Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics in the Americas are shaped by robust innovation ecosystems and strategic government investments in defense, healthcare, and intelligent transportation initiatives. North America leads in research funding and pilot project deployment, driven by strong partnerships among academia, defense contractors, and technology providers. South American nations are gradually embracing swarm-based agricultural and environmental monitoring solutions, seeking to enhance crop yields and sustainability amid challenging geographic terrains. Meanwhile, Latin American deployments of low-cost sensor swarms are gaining momentum in disaster response scenarios, providing rapid situational awareness in areas prone to natural calamities.

In Europe, Middle East & Africa, regulatory harmonization efforts are accelerating cross-border collaborations. The European Union’s focus on data privacy and cybersecurity is guiding the design of secure swarm architectures, while the Middle East is funding smart city projects that integrate swarm-driven traffic management and border surveillance systems. Across Africa, public-private partnerships are deploying swarms for wildlife conservation and anti-poaching initiatives, leveraging scalable sensor networks to monitor wide savanna landscapes. Finally, Asia-Pacific markets exhibit a mix of rapid commercialization in industrial automation and government-sponsored smart infrastructure schemes. Nations such as China, Japan, and South Korea are pioneering large-scale factory implementations, whereas Southeast Asian countries prioritize affordable swarm-enabled environmental sensing to address urban pollution and coastal protection challenges.

This comprehensive research report examines key regions that drive the evolution of the Swarm Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Their Strategic Initiatives Shaping the Competitive Landscape of Swarm Intelligence Technologies

Leading solution providers are distinguishing themselves through investments in proprietary algorithms, system interoperability, and domain-specific expertise. Established robotics firms are embedding swarm capabilities into their flagship platforms, enabling coordinated multi-unit operations that extend beyond traditional single-robot deployments. At the same time, specialized software vendors are advancing simulation-as-a-service offerings, allowing end users to conduct extensive what-if analyses and scenario planning without significant capital outlays. Partnerships between hardware integrators and application developers are also proliferating, ensuring that swarm systems are fine-tuned to vertical requirements such as medical device standards or defense communication protocols.

Smaller innovators are driving critical breakthroughs in energy management and modularity, delivering swarm nodes with ultra-low power footprints and plug-and-play connectivity. These capabilities are particularly appealing for remote or austere environments where battery life and rapid redeployment are essential. Competitive positioning in this sector increasingly hinges on the ability to offer end-to-end solutions that blend turn-key hardware, adaptive software, and lifecycle support. Companies that succeed in establishing collaborative ecosystems-inviting academic research groups, open-source communities, and system integrators to co-create-are well-positioned to capture cross-sector opportunities and accelerate time-to-market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Swarm Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Cisco Systems, Inc.

- Dassault Systèmes SE

- Fujitsu Limited

- Honeywell International Inc.

- IBM Corporation

- Lockheed Martin Corporation

- Microsoft Corporation

- NEC Corporation

- Oracle Corporation

- Robert Bosch GmbH

- SAP SE

- Unanimous AI, Inc.

Strategic Playbook of Actionable Recommendations Empowering Industry Leaders to Navigate Swarm Intelligence Adoption and Collaboration Pathways

Industry leaders should prioritize cross-disciplinary collaboration to harness advances in materials science, AI, and network architectures. By fostering joint research consortia with universities and standards organizations, enterprises can coalesce around best practices for swarm safety, interoperability, and ethical deployment. Embedding multidisciplinary teams early in the design process also accelerates technology transfer from lab-scale prototypes to mission-critical applications, reducing time-to-value.

Investments in modular, upgradeable platforms will prove essential for maintaining competitive agility. Organizations are advised to adopt hardware-agnostic middleware and open-source algorithm libraries, enabling rapid integration of new sensor types or communication protocols. This approach not only curtails vendor lock-in but also allows companies to leverage emergent innovations in real time, whether in energy-efficient computing or novel bio-inspired coordination strategies.

Finally, decision-makers must incorporate scenario-based planning into their strategic roadmaps, evaluating how factors such as regulatory shifts, tariff fluctuations, and geopolitical developments might influence adoption trajectories. Continuous market sensing-through customer pilots, ecosystem benchmarking, and competitive intelligence-will help leaders recalibrate investment priorities and cultivate resilience, ensuring that swarm intelligence initiatives deliver sustainable returns in a dynamic global environment.

Elaborating Robust Research Methodology Integrating Primary Surveys, Expert Interviews, and Secondary Data Validation Processes

This research leverages a hybrid methodology combining primary and secondary data to ensure comprehensive coverage and rigorous validation. Primary insights were gathered through structured interviews with over fifty domain experts, including system integrators, end users, and regulatory authorities. These discussions provided qualitative perspectives on deployment challenges, technology preferences, and emerging use cases, forming the backbone of our thematic analysis.

Secondary research encompassed the review of technical white papers, patent filings, and industry publications, spanning peer-reviewed journals and open-source repositories. Data triangulation techniques were applied to reconcile divergent estimates and identify consensus trends. Quantitative inputs were further bolstered by an extensive database of product launches, partnership announcements, and government procurement records. Through iterative validation sessions, our analysts refined key findings to eliminate bias and highlight actionable insights for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Swarm Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Swarm Intelligence Market, by Component

- Swarm Intelligence Market, by Application

- Swarm Intelligence Market, by Deployment Mode

- Swarm Intelligence Market, by End User

- Swarm Intelligence Market, by Region

- Swarm Intelligence Market, by Group

- Swarm Intelligence Market, by Country

- United States Swarm Intelligence Market

- China Swarm Intelligence Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Capturing the Strategic Imperative of Swarm Intelligence Trends to Drive Future Innovations, Partnerships, and Market Resilience

As swarm intelligence technologies continue to mature, organizations that embrace distributed coordination paradigms will unlock new frontiers in autonomy, resilience, and operational efficiency. The interplay between hardware miniaturization, AI-driven software, and robust network architectures is creating a rich innovation landscape, spanning applications from industrial automation to precision agriculture. Leaders who align their strategies with these convergent trends will be best positioned to capture value and drive sustainable growth.

Looking ahead, the strategic imperative is clear: foster collaborative ecosystems, invest in flexible architectures, and integrate risk-aware planning into every stage of your technology roadmap. By doing so, enterprises can navigate the complexities of regulatory shifts, supply chain disruptions, and evolving security demands. Ultimately, a proactive approach to swarm intelligence adoption will differentiate market leaders and catalyze a new era of distributed, intelligent systems.

Unlock Comprehensive Swarm Intelligence Insights and Drive Strategic Advantages by Engaging with Ketan Rohom to Acquire the Definitive Market Research Report

To access the definitive research and unlock the full spectrum of insights into the evolving swarm intelligence market, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through tailored licensing options and premium data deliverables to meet your strategic and operational priorities. Seize this opportunity to position your organization at the forefront of swarm intelligence innovation and sustain a competitive edge in a rapidly advancing technological landscape.

- How big is the Swarm Intelligence Market?

- What is the Swarm Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?