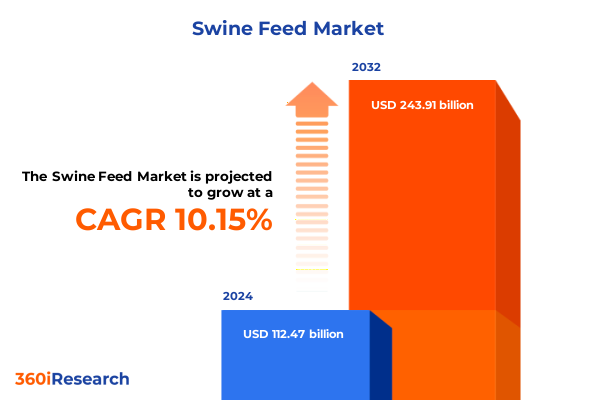

The Swine Feed Market size was estimated at USD 123.48 billion in 2025 and expected to reach USD 135.56 billion in 2026, at a CAGR of 10.21% to reach USD 243.91 billion by 2032.

Unveiling the Critical Foundations of Swine Feed Dynamics to Inform Strategic Decision-Making in an Evolving Agricultural Ecosystem

The global swine feed sector occupies a critical nexus between animal nutrition science and agricultural economics, shaping the productivity and sustainability of pork production worldwide. As pork remains one of the most consumed proteins in numerous markets, continuous innovation in feed formulations and supply chain orchestration has become indispensable to industry stakeholders seeking to optimize operational efficiency. This introduction establishes the foundational context required to appreciate the complex interplay of emerging technologies, regulatory influences, and shifting demand patterns that define today’s feed landscape.

Drawing on a multi-faceted analysis that encompasses evolving consumer preferences, input cost pressures, and geopolitical factors, this executive summary offers a strategic overview of the swine feed domain. By exploring transformative shifts, assessing the repercussions of recently implemented tariffs, and unveiling deep segmentation and regional insights, the report equips decision-makers with the clarity needed to prioritize investments and partnerships. Subsequent sections delve into corporate strategies, actionable recommendations, and methodological rigor, providing a coherent roadmap for navigating an industry at the cusp of rapid evolution.

Navigating the Pivotal Transformative Shifts Reshaping the Swine Feed Landscape and Driving New Opportunities for Competitive Advantage in Market Dynamics

In recent years, the swine feed industry has witnessed profound transformation as sustainable sourcing, precision nutrition, and digital integration converge to redefine best practices. The advent of advanced data analytics platforms allows producers to tailor diets at the individual animal level, leveraging real-time performance metrics to optimize nutrient delivery while reducing waste. Concurrently, heightened scrutiny over antibiotic use and environmental impact has catalyzed the adoption of novel feed additives and alternative proteins, spurring collaborative research between ingredient manufacturers and academic institutions.

Furthermore, innovations in feed processing technologies have enhanced pellet durability and nutrient stability, responding to growing demand for cost-effective formulations that maintain animal health. Across the value chain, blockchain and Internet of Things solutions are enhancing traceability, enabling end-to-end transparency that resonates with increasingly discerning retailers and consumers. Collectively, these shifts are not only elevating feed quality and safety but are also generating competitive differentiation opportunities for early adopters prepared to integrate cutting-edge approaches into their operations.

Assessing the Far-Reaching Consequences of Newly Implemented United States Tariffs on Swine Feed Supply Chains and Cost Structures in 2025

Amid a backdrop of escalating trade tensions, the United States implemented targeted tariffs on a range of imported feed ingredients in early 2025, recalibrating cost structures and prompting supply chain realignments across the sector. Key import duties were levied on certain cereal grains and specialty oil blends, driving up landed costs for feedmills reliant on those inputs. As a result, producers faced immediate margin compression and were compelled to explore substitutive ingredient sources to preserve price competitiveness while maintaining nutritional integrity.

Responding to these pressures, many feed formulators have increased their engagement with domestic grain producers and have intensified research into underutilized crops such as sorghum and barley to offset corn price volatility. Parallel efforts have focused on localizing the production of vitamin and mineral premixes, thereby insulating operations from tariff-induced supply disruptions. These adaptive strategies underscore the industry’s resilience and highlight the imperative of flexible procurement models to navigate an era marked by fluctuating trade policy and cost unpredictability.

Illuminating Deep Segmentation Insights Across Feed Types Forms Ingredients Additives and Distribution Channels to Drive Targeted Growth Strategies

A nuanced segmentation analysis reveals distinct growth drivers and strategic imperatives across feed categories, guiding stakeholders toward targeted value propositions. In the realm of feed type, the market encompasses specialized formulations for finishers, growers, piglets, sows, and starters, each tailored to specific life stages and production objectives. These formulations balance energy, protein, and micronutrient requirements to optimize growth performance and reproductive health.

Regarding feed form, crumbles, mash, and pellets present varying degrees of handling efficiency and animal acceptance, influencing procurement decisions based on farm infrastructure and feeding protocols. Ingredient segmentation further dissects the domain into core components including cereal grains, dicalcium phosphate, fat and oil derivatives, soybean meal, and vitamin and mineral premixes. The cereal grain subset comprises barley, corn, sorghum, and wheat, while the fat and oil category differentiates between animal fats and vegetable oils, each offering unique fatty acid profiles.

Additive analysis spotlights functional enhancements delivered by acidifiers, antibiotics, enzymes, prebiotics, and probiotics, with the latter partitioned into Bacillus, Lactobacillus, and yeast strains that underpin gut health and feed efficiency. Finally, the distribution channel landscape spans traditional offline outlets such as cooperatives and agribusiness distributors, alongside emerging online sales platforms that cater to digitally enabled farms seeking convenience and data transparency. Understanding how these segments intersect and influence one another is essential for crafting differentiated product portfolios and go-to-market strategies.

This comprehensive research report categorizes the Swine Feed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Ingredient

- Additives

- Distribution Channel

Uncovering Key Regional Patterns Influencing Swine Feed Demand Supply and Innovation across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a pronounced influence on feed formulation preferences, regulatory compliance requirements, and innovation trajectories. In the Americas, North America’s mature feed infrastructure is characterized by integrated supply chains, robust domestic grain production, and progressive adoption of digital feed management tools, while South America’s emergence as a soybean and corn powerhouse fuels export-oriented feed solutions optimized for cost efficiency and high throughput.

Within Europe, the Middle East, and Africa, stringent regulations on antibiotic usage and increasing mandates for environmental stewardship have accelerated demand for natural acidifiers and enzyme-based performance enhancers. Countries across the Asia Pacific region display a wide spectrum of development, with leading markets such as China and India investing heavily in feed mill modernization and precision feeding systems, whereas developing Southeast Asian nations prioritize affordable starter and piglet feed blends to support burgeoning pork production.

These regional variations underscore the necessity for multinational feed companies to customize offerings based on local ingredient availability, regulatory landscapes, and technological readiness, ensuring product portfolios resonate with the distinct operational realities of each geography.

This comprehensive research report examines key regions that drive the evolution of the Swine Feed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Prominent Industry Stakeholders Driving Innovation Investment and Collaborative Initiatives in the Global Swine Feed Sector

The competitive arena of swine feed is dominated by vertically integrated agribusiness conglomerates that leverage global sourcing networks and proprietary formulation technologies. Leading players invest heavily in research partnerships to advance feed digestibility and reduce environmental footprints, forging alliances with biotechnology firms to expand the suite of enzyme and probiotic solutions.

Simultaneously, agile mid-tier companies have gained traction by offering customizable feed blends and value-added services such as on-farm technical support and digital monitoring platforms. Start-ups specializing in alternative protein ingredients and precision feeding algorithms are attracting strategic investments from established feed manufacturers seeking to bolster their innovation pipelines. This collaborative and competitive interplay between large incumbents and emerging challengers is shaping an industry ecosystem where speed of innovation and depth of expertise are primary differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Swine Feed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Agri Ltd

- Alltech

- Archer Daniels Midland Company

- BASF SE

- Cargill Incorporated

- Charoen Pokphand Foods

- De Heus Animal Nutrition

- DSM-Firmenich

- Evonik Industries AG

- ForFarmers N.V.

- Hi-Pro Feeds

- J.D. Heiskell & Co.

- Kent Nutrition Group

- Land O'Lakes Inc.

- New Hope Group

- Nutreco N.V.

- Perdue AgriBusiness

- Provimi

- Ridley Corporation Limited

- Weston Milling Animal Nutrition

Implementing Actionable Strategic Recommendations to Enhance Competitiveness Sustainability and Profitability in the Evolving Swine Feed Market

To thrive amidst evolving market dynamics, industry leaders must prioritize the integration of digital feed formulation platforms that harness predictive analytics for real-time optimization of nutrient delivery. Diversifying ingredient sourcing strategies by forging partnerships with local grain cooperatives and alternative protein suppliers will mitigate exposure to tariff fluctuations and input scarcity. Concurrently, leveraging sustainable feed additives and enhancing transparency through traceability solutions will foster trust among consumers and regulatory bodies.

Investment in collaborative research and development consortia can accelerate the introduction of next-generation enzymes and probiotics, while targeted engagement with policy makers can shape favorable regulatory frameworks. Lastly, building flexible production capabilities capable of seamless transitions between feed forms and ingredient blends will future-proof operations against shifting demand patterns and emerging nutritional paradigms.

Detailing Rigorous Research Methodology Approaches Data Sources and Analytical Frameworks Underpinning the Swine Feed Market Analysis

The research framework underpinning this analysis combines primary and secondary methodologies to ensure comprehensive coverage and robust validation. Primary research comprised in-depth interviews with feed mill managers, nutritionists, and key opinion leaders across major producing regions, supplemented by site visits to leading feed manufacturing facilities. Secondary research drew upon industry publications, government agricultural reports, and trade association data to contextualize findings within broader market trends.

Analytical techniques included Porter’s Five Forces to assess competitive intensity, PESTEL analysis for external factor evaluation, and SWOT matrices to identify strategic imperatives. Geographic and segment-level data were triangulated through multiple sources to reconcile discrepancies and hone accuracy. This multi-layered approach ensures that the insights presented are both actionable and reflective of the dynamic realities facing swine feed stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Swine Feed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Swine Feed Market, by Type

- Swine Feed Market, by Form

- Swine Feed Market, by Ingredient

- Swine Feed Market, by Additives

- Swine Feed Market, by Distribution Channel

- Swine Feed Market, by Region

- Swine Feed Market, by Group

- Swine Feed Market, by Country

- United States Swine Feed Market

- China Swine Feed Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Critical Findings Conclusions and Insights to Guide Stakeholders Toward Informed Decision-Making in the Swine Feed Industry

In conclusion, the swine feed industry stands at a crossroads defined by technological innovation, shifting regulatory regimes, and an imperative to bolster sustainability. Transformative advances in precision nutrition and digital traceability promise to drive efficiency gains, while the imposition of new tariffs underscores the critical importance of agile supply chain strategies. Through a detailed segmentation lens, stakeholders can identify high-value niches and tailor product offerings to match life-stage requirements, feed forms, and functional additive needs.

Regional nuances in ingredient availability and policy environments necessitate localized approaches, and the competitive landscape continues to evolve through collaborations between established conglomerates and disruptive newcomers. By implementing the strategic recommendations outlined, participants can secure competitive advantage, enhance resilience against external shocks, and chart a course toward long-term growth and profitability. This synthesis of findings provides a clear foundation for informed decision-making in the dynamic swine feed market.

Empowering Strategic Action Through Comprehensive Market Intelligence Consultation and Collaboration for Maximizing Swine Feed Sector Opportunities Today

To gain deeper insights and tailor strategic plans that will position your organization at the forefront of the evolving swine feed industry, reach out to Ketan Rohom, Associate Director of Sales & Marketing. With an extensive track record in guiding leading agribusinesses toward sustainable growth and competitive differentiation, Ketan can arrange a comprehensive consultation to discuss the full market research report and customized data solutions. Collaborate directly with an expert who understands the nuances of feed formulation, supply chain dynamics, and regulatory landscapes, ensuring you capitalize on emerging trends and mitigate potential risks. Secure your access to detailed regional breakdowns, granular segmentation analyses, and forward-looking recommendations that will empower your next strategic move in the swine feed sector.

- How big is the Swine Feed Market?

- What is the Swine Feed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?