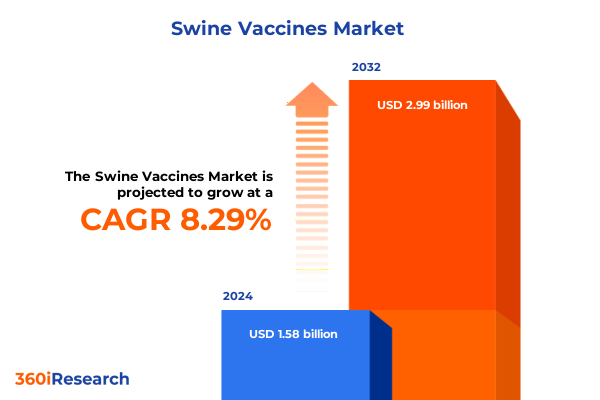

The Swine Vaccines Market size was estimated at USD 1.70 billion in 2025 and expected to reach USD 1.84 billion in 2026, at a CAGR of 8.34% to reach USD 2.99 billion by 2032.

Unveiling the Critical Role of Swine Vaccination in Safeguarding Herd Health Amidst Intensifying Disease Pressures and Global Demand Dynamics

Global demand for pork continues to surge, with pork accounting for approximately 36% of the meat consumed worldwide, totaling 112.6 kilotons in recent measurements and projected to grow further by 2031. As production intensifies to meet evolving consumer preferences, the role of vaccination in swine health management has become increasingly critical to safeguard herd productivity and maintain food security.

Emerging disease threats such as porcine reproductive and respiratory syndrome, classical swine fever, and African swine fever underscore the imperative for robust immunization programs. In early 2025, the American Association of Swine Veterinarians Industry Support Council convened leading manufacturers and veterinary experts to address these challenges through vaccine innovation and enhanced biosecurity protocols.

Emerging Technological and Strategic Shifts Revolutionizing the Swine Vaccine Landscape Through Advanced Delivery and Adoption in Pig Farming

Advancements in vaccine formulation are reshaping the swine health landscape by enabling combination and multivalent platforms that streamline disease coverage. For example, the TwistPak technology introduced by Boehringer Ingelheim allows IngelvacCircoFLEX and IngelvacMycoFLEX to be blended conveniently at the point of use, preserving flexibility for monovalent or combined administration while reducing handling time for producers.

Simultaneously, the introduction of mRNA-based swine influenza vaccines by MSD Animal Health has demonstrated the capacity to mount rapid protective responses against emerging influenza strains, with pilot deployments covering over 10 million pigs in North America in early 2024. This approach mirrors the success of mRNA in human medicine and opens the door to precision vaccines targeting PRRSV and other complex pathogens.

Meanwhile, novel delivery modalities including needle-free injectors, oral vaccine formulations, and aerosolized platforms are being adopted to improve uptake and streamline mass vaccination campaigns. These innovations reduce stress for animals, lower transmission risks, and enhance immune response consistency across large-scale operations.

Assessing the Cascading Effects of Multiple U.S. Tariff Measures on Swine Vaccine Supply Chains Pricing and Global Trade in 2025

On April 5, 2025, the United States implemented a 10% global tariff on nearly all imported goods, including active pharmaceutical ingredients essential to vaccine manufacturing, while explicitly excluding finished veterinary pharmaceuticals to maintain medication access for producers. Despite this exemption, the levies on raw inputs have led to notable cost pressures throughout the supply chain.

Earlier, on March 4, 2025, the administration enacted a 25% reciprocal tariff on imports from Canada and Mexico, a move that has elevated costs for feed components, packaging materials, and lab reagents integral to vaccine production and distribution in the North American region.

In a parallel response to U.S. tariff measures, China imposed additional 15% duties on American pork and related animal health products effective March 10, 2025, threatening export volumes and complicating market access for U.S.-produced vaccines and pharmaceuticals.

Together, these compounded tariff actions have introduced supply chain uncertainties and pricing volatility, compelling stakeholders to reassess sourcing strategies, pursue domestic API capacity, and engage with policymakers to mitigate disruptions in critical immunization programs.

Decoding Market Segmentation Insights That Illuminate Diverse Swine Vaccine Needs Across Types Ages Administration Modes Packaging and End Users

The swine vaccine market encompasses a spectrum of immunization modalities ranging from DNA-based constructs to inactivated, live attenuated, recombinant, subunit, and toxoid formulations, each engineered to target specific pathogens and optimize immune protection. Market participants are navigating the technical nuances of these platforms to address pathogen variability and safety considerations.

Age-specific immunization protocols are fundamental to herd health management, with vaccine schedules tailored for breeding animals including boars and sows, as well as finishers, growers, piglets, and weaners. These cohorts demand distinct antigen presentations and adjuvant systems to ensure effective seroconversion and maternal antibody transfer.

Routes of administration diversify delivery options, spanning intramuscular and subcutaneous injections to nasal and oral applications. The selection of delivery mechanism influences vaccine uptake, ease of handling, and biosecurity measures on commercial operations.

Packaging formats such as multi-dose bottles, prefilled syringes, and single-dose vials are strategically designed to balance inventory flexibility, waste reduction, and cold-chain integrity, catering to the needs of different farm sizes and operational workflows.

End users in the market include commercial farming enterprises, research institutions conducting experimental trials, veterinary clinics providing herd health services, and veterinary hospitals managing large-scale vaccination initiatives. Each channel shapes procurement behaviors and distribution models.

Disease profiles continue to drive product development priorities, with immunizations against classical swine fever, erysipelas, Mycoplasma pneumonia, porcine circovirus, porcine reproductive and respiratory syndrome, and swine influenza commanding focused research investments to enhance efficacy and safety.

Distribution pathways integrate traditional veterinary clinics and hospitals with online pharmacies, encompassing company-owned websites and e-commerce platforms to expand market reach and facilitate direct-to-farm delivery models.

This comprehensive research report categorizes the Swine Vaccines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Animal Age

- Route Of Administration

- Packaging Type

- End User

- Disease Type

- Distribution Channel

Unraveling Regional Dynamics That Influence Swine Vaccine Adoption Across the Americas EMEA and Asia-Pacific Growth Corridors

North America maintains its position as the largest regional market for swine vaccines, underpinned by a well-established veterinary infrastructure, advanced cold-chain logistics, and proactive adoption of preventive health strategies among producers and integrated operations.

In Europe, Middle East & Africa, regulatory rigor and collective biosecurity initiatives have driven an 83% decline in African swine fever outbreaks in domestic pigs between 2023 and 2024, evidencing the impact of coordinated vaccination campaigns and surveillance enhancements. However, heterogeneity in veterinary resources and market access across the EMEA region continues to influence vaccine penetration rates.

The Asia-Pacific region is characterized by rapid pork industry expansion, with China alone producing approximately 52 million tonnes of pork-44.1% of global output-in recent years, fueling demand for genotype-specific and autogenous vaccines to combat endemic and emerging diseases. Regulatory advancements in countries such as Japan and Australia further reinforce immunization programs and cross-border collaboration on disease control.

This comprehensive research report examines key regions that drive the evolution of the Swine Vaccines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders Driving Innovation and Strategic Expansion in the Global Swine Vaccine Arena Through Partnerships and R&D

Merck Animal Health has bolstered its portfolio with the launch of Circumvent CML, a multivalent platform introduced in June 2023 that enables comprehensive control of PCV-2a, PCV-2d, Mycoplasma hyopneumoniae, and Lawsonia intracellularis through a single formulation. This strategic expansion underscores Merck’s commitment to integrated herd health solutions.

Boehringer Ingelheim’s TwistPak platform exemplifies continued innovation by simplifying the preparation and administration of combination vaccines, reinforcing its leadership in dual-purpose immunization technologies aimed at circovirus and mycoplasma control.

Zoetis expanded its manufacturing capacity by 30% in 2023 to supply approximately 180 million doses annually, addressing escalating demand across Europe and Asia-Pacific and supporting next-generation genotype vaccine development.

Elanco, Ceva, Hipra, and emerging biotech firms are accelerating research into mRNA platforms and live attenuated solutions, exemplified by the EU-funded Vax4ASF consortium led by HIPRA, which seeks safe and effective next-generation vaccines against African swine fever.

This comprehensive research report delivers an in-depth overview of the principal market players in the Swine Vaccines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bimeda Holdings plc

- Biogénesis Bagó S.A.

- Biovac Ltd.

- Bioveta, a.s.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale SA

- China Animal Husbandry Industry Co., Ltd.

- Elanco Animal Health Incorporated

- Hester Biosciences Limited

- HIPRA Laboratories, S.A.

- Hygieia Biological Laboratories (private company)

- IDT Biologika GmbH

- Indian Immunologicals Limited

- Intervet Inc.

- Jinyu Bio-Technology Co., Ltd.

- KM Biologics Co., Ltd.

- Komipharm International Co., Ltd.

- Kyoritsu Seiyaku Corporation

- Lohmann Animal Health International GmbH & Co. KG

- Merck & Co., Inc.

- Phibro Animal Health Corporation

- Vetoquinol S.A.

- Virbac S.A.

- Zoetis Inc.

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Navigate Regulatory Tariffs and Technological Disruption in Swine Health

Invest in next-generation vaccine platforms, including mRNA and precision adjuvant technologies, to accelerate response times to emerging viral strains and enhance antigenic breadth. Align research pipelines with pathogen surveillance data to prioritize candidate targets and reduce development timelines.

Develop flexible, geographically diversified manufacturing strategies to mitigate exposure to tariff-induced cost pressures and API supply constraints. Establish local partnerships and leverage free trade agreements to secure critical raw materials and maintain consistent production capacity.

Cultivate cross-sector collaborations with research institutes, veterinary associations, and producer networks to co-design immunization programs that address on-farm challenges. Share real-world efficacy data to refine formulation standards and inform regulatory submissions.

Enhance digital and direct-to-farm distribution channels by integrating e-commerce platforms with veterinary clinics and hospitals. Leverage data analytics to optimize packaging formats and delivery schedules, reducing waste and improving cold-chain compliance.

Prioritize comprehensive scenario planning that accounts for evolving trade policies, tariff fluctuations, and the emergence of novel viral variants. Implement adaptive risk management frameworks to safeguard herd immunity initiatives and maintain program continuity.

Detailing the Rigorous Research Methodology Underpinning Insights on Swine Vaccine Market Trends Data Sources and Analytical Frameworks

This analysis synthesizes insights from a rigorous mixed-methodology approach, beginning with exhaustive secondary research across regulatory filings, scientific literature, and industry white papers. Publicly available data from the FAO, EFSA, and AASV were integrated to contextualize disease prevalence and consumption patterns.

Supplementing the secondary findings, primary interviews were conducted with swine veterinarians, production managers, and R&D leaders across key market geographies to capture firsthand perspectives on technology adoption, distribution challenges, and tariff impacts. Responses were systematically coded and triangulated with quantitative data sets.

Data validation protocols included cross-referencing third-party trade statistics, tariff schedules, and patent filings to ensure accuracy and relevance. An iterative review process with subject matter experts was employed to confirm interpretations and refine strategic insights.

Analytical frameworks encompassing PESTLE, SWOT, and Porter’s Five Forces were applied to evaluate external environmental factors, competitive dynamics, and internal organizational capabilities, culminating in actionable recommendations tailored to stakeholder objectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Swine Vaccines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Swine Vaccines Market, by Vaccine Type

- Swine Vaccines Market, by Animal Age

- Swine Vaccines Market, by Route Of Administration

- Swine Vaccines Market, by Packaging Type

- Swine Vaccines Market, by End User

- Swine Vaccines Market, by Disease Type

- Swine Vaccines Market, by Distribution Channel

- Swine Vaccines Market, by Region

- Swine Vaccines Market, by Group

- Swine Vaccines Market, by Country

- United States Swine Vaccines Market

- China Swine Vaccines Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Insights Emphasizing Strategic Priorities for Enhancing Swine Vaccine Effectiveness Market Resilience and Herd Health Outcomes

In summary, the global swine vaccine sector is undergoing profound transformation driven by technological breakthroughs, shifting trade policies, and evolving disease landscapes. Innovative platforms such as mRNA constructs, combination vaccines, and advanced delivery methods are reshaping immunization strategies, while tariff measures and supply chain realignments introduce new complexities for cost management and access.

A nuanced understanding of market segmentation, regional dynamics, and competitive positioning is essential for organizations to capitalize on growth opportunities and maintain resilience. By integrating robust research methodologies, leveraging strategic partnerships, and adopting adaptive risk frameworks, stakeholders can navigate volatility, optimize herd health outcomes, and secure long-term market leadership.

Connect with Ketan Rohom to Secure In-Depth Swine Vaccine Market Insights and Empower Strategic Decision Making

To gain unparalleled visibility into market dynamics, regulatory impacts, and technological breakthroughs in the swine vaccine sector, connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report. Ketan’s expert guidance will help you navigate the complexities of tariffs, segmentation analyses, and regional insights, ensuring you have the actionable intelligence needed to drive strategic decisions. Reach out today to discuss customized pricing, exclusive data packages, and value-added services that align with your organization’s goals and accelerate your path to market leadership.

- How big is the Swine Vaccines Market?

- What is the Swine Vaccines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?