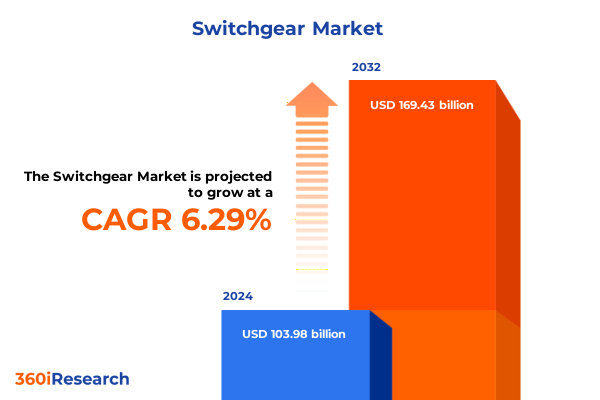

The Switchgear Market size was estimated at USD 110.03 billion in 2025 and expected to reach USD 116.66 billion in 2026, at a CAGR of 6.35% to reach USD 169.43 billion by 2032.

Charting the Evolution of Electrical Distribution Infrastructure Through Advanced Switchgear Innovations and Global Market Dynamics

The dynamic evolution of global power infrastructure hinges on the performance and reliability of switchgear, the cornerstone components that control, protect, and isolate electrical equipment across transmission and distribution networks. As utilities and industrial operators grapple with the twin imperatives of accommodating rapidly rising demand and achieving decarbonization targets, the imperative for modern, intelligent switchgear solutions has never been clearer. Innovations in digital switchgear have unlocked significant operational advantages; ABB’s recent white paper highlights how data-driven devices can generate cost savings of up to 30 percent by enabling continuous condition monitoring and predictive maintenance, thereby minimizing unplanned outages and optimizing resource allocation.

Moreover, the acceleration of grid modernization initiatives is intensifying demand for flexible architectures capable of seamless integration with renewable energy sources and next-generation technologies. Leading manufacturers are investing heavily in research and development, focusing on sensor networks and IoT-enabled platforms that deliver real-time insights into asset health. According to industry analysis, modular, retrofit-friendly monitoring systems are gaining traction in North America and the Middle East, signaling a broader shift toward data-centric maintenance regimes and lifecycle services. Simultaneously, market participants are emphasizing supply chain resilience, as evidenced by ABB’s commitment of $120 million to expand domestic production capacity for low-voltage electrical equipment in Tennessee and Mississippi, a strategic move aimed at mitigating tariff-related risks and pandemic-induced disruptions.

Exploring Pivotal Technological and Regulatory Transformations Redefining the Contemporary Global Switchgear Industry Landscape

The switchgear industry is undergoing profound transformation driven by a confluence of technological breakthroughs and tightened environmental regulations. Digitalization forms the backbone of this shift, with advanced sensors and edge-computing architectures enabling switchgear to evolve from static protective devices into intelligent nodes within a connected grid. At the same time, the industry is mobilizing around SF₆-free technologies in response to stringent regulatory mandates. Effective March 2024, Regulation (EU) 2024/573 established a phased prohibition on SF₆-based switchgear in new medium- and high-voltage applications, compelling manufacturers and utilities to accelerate the development and deployment of alternative insulation methods such as vacuum interrupters, clean air mixtures, and solid dielectric systems.

In parallel, leading original equipment manufacturers are commercializing next-generation SF₆-free products in anticipation of regulatory deadlines. ABB, for example, plans to launch dry air-insulated switchgear for 24 kV and above applications in 2025, maintaining footprint and user interface consistency with its legacy portfolio to facilitate a seamless transition for customers. Beyond Europe, regional authorities in California and New York have begun implementing their own restrictions on SF₆ emissions, underscoring a global momentum toward greener alternatives. As a result, the drive to phase out high-GWP gases is catalyzing innovation, triggering collaborative R&D initiatives and forging new partnerships between switchgear manufacturers, utilities, and technology providers.

Understanding the Comprehensive Effects of United States Trade Tariffs on Switchgear Supply Chains and Market Stability through 2025

Since the initiation of Section 301 tariffs under the Trump administration in 2018, U.S. trade policy has exerted mounting pressure on switchgear supply chains, particularly those reliant on critical components sourced from abroad. In May 2024, the U.S. Trade Representative finalized a series of tariff increases affecting a broad range of electrical and electronic products, with new duties on semiconductors set to rise from 25 percent to 50 percent effective January 1, 2025, alongside elevated rates on battery parts, natural graphite, and other key inputs. These measures build upon earlier phases enacted in September 2024, which raised tariffs to 50 percent on solar cells and 25 percent on steel and aluminum products integral to switchgear enclosures.

The impact of these cumulative tariff actions has been palpable across the power industry. Increased import duties have driven up the cost of transformers and switchgear by substantial margins, intensifying material inflation concerns and exacerbating existing component shortages. A Wall Street Journal analysis shows that domestic supply currently meets only around 20 percent of U.S. transformer demand, and heightened tariffs threaten to further constrain availability and elevate consumer electricity prices. In response, manufacturers have accelerated localization efforts; ABB’s multi-hundred-million-dollar investments in U.S. production facilities aim to achieve over 90 percent domestic output, thereby insulating the company from future tariff uncertainties and reinforcing supply chain resilience. Notably, in May 2025, an executive order temporarily reduced reciprocal tariffs with China, Hong Kong, and Macau to 10 percent for a 90-day period, offering short-term relief even as core Section 301 rates remain intact.

Uncovering Critical Segmentation Dimensions That Drive Product Differentiation and Strategic Insights in the Switchgear Market

Based on product type, the switchgear market offers distinct platforms tailored to diverse application requirements, ranging from air insulated switchgear designed for cost-effective, low-voltage distribution to gas insulated switchgear that delivers compact footprints and superior performance in space-constrained environments. Hybrid switchgear combines the best attributes of both air and gas insulation, while vacuum switchgear provides a reliable, maintenance-free solution for medium-voltage protection systems.

Based on voltage rating, industry participants differentiate offerings across low-voltage assemblies suited for residential and commercial installations, medium-voltage units that underpin industrial and transportation infrastructure, and high-voltage switchgear engineered for utility-scale transmission networks. Each category demands unique engineering approaches to address challenges such as dielectric stress, fault interruption, and environmental robustness.

Based on insulation type, the landscape spans air insulated configurations optimized for simplicity and serviceability, sulfur hexafluoride (SF₆) insulated solutions known for their compact size and high dielectric strength, solid dielectric alternatives that eliminate gas handling requirements, and vacuum insulated systems that leverage vacuum interrupters to achieve maintenance-free switching functionality.

Based on installation type, manufacturers design switchgear to perform reliably whether housed indoors within controlled environments or installed outdoors where equipment must withstand harsh weather, seismic events, and fluctuating thermal conditions. Enclosures, corrosion protection, and thermal management strategies diverge significantly between these deployment scenarios.

Based on application, the spectrum covers commercial switchgear installations in office buildings, retail complexes, and institutional campuses; industrial deployments across chemical and petrochemical plants, manufacturing operations-spanning automotive assembly, food and beverage processing, and metals production-and critical transportation nodes such as airports and railways; and utilities infrastructure, including power generation facilities and transmission and distribution networks that require robust, scalable switchgear platforms to manage grid reliability and resilience.

This comprehensive research report categorizes the Switchgear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insulation Type

- Voltage Rating

- Current Type

- Design Type

- Installation Type

- Application

- Distribution Channel

Illuminating Regional Market Dynamics and Growth Drivers Shaping Switchgear Adoption Across the Americas, EMEA, and Asia-Pacific Regions

In the Americas, the North American grid is undergoing a comprehensive upgrade cycle driven by aging infrastructure, growing renewables integration, and stringent reliability standards. Utilities and industrial consumers are increasingly adopting digital switchgear solutions to support predictive maintenance and dynamic load management. At the same time, Latin American nations are investing in rural electrification and microgrid projects, accelerating demand for compact, modular switchgear platforms capable of operating in remote environments. ABB’s expansion of U.S. manufacturing facilities underscores the region’s focus on strengthening domestic production capabilities and mitigating exposure to import tariffs.

Across Europe, the Middle East, and Africa, regulatory and environmental mandates are primary catalysts for market growth. The European Union’s SF₆ phase-out schedule compels utilities and industrial operators to transition to sustainable insulation technologies, while GCC countries are channeling oil and gas revenues into grid resiliency and smart city initiatives. In Africa, electrification programs targeting underserved populations are driving adoption of medium-voltage switchgear in mini-grids and utility-scale projects. The convergence of regulatory pressure and infrastructure spending is reshaping the regional switchgear landscape, with digitalization and ESG compliance serving as critical competitive differentiators.

In the Asia-Pacific region, China and India dominate market dynamics through massive infrastructure investments and ambitious renewable energy targets. China’s State Grid Corporation and China Southern Power Grid collectively invested over CNY 600 billion in power infrastructure in 2023, fueling substantial procurement of medium- and high-voltage switchgear for ultra-high-voltage and smart grid deployments. India’s Power for All initiative, along with policies like DDUGJY and Saubhagya, has extended reliable electricity access to nearly the entire population and is now focused on integrating solar and wind capacity, driving significant demand for advanced switchgear solutions. Domestic firms like BHEL, Crompton Greaves, and Havells, alongside international players, are vying for leadership positions through strategic partnerships and localized manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Switchgear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Switchgear Manufacturers and Their Strategic Initiatives Shaping Technological Advancements and Competitive Advantage

ABB continues to forge its position as a market leader through a dual approach of digital product innovation and localized production. Its ABB Ability™ platform extends digital switchgear capabilities, enabling customers to harness real-time operational data for predictive maintenance and asset optimization. Concurrently, ABB has allocated over $120 million toward expanding manufacturing operations in Tennessee and Mississippi to fortify U.S. supply chain resilience and circumnavigate tariff-related risks.

Siemens has similarly intensified focus on both product and production prowess. The company’s $108 million investment in its Frankfurt gas-insulated switchgear plant will boost capacity for its GI Switchgear lines, creating up to 400 new jobs by 2027 and aligning output with burgeoning demand for compact, high-voltage solutions in European and global markets. On the technology front, Siemens Sensgear and Sensformer condition monitoring systems showcase modular, retrofit-friendly designs tailored for existing assets, reinforcing Siemens’ strategy to deliver holistic digital services alongside core hardware offerings.

Schneider Electric has leveraged its EcoStruxure architecture to integrate switchgear condition monitoring with comprehensive energy management and automation solutions. By emphasizing open, interoperable platforms and AI-driven analytics, Schneider is deepening its footprint within industrial and commercial sectors seeking end-to-end operational intelligence. Partnerships with original equipment manufacturers and digital service providers have extended the reach of EcoStruxure-enabled switchgear, positioning Schneider as a versatile ecosystem provider focused on sustainability and cybersecurity safeguards.

Eaton’s strategic investments reflect a targeted approach to medium-voltage switchgear diagnostics, offering predictive analytics tools that proactively identify potential failure modes. By embedding edge computing capabilities within its Xiria and Pow-R-Line series, Eaton delivers actionable insights to field technicians and asset managers, reducing service disruptions and extending equipment lifecycles.

GE Vernova’s recent $16 million investment in Indian manufacturing underscores its commitment to localizing production for critical grid technologies, including HVDC and FACTS components. This strategic move bolsters India’s grid modernization agenda while reinforcing GE Vernova’s global supply chain agility. Meanwhile, Hitachi Energy is integrating digital substation solutions with its stationary switchgear portfolio, emphasizing cybersecurity and lifecycle service offerings as key differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Switchgear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bharat Heavy Electricals Limited

- CG Power and Industrial Solutions

- Chint Group

- Delixi Electric

- Eaton Corporation PLC

- Fuji Electric Co., Ltd.

- G&W Electric

- General Electric Company

- Ghorit Electrical Co., Ltd.

- Havells India Limited

- Hitachi Energy Ltd.

- IAG Automation Pvt. Ltd.

- Kraus & Naimer Group

- L&R Electric Group

- Lauritz Knudsen Electrical & Automation

- Legrand SA

- Lucy Electric

- Meidensha Corporation

- Mitsubishi Electric Corporation

- Orecco Electric

- Powell Industries Inc.

- RESA Power

- Schneider Electric SE

- Siemens AG

- Spike Electric Controls

- Switchgear Company NV

- Toshiba Corporation

- WEG S.A.

Implementing Strategic Measures for Industry Leaders to Navigate Supply Chain, Regulatory Shifts, and Technological Disruptions in Switchgear

Industry leaders must prioritize digital transformation as the foundation for future competitiveness. By embedding advanced sensors and adopting cloud-based analytics platforms, companies can transition from scheduled maintenance regimes to condition-based strategies, significantly reducing unplanned downtime and optimizing operational expenditures. In parallel, collaboration with technology providers and utilities to develop interoperable, open-architecture solutions will be crucial to meeting diverse customer needs and ensuring seamless integration across multivendor environments.

To mitigate the ongoing impact of trade policy volatility, businesses should diversify their supplier base and reevaluate global sourcing strategies. Establishing agile manufacturing footprints in tariff-exposed markets will not only shield against duty fluctuations but also enhance responsiveness to shifting demand patterns. Companies can leverage available exclusion processes and engage with trade authorities to secure temporary relief for critical machinery, as underscored by recent USTR initiatives aimed at excluding eligible subheadings under Chapters 84 and 85 of the HTSUS.

As regulatory pressure intensifies around SF₆ phase-out, early pilot projects with SF₆-free switchgear alternatives will yield valuable insights into operational performance and lifecycle costs. Engaging with regulatory bodies and participating in standard-setting organizations can help shape practical timelines for compliance, ensuring a balanced transition that aligns environmental objectives with reliability requirements. Investment in workforce training and third-party certification for new insulation technologies will further facilitate market adoption and mitigate project delays.

Strategic partnerships with utilities and large end-users will be instrumental in co-developing integrated service models that combine hardware, software, and expert consultation. Offering subscription-based maintenance agreements or outcome-based performance contracts can differentiate value propositions and foster long-term customer relationships. By aligning product roadmaps with emerging demands for cybersecurity, grid resilience, and energy management, industry incumbents and newcomers alike can secure a competitive edge in a rapidly evolving marketplace.

Detailing the Rigorous Research Methodology Ensuring Robustness, Reliability, and Relevance in Switchgear Market Analysis

This analysis employs a comprehensive, multi-stage research methodology to ensure robust and reliable insights. Primary research involved in-depth interviews with C-level executives, engineering leads, and procurement specialists across utilities, industrial end-users, and original equipment manufacturers. These qualitative inputs were complemented by quantitative data collection through surveys targeting switchgear operators and service providers in key geographic markets.

Secondary research encompassed a systematic review of industry publications, regulatory filings, patent databases, and corporate financial reports. Regulatory frameworks and policy developments, including Section 301 tariffs and SF₆ phase-out schedules, were examined through official government documents and authoritative legal analyses to ensure accuracy.

Data triangulation techniques were applied to validate findings, cross-referencing market intelligence from multiple sources and adjusting for regional variances. Segmentation criteria were rigorously defined based on product type, voltage rating, insulation medium, installation environment, and end-use application to facilitate granular analysis. Regional assessments incorporated macroeconomic indicators, infrastructure investment data, and energy transition policies.

Finally, a peer-review process involving industry experts and academic advisors was conducted to refine interpretations, challenge assumptions, and confirm the practical relevance of actionable recommendations for stakeholders in the switchgear ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Switchgear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Switchgear Market, by Insulation Type

- Switchgear Market, by Voltage Rating

- Switchgear Market, by Current Type

- Switchgear Market, by Design Type

- Switchgear Market, by Installation Type

- Switchgear Market, by Application

- Switchgear Market, by Distribution Channel

- Switchgear Market, by Region

- Switchgear Market, by Group

- Switchgear Market, by Country

- United States Switchgear Market

- China Switchgear Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Key Learnings and Converging Trends Guiding Stakeholders Toward Informed Decisions in the Switchgear Domain

The culmination of transformative trends-from digitalization and decarbonization to trade policy dynamics-underscores the critical role of adaptive strategies in the switchgear sector. Stakeholders must embrace intelligent, data-driven technologies to unlock operational efficiencies and meet evolving grid demands. Concurrently, navigating regulatory shifts around SF₆ phase-out and trade tariffs will require proactive engagement and strategic investments in diverse manufacturing footprints.

Regional market variations highlight the importance of tailoring approaches to local priorities: the Americas focus on reliability and localization, EMEA on sustainability compliance, and Asia-Pacific on rapid infrastructure expansion. Leading manufacturers are already differentiating through integrated ecosystems, condition monitoring solutions, and SF₆-free platforms, setting benchmarks for the next generation of switchgear offerings.

As the industry charts its path forward, collaboration across value chains-spanning utilities, equipment suppliers, and policymakers-will be indispensable. By aligning innovation agendas with overarching objectives of environmental stewardship, grid resilience, and cost optimization, companies can secure competitive advantage and contribute to a more sustainable and reliable global power system.

Seize the Opportunity to Gain In-Depth Switchgear Market Intelligence with Expert-Led Research from Our Associate Director, Sales and Marketing

Ready to harness unparalleled market intelligence and strategic foresight for your organization’s next phase of growth? Connect with Ketan Rohom, an experienced Associate Director of Sales & Marketing, to secure your comprehensive switchgear market research report. Ketan’s expertise ensures you receive tailored insights that align with your strategic objectives and operational priorities. Benefit from in-depth analysis covering technology trends, regulatory impacts, supply chain considerations, and competitive strategies-all designed to empower your decision-making.

Don’t miss the opportunity to equip your leadership team with the critical data and actionable guidance needed to outperform in a rapidly evolving landscape. Reach out to Ketan today to discuss your research needs and explore exclusive options for customized deliverables. Take the next step toward confident, data-driven decisions-contact Ketan Rohom to purchase the definitive switchgear market research report and transform your strategic planning.

- How big is the Switchgear Market?

- What is the Switchgear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?