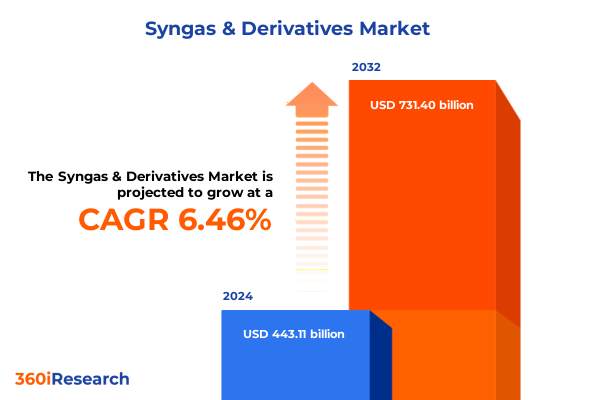

The Syngas & Derivatives Market size was estimated at USD 465.38 billion in 2025 and expected to reach USD 488.78 billion in 2026, at a CAGR of 6.67% to reach USD 731.40 billion by 2032.

Setting the Stage for Syngas and Derivatives Market Evolution Reflecting Strategic Drivers and Emerging Dynamics Across Global Value Chains

As global energy and chemical sectors intensify their focus on sustainable and flexible feedstocks, syngas and its downstream derivatives have emerged as pivotal components in the transition toward low-carbon economies. The ability of syngas to serve as a building block for ammonia, hydrogen, methanol, Fischer-Tropsch fuels, and electricity generation underscores its strategic importance. In this context, organizations increasingly view syngas pathways as enablers of circular carbon economies, leveraging biomass residues, waste materials, natural gas, coal, and petroleum coke to meet diverse market demands.

The convergence of environmental regulations, decarbonization targets, and evolving consumer preferences has accelerated investment in advanced gasification and reforming technologies. Entrained flow, fixed bed, and fluidized bed gasifiers now operate alongside autothermal reformers, partial oxidation units, and steam methane reformers to optimize yield, energy efficiency, and carbon capture integration. As a result, industry stakeholders from chemical manufacturers to power utilities and transportation fuel producers are realigning their strategic roadmaps to harness syngas versatility.

This executive summary distills core market dynamics, tariff implications, segmentation insights, regional variations, and competitive landscapes. By examining recent shifts and identifying actionable pathways, this analysis equips leaders with the context and foresight needed to navigate the complexities of syngas derivatives markets and drive long-term value creation.

Unveiling the Pivotal Transformative Shifts Reshaping Syngas Production Technologies and Value Chain Integration in an Era of Sustainability and Innovation

Over the past several years, transformative shifts have redefined the syngas value chain, pushing operators and investors to embrace innovative technologies and collaborative models. The integration of carbon capture, utilization, and storage within gasification and reforming facilities has emerged as a critical lever for decarbonization, enabling negative emission pathways when coupled with biomass feedstocks. Concurrently, digitalization and advanced analytics are optimizing reactor performance, reducing downtime, and enhancing operational flexibility across diverse feedstock inputs.

Investment flows have pivoted toward modular and scalable plant designs that can adapt to fluctuating feedstock availabilities and evolving regulatory frameworks. This agility empowers project developers to pursue projects in both emerging and established markets, balancing unit economics with environmental objectives. Partnerships between technology licensors, engineering firms, and feedstock suppliers have grown more strategic, ensuring that offtake agreements and project financing align with sustainability benchmarks and long-term policy incentives.

In parallel, the rise of green hydrogen initiatives and renewable power integration has catalyzed new pathways for electrolytic syngas production, particularly in regions with abundant wind and solar resources. As cross-sector collaboration intensifies, stakeholders are exploring hybrid supply chains that blend traditional gasification outputs with renewable hydrogen streams, further diversifying product portfolios and unlocking novel applications in chemicals, fuels, and power generation.

Assessing the Cumulative Impact of United States Tariff Measures Enacted in 2025 on Trade Dynamics Competitiveness and Supply Chain Resilience within Syngas Derivatives

In 2025, the United States implemented a series of tariff measures targeting imported syngas derivatives and feedstock components to protect domestic producers and incentivize local investments. These measures include ad valorem duties on ammonia and methanol imports and specific tariffs on technologies and catalyst precursors sourced from key exporting regions. The cumulative impact has manifested in near-term cost increases for non-domestic suppliers, prompting buyers to reevaluate sourcing strategies and, in some cases, accelerate local project development.

Domestic producers have leveraged tariff protections to negotiate more favorable offtake agreements and secure long-term contracts at stabilized price points. Simultaneously, licensors and engineering firms have reported increased engagement from U.S.-based clients seeking to lock in domestic technology licenses and EPC services. However, end users reliant on global supply chains, such as fertilizer manufacturers and certain chemical intermediates producers, have faced margin pressures as tariff pass-through has elevated input costs.

Beyond direct cost implications, the tariff landscape has influenced strategic partnerships and cross-border investments. International stakeholders are exploring joint ventures with U.S. entities to mitigate duties, while domestic companies are assessing expansion opportunities abroad to diversify market exposure. These shifts underscore the multifaceted repercussions of tariff policy on competitiveness, supply chain resilience, and capital allocation across the syngas derivatives space.

Deriving Key Segmentation Insights by Derivatives Feedstocks Technologies and End Use Industries Driving Strategic Positioning and Investment Priorities

The syngas and derivatives market can be understood through multiple lenses that together shape its competitive dynamics and investment priorities. Derivative categories such as ammonia, electricity, Fischer-Tropsch fuels, hydrogen, and methanol each present unique economic drivers, regulatory considerations, and application end markets. Within the feedstock dimension, the utilization of biomass and waste streams offers a pathway to circularity, while coal and natural gas remain foundational sources that underscore scale and reliability. Petroleum coke continues to play a niche role where refinery integrations and cost arbitrage drive localized opportunities.

Technology selection further refines market positioning, with gasification processes-encompassing entrained flow, fixed bed, and fluidized bed configurations-offering flexibility across feedstock types and scales. Conversely, reforming approaches such as autothermal reforming, partial oxidation, and steam methane reforming deliver optimized hydrogen-lean or hydrogen-rich syngas streams suited to specific derivative pathways and integration scenarios. This technological diversity enables project developers to match plant designs with feedstock availability, desired product slate, and carbon intensity targets.

End use industries, spanning chemicals, fertilizers, power generation, and transportation, compete for syngas derivatives according to volumetric demand, regulatory mandates, and final product specifications. Chemical producers prioritize high-purity syngas for specialty intermediates and solvents, whereas the fertilizer sector focuses on ammonia yield and feedstock cost efficiency. Power generators assess electricity‐grade syngas applications alongside carbon capture viability, and transportation stakeholders evaluate Fischer-Tropsch fuels and green hydrogen for decarbonization compliance and fuel quality standards.

This comprehensive research report categorizes the Syngas & Derivatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Derivative

- Feedstock

- Technology

- End Use Industry

Discerning Key Regional Insights into Syngas and Derivatives Market Trajectories across Americas Europe Middle East Africa and AsiaPacific Landscapes

Geographically, the syngas and derivatives market exhibits distinct characteristics and growth trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In the Americas, strong shale gas resources and mature petrochemical value chains have cemented natural gas reforming as a dominant pathway, while the United States’ policy support for clean hydrogen and carbon capture projects has expanded interest in both reforming and gasification solutions. Latin American markets are increasingly exploring biomass gasification to valorize agricultural residues and support rural economic development.

Europe, the Middle East, and Africa present a mosaic of regulatory drivers and feedstock endowments. European mandates on carbon neutrality and incentives for green ammonia have spurred investments in renewable‐syngas facilities and electrolytic integration. Gulf Cooperation Council nations leverage their hydrocarbon revenues to pilot large-scale gasification plants with carbon capture and storage, positioning themselves as future exporters of low-carbon derivatives. In Africa, feedstock availability and off-grid power needs have catalyzed small to mid-scale biomass gasification deployments and hybrid reforming projects.

Asia-Pacific remains a powerhouse for syngas derivatives, underpinned by vast coal reserves, emerging green hydrogen policies, and industrial decarbonization targets. China’s aggressive capacity expansions in methanol and ammonia are driving gasification growth, while India’s focus on energy security has accelerated natural gas reforming projects. Southeast Asian markets are experimenting with pilot renewable syngas concepts to supplement conventional pipeline gas and support fertilizer self-sufficiency.

This comprehensive research report examines key regions that drive the evolution of the Syngas & Derivatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Insights with Strategic Profiles Innovations Collaborations and Competitive Positioning Shaping the Syngas Derivatives Ecosystem

Leading participants in the syngas and derivatives ecosystem differentiate themselves through strategic technology portfolios, integrated project pipelines, and collaborative partnerships. Major licensors of gasification and reforming technologies continuously refine reactor designs to enhance feedstock flexibility, energy efficiency, and carbon capture compatibility, thereby reinforcing their leadership positions. EPC firms differentiate by offering end-to-end solutions that encompass front-end engineering, catalyst supply, and integrated automation packages, enabling streamlined project execution.

Feedstock suppliers and offtakers are forging long-term agreements that align feedstock sourcing with volume demands and sustainability criteria, fostering greater certainty for project financiers. Chemical and fertilizer majors are investing in joint ventures to secure upstream syngas supply, while energy and utility companies are positioning themselves as pivotal enablers of low-carbon syngas by co-developing carbon capture and renewable hydrogen facilities. Emerging technology developers are forging alliances with established players to pilot advanced reforming catalysts and membrane reactors that promise incremental performance gains.

Competitive positioning is further influenced by geographic footprints and policy alignments. Companies with established presence in policy-supportive regions are better positioned to capitalize on emerging incentives, whereas those expanding into developing markets must demonstrate adaptability to local feedstock conditions and regulatory landscapes. Cross-sector collaborations, including with agricultural, waste management, and renewable energy stakeholders, are expanding the ecosystem boundary and creating new pathways for syngas derivatives deployment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Syngas & Derivatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide SA

- Air Products and Chemicals, Inc.

- China Petroleum & Chemical Corporation

- China Shenhua Energy Company Limited

- Eastman Chemical Company

- Exxon Mobil Corporation

- INEOS Group Limited

- Linde plc

- Methanex Corporation

- Mitsubishi Heavy Industries, Ltd.

- Sasol Limited

- Shell plc

Formulating Actionable Recommendations Empowering Industry Leaders to Leverage Technological Advancements Policy Developments and Market Collaborations for Sustainable Growth

Industry leaders should prioritize integration of carbon capture and hydrogen co-production within both gasification and reforming projects to align with evolving decarbonization mandates. By embedding capture technologies at the design phase, developers can optimize capital deployment and secure access to incentives, while securing long-term offtake arrangements for captured CO₂ enhances project bankability. Simultaneously, investing in modular and skid-mounted plant architectures will facilitate faster project timelines and reduce exposure to construction cost volatility.

Collaboration across the value chain remains critical; stakeholders are encouraged to form consortiums that bring together licensors, feedstock providers, financiers, and end users to share risks and pool expertise. Engaging early with regulators to shape supportive policy frameworks and streamline permitting processes will further de-risk projects and accelerate deployment. Moreover, establishing strategic partnerships with technology startups can provide access to next-generation reforming catalysts, advanced membrane reactors, and digital twins for predictive operations.

To navigate tariff landscapes, companies should evaluate local manufacturing options for critical equipment and explore joint ventures with domestic players to mitigate import duties. Concurrently, pursuing geographic diversification and flexible sourcing agreements will bolster supply chain resilience. Finally, fostering talent development in process engineering, project finance, and digital operations will sustain long-term competitiveness and position organizations to capitalize on emerging syngas derivative applications.

Outlining Rigorous Research Methodology Employed in Analyzing Syngas Derivatives Market Dynamics Ensuring Data Integrity Validity and Comprehensive Analytical Rigor

This analysis employed a multi-tiered research methodology combining primary and secondary data collection with rigorous validation protocols. Primary research included in-depth interviews with industry executives, technology licensors, EPC providers, feedstock suppliers, and end users to capture firsthand perspectives on strategic priorities, technology adoption, and policy influences. Secondary research encompassed review of industry publications, patent filings, regulatory frameworks, and white papers to contextualize market trends and identify emerging innovations.

Data triangulation ensured that insights were corroborated across multiple sources, while expert panel consultations provided additional validation and nuanced interpretation of regional and segment-specific dynamics. A technology benchmarking process assessed performance metrics such as feedstock flexibility, carbon intensity, energy efficiency, and integration potential with carbon capture and renewable hydrogen. Regulatory analysis mapped incentive structures, tariff schedules, and permitting requirements across key jurisdictions to elucidate policy impacts on project economics.

Quantitative analysis focused on trend mapping and comparative assessments rather than market sizing, enabling a clear delineation of growth vectors and strategic inflection points. The research team applied scenario modeling to explore alternative policy and technology development pathways, highlighting potential risk factors and mitigation strategies. Throughout, emphasis was placed on maintaining data integrity, methodological transparency, and reproducibility of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Syngas & Derivatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Syngas & Derivatives Market, by Derivative

- Syngas & Derivatives Market, by Feedstock

- Syngas & Derivatives Market, by Technology

- Syngas & Derivatives Market, by End Use Industry

- Syngas & Derivatives Market, by Region

- Syngas & Derivatives Market, by Group

- Syngas & Derivatives Market, by Country

- United States Syngas & Derivatives Market

- China Syngas & Derivatives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Drawing Conclusive Perspectives on Syngas and Derivatives Market Outlook to Inform Strategic Decisions Foster Technological Adoption and Navigate Regulatory Landscapes Effectively

This executive summary underscores the pivotal role of syngas and its derivatives in bridging today’s energy landscape with tomorrow’s low-carbon future. By unpacking transformative shifts in technology, the cumulative impact of tariff policies, granular segmentation insights, and region-specific dynamics, stakeholders can better align strategies with emerging opportunities and risks. The competitive landscape reveals a convergence of traditional and innovative players, each leveraging partnerships, modular plant designs, and advanced analytics to secure market positioning.

Looking forward, the integration of carbon capture and renewable hydrogen, coupled with digital optimization, will define the next wave of project competitiveness. Tariff environments will continue to influence sourcing and investment decisions, reinforcing the importance of geographic diversification and collaborative ventures. Regional policy frameworks and feedstock endowments will shape project viability, demanding nuanced approaches tailored to local conditions.

Ultimately, the ability to anticipate policy shifts, adopt best-in-class technologies, and forge resilient partnerships will determine success in the rapidly evolving syngas derivatives domain. This analysis provides a holistic perspective, equipping decision-makers with the insights needed to navigate complexity, seize growth avenues, and champion sustainable solutions in the global energy and chemical sectors.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure Comprehensive Syngas Derivatives Market Research Report for Unparalleled Strategic Insights

To access the full breadth of insights contained in this comprehensive syngas and derivatives market research report, we invite you to reach out directly to Ketan Rohom, Associate Director, Sales and Marketing. By engaging with Ketan, you will gain clarity on specific report components, customize data packages to suit your strategic objectives, and explore partnership opportunities for tailored analysis. His expertise in connecting leading energy and chemical industry stakeholders with actionable intelligence ensures you receive the most relevant and timely information.

Securing this report empowers your organization with a competitive edge through deep understanding of derivative trends, tariff impacts, regional nuances, and technology trajectories. Whether you seek to refine investment strategies, optimize supply chain resilience, or accelerate sustainable innovations, Ketan will guide you through the acquisition process, pricing options, and ongoing support.

Contacting Ketan not only grants immediate access to critical market findings but also establishes a direct line for follow-on inquiries, bespoke consulting, and future updates. Reach out today to equip your leadership team with unparalleled strategic insights and pave the way for informed decision-making in the rapidly evolving syngas and derivatives landscape

- How big is the Syngas & Derivatives Market?

- What is the Syngas & Derivatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?