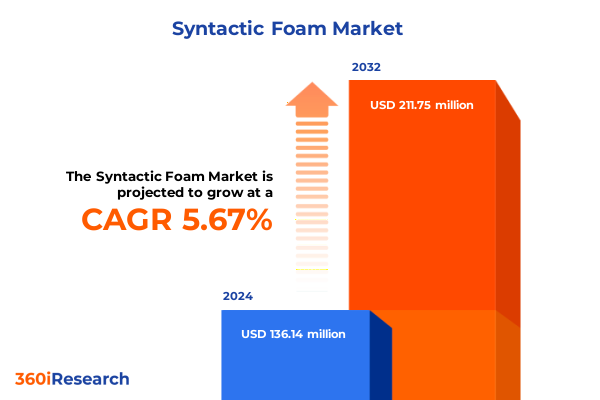

The Syntactic Foam Market size was estimated at USD 143.34 million in 2025 and expected to reach USD 151.18 million in 2026, at a CAGR of 5.73% to reach USD 211.75 million by 2032.

Exploring the foundational principles the diverse innovation pathways and strategic role of syntactic foam in engineering sectors shaping next generation materials

Syntactic foam represents a strategic class of engineered composites characterized by the incorporation of hollow microspheres within a polymer, ceramic, or metallic matrix. The unique structure of these materials delivers exceptional mechanical strength combined with reduced density, rendering them indispensable in sectors where lightweight durability and performance under extreme conditions are nonnegotiable. Originally developed for deep-sea buoyancy applications, syntactic foam has evolved through decades of material science advances to become a cornerstone of innovation in aerospace, defense, automotive, and offshore engineering.

The core principle of syntactic foam hinges on the distribution of rigid, hollow spheres-ranging from ceramic to glass or polymeric compositions-within a continuous matrix. This arrangement grants the composite remarkable resistance to compression and fatigue, while enabling designers to fine-tune density parameters for targeted applications. In recent years, research has expanded into multifunctional hybrids that combine thermal insulation and vibration damping properties, thus further broadening potential use cases.

Today’s engineering challenges demand materials that can satisfy stringent performance criteria while adhering to sustainability mandates. As international standards push for lower carbon footprints and increased recyclability, syntactic foam developers are exploring bio-based polymers and novel microsphere chemistries. Consequently, this material class is positioned as a pivotal enabler for next-generation lightweight structures that reduce energy consumption without compromising strength or reliability.

Analyzing the pivotal shifts redefining the syntactic foam landscape as emerging technologies regulatory reforms and sustainability priorities converge to reshape the industry

The syntactic foam industry is undergoing transformative shifts driven by converging technological breakthroughs and heightened sustainability imperatives. Advances in microsphere fabrication now allow for uniform wall thickness control at the micro- and nanoscale, which significantly enhances mechanical consistency across large composite volumes. Coupled with computational modeling techniques such as finite element analysis and digital twin technology, manufacturers can predict material performance under complex load conditions, accelerating development cycles and reducing prototyping costs.

Regulatory forces also play a central role in redefining market dynamics. Emission reduction targets and lightweighting mandates in the automotive and aerospace sectors compel engineers to replace traditional metals with high-performance syntactic foams. Moreover, certifications for offshore oil and gas applications now stipulate stringent fire, smoke, and toxicity thresholds, prompting material innovators to integrate non-halogenated flame retardants within resin systems. This regulatory rigor has elevated quality benchmarks while fostering closer collaboration between material suppliers and certifying bodies.

In parallel, sustainability considerations are reshaping value chains. Producers are exploring the use of recycled glass microspheres and biopolymer matrices to mitigate environmental impact. Supply chain digitization-through blockchain-enabled traceability-further ensures material provenance and compliance. As these transformative shifts coalesce, stakeholders must adapt to a landscape where innovation speed, regulatory alignment, and ecological responsibility determine competitive advantage.

Understanding the cumulative ripple effects of recent United States tariffs on syntactic foam supply chains pricing structures and market competitive dynamics

A new wave of United States tariffs on imported microspheres and composite precursors, enacted in early 2025, has created a ripple effect across the syntactic foam ecosystem. By imposing incremental duties on key raw materials primarily sourced from leading exporters, these measures have elevated input costs and compelled manufacturers to reevaluate supply chain architectures. The result is a dual focus on nearshoring strategies and long-term supplier diversification to mitigate exposure to fluctuating trade policies.

As procurement teams absorb higher landed costs, pricing structures for finished foam products have experienced upward pressure, translating into tighter margins for downstream fabricators and OEMs. To counterbalance this, several domestic producers have accelerated capacity expansion plans, investing in specialized microsphere production lines and strategic partnerships with polymer suppliers. Concurrently, importers are exploring preferential trade agreements within allied regions to secure duty-free access for alternative feedstocks.

These tariff-driven dynamics also influence end-user adoption timelines. Industries with high regulatory oversight, such as aerospace and defense, have maintained continuity through existing contracts but are now emphasizing lifecycle cost assessments when qualifying new foam formulations. Conversely, sectors with shorter procurement cycles, including sports and leisure or consumer marine applications, are gravitating toward lower-cost substitutes or hybrid solutions. As the cumulative impact of these tariffs continues to unfold, stakeholders must remain agile, balancing cost pressures against performance requirements in a climate of evolving trade barriers.

Key segmentation insights revealing how product material density production methods application focus and distribution channel choices inform strategic decisions for informed market positioning

Segmenting the syntactic foam landscape reveals nuanced market behaviors informed by distinct product architecture variations. Single-phase composites dominate applications requiring uniform mechanical responses, whereas two-phase and three-phase structures-featuring graded density profiles-address multi-functional demands such as combined load bearing and thermal insulation. By assessing these product types, strategic decisions emerge that align composite design with application performance criteria.

Material selection further differentiates value propositions. Ceramic microspheres deliver exceptional thermal stability and compressive strength for deep subsea or high-temperature scenarios, while glass microspheres balance cost efficiency with dimensional stability. Polymeric microspheres introduce flexibility and impact resilience, making them suitable for vibration damping and acoustic insulation roles. Choosing between these material types allows stakeholders to optimize performance against environmental constraints and budgetary parameters.

Density classifications-ranging from low to high-serve as critical levers for engineers. Low-density formulations excel in buoyancy-dependent applications, whereas medium-density grades offer a compromise of strength and weight for automotive and structural reinforcement needs. High-density variants, though heavier, are preferred in environments demanding maximum compressive resistance. This diversity in density underpins product differentiation strategies.

Production processes also hold strategic importance. Compression molding yields precise control over microsphere distribution, injection molding supports complex geometries, and extrusion molding offers cost-effective throughput. Application focuses span aerospace and defense, automotive, construction, marine, and sports and leisure, each demanding a tailored synthesis of material, density, and process. Additionally, end-use benefits manifest in acoustic insulation, buoyancy material, structural reinforcement, thermal insulation, and vibration damping. Distribution channels, split between traditional offline sales and digital storefronts-including proprietary brand websites and major e-commerce platforms-complete the segmentation framework, underscoring the need for an integrated go-to-market approach that leverages insights across all dimensions.

This comprehensive research report categorizes the Syntactic Foam market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Matrix Material

- Microballoon Type

- Density Class

- Form Factor

- Application

- Application

- Distribution Channel

Revealing regional growth narratives by examining Americas Europe Middle East Africa and Asia Pacific dynamics shaping syntactic foam adoption and competitive landscapes

Regional trends across the Americas demonstrate a strong emphasis on advanced manufacturing capabilities and innovation ecosystems. In North America, a surge in defense and space programs has underpinned demand for ultra-lightweight syntactic foams, while Latin American infrastructure projects focused on offshore exploration have driven regional composites consumption. Collaborative initiatives between OEMs and academic institutions have further catalyzed the development of next-generation microsphere technologies.

In the Europe Middle East and Africa region, stringent environmental regulations and energy diversification efforts shape market dynamics. European Union mandates on sustainable materials have accelerated the adoption of bio-based resin systems and recycled microspheres. Meanwhile, Middle East energy hubs continue to prioritize corrosion-resistant syntactic foams for subsea pipelines and floating production storage facilities. African markets, though nascent, present growth potential as coastal infrastructure and resource exploration activities ramp up.

Asia Pacific remains a critical growth engine driven by rapid industrialization and regional supply chain integration. China’s expansive composites manufacturing base benefits from government subsidies aimed at reducing import reliance, while Japan and South Korea lead in precision microsphere production for electronics and automotive sectors. Emerging economies such as India, Vietnam, and Thailand are beginning to embrace syntactic foam solutions for coastal engineering and renewable energy applications. Across the region, tariff policies and bilateral trade agreements continue to inform sourcing strategies, presenting both opportunities and challenges for global market participants.

This comprehensive research report examines key regions that drive the evolution of the Syntactic Foam market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating strategic moves competitive positioning and innovation drivers among leading companies shaping the global syntactic foam industry

Leading players in the syntactic foam industry are differentiating through targeted investments in research and strategic partnerships. One global conglomerate has expanded its microsphere R&D center to develop hybrid ceramic-polymer spheres that deliver enhanced toughness under cyclic loading. Another industry stalwart has pursued joint ventures with regional resin producers to secure stable, cost-effective supply chains in the Asia Pacific.

Mergers and acquisitions have also featured prominently as companies seek to bolster their end-to-end capabilities. A recent acquisition of a high-precision molding specialist by a composites solutions provider underscores the drive toward integrated manufacturing networks. Simultaneously, cross-sector collaborations unite material innovators with OEM design teams, enabling co-development of application-specific syntactic foam architectures for automotive lightweighting and marine buoyancy modules.

Open innovation models are gaining traction, with select firms hosting consortiums that include academic researchers, end-users, and certification bodies. These collaborative platforms accelerate validation processes for new microsphere chemistries and resin formulations, reducing time to market. Investments in digital tools-such as predictive analytics for supply chain optimization and real-time quality monitoring-further strengthen competitive positioning by enabling proactive risk mitigation and cost control.

This comprehensive research report delivers an in-depth overview of the principal market players in the Syntactic Foam market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acoustic Polymers Ltd.

- Advanced Innergy Solutions Limited

- Akzo Nobel N.V.

- ALCEN TECHNOLOGIES PRIVATE LIMITED

- Balmoral Comtec Ltd.

- Beihai Composite Materials Co., Ltd.

- China Beihai Fiberglass Co.,Ltd.

- CMT Materials LLC

- DeepWater Buoyancy, Inc.

- Diab Group AB

- Engineered Syntactic Systems, LLC

- ESCO Technologies Inc.

- Float X

- Hexcel Corporation

- Huntsman Corporation

- Key Polymer

- Matrix Composites & Engineering

- Mica-Tron Products Corp.

- Nuclead Manufacturing Co. Inc.

- Oriental Ocean Tech.

- Parker-Hannifin Corporation

- PPG Industries, Inc.

- Precision Acoustics Ltd.

- Qingdao Doowin Marine Engineering Co., Ltd

- Resinex Trading S.r.l.

- SynFoam LG by of UDC

- Taizhou Cbm-future New Materials S&T Co.,Ltd.

- Tooling Tech Group

- Toray Industries, Inc.

- Trelleborg AB

Delivering actionable strategic recommendations for industry leaders to harness innovation optimize supply chains and strengthen competitive positioning in syntactic foam markets

Industry leaders should prioritize a multifaceted innovation agenda that balances material performance with sustainability objectives. By integrating bio-derived matrix resins and recycled microspheres into product lines, organizations can meet evolving environmental standards while differentiating offerings in price-sensitive segments. Collaborating with suppliers on co-innovation projects will accelerate the development of next-generation composites that address both thermal and mechanical performance targets.

Supply chain resilience is critical in the face of trade policy uncertainties and raw material constraints. Companies are advised to diversify sourcing channels by establishing alternative partnerships across allied regions and nearshore locations. Embracing digital procurement platforms and real-time inventory analytics will further enhance agility, reducing lead times and mitigating the impact of tariff fluctuations.

To capture emerging applications, stakeholders should cultivate deeper engagement with key end-users in aerospace automotive marine and construction sectors. Offering joint testing programs and design-for-manufacturing workshops can solidify customer relationships and generate early insights into future performance requirements. Finally, embedding advanced data analytics and machine learning algorithms into quality control and production planning will unlock efficiency gains, ensuring competitiveness in a dynamically evolving market.

Detailing the comprehensive research methodology integrating qualitative and quantitative approaches to underpin robust analysis of syntactic foam markets

This research integrates a balanced blend of primary and secondary methodologies to ensure rigorous, actionable insights. Primary data collection involved structured interviews with materials scientists procurement executives and end-use OEM engineers, enabling first-hand perspectives on performance requirements and supply chain challenges. In parallel, surveys targeting industry associations and fabrication specialists provided quantitative validation of emerging trends and adoption timelines.

Secondary sources included peer-reviewed journals on composite materials advanced engineering reports and publicly available regulatory filings. Trade association publications and patent databases were systematically reviewed to map innovation trajectories and identify intellectual property developments. All secondary findings were cross-referenced against primary insights to maintain analytical integrity.

Data triangulation underpinned the analytical framework, ensuring consistency across diverse input streams. Statistical techniques, including regression analysis and cluster mapping, were employed to uncover relationships between material properties application performance and pricing dynamics. Quality control measures such as peer review and stakeholder workshops further validated conclusions, guaranteeing that strategic recommendations are grounded in robust evidence and reflective of current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Syntactic Foam market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Syntactic Foam Market, by Matrix Material

- Syntactic Foam Market, by Microballoon Type

- Syntactic Foam Market, by Density Class

- Syntactic Foam Market, by Form Factor

- Syntactic Foam Market, by Application

- Syntactic Foam Market, by Application

- Syntactic Foam Market, by Distribution Channel

- Syntactic Foam Market, by Region

- Syntactic Foam Market, by Group

- Syntactic Foam Market, by Country

- United States Syntactic Foam Market

- China Syntactic Foam Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing critical insights drawn from market dynamics technological advancements and regulatory shifts to highlight the strategic imperative of syntactic foam innovation

The analysis presented herein synthesizes key market dynamics technological trends and regulatory influences that define the syntactic foam landscape. By examining foundational principles alongside advanced segmentation and regional narratives, stakeholders gain a holistic understanding of both established applications and emerging opportunities. The convergence of sustainability mandates, supply chain realignment, and digital innovation underscores the strategic imperative of material adaptability.

Tariff-driven cost pressures have catalyzed a reevaluation of sourcing strategies, prompting investments in domestic production capabilities and alternative supplier networks. Simultaneously, segmentation insights illuminate how targeted product variations-across microsphere chemistries, density profiles, production methods, and distribution channels-enable tailored solutions that align closely with end-user demands.

Looking forward, collaboration between material developers OEMs and regulatory bodies will be critical in accelerating certification pathways for novel syntactic foam formulations. As performance expectations continue to rise, combining advanced computational modeling with sustainable material practices will distinguish market leaders. The imperative for strategic foresight, underpinned by actionable insights, has never been more pronounced in guiding organizations toward resilient and innovative growth trajectories.

Unlock comprehensive syntactic foam market insights engage with Associate Director Sales and Marketing to explore tailored research solutions and drive strategic growth

Connect directly with Associate Director of Sales & Marketing Ketan Rohom to discuss how this detailed market research can address your strategic objectives and operational challenges. By engaging with Ketan Rohom, you’ll gain personalized guidance on navigating the complexities of syntactic foam supply chains, segmentation strategies, and regional growth opportunities.

Reserve your comprehensive report today to unlock actionable insights that can drive innovation, enhance competitive positioning, and accelerate time to market. Our research delivers the clarity and depth needed to make informed decisions in a market defined by rapid technological change and evolving regulatory frameworks.

Reach out now to schedule a consultation and explore tailored solutions that align with your organizational goals. Let Ketan Rohom help you transform data into strategic advantage-take the next step toward maximizing the potential of syntactic foam in your business initiatives

- How big is the Syntactic Foam Market?

- What is the Syntactic Foam Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?