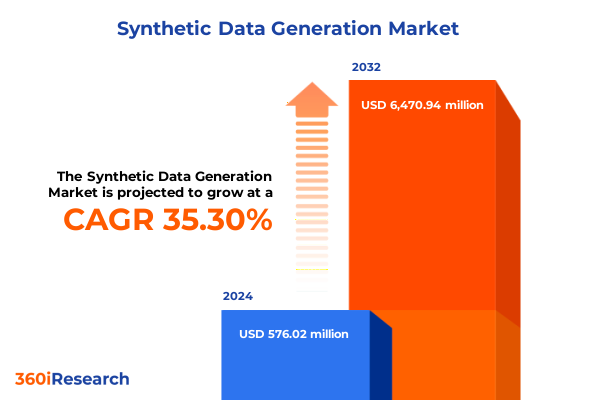

The Synthetic Data Generation Market size was estimated at USD 736.23 million in 2025 and expected to reach USD 947.30 million in 2026, at a CAGR of 29.94% to reach USD 4,606.90 million by 2032.

Setting the stage for the future of AI-driven insights by exploring how synthetic data empowers enterprise innovation, privacy, and model robustness at scale

The rapidly evolving domain of synthetic data generation stands at the forefront of AI innovation, significantly transforming how organizations address data scarcity, privacy, and model performance challenges. As enterprises strive to build more resilient and accurate artificial intelligence systems, synthetic data offers a compelling alternative to real-world datasets by providing scalable, customizable, and privacy-preserving inputs. This paradigm shift is reshaping data strategies across sectors, enabling advancements in machine learning applications that were previously constrained by limited or sensitive data access.

Amid this transition, industry leaders are increasingly harnessing synthetic data workflows to accelerate model development cycles and enhance the robustness of AI-driven solutions. Notably, major technology firms have announced new synthetic data platforms designed to support high-fidelity image, video, and tabular data generation, reflecting the strategic importance of this capability in large-scale deployments. At CES 2025, the emphasis on synthetic data underscored its critical role in automotive and robotics applications, where realistic scenario simulation is paramount for safe and efficient operation.

Moreover, strategic acquisitions, such as Nvidia’s integration of Gretel’s synthetic data technology into its AI services suite, highlight the competitive imperative to offer end-to-end data generation tools that address privacy, bias mitigation, and data augmentation needs. Looking ahead, the convergence of advanced generative architectures and industry-specific synthetic data capabilities promises to unlock new opportunities for personalized AI experiences, ensuring that synthetic data remains a cornerstone of future innovation roadmaps.

Examining the groundbreaking technological advancements and adoption trends that are reshaping synthetic data generation across industries

The synthetic data landscape is undergoing transformative shifts driven by breakthroughs in generative modeling techniques and heightened enterprise demand for privacy-preserving data solutions. Cutting-edge architectures such as generative adversarial networks and variational autoencoders are evolving to produce data with unprecedented fidelity, enabling organizations to simulate complex real-world phenomena without exposing sensitive information. This maturation of algorithmic capabilities has elevated synthetic data from a research curiosity to a mission-critical resource for AI practitioners.

Simultaneously, demand for domain-specific synthetic datasets is rising, fueling customized data creation pipelines in industries from healthcare diagnostics to autonomous mobility. The intersection of synthetic data with reinforcement learning and digital twin technologies is unlocking more sophisticated simulation environments, allowing for iterative testing and validation of AI models under variable conditions. This synergy is particularly evident in sectors that rely heavily on scenario diversity, such as autonomous vehicle navigation and precision medicine, where traditional data collection methods struggle to capture edge cases.

Furthermore, the ecosystem is expanding through strategic partnerships between AI labs and industry stakeholders seeking to embed synthetic data solutions directly into their development frameworks. This collaborative approach accelerates the integration of synthetic data capabilities into existing workflows, reducing time-to-value and lowering the barrier to entry for smaller organizations. As these transformative shifts continue, synthetic data is poised to redefine best practices in model training, testing, and deployment across the AI landscape.

Analyzing how recent United States trade policies and tariff measures are reshaping the synthetic data ecosystem and infrastructure costs

Recent United States trade policies and tariff measures have begun to reverberate through the synthetic data ecosystem by affecting the underlying infrastructure necessary for large-scale data generation and model training. Tariffs on critical hardware components-such as graphics processing units, server chassis, and cooling systems-have introduced higher procurement costs and longer lead times for organizations building AI data centers. These increased expenses are compelling some enterprises to explore alternative sourcing strategies and geographic redistribution of their compute resources to mitigate cost pressures and ensure continuity of operations.

In addition, the uncertainty surrounding tariff exemptions and legal challenges has spurred careful reevaluation of existing supply chains. Companies reliant on imported semiconductor components face the dual challenge of navigating regulatory ambiguity while maintaining the high-performance compute environments required for synthetic data generation. This has led many to consider onshore manufacturing partnerships or to diversify their procurement across multiple regions to avoid single points of failure. While these strategic adjustments can bolster resilience, they often come at the expense of increased capital allocation and extended deployment timelines.

Despite these headwinds, industry leaders are actively lobbying for targeted tariff relief on essential AI hardware and advocating for exemption protocols that recognize the unique role of synthetic data technologies in driving national innovation agendas. Such policy dialogue underscores the critical linkage between trade policy and technological competitiveness in an era where data-driven insights are central to economic growth and security.

Revealing nuanced market dynamics through detailed understanding of data type, modeling, deployment, enterprise scale, application, and end-use variations

A nuanced understanding of market dynamics emerges through careful analysis of synthetic data segmentation across multiple dimensions. By data type, enterprises are leveraging image and video data generation to simulate complex visual environments, harnessing tabular data capabilities to replicate structured datasets for financial modeling and business intelligence, and utilizing text data synthesis to bolster natural language processing and conversational AI applications. Transitioning to the modeling dimension, agent-based approaches enable the simulation of interactive entities for scenarios such as crowd movement or autonomous agent coordination, while direct modeling offers more straightforward algorithmic pathways ideal for rapid prototyping and standardized data augmentation.

Delving into deployment models, cloud-based solutions have gained traction due to their scalability, on-demand resource allocation, and managed service offerings that streamline integration. In parallel, on-premise deployments remain vital for organizations with stringent data governance requirements, providing tighter control over data residency and customization of computational environments. Considering enterprise size, large corporations leverage synthetic data platforms to support vast AI initiatives, tapping into advanced analytics teams and cross-functional expertise, whereas small and medium enterprises adopt more accessible synthetic data services to innovate within budget constraints and enhance agility.

Application-specific segmentation further reveals that AI/ML training and development workflows benefit from synthetic data for model validation, while data analytics and visualization use cases draw on synthetic datasets to supplement real-world gaps. Enterprise data sharing frameworks are enriched by privacy-compliant synthetic replicas, and test data management processes are streamlined through controlled scenario generation. Finally, across end-use verticals-from automotive and transportation safety simulations to BFSI risk modeling, government and defense scenario planning, healthcare and life sciences diagnostics, IT and ITeS process optimization, manufacturing defect detection, and retail and e-commerce personalization-the tailored synthetic data solutions underscore the versatility and strategic value of this technology.

This comprehensive research report categorizes the Synthetic Data Generation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Data Type

- Modelling

- Technology

- Deployment Model

- Application

- End-use

Highlighting regional strengths, adoption patterns, and strategic priorities across the Americas, Europe Middle East Africa, and Asia Pacific markets

The global expansion of synthetic data adoption reflects distinct regional priorities and technological capabilities across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, advanced AI research ecosystems and robust investment climates have positioned North America as an early adopter of enterprise synthetic data solutions, particularly within hyperscale technology firms and financial institutions seeking rigorous privacy compliance. This region’s mature cloud infrastructure and supportive regulatory frameworks continue to accelerate innovation cycles and strategic collaborations.

Shifting focus to Europe, the Middle East, and Africa, stringent data protection regulations and an emphasis on ethical AI have catalyzed demand for synthetic data as a tool to balance innovation with compliance. Organizations in this region are integrating synthetic data to meet the requirements of comprehensive privacy laws, while also exploring its potential for public sector applications such as urban planning simulations and defense readiness exercises. Collaborative research initiatives between academic institutions and industry consortia further fuel the region’s dynamic synthetic data landscape.

In the Asia-Pacific, rapid digital transformation and government-led AI strategies are driving widespread deployment of synthetic data technologies. From automotive manufacturers in Japan leveraging virtual environments for driver assistance testing to healthcare providers in Australia utilizing synthetic patient records for research, the region’s diverse use cases underscore its fast-growing appetite for scalable, secure data solutions. Across all regions, localized innovation hubs and policy frameworks are shaping differentiated adoption paths, reflecting each region’s unique blend of market drivers and strategic goals.

This comprehensive research report examines key regions that drive the evolution of the Synthetic Data Generation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering leading players’ strategic initiatives, partnerships, and innovation trajectories that define the competitive synthetic data landscape

Key players in the synthetic data arena are defining competitive trajectories through strategic investments, technology development, and market partnerships. Leading semiconductor innovators have embedded synthetic data capabilities into hardware ecosystems to streamline AI model prototyping, while software-centric enterprises are expanding their platforms to offer integrated synthetic data pipelines that support end-to-end AI development. Collaborative alliances between cloud service providers and synthetic data specialists are further enriching solution portfolios, delivering unified environments for scalable data synthesis and model optimization.

At the same time, nimble startups are carving out specialized niches in privacy-focused synthetic data generation, attracting venture capital interest that underscores the market’s growth potential. These emerging companies complement established industry leaders by addressing specific domain challenges-such as anonymized healthcare records or realistic sensor data for autonomous systems-thereby broadening the synthetic data ecosystem. Meanwhile, cross-sector partnerships with research institutions are fostering accelerated innovation, enabling rapid translation of academic advances into commercial applications.

This dynamic interplay between global technology titans, specialized startups, and academic collaborators underscores a vibrant competitive landscape. Market leadership is increasingly determined by an organization’s ability to deliver high-fidelity synthetic data at scale, integrate seamlessly with existing AI toolchains, and maintain rigorous compliance with evolving data governance standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Synthetic Data Generation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- NVIDIA Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- DataRobot, Inc

- International Business Machines Corporation

- Google LLC by Alphabet Inc.

- Broadcom Inc.

- TonicAI, Inc.

- SAS Institute Inc.

- Perforce Software Inc.

- K2view Ltd.

- MOSTLY AI

- Synthesized Ltd.

- GenRocket, Inc.

- BetterData Pte Ltd

- Bifrost AI, Inc.

- DataGen Private Limited

- Datawizz.ai

- DATPROF

- Folio3 Software Inc.

- Kinetic Vision, Inc.

- MDClone Inc

- Simulacra Synthetic Data Studio

- syntheticAIdata ApS

- Syntho

- YData Labs Inc.

Delivering practical guidance for industry executives to leverage synthetic data opportunities, mitigate risks, and drive sustainable competitive advantage

To navigate the complexities of synthetic data adoption and maximize its strategic benefits, industry leaders must adopt a proactive, structured approach. Executives should align synthetic data initiatives with broader AI governance frameworks, ensuring that data generation processes adhere to ethical guidelines, privacy regulations, and internal policies. By establishing clear governance protocols, organizations can mitigate risks related to bias, maintain data lineage transparency, and foster stakeholder trust.

Next, integrating synthetic data seamlessly into existing AI development workflows requires robust orchestration and validation mechanisms. Leaders should prioritize platforms that offer modular integration with popular ML frameworks, enabling efficient data versioning, performance monitoring, and anomaly detection. This approach reduces the time and resources needed to validate synthetic datasets and ensures ongoing alignment between data quality and model requirements.

Furthermore, fostering cross-functional collaboration between data science, IT, security, and legal teams is crucial for successful synthetic data deployments. By creating multidisciplinary governance councils, organizations can accelerate decision-making, address potential compliance challenges early, and tailor synthetic data solutions to domain-specific needs. Investing in upskilling programs for data practitioners will also ensure that teams possess the necessary expertise to evaluate, customize, and optimize synthetic data pipelines for maximum impact.

Outlining the rigorous mixed-method research design, data sources, and analytical frameworks underpinning this comprehensive synthetic data analysis

This research is grounded in a comprehensive mixed-methods design that combines qualitative and quantitative approaches to yield holistic insights into the synthetic data domain. Primary data sources encompass structured interviews with industry experts, surveys of technology decision-makers, and in-depth case studies of synthetic data implementations across diverse sectors. These primary inputs provide rich contextual understanding of strategic priorities, technical challenges, and emerging best practices.

Complementing these efforts, secondary research involved the systematic review of technical papers, industry reports, thought leadership articles, and regulatory documents to triangulate trends and validate core findings. Data triangulation techniques were employed to reconcile insights from multiple sources, ensuring the reliability and robustness of the research outcomes. Furthermore, thematic analysis frameworks guided the synthesis of qualitative inputs, while statistical analysis tools facilitated the examination of survey data patterns and correlations.

To enhance contextual relevance, regional workshops and expert roundtables were conducted across key geographies, fostering dialogue on localized adoption drivers and policy environments. The resulting methodological framework ensures that the insights presented reflect both global trends and nuanced regional perspectives, providing readers with actionable intelligence to inform their synthetic data strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Synthetic Data Generation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Synthetic Data Generation Market, by Data Type

- Synthetic Data Generation Market, by Modelling

- Synthetic Data Generation Market, by Technology

- Synthetic Data Generation Market, by Deployment Model

- Synthetic Data Generation Market, by Application

- Synthetic Data Generation Market, by End-use

- Synthetic Data Generation Market, by Region

- Synthetic Data Generation Market, by Group

- Synthetic Data Generation Market, by Country

- United States Synthetic Data Generation Market

- China Synthetic Data Generation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding the critical insights and strategic implications of synthetic data trends to inform decision-making and future technology investments

As synthetic data generation continues to mature, it emerges as a pivotal enabler of next-generation AI applications, empowering organizations to overcome data scarcity, safeguard privacy, and accelerate innovation. The insights presented herein reveal a market characterized by rapid technological advancement, strategic partnerships, and evolving governance imperatives. By understanding the transformative shifts, tariff impacts, and segmentation dynamics, decision-makers can position their organizations to harness synthetic data’s full potential.

Regional variations highlight the importance of tailoring synthetic data strategies to local regulatory frameworks and industry priorities. Meanwhile, competitive analysis underscores the need for continuous innovation and ecosystem collaboration to maintain market leadership. Ultimately, the actionable recommendations and methodological rigor embedded in this research serve as a roadmap for organizations seeking to leverage synthetic data as a sustainable driver of AI excellence.

In conclusion, the synthetic data landscape offers compelling opportunities for enterprises willing to adopt disciplined governance, invest in integration capabilities, and foster cross-functional collaboration. By embracing these imperatives, industry leaders can unlock the strategic advantages of synthetic data generation and chart a course toward data-driven growth and competitive resilience.

Engage with Ketan Rohom for tailored insights and secure expert guidance to leverage synthetic data research for strategic business growth

I invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this comprehensive synthetic data market research report can directly align with your strategic goals. Engaging with Ketan will provide you with personalized guidance on how to leverage in-depth analytics and industry forecasts to enhance your decision-making process. By connecting with him, you will gain clarity on report features, access sample insights, and explore tailored consultation that addresses your unique challenges and objectives. Don’t miss the chance to secure the competitive edge offered by the latest synthetic data trends and transformative recommendations. Contact Ketan Rohom today to unlock exclusive benefits, refine your strategies, and accelerate your organization’s innovation journey with data-driven confidence.

- How big is the Synthetic Data Generation Market?

- What is the Synthetic Data Generation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?