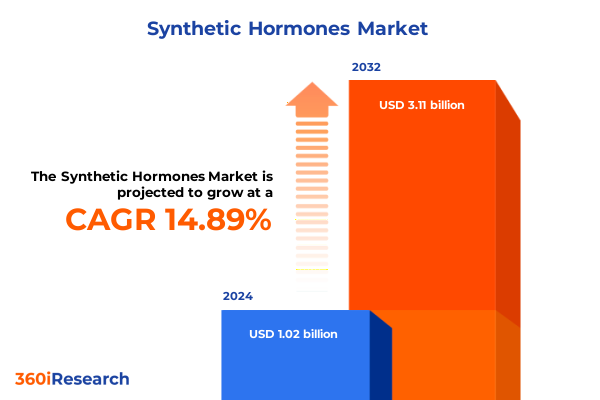

The Synthetic Hormones Market size was estimated at USD 1.17 billion in 2025 and expected to reach USD 1.33 billion in 2026, at a CAGR of 14.88% to reach USD 3.11 billion by 2032.

Pioneering the Future of Therapeutics with Synthetic Hormones: An Overview of Innovations, Applications, and Market Evolution

Synthetic hormones represent a cornerstone of modern therapeutics, providing essential interventions where the body’s natural endocrine system falls short. Treatments ranging from insulin therapies for diabetes management to estrogen and progesterone formulations for menopausal symptom relief underscore the clinical versatility of these compounds. The prevalence of hormonal disorders continues to rise in tandem with demographic shifts, particularly an expanding population of individuals over age fifty, which accounts for over a quarter of the global female population as of 2021. This demographic trend has amplified the demand for reliable hormone replacement therapies and catalyzed substantial investment in novel hormone analogs and delivery technologies. The synthetic hormone sector also plays a critical role in managing thyroid conditions, with levothyroxine often prescribed to address hypothyroidism and maintain metabolic equilibrium, reflecting the indispensable nature of these agents in primary care settings.

Unveiling the Next Wave of Disruption in Synthetic Hormone Delivery, Personalization, Bioidentical Therapies, and Market Dynamics

The synthetic hormone landscape is undergoing profound transformation driven by advances in personalized medicine, where tailored treatment regimens based on genetic and physiological profiling are becoming increasingly prevalent. This shift promises to optimize therapeutic efficacy and reduce adverse events, as clinicians harness patient-specific biomarkers to calibrate hormone dosages in real time. Concurrently, the growing interest in bioidentical and plant-derived hormone therapies reflects consumer preference for alternatives that mimic endogenous structures while potentially offering improved safety profiles. While these formulations are distinct from purely synthetic counterparts, the trend influences innovation roadmaps as manufacturers explore hybrid compositional strategies to address patient demand. Moreover, non-invasive delivery modalities such as transdermal patches, nasal sprays, and topical gels are reshaping administration paradigms by offering enhanced convenience and more consistent pharmacokinetics. These approaches cater to patient-centric care models, reducing the burden of daily injections and enhancing long-term adherence for chronic therapies. Finally, the expansion of gender-affirming hormone treatments for transgender populations is prompting both regulatory bodies and manufacturers to refine labeling, dosing algorithms, and safety monitoring guidelines, underscoring an inclusive approach to endocrine care.

Examining the Strategic Ripple Effects of 2025 U.S. Tariff Policies on Synthetic Hormone Manufacturing, Supply Chains, and Cost Structures

The implementation of a universal 10% global tariff on healthcare imports in April 2025 marked a pivotal disruption for synthetic hormone manufacturers that depend on complex international supply chains for active pharmaceutical ingredients (APIs) and excipients. Immediate consequences included elevated procurement costs for APIs, driving companies to reassess sourcing strategies and inventory models to preserve margin integrity amid rising input prices. Compounding these pressures, a Section 232 probe signaled the potential imposition of 25% duties on pharmaceutical imports, contradicting longstanding World Trade Organization exemptions for drug ingredients and provoking significant supply chain uncertainty. The prospect of broad-based tariffs has encouraged firms to accelerate reshoring initiatives and forge partnerships with domestic manufacturers to mitigate compliance risk and safeguard production continuity.

Deep Dive into Synthetic Hormone Market Segmentation: Hormone Classes, Clinical Applications, Technological Innovations, and End-User Dynamics Across the Value Chain

By hormone class, synthetic formulations span estrogen analogs vital to menopausal and contraceptive therapies, insulin analogs that uphold glycemic control for diabetes patients, and levothyroxine derivatives that correct thyroid hormone deficiencies, each requiring distinct synthesis and regulatory pathways. Within the realm of clinical applications, contraception regimens bifurcate into combined oral estrogen-progestin and progestin-only options, while diabetes management leverages rapid-acting and long-acting insulin profiles. Growth hormone deficiency treatments differentiate care protocols for adult and pediatric populations, and menopause symptom management disaggregates into targeted relief for hot flashes, osteoporosis prevention, and vaginal atrophy conditions. Thyroid disorder therapies address both hyperthyroidism and hypothyroidism through precise hormonal titration. On the technology front, chemical synthesis methods embrace liquid-phase and solid-phase approaches to optimize reaction kinetics, whereas recombinant DNA platforms employ bacterial, mammalian, and yeast expression systems to yield high-purity peptide hormones with scalable yields. From an end-user perspective, these therapies traverse multiple channels, from general practice and specialty clinics to private and public hospitals, as well as homecare models featuring nursing services and self-administration. Pharmaceutical distribution further spans online pharmacies offering over-the-counter and prescription-based models and brick-and-mortar retail outlets, including both chain and independent pharmacies, reflecting a multifaceted ecosystem where each segment influences commercialization strategies.

This comprehensive research report categorizes the Synthetic Hormones market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Hormone Class

- Technology

- End User

- Application

Regional Perspectives Shaping Synthetic Hormone Adoption: Analyzing Trends and Growth Drivers Across the Americas, EMEA, and Asia-Pacific Markets

The Americas serve as a critical nexus for synthetic hormone utilization, underpinned by robust reimbursement frameworks and advanced clinical infrastructure. The United States, in particular, grapples with a significant diabetic population that relies heavily on synthetic insulin analogs, reinforcing its dominance in R&D and distribution capabilities. National initiatives to curb prescription drug costs continue to influence pricing strategies, while supply chain resilience programs aim to reduce overreliance on imported active ingredients. In the Europe, Middle East & Africa region, stringent health technology assessments and price control mechanisms challenge manufacturers to balance affordability with innovation. Countries such as Germany and the United Kingdom maintain comprehensive coverage for hormone replacement therapies, whereas outreach in emerging Middle Eastern markets has accelerated, leveraging public–private collaborations for diversified access. Concurrent reciprocal tariff threats in certain European jurisdictions underscore the geopolitical complexity inherent in transatlantic pharmaceutical trade, driving contingency planning among global players. Meanwhile, the Asia-Pacific landscape is energized by rising healthcare expenditures and expanding middle-class demographics in China and India, fostering expansive generic production and rapid urbanization. Governments are enhancing regulatory harmonization to streamline drug approvals, while local manufacturing incentives are drawing foreign direct investment to develop high-performance recombinant hormone production facilities.

This comprehensive research report examines key regions that drive the evolution of the Synthetic Hormones market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders and Innovators Accelerating the Momentum in Synthetic Hormone Research, Production, and Strategic Partnerships

Novo Nordisk continues to set industry benchmarks with its research-intensive pipeline of next-generation insulin analogs and smart delivery devices, establishing collaborations with digital health firms to integrate continuous glucose monitoring for patient-tailored dosing. Roche, Pfizer, and Eli Lilly have collectively announced multibillion-dollar commitments to expand U.S.-based manufacturing capabilities for peptide hormone APIs, signaling a concerted effort to shore up supply chain security in anticipation of evolving trade policies. AstraZeneca’s historic $50 billion domestic investment pledge exemplifies this trend, encompassing new facilities across Virginia, Maryland, Massachusetts, California, Indiana, and Texas to produce critical synthetic hormone intermediates and refine biologics capabilities. Smaller biotech firms are emerging as agile innovators, leveraging recombinant DNA platforms to engineer ultra-purified hormone analogs and exploring niche therapeutic indications, while strategic alliances with specialty clinics and compounding pharmacies are enhancing localized access to customized hormone formulations. This constellation of established multinationals and entrepreneurial ventures is reshaping competitive dynamics and fostering an environment of rapid technological convergence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Synthetic Hormones market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Eli Lilly and Company

- Endo Pharmaceuticals Inc.

- Ferring B.V.

- Gilead Sciences Inc.

- IBSA Institut Biochimique SA

- Ipsen S.A.

- Johnson & Johnson

- Lupin Pharmaceuticals Inc.

- Merck & Co. Inc.

- Merck KGaA

- Novartis AG

- Novo Nordisk A/S

- Organon & Co.

- Pfizer Inc.

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

- Theramex

- TherapeuticsMD Inc.

- Viatris Inc.

Actionable Strategic Priorities for Synthetic Hormone Manufacturers: Navigating Supply Chain Resilience, Regulatory Alignment, and Patient-Centric Innovation

Industry leaders should prioritize diversified sourcing of key raw materials and active pharmaceutical ingredients to minimize exposure to tariff-induced cost volatility. Establishing strategic partnerships with domestic API manufacturers and exploring nearshoring opportunities can mitigate supply chain risk while preserving regulatory compliance. Investment in advanced chemical synthesis and recombinant DNA production platforms will enable scalable output and support tailored hormone analog development, bolstering agility in response to emerging clinical needs. Embracing personalized medicine frameworks, such as pharmacogenomic-guided dosing protocols and integrated digital health ecosystems, can differentiate product portfolios and enhance adherence outcomes, driving long-term patient engagement. Additionally, expanding non-invasive delivery systems, including transdermal patches and nasal formulations, will align with patient preferences for convenience and consistent pharmacokinetics. Finally, proactive regulatory engagement to shape favorable policy frameworks around tariffs and reimbursement, combined with transparent stakeholder communication, will foster resilience and secure market access in an environment of geopolitical complexity.

Robust Research Framework Integrating Multi-Source Intelligence, Qualitative Interviews, and Rigorous Data Validation to Illuminate Synthetic Hormone Trends

This research methodology integrates comprehensive secondary analysis and structured primary engagements to ensure robustness and credibility. Secondary sources include government tariff documentation, regulatory filings, scientific literature, and reputable industry publications. These data were systematically triangulated to validate thematic findings and identify market inflection points. Primary research involved in-depth interviews with senior executives across pharmaceutical manufacturers, contract development organizations, and healthcare providers, yielding qualitative insights on strategic responses to tariff policies and emerging therapeutic trends. Quantitative data were captured through anonymous surveys targeting R&D leaders and supply chain managers, enabling the corroboration of overarching narratives with empirical observations. A rigorous validation process, featuring cross-functional expert review panels, ensured that conclusions reflect current market realities and anticipate future shifts within the synthetic hormone ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Synthetic Hormones market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Synthetic Hormones Market, by Hormone Class

- Synthetic Hormones Market, by Technology

- Synthetic Hormones Market, by End User

- Synthetic Hormones Market, by Application

- Synthetic Hormones Market, by Region

- Synthetic Hormones Market, by Group

- Synthetic Hormones Market, by Country

- United States Synthetic Hormones Market

- China Synthetic Hormones Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesis of Critical Insights and Future Outlook Highlighting Strategic Imperatives for Stakeholders in the Synthetic Hormone Ecosystem

The evolving synthetic hormone landscape is characterized by a confluence of technological innovation, shifting policy environments, and nuanced segmentation across classes, applications, and end-user channels. Transformative trends in personalized medicine, bioidentical formulations, and non-invasive delivery methods underscore an industry in transition toward patient-centric paradigms. Meanwhile, the imposition of multifaceted tariff regimes in 2025 has precipitated strategic realignments in global supply chains, compelling manufacturers to reassess sourcing, manufacturing footprints, and stakeholder collaborations. Regional dynamics further amplify complexity as established markets in the Americas and EMEA navigate cost controls and reciprocal trade measures, while Asia-Pacific economies drive expansion through regulatory harmonization and domestic capacity building. Leading companies are responding with targeted investments, strategic partnerships, and advanced production technologies to secure competitive advantage. By synthesizing these critical insights and adopting proactive strategies, stakeholders can confidently navigate the uncertainties ahead and capitalize on opportunities to enhance therapeutic outcomes and operational resilience.

Seize Competitive Advantage and Accelerate Growth with Exclusive Synthetic Hormone Market Intelligence from Ketan Rohom – Secure Your Copy Today

Discover unparalleled insights into the synthetic hormone market by connecting with Ketan Rohom, Associate Director of Sales & Marketing, who can tailor the research findings to your strategic priorities. He offers a personalized consultation to explore critical trends, tariff analyses, and segmentation intelligence that can drive your decision-making and accelerate your competitive edge. Reach out to unlock detailed recommendations, validate your growth hypotheses, and gain proprietary access to our comprehensive market research report, ensuring your organization stays ahead of the curve in a rapidly evolving healthcare landscape.

- How big is the Synthetic Hormones Market?

- What is the Synthetic Hormones Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?