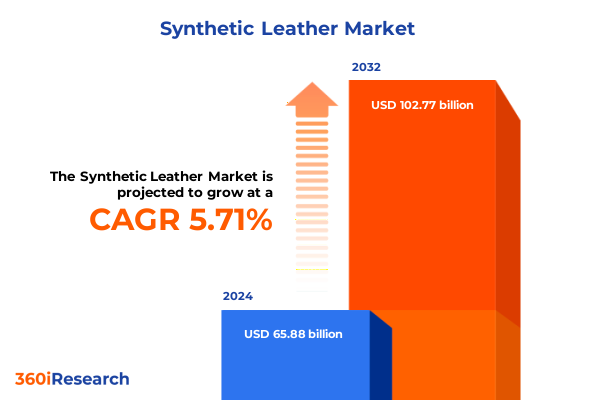

The Synthetic Leather Market size was estimated at USD 69.55 billion in 2025 and expected to reach USD 73.43 billion in 2026, at a CAGR of 5.73% to reach USD 102.77 billion by 2032.

Discover how modern synthetic leather is redefining ethical and sustainable material standards across industries to deliver high-performance, animal-free alternatives

Modern synthetic leather has rapidly ascended from a niche material to an indispensable cornerstone of contemporary manufacturing across automotive, furniture, fashion, and consumer goods industries. Fueled by escalating consumer demands for ethical alternatives, regulatory pressures to reduce environmental footprints, and relentless technological progress, it offers a compelling combination of performance, versatility, and affordability. The transition toward cruelty-free materials has driven leading brands to adopt polyurethane and polyvinyl chloride alternatives, while evolving emissions regulations have catalyzed the emergence of water-based and solvent-free formulations that align with sustainability mandates and corporate ESG targets

Revolutionary Material Breakthroughs and Process Innovations Catapult Synthetic Leather into a New Era of Sustainability and Functionality

In recent years, the synthetic leather landscape has been transformed by a wave of paradigm-shifting innovations that marry green chemistry with advanced material science. Manufacturers have pioneered water-based polyurethane processes that drastically curtail volatile organic compound emissions, setting new benchmarks for environmental stewardship. Simultaneously, solvent-free production techniques have gained traction, minimizing hazardous byproducts while preserving the soft touch and durability intrinsic to high-grade synthetic leather

Assessing the Full Spectrum Impact of 2025 U.S. Import Tariffs on Synthetic Leather Value Chains and Cost Dynamics across Key End-Use Sectors

The sweeping tariff measures implemented by the United States in early 2025 have reshaped the cost structure and strategic calculus for synthetic leather supply chains. Targeted duties on imports from key Asia-Pacific manufacturing hubs have triggered immediate inflationary pressures across automotive interiors, apparel, and furniture upholstery segments. Analysts warn that with average tariff rates soaring above previous levels, material costs are poised to climb substantially, compelling buyers to reassess sourcing strategies and negotiate new supplier agreements

Unveiling Comprehensive Segmentation Dynamics: How Material Type, Product Form, Thickness, Application, Usage, and Distribution Influence Market Behavior

Market participants navigate a multilayered framework of segmentation that defines strategic positioning and product development. Across the material spectrum, demand is bifurcated between bio-based alternatives and traditional synthetic resins, with polyurethane and polyvinyl chloride variants dominating the latter. In parallel, product formats are differentiated into expansive sheets & rolls prized for automotive and furniture upholstery, and modular tiles leveraged for decorative applications. Thickness specifications create further differentiation, as sub-1.0mm films cater to lightweight apparel and accessories, while thicker grades exceed 1.0mm for enhanced durability in industrial and commercial contexts. Application domains span automotive interiors with specialized dashboard coverings and seating, decorative surfaces such as curtains and wallpaper, fashion accessories including belts and handbags, apparel items from coats to shoes, and furniture products like chairs and sofas. Usage patterns are categorized across commercial, industrial, and residential channels, each with tailored performance and regulatory requirements. Finally, distribution pathways range from traditional offline networks-encompassing direct sales, retailers, and wholesale distributors-to online platforms via company-owned websites and third-party e-commerce ecosystems, each dictating unique go-to-market strategies

This comprehensive research report categorizes the Synthetic Leather market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product

- Thickness Level

- Application

- Usage

- Distribution Channel

Decoding Regional Demand Patterns: Strategic Growth Hubs in the Americas, Europe Middle East Africa, and Asia-Pacific Driving Synthetic Leather Adoption

Geographic contours of demand reveal distinct regional narratives shaping investment priorities and innovation focus areas. In the Americas, mature markets in the United States and Canada emphasize premium automotive upholstery and furniture applications, driven by established OEM relationships and consumer expectations for quality and sustainability. Meanwhile, the Europe, Middle East & Africa landscape is characterized by rigorous regulatory ecosystems that incentivize solvent-free processes and bio-based formulations, alongside strong design houses in Western Europe prioritizing fashion-grade synthetics. Asia-Pacific retains its position as the fastest-growing market, with China, India, South Korea, and Southeast Asian economies scaling up production capacity to meet booming domestic demand and export orders, while forging partnerships with global brands to co-develop next-generation materials

This comprehensive research report examines key regions that drive the evolution of the Synthetic Leather market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market-Shaping Leaders: Strategic Initiatives and Innovation Roadmaps of Top Synthetic Leather Manufacturers and Emerging Disruptors

A cadre of established chemical and materials conglomerates anchors the competitive landscape, leveraging extensive R&D capabilities and global supply networks to set quality and cost benchmarks. Leading players such as Asahi Kasei, Nan Ya Plastics Corporation, Toray Industries, Teijin Limited, and Kuraray Co. Ltd. command significant production footprints, offering diversified portfolios that span traditional PU and PVC grades to pioneering bio-based leathers. These firms invest heavily in green process technologies, strategic joint ventures, and backward integration of polyol and polymer feedstocks to secure reliable access to key inputs while mitigating price volatility

This comprehensive research report delivers an in-depth overview of the principal market players in the Synthetic Leather market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- BASF SE

- DuPont de Nemours, Inc.

- Ergis S.A.

- Giriraj Coated Fab PVT. LTD.

- H.R. Polycoats Pvt. Ltd.

- Hantron Plastic Products Co., Ltd.

- Jasch Industries Limited

- Kolon Industries, Inc.

- Konrad Hornschuch AG

- Kuraray Co., Ltd.

Action Framework for Leaders: Strategic Pathways to Harness Sustainable Practices, Mitigate Trade Risks, and Capitalize on Emerging Synthetic Leather Trends

Industry leaders should prioritize investment in next-generation water-based and solvent-free polyurethane platforms to stay ahead of tightening emissions standards and evolving customer preferences for low-impact materials. Concurrently, diversifying sourcing portfolios by cultivating relationships with alternative bio-based suppliers and near-shore manufacturers can attenuate tariff-induced cost pressures and shorten lead times. Embracing digital customization capabilities-such as laser embossing and on-demand printing-will unlock premium margins in fashion accessories and luxury automotive interiors. Finally, establishing closed-loop recycling programs and collaborating with industry consortia on circular economy frameworks will reinforce brand credibility and future-proof supply chains against raw material shortages

Rigorous Research Blueprint: Methodological Foundations and Analytical Approaches Underpinning the Synthetic Leather Market Study

This study integrates primary and secondary methodologies to distill actionable intelligence and robust market insights. Primary inputs were gathered through confidential interviews with senior executives across leading synthetic leather manufacturers, key OEMs in automotive and fashion verticals, and specialist raw material suppliers. Secondary research leveraged corporate disclosures, regulatory filings, technical publications, and market registers to validate historical trends and corroborate expert testimonies. Data triangulation was performed using a bottom-up sizing approach paired with top-down validation, ensuring coherence across segmentation analysis and regional breakdowns. Rigorous quality checks and review cycles with domain specialists guarantee the accuracy and reliability of findings and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Synthetic Leather market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Synthetic Leather Market, by Type

- Synthetic Leather Market, by Product

- Synthetic Leather Market, by Thickness Level

- Synthetic Leather Market, by Application

- Synthetic Leather Market, by Usage

- Synthetic Leather Market, by Distribution Channel

- Synthetic Leather Market, by Region

- Synthetic Leather Market, by Group

- Synthetic Leather Market, by Country

- United States Synthetic Leather Market

- China Synthetic Leather Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Executive Synthesis: Key Takeaways and Strategic Imperatives Reinforcing the Business Case for Advanced Synthetic Leather Adoption

By synthesizing technological, commercial, and regulatory vectors, the study underscores synthetic leather’s ascendancy as a high-performance, ethically sourced material platform poised to redefine multiple end markets. Material innovations-from bio-based formulations to smart functionalities-are rapidly closing performance gaps with genuine leather, while sustainability imperatives and evolving trade dynamics are compelling stakeholders to rethink sourcing strategies. Leaders equipped with granular segmentation insights, regional demand intelligence, and a clear action blueprint stand well-positioned to capture share in an accelerating market landscape that values agility, environmental responsibility, and design differentiation

Connect with Associate Director Ketan Rohom to Secure Exclusive Access to the Definitive Synthetic Leather Market Intelligence and Accelerate Strategic Decisions

For tailored insights and in-depth strategic guidance on the synthetic leather sector, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, whose expertise can ensure you secure the comprehensive market intelligence you need to drive impactful business decisions. Ketan’s guidance will help you navigate evolving trade dynamics, sustainability imperatives, and segmentation intricacies, empowering your organization to optimize operations, identify growth avenues, and outpace the competition. Contact him today to purchase the definitive report and gain exclusive access to actionable data, proprietary analysis, and expert forecasts that will shape your strategic roadmap for synthetic leather.

- How big is the Synthetic Leather Market?

- What is the Synthetic Leather Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?