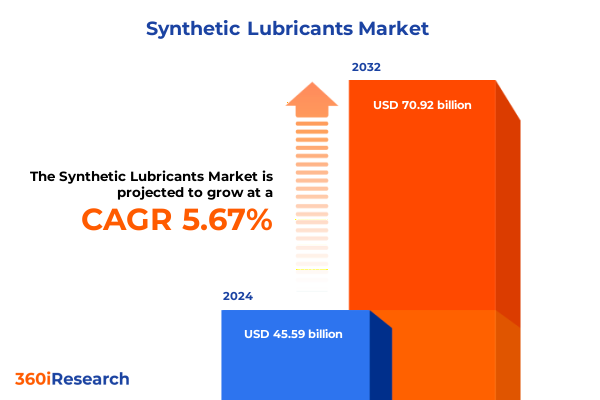

The Synthetic Lubricants Market size was estimated at USD 48.14 billion in 2025 and expected to reach USD 50.82 billion in 2026, at a CAGR of 5.69% to reach USD 70.92 billion by 2032.

Understanding the Transformative Role of Synthetic Lubricants in Modern Industry and Automotive Applications Amidst Technological and Regulatory Shifts

The escalating importance of synthetic lubricants emerges from their critical role in enhancing equipment performance under extreme conditions and advancing sustainability targets. As industrial and automotive sectors pursue higher efficiency, the reliance on engineered base stocks that deliver superior thermal stability, oxidation resistance, and low-temperature fluidity has grown exponentially. This introduction frames synthetic lubricants as a cornerstone technology that reconciles demanding performance requirements with stringent environmental regulations.

Moreover, the shift toward electrification, renewable energy systems, and advanced manufacturing processes has underscored the need for lubricants that can withstand diverse operating environments without compromising on longevity or compatibility. By replacing traditional mineral oils with tailored formulations based on advanced chemistry, industries are achieving improved energy efficiency, extended maintenance cycles, and reduced ecological impact. Consequently, this segment stands at the forefront of innovation, driven by a convergence of regulatory mandates and technological advancements that collectively reshape the lubrication landscape.

Identifying Technological Innovations, Regulatory Pressures, and Market Dynamics Redefining the Synthetic Lubricants Landscape Worldwide

Recent years have witnessed a confluence of forces accelerating the transformation of the synthetic lubricants domain. Technological breakthroughs in base stock chemistry are enabling fourth- and fifth-generation products that offer unparalleled viscosity control and additive compatibility. These innovations, coupled with the advent of digital monitoring systems and condition-based maintenance platforms, are redefining how end-users assess lubricant health and replace intervals.

In addition, regulators in major economies have introduced ever-stricter emissions and fuel-economy standards, pushing OEMs and aftermarket suppliers to adopt formulations that reduce friction and minimize volatile organic compound emissions. Concurrently, consumer demand for cleaner, quieter, and more efficient machinery has encouraged market participants to prioritize sustainable feedstocks and bio-based additives. Through these combined dynamics, the industry is experiencing a fundamental shift from conventional petroleum-derived oils toward high-performance synthetic alternatives that align with the evolving needs of a decarbonizing world.

Analyzing the Far Reaching Consequences of the 2025 United States Tariff Measures on Import of Synthetic Lubricants and Supply Disruptions

The introduction of new tariff measures by the United States in 2025 has significantly disrupted the importation of synthetic lubricants, prompting immediate adjustments throughout the supply chain. By imposing additional duties on key base stock shipments originating from major producing regions, import costs for Group III, Group IV, and Group V stocks have increased substantially. Consequently, domestic manufacturers and blending facilities have faced both operational challenges and price volatility as they seek alternative supply sources or invest in localized production capacity.

Furthermore, the measure has compelled multinational corporations to reevaluate their global procurement strategies, balancing the higher expenses against the imperative for uninterrupted supply. Meanwhile, smaller market entrants and distributors have experienced compression in their margins, given the limited leverage in negotiating freight and raw-material contracts. In response, stakeholders across the value chain are exploring strategic partnerships and vertical integration opportunities to mitigate the tariff’s ripple effects and safeguard profit margins.

Unlocking Key Market Insights Through Product Type, Base Stock, Application Hierarchies, and Viscosity Grade Differentiation in Synthetic Lubricants

Delving into the market through the lens of product type reveals compressor oil, engine oil, gear oil, and hydraulic oil each evolving to meet specific operational demands. Compressor oil formulations are being refined to deliver exceptional demulsibility and anti-foaming properties, while engine oils leverage next-generation additive packages to enhance fuel economy and extending drain intervals. At the same time, gear oils focus on extreme-pressure performance and synchronicity with advanced materials, and hydraulic oils are engineered for precise viscosity stability across temperature extremes and long-term oxidation resistance.

Shifting focus to base stock composition, Group III stocks remain dominant for cost-effective general-purpose applications, yet Group IV stocks, predominantly polyalphaolefin, offer superior shear stability for high-stress environments. Group V stocks, encompassing esters and other specialty chemistries, are witnessing rising adoption in niche segments demanding biodegradability or exceptional thermal properties. Within the application sphere, the synthetic lubricant market is bifurcated into automotive and industrial sectors. The automotive side, spanning commercial and passenger vehicles, increasingly demands ultra-low viscosity grades such as SAE 0W-20 to improve efficiency, whereas heavier commercial fleets require robust formulations for extended oil-change intervals. Industrial machinery and manufacturing equipment call for tailored formulations that maintain performance under continuous operation and heavy loading.

Lastly, viscosity grade differentiation highlights a stratified user preference among SAE 0W-20, SAE 5W-30, and SAE 10W-40 formulations. The thinnest viscosity grades are championed in modern engines seeking friction reduction, whereas the thicker SAE 10W-40 oils find favor in legacy systems and heavy-duty equipment where film strength and thermal stability are paramount.

This comprehensive research report categorizes the Synthetic Lubricants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Base Stock

- Viscosity Grade

- Application

Exploring Regional Variations in Demand, Regulatory Frameworks, and Infrastructure That Drive Synthetic Lubricants Trends Across Global Regions

Examining the Americas reveals a mature market driven by stringent fuel-efficiency regulations in the United States and Canada, as well as strong aftermarket penetration. Infrastructure for distribution is highly developed, with blending facilities strategically located near major consumption hubs. Meanwhile, Latin American countries demonstrate a growing appetite for high-performance lubricants, fueled by expanding industrial projects and modernization of transportation fleets.

Turning to Europe, Middle East & Africa, regulatory harmonization around Euro VI standards and concerted efforts to reduce carbon emissions have catalyzed the adoption of ultra-low viscosity synthetic engine oils. The Middle East’s reliance on heavy-duty hydraulic and gear oils in oil and gas operations underscores the need for thermal resilience, while Africa’s nascent automotive industry offers emerging opportunities as consumers upgrade to passenger vehicles equipped with modern engines. Across Asia-Pacific, rapid industrial growth, expanding commercial vehicle fleets, and aggressive infrastructure investments in countries like China and India drive the largest incremental demand. The region also leads in integrating bio-derived base stocks due to governmental incentives supporting circular economy initiatives.

Such regional contrasts illustrate a dynamic landscape where regulatory frameworks, end-use applications, and infrastructural maturity collectively shape the competitive environment, demanding nuanced strategies for market entry and expansion.

This comprehensive research report examines key regions that drive the evolution of the Synthetic Lubricants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives That Are Shaping Competition and Innovation in Synthetic Lubricants

Leading participants in this arena are characterized by their commitment to innovation, expansive production networks, and robust research capabilities. These companies invest heavily in developing proprietary additive blends that optimize friction reduction and deposit control, while also collaborating with OEMs to secure approvals for next-generation engine platforms. Strategic alliances and joint ventures enable them to tap into emerging markets, localize supply chains, and achieve economies of scale through regional blending hubs.

In addition, several players differentiate themselves through sustainability initiatives, such as leveraging renewable feedstocks, reducing greenhouse gas emissions in their refineries, and implementing closed-loop packaging programs. They also pursue digital enablement, offering predictive analytics tools and real-time monitoring solutions that allow end-users to transition from time-based maintenance schedules to condition-based systems. Such capabilities reinforce customer loyalty and drive aftermarket service revenues, underscoring the strategic importance of integrated solutions beyond mere lubricant supply.

This comprehensive research report delivers an in-depth overview of the principal market players in the Synthetic Lubricants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADDINOL Lube Oil GmbH

- Amalie Oil Co.

- BECHEM India

- Bel-Ray by Calumet Specialty Products Partners, L.P.

- Bharat Petroleum Corporation Limited

- BP p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Croda International PLC

- DuPont de Nemours, Inc.

- Eni Benelux B.V.

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Ltd.

- LIQUI MOLY GmbH

- Lubrication Engineers, Inc.

- Maax Lubrication Pvt. Ltd.

- Motorex Oil

- Motul

- Petro-Canada Lubricants By HollyFrontier Corporation

- PetroChina Company Limited

- Petroliam Nasional Berhad

- Repsol, S.A.

- Royal Dutch Shell plc

- Synthetic Lubricants Inc.

- TotalEnergies SE

- Veedol Industrial Lubricants.

- Würth Group

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities, Navigate Tariff Challenges, and Drive Sustainable Growth

To capitalize on market momentum and offset tariff-induced cost pressures, companies should accelerate investment in domestic base-stock production facilities while forging strategic partnerships to diversify supply sources. Embracing advanced analytics and digital condition monitoring will optimize lubricant usage, reduce downtime, and strengthen customer retention by demonstrating clear total-cost-of-ownership benefits.

Furthermore, industry leaders must champion sustainability by integrating bio-derived and recyclable chemistries into their portfolios, aligning their product roadmaps with emerging global ESG mandates. Engaging proactively with regulatory bodies to shape sensible standards and secure approvals for innovative formulations will provide a competitive edge. Simultaneously, enhancing technical support services and educational outreach can elevate market perception and drive adoption in both established and emerging markets. By executing these measures cohesively, organizations can mitigate geopolitical risk, address evolving customer demands, and fortify their leadership positions.

Defining a Comprehensive Research Framework Integrating Primary Interviews, Secondary Data Analysis, and Rigorous Validation for Lubricants Market Insights

This analysis integrates a rigorous research framework combining extensive primary insights from industry executives, technical experts, and end-users with comprehensive secondary data obtained from trade associations, regulatory filings, and academic publications. Quantitative validation was achieved through cross-referencing proprietary shipment databases and customs records to confirm trends in base-stock flows and product distribution. Meanwhile, qualitative perspectives were distilled from in-depth interviews to elucidate drivers behind adoption patterns and regional preferences.

Additionally, the methodology incorporates a multi-stage review process in which findings are critically assessed by an advisory panel of industry veterans to ensure relevance and accuracy. Advanced statistical tools and scenario modeling were employed to stress-test hypotheses and surface sensitivities across different tariff, regulatory, and technological scenarios. This structured approach guarantees that the report’s conclusions are grounded in factual evidence and reflective of current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Synthetic Lubricants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Synthetic Lubricants Market, by Product Type

- Synthetic Lubricants Market, by Base Stock

- Synthetic Lubricants Market, by Viscosity Grade

- Synthetic Lubricants Market, by Application

- Synthetic Lubricants Market, by Region

- Synthetic Lubricants Market, by Group

- Synthetic Lubricants Market, by Country

- United States Synthetic Lubricants Market

- China Synthetic Lubricants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Core Findings and Strategic Implications of the Synthetic Lubricants Market Analysis to Inform Future Decision Making and Investment

In summary, synthetic lubricants stand at the intersection of performance excellence and environmental stewardship, propelled by advances in base-stock chemistry, additive technology, and digital maintenance solutions. The confluence of tighter emissions standards, electrification trends, and regional trade policies has reconfigured competitive dynamics, compelling stakeholders to adapt in real time.

Looking ahead, organizations that leverage localized production, cultivate strategic alliances, and prioritize sustainable feedstocks will be best positioned to thrive. Similarly, those that harness data-driven maintenance platforms and educate end-users about lifecycle benefits will foster deeper customer engagement. Ultimately, the strategic insights distilled through this analysis serve as a roadmap for decision-makers striving to navigate complexity and seize long-term growth opportunities in the synthetic lubricants market.

Engage with Our Associate Director, Sales & Marketing to Secure Your Comprehensive Synthetic Lubricants Market Research Report and Gain Strategic Advantage

As you consider the implications of this comprehensive analysis and the evolving dynamics that define the synthetic lubricants market, there is a clear opportunity to gain deeper insights tailored to your strategic needs. By purchasing the full market research report, you will unlock detailed data, in-depth case studies, and proprietary outlooks engineered to empower your decision-making process.

To take the next step toward reinforcing your competitive advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through the report’s rich insights and help you customize your purchase to align with your organization’s unique objectives. Make an informed investment in actionable intelligence today and secure your position at the forefront of the synthetic lubricants industry.

- How big is the Synthetic Lubricants Market?

- What is the Synthetic Lubricants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?