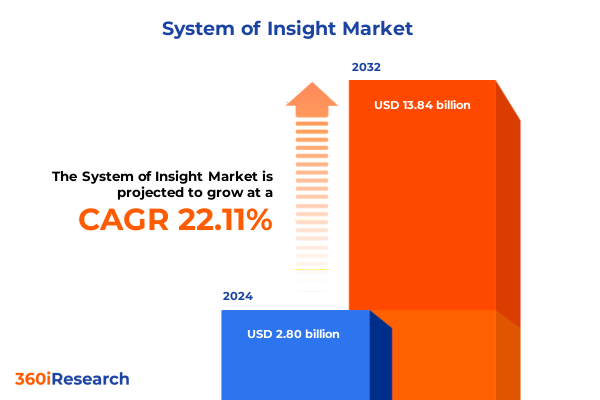

The System of Insight Market size was estimated at USD 3.40 billion in 2025 and expected to reach USD 4.13 billion in 2026, at a CAGR of 22.17% to reach USD 13.84 billion by 2032.

Discover How Integrated Analytics Architectures Are Reinventing Decision-Making and Operational Excellence Across Industries

Organizations across industries are increasingly recognizing that raw data alone is no longer sufficient to sustain competitive momentum. Instead, actionable intelligence derived from integrated systems of insight serves as the foundation for informed decision-making and agile strategy. This executive summary introduces an exploration of the evolving landscape, framing how enterprises are leveraging comprehensive analytics architectures to transform unstructured information into strategic assets.

By synthesizing data from disparate sources and applying advanced algorithms, modern systems of insight enable real-time visibility into customer behavior, operational efficiency, and risk management. The introduction sets the stage for a deeper dive into transformative shifts, regulatory challenges, and emerging best practices. It outlines the critical factors influencing adoption, articulates the role of key market participants, and previews segmentation and regional variations that define the competitive environment. Through this lens, readers gain a holistic understanding of how systems of insight drive value creation across deployment models and business functions.

Explore the Technological and Regulatory Paradigm Shifts That Are Redefining Data-Driven Intelligence Strategies

The current era is defined by fundamental shifts reshaping how organizations harness data for intelligence. Artificial intelligence and machine learning have migrated from experimental proofs of concept to core components of enterprise architecture, enabling predictive maintenance and automated anomaly detection at scale. Concurrently, the proliferation of edge computing has decentralized processing, empowering teams with near-instantaneous insights without depending solely on centralized data lakes.

At the same time, the rise of data democratization initiatives has placed governance and self-service analytics at the forefront of strategic planning. Enterprises are embedding security and compliance frameworks within analytics pipelines to satisfy stringent regulatory requirements and to safeguard against cyberthreats. Additionally, cross-industry convergence is fostering novel use cases, as manufacturing firms apply finance-grade reporting tools while financial institutions integrate workflow automation to streamline compliance workflows. These transformative shifts collectively underscore a market that is not only expanding in breadth but also deepening in technological sophistication and enterprise impact.

Analyze the Cost Dynamics and Compliance Complexities Triggered by New U.S. Tariff Policies on Enterprise Insight Infrastructures

The series of tariff adjustments imposed by the United States in 2025 has exerted far-reaching effects on the procurement of hardware components and software licensing agreements integral to systems of insight deployments. Steel and aluminum duties have increased manufacturing costs for on-premise appliances, prompting many organizations to evaluate the total cost of ownership associated with self-hosted analytics infrastructures. At the same time, elevated tariffs on imported semiconductor components have introduced price volatility, encouraging a strategic pivot toward cloud-based architectures to mitigate supply chain risk.

These cumulative impacts extend beyond cost considerations, feeding into longer procurement cycles and prompting enterprises to renegotiate vendor contracts to include more flexible pricing arrangements. Moreover, complex compliance obligations surrounding tariff classifications and import documentation have necessitated the adoption of automated reporting and visualization tools to maintain audit readiness. The result has been a gradual reconfiguration of investment priorities, with many decision-makers opting to accelerate cloud migrations and to explore hybrid strategies that balance control with cost efficiencies.

Uncover the Deep-Dive Segmentation Insights Highlighting How Applications, Deployment Modes, Pricing Structures, and Industry Verticals Shape Analytics Adoption

Insights derived from application-level segmentation reveal that data analytics continues to anchor the system of insight ecosystem, with descriptive analytics supporting historical trend analysis while predictive analytics anticipates future scenarios and prescriptive analytics recommends corrective actions. Organizations are also leveraging predictive maintenance to reduce unplanned downtime, embedding security and compliance modules within reporting and visualization platforms, and orchestrating end-to-end workflows through automation that spans data ingestion to decision execution.

From a deployment perspective, cloud environments dominate strategic roadmaps, with organizations choosing between public and private clouds or architecting multi-cloud topologies to optimize performance and resilience. Hybrid deployments offer a bridge for those balancing legacy on-premise systems-often hosted privately-with newer cloud-native components. Meanwhile, usage-based pricing models, subscription-based licensing-whether monthly or annual-and traditional perpetual licenses coexist, affording enterprises the flexibility to align expenditures with consumption patterns.

Examining industry verticals, the banking, financial services, and insurance sector drives robust demand for compliance-driven analytics; healthcare providers prioritize data security and patient-centric reporting; IT and telecom companies focus on scalability and real-time monitoring; manufacturing segments such as automotive, electronics, and food and beverage apply insights to streamline production lines; and retail sellers seek consumer behavior intelligence. Finally, large enterprises pursue comprehensive, end-to-end solutions, while small and medium enterprises adopt targeted modules to address high-priority use cases.

This comprehensive research report categorizes the System of Insight market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pricing Model

- Industry Vertical

- Enterprise Size

- Deployment Mode

- Application

Delve into the Regional Variations Shaping Analytics Platform Uptake across the Americas, EMEA, and Asia-Pacific Economies

Across the Americas, organizations in North America lead in deploying advanced insight platforms, propelled by mature digital infrastructures and a strong regulatory environment that emphasizes data protection and financial compliance. Latin American enterprises are increasingly adopting cloud-based solutions to leapfrog legacy constraints, often prioritizing security and cost predictability to support their growth trajectories.

In Europe, Middle East & Africa, regulatory frameworks such as GDPR in European jurisdictions drive a heightened focus on data governance and privacy-first analytics workflows. Enterprises across the Middle East are rapidly modernizing their analytics capabilities to underpin smart city and digital government initiatives, while African markets demonstrate a burgeoning interest in mobile-enabled insights to support agricultural and financial inclusion efforts.

Within the Asia-Pacific region, digital transformation initiatives are being accelerated by government-led policies that incentivize cloud adoption and data sovereignty. East Asian economies emphasize high-performance infrastructure to support AI-driven manufacturing, while Southeast Asian markets are leveraging hybrid strategies to bridge connectivity gaps and to democratize access to reporting and visualization tools.

This comprehensive research report examines key regions that drive the evolution of the System of Insight market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine How Leading Technology Providers Are Differentiating Their Insight Platforms through AI, Niche Specializations, and Open-Source Amplification

Major technology providers continue to innovate by embedding artificial intelligence and machine learning directly into their system of insight platforms. Companies with extensive cloud portfolios have differentiated themselves by offering unified environments that integrate data storage, processing, and advanced analytics under a single pane of glass. These organizations invest heavily in platform extensibility, enabling third-party integrations and low-code development to meet the bespoke requirements of global enterprises.

Simultaneously, specialized vendors are carving out niches by delivering domain-specific solutions tailored to industries such as healthcare and manufacturing. Their focus on preconfigured workflows and compliance-driven reporting addresses critical vertical pain points and accelerates time to value. Collaborative partnerships between ecosystem players and consulting firms further amplify market reach, as clients seek comprehensive services encompassing deployment, integration, and ongoing optimization.

Competitive dynamics are also influenced by the growing importance of open-source frameworks. A handful of companies have bolstered their offerings with community-driven analytics engines and developer tooling, capturing attention from agile teams seeking cost-effective customization. Overall, the key implications for buyers center on balancing innovation velocity, platform maturity, and the depth of industry expertise offered by potential suppliers.

This comprehensive research report delivers an in-depth overview of the principal market players in the System of Insight market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alteryx Inc.

- Board International SA

- Domo Inc.

- GoodData Corporation

- IBM Corporation

- Informatica LLC

- Microsoft Corporation

- MicroStrategy Incorporated

- OpenText Corporation

- Oracle Corporation

- Pegasystems Inc.

- QlikTech International AB

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Sisense Ltd.

- Software AG

- Teradata Corporation

- ThoughtSpot Inc.

- TIBCO Software Inc.

Actionable Best Practices for Accelerating Analytics Maturity through AI Operationalization, Hybrid Architectures, and Collaborative Cultures

Industry leaders should prioritize the integration of artificial intelligence and machine learning at every layer of the analytics stack to ensure that predictive and prescriptive capabilities are not confined to pilot projects but become operationalized at scale. This requires establishing clear data governance frameworks, enabling self-service analytics for business users, and embedding security and compliance checks within automated pipelines. By doing so, organizations can accelerate time to insight and reduce the risk of data misuse.

Furthermore, decision-makers are advised to pursue hybrid architectures that combine on-premise control with cloud scalability. Structured proof-of-concept initiatives can validate the right balance of latency, cost, and sovereignty requirements before full-scale migration. Leaders should also negotiate flexible pricing models with vendors, aligning commercial terms to usage patterns and future growth projections.

Lastly, it is critical to foster a culture of continuous learning and cross-functional collaboration. Providing specialized training for analytics engineers, upskilling business analysts in data interpretation, and engaging executive sponsors will drive adoption and ensure that systems of insight become embedded in strategic decision-making processes.

Detailed Multimethod Research Framework Combining Primary Interviews, Quantitative Surveys, and Iterative Segmentation Validation

This research utilizes a hybrid methodology combining primary and secondary sources to ensure a robust and balanced perspective. Secondary research involved examining regulatory documents, industry white papers, technology roadmaps, and peer-reviewed journals to identify prevailing trends and to understand the implications of U.S. tariffs on analytics infrastructure. Primary research comprised in-depth interviews with senior IT executives, data scientists, and compliance officers across multiple regions and industry verticals, providing firsthand insights into strategic priorities and deployment challenges.

Quantitative data was collected through structured surveys targeting decision-makers responsible for analytics investments, ensuring representation from large enterprises and small and medium businesses. Responses were triangulated with vendor disclosures and publicly available financial reports to validate qualitative findings. The segmentation framework was developed iteratively, with each category refined through expert workshops and cross-validation to capture the nuances of application types, deployment modes, pricing models, vertical use cases, and enterprise sizes.

Data analysis employed thematic coding and trend mapping techniques, supplemented by scenario planning to assess the potential trajectories of emerging technology and policy interventions. The combined approach ensures that the conclusions and recommendations are both empirically grounded and strategically relevant.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our System of Insight market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- System of Insight Market, by Pricing Model

- System of Insight Market, by Industry Vertical

- System of Insight Market, by Enterprise Size

- System of Insight Market, by Deployment Mode

- System of Insight Market, by Application

- System of Insight Market, by Region

- System of Insight Market, by Group

- System of Insight Market, by Country

- United States System of Insight Market

- China System of Insight Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesize the Critical Insights and Market Dynamics Guiding Next-Generation Analytics Adoption and Strategic Technology Investments

In summary, the system of insight market is experiencing a period of rapid evolution fueled by advances in artificial intelligence, cloud-native architectures, and stringent regulatory demands. Organizations face complex decisions when selecting platforms that must balance innovation speed with governance rigor, all while contending with the cost and compliance impacts of recent tariff policies.

Key segmentation and regional patterns reveal that no single solution fits all contexts; rather, success depends on tailoring analytics capabilities to specific application areas, deployment environments, pricing preferences, industry requirements, and organizational scales. The competitive landscape underscores the importance of evaluating vendor roadmaps, domain expertise, and partnership ecosystems to secure solutions that can adapt to shifting business objectives.

As enterprises seek to unlock the full potential of their data assets, this report provides a structured lens for understanding the drivers, challenges, and opportunities shaping the next wave of insights-driven transformation.

Unlock Your Strategic Advantage by Connecting with Ketan Rohom to Secure Your Customized System of Insight Market Research Report

To gain immediate access to this comprehensive market research report and explore its strategic value for your organization, connect with Associate Director of Sales & Marketing, Ketan Rohom. He can guide you through tailored purchasing options and outline how the detailed system of insight analysis aligns with your specific goals. Leveraging his deep understanding of executive-level priorities, Ketan stands ready to facilitate a seamless acquisition process and ensure you receive insights that drive measurable business outcomes. Contact him today to secure your copy and begin translating research findings into actionable strategies that position your enterprise for sustained growth and competitive differentiation.

- How big is the System of Insight Market?

- What is the System of Insight Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?