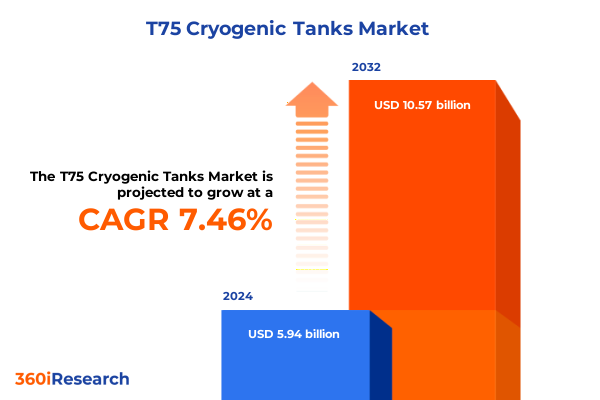

The T75 Cryogenic Tanks Market size was estimated at USD 6.38 billion in 2025 and expected to reach USD 6.80 billion in 2026, at a CAGR of 7.46% to reach USD 10.57 billion by 2032.

Establishing a Comprehensive Foundation for the T75 Cryogenic Tanks Market With Insights Into Technological Evolution and Strategic Imperatives

The T75 Cryogenic Tanks market represents a dynamic convergence of advanced materials, thermal insulation innovations, and stringent safety regulations that collectively underpin storage and transportation solutions for ultra-low temperature fluids. These specialized vessels are engineered to maintain consistent sub-ambient conditions for liquefied gases, supporting a spectrum of critical applications ranging from industrial gas distribution to biomedical preservation. Over recent years, the relentless pursuit of performance optimization has driven manufacturers to refine vacuum insulation, adopt composite structural components, and integrate real-time monitoring systems, thereby setting a new benchmark for reliability and operational efficiency.

Against this backdrop, the present analysis provides a comprehensive introduction to the foundational elements shaping the T75 Cryogenic Tanks arena. It outlines the primary market drivers, including escalating demand in energy and healthcare sectors, evolving regulatory frameworks aimed at mitigating leak and emissions risks, and the transformative impact of digitalization on asset management. By framing the essential technological, economic, and policy levers in play, this section establishes a clear context for understanding the subsequent deep-dive examination of market shifts, tariff pressures, segmentation dynamics, regional performance, leading participants, and strategic pathways for industry stakeholders.

Mapping the Transformative Shifts Redefining the T75 Cryogenic Tanks Landscape From Operational Efficiency to Sustainable Energy Integration

In recent years, the T75 Cryogenic Tanks landscape has experienced transformative shifts that extend far beyond incremental product enhancements. The widespread integration of digital twin platforms has redefined predictive maintenance, enabling operators to anticipate performance deviations and schedule interventions before critical failures occur. Simultaneously, the advent of eco-friendly insulation materials, such as advanced aerogel composites, has propelled reductions in boil-off rates, aligning storage solutions with broader sustainability goals. These technological breakthroughs have been paralleled by an increased emphasis on modular, scalable tank designs, streamlining deployment in remote or temporary installations where rapid mobilization is essential.

Furthermore, the growing prominence of hydrogen as a clean energy vector is catalyzing a new generation of cryogenic infrastructure, necessitating tanks capable of withstanding extreme pressure fluctuations and minimizing energy losses during refueling cycles. At the same time, supply chain digitalization has fostered end-to-end traceability, reinforcing regulatory compliance and mitigating logistical risks. Taken together, these developments constitute a fundamental paradigm shift, transitioning the industry from traditional heavy steel vessels to smarter, more sustainable, and highly adaptable cryogenic storage ecosystems.

Analyzing the Cumulative Impact of 2025 United States Tariffs on the T75 Cryogenic Tanks Ecosystem Including Cost Structures and Supply Chain Resilience

The imposition of updated United States tariffs in 2025 has introduced a complex layer of cost and strategic considerations for stakeholders in the T75 Cryogenic Tanks market. Components traditionally sourced from international suppliers, including specialized vacuum panels and precision-machined valves, have become subject to elevated duties, leading many original equipment manufacturers to reevaluate global procurement strategies. This shift has translated into upward pressure on production costs, compelling companies to absorb margin impacts, renegotiate supplier contracts, or explore alternative material sourcing within domestic markets.

In response to these challenges, a growing number of tank manufacturers have accelerated investments in localized assembly hubs and strengthened relationships with North American raw material producers to insulate operations from volatility. At the same time, end-users are recalibrating total cost of ownership assessments to incorporate tariff-driven price adjustments, making second-life refurbishment and aftermarket service offerings increasingly attractive. As a result, the tariff landscape has not only reshaped the competitive intensity among global suppliers but also catalyzed strategic realignments across the value chain, underscoring the importance of agility and supply chain resilience in a constrained trade environment.

Unveiling Key Segmentation Insights Across Cryogen Types, Applications, Capacities, Configurations, and Pressure Ratings That Drive the T75 Tank Market

Close examination of market segmentation reveals distinct trajectories across cryogen type, application, capacity, configuration, and pressure rating dimensions that collectively influence demand patterns for T75 storage solutions. Within the cryogen type spectrum, liquid nitrogen commands leadership owing to its ubiquity in food preservation, semiconductor manufacturing, and healthcare procedures, although liquid oxygen and liquid argon tanks are gaining traction in oxygen therapy applications and high-purity gas production respectively. When evaluated through the lens of end-user application, energy and power scenarios, such as LNG regasification and hydrogen transport, are driving demand for larger capacity vessels, whereas scientific research settings favor smaller units optimized for laboratory-scale cryostorage.

Capacity segmentation underscores this variation, with under 5,000 liter tanks prioritizing portability and rapid cooldown rates, and above 20,000 liter units emphasizing minimized boil-off for bulk storage. Configuration considerations further differentiate product selection: horizontal models cater to stable, long-term storage sites, while vertical tanks offer space-efficient footprints for urban or constrained facilities. Finally, pressure rating distinctions play a pivotal role; high-pressure vessels enable accelerated dispensing rates in industrial gas production, medium pressure solutions balance throughput with safety margins for healthcare logistics, and low-pressure systems serve educational and research environments where simplicity and cost-effective operation are paramount. Together, these nuanced insights guide tailored product development and marketing strategies, ensuring tank designs align precisely with diverse operational requirements.

This comprehensive research report categorizes the T75 Cryogenic Tanks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cryogen Type

- Capacity

- Configuration

- Pressure Rating

- Application

Decoding Regional Performance Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific to Reveal Growth Catalysts and Market Nuances

Regional dynamics exert significant influence on the trajectory of the T75 Cryogenic Tanks market, reflecting diverse end-use demands, infrastructure maturity, and regulatory landscapes. In the Americas, the proliferation of liquefied natural gas export terminals and the expansion of aerospace facilities have elevated demand for large-scale cryogenic storage, while stringent emissions controls in select states are prompting investments in low-boil-off technologies. Moving across to the combined Europe, Middle East, and Africa region, renewable energy targets and metallurgical industry growth are stimulating adoption of cryogenic solutions for industrial gas applications, alongside burgeoning healthcare spending that is bolstering oxygen-centric tank deployments.

Meanwhile, the Asia-Pacific arena stands out as the fastest expanding region, fueled by rapid industrialization in emerging economies, government initiatives to develop hydrogen fueling infrastructure, and a surging biotech sector. Market participants are capitalizing on aggressive infrastructure investments in port facilities and petrochemical complexes, while forging partnerships with local engineering firms to navigate complex import regulations. Collectively, these regional insights underscore the need for adaptive strategies that leverage local strengths, anticipate regulatory shifts, and optimize logistics networks to capture growth opportunities in each distinct geographic segment.

This comprehensive research report examines key regions that drive the evolution of the T75 Cryogenic Tanks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants to Highlight Strategic Collaborations, Innovation Pipelines, and Competitive Positioning in the T75 Cryogenic Tanks Arena

A thorough assessment of leading participants in the T75 Cryogenic Tanks domain highlights a competitive landscape characterized by differentiated value propositions and strategic collaborations. Established original equipment manufacturers have reinforced their foothold through targeted acquisitions of specialty insulation technology suppliers, as well as alliances with digital monitoring solution providers to enhance predictive maintenance offerings. Meanwhile, emerging market entrants are carving out niches by developing modular tank designs that reduce on-site assembly requirements and by pioneering subscription-based service models that bundle performance guarantees with routine maintenance.

Concurrently, several companies have prioritized standardized platforms adaptable across cryogen types, enabling scalable production runs that drive cost efficiencies. Investment in in-house welding and pressure testing capabilities has also emerged as a differentiator, ensuring compliance with region-specific certifications and expediting time to market. As competitive pressures intensify, the importance of sustained R&D programs, global distribution networks, and customer-centric aftermarket services has never been more pronounced, reinforcing a paradigm where innovation, quality assurance, and service excellence define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the T75 Cryogenic Tanks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products and Chemicals Inc.

- Chart Industries Inc.

- Cryofab Inc.

- Cryogenmash JSC

- Cryolor SAS

- Cryoquip LLC

- CryoVation GmbH

- Ebner GmbH & Co. KG

- Fiba Technologies Inc.

- Gardner Cryogenics

- INOX India Ltd.

- Isisan A.S.

- Lapesa Group

- Linde plc

- M1 Engineering Ltd.

- Minnesota Valley Engineering Inc.

- Praxair Inc.

- Suretank Group Ltd.

- Taylor-Wharton

- Universal Industrial Gases Inc.

- VRV S.p.A.

- Wessington Cryogenics Ltd.

Delivering Actionable Recommendations Enabling Industry Leaders to Harness Technological Advancements and Forge Strategic Partnerships in Cryogenic Storage Solutions

Industry leaders poised to drive future growth in the T75 Cryogenic Tanks market must embrace a multifaceted set of strategic actions to capitalize on evolving opportunities. Prioritizing research and development investments in next-generation insulation and lightweight structural composites will not only enhance thermal performance but also reduce total system weight and transportation costs. Complementing material innovations with comprehensive digital integration-such as embedding IoT sensors for real-time pressure and temperature analytics-will empower predictive maintenance regimes and minimize operational disruptions.

Moreover, crafting strategic partnerships with regional suppliers and service providers can mitigate tariff exposure and streamline localized production, while collaboration with academic and research institutions will accelerate breakthroughs in cryogenic technologies. Equally important is the adoption of flexible financing and leasing models, which address the capital intensity of cryogenic assets and broaden access to emerging end-users. By executing these recommendations in concert, market participants can fortify their competitive positioning and deliver end-to-end value propositions that resonate with an increasingly sophisticated customer base.

Outlining a Robust Research Methodology Integrating Quantitative Data Analysis, Primary Stakeholder Interviews, and Rigorous Validation to Ensure Comprehensive Market Insights

The insights presented in this report are grounded in a rigorous research methodology designed to ensure accuracy, relevance, and depth. Initial data gathering involved extensive secondary research across publicly available sources, including regulatory filings, industry white papers, and academic journals focused on cryogenics and material science. This foundation was augmented by primary interviews with key stakeholders, such as manufacturing executives, R&D specialists, and supply chain managers, conducted through structured questionnaires to capture nuanced perspectives on market dynamics and operational challenges.

Subsequently, quantitative data were analyzed using statistical techniques to identify demand patterns, growth drivers, and risk factors. Triangulation of findings was achieved by cross-referencing multiple data sets, while expert validation sessions were held with industry thought leaders to refine conclusions and ensure the robustness of critical assumptions. Quality control procedures, including peer reviews and consistency checks, were integrated throughout the research lifecycle to uphold the integrity of the final deliverables and provide stakeholders with a dependable roadmap for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our T75 Cryogenic Tanks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- T75 Cryogenic Tanks Market, by Cryogen Type

- T75 Cryogenic Tanks Market, by Capacity

- T75 Cryogenic Tanks Market, by Configuration

- T75 Cryogenic Tanks Market, by Pressure Rating

- T75 Cryogenic Tanks Market, by Application

- T75 Cryogenic Tanks Market, by Region

- T75 Cryogenic Tanks Market, by Group

- T75 Cryogenic Tanks Market, by Country

- United States T75 Cryogenic Tanks Market

- China T75 Cryogenic Tanks Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings on Evolving Market Drivers, Tariff Implications, and Strategic Pathways to Inform Decision Making in T75 Cryogenic Tank Investments

In conclusion, the T75 Cryogenic Tanks market is undergoing a profound transformation propelled by technological innovations, evolving application requirements, and shifting trade dynamics. Breakthroughs in insulation materials and digital monitoring capabilities are elevating performance standards, while the 2025 United States tariffs are reshaping supply chains and cost structures in ways that demand strategic agility. Segmentation insights reveal that diverse operational contexts-from small-scale laboratory environments to large industrial gas production facilities-require tailored tank configurations, capacities, and pressure ratings to optimize functionality and safety.

Regional disparities underscore the imperative for localized strategies, as each geographic segment presents unique regulatory frameworks, infrastructure maturity levels, and growth catalysts. Leading companies are differentiating through targeted collaborations, streamlined manufacturing platforms, and enhanced aftermarket services, paving the way for sustained competitive advantage. By aligning strategic priorities with the recommendations outlined in this analysis, stakeholders can navigate complexity, leverage emerging opportunities, and chart a course toward resilient, innovation-driven growth in the cryogenic storage domain.

Take the Next Step Toward Empowered Decision Making by Securing Your Detailed T75 Cryogenic Tanks Market Intelligence Report Today

Embarking on the journey to unlock unparalleled industry insights begins with a single step toward acquiring the definitive market intelligence report on the T75 Cryogenic Tanks landscape. Speak with Ketan Rohom, Associate Director of Sales & Marketing, to explore a bespoke briefing tailored to your strategic objectives and gain exclusive access to in-depth analysis, expert interviews, and a comprehensive view of emerging trends.

Secure your competitive edge by arranging a consultation today and discover how this authoritative report can guide your investment decisions, optimize supply chain strategies, and drive growth in a rapidly evolving sector. Reach out to our team to schedule a personalized walkthrough and learn how the granular data and actionable recommendations contained within can empower your organization to lead in the cryogenic storage solutions market.

- How big is the T75 Cryogenic Tanks Market?

- What is the T75 Cryogenic Tanks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?