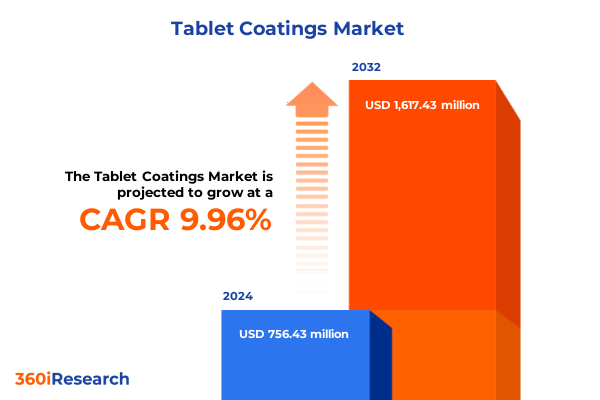

The Tablet Coatings Market size was estimated at USD 823.33 million in 2025 and expected to reach USD 899.14 million in 2026, at a CAGR of 10.12% to reach USD 1,617.43 million by 2032.

Pioneering the Future of Tablet Coatings Through Innovative Practices and Advanced Material Applications for Enhanced Efficacy and Patient Compliance

The tablet coatings industry stands at the confluence of scientific rigor and commercial innovation, providing a critical bridge between formulation excellence and patient-centric design. Across pharmaceutical, nutraceutical, and veterinary applications, tablet coatings fulfill vital functions: they modify release profiles to optimize therapeutic efficacy, mask unpleasant tastes to enhance patient compliance, and protect active ingredients from environmental stressors. In recent years, the industry has experienced a surge in demand driven by rising prevalence of chronic diseases, expanding nutraceutical adoption, and increasing complexity of novel active pharmaceutical ingredients. As formulators and manufacturers seek to differentiate their products, the sophistication of coating materials and application technologies has become a decisive factor in driving brand value and development timelines.

With regulatory authorities placing greater emphasis on product quality, safety, and performance, coating processes now integrate real-time monitoring and process analytical technologies to ensure consistency and compliance with stringent guidelines. Moreover, the shift toward continuous manufacturing and Industry 4.0 principles is reshaping plant designs, compelling stakeholders to adopt flexible, scalable equipment capable of handling diverse formulations. Against this backdrop, a comprehensive understanding of material science, process optimization, and market dynamics is essential for making informed strategic decisions. This report delivers a foundational overview of current challenges and opportunities, setting the stage for deeper analysis of transformative trends, emerging market forces, and actionable strategies.

Unveiling the Transformative Technological Advances and Regulatory Trends Reshaping the Global Tablet Coatings Ecosystem in a Rapidly Evolving Landscape

In the past decade, the tablet coatings arena has undergone transformative shifts driven by breakthroughs in polymer engineering and coating techniques that extend well beyond traditional functions. The advent of novel functional polymers has enabled the development of coatings with precise pH-triggered release mechanisms, ensuring targeted delivery within the gastrointestinal tract. Meanwhile, solvent-free and dry powder technologies have gained traction as sustainability concerns catalyze the reduction of organic solvent emissions and enhance operator safety. These technological leaps, coupled with process analytical advancements such as near-infrared spectroscopy and in-line imaging systems, have elevated process control, minimized batch failures, and accelerated time-to-market for complex formulations.

Simultaneously, regulatory landscapes have evolved to foster innovation while safeguarding patient health. Agencies in North America, Europe, and Asia-Pacific are increasingly adopting harmonized guidelines for continuous manufacturing and real-time quality monitoring, reducing approval timelines for compliant facilities. As a result, manufacturers are investing in advanced coating equipment outfitted with digital twins and predictive analytics, enabling proactive troubleshooting and adaptive process optimization. This convergence of regulatory support, material innovation, and digital transformation marks a pivotal moment for the industry, as stakeholders navigate shifting market expectations and embrace next-generation coating solutions that deliver both performance and sustainability.

Assessing the Comprehensive Effects of 2025 United States Tariff Policies on Tablet Coatings Supply Chains and Cost Structures Across Critical Markets

The imposition of new tariff measures by the United States in 2025 has introduced a complex set of cost pressures and supply chain challenges for tablet coatings manufacturers and end users. Raw materials sourced from key suppliers in Asia and Europe have seen duty increases that range from moderate to high, particularly impacting specialty polymers and film-forming agents. In response, many stakeholders have reevaluated their sourcing strategies, shifting a portion of procurement to more cost-effective domestic or nearshore suppliers to mitigate the impact of import duties. However, this recalibration often involves trade-offs in material availability and quality attributes, compelling formulators to reformulate or qualify alternative excipients under stringent regulatory scrutiny.

Furthermore, the additional tariff burden has prompted industry leaders to explore vertical integration opportunities and strategic partnerships spanning the value chain. By collaborating directly with monomer and polymer manufacturers, coating equipment suppliers, and contract development organizations, companies aim to lock in supply agreements, negotiate volume-based concessions, and secure priority access to critical materials. These initiatives, when combined with process efficiencies and lean manufacturing practices, can offset tariff-related cost increases. Looking ahead, the evolving policy landscape underscores the necessity for agile supply chain planning, robust risk assessment, and proactive stakeholder engagement to maintain competitive positioning and ensure uninterrupted product availability.

Deriving Strategic Insights by Examining the Multifaceted Segmentation Dimensions That Define the Tablet Coatings Market Dynamics

A nuanced understanding of the tablet coatings market emerges when evaluating its multiple segmentation dimensions, each offering unique insights into product performance, costing dynamics, and end-user requirements. When segmenting based on product type, the market encompasses film, functional, and sugar coatings, with film subtypes including controlled release, delayed release, and immediate release matrices that cater to distinct therapeutic objectives. Functional coatings subdivide into enteric, sustained release, and taste-masking systems, each engineered to address gastrointestinal compatibility and patient compliance. Sugar-based coatings, in turn, differentiate between conventional sugar and functional sugar formulations, providing cost-effective yet visually appealing options for over-the-counter and nutraceutical products.

Turning to technology, the industry’s capabilities span aqueous, dry powder, solvent, and solvent-free processes, each offering advantages in terms of solvent usage, environmental footprint, and application efficiency. When analyzing by application, tablet coatings serve nutraceutical, oral pharmaceutical, and veterinary markets, each with specific regulatory mandates, performance criteria, and scale considerations. Coating material selection further refines the landscape, encompassing acrylic polymers, cellulose polymers, gelatin, and sugar polymers that drive functional attributes and cost structures. In addition, segmentation by end user-from contract research organizations and nutraceutical manufacturers to pharmaceutical companies and veterinary enterprises-reveals diverse procurement patterns and strategic priorities. Finally, sales channels including direct sales, distributors, and ecommerce platforms influence market access strategies, pricing models, and customer engagement approaches, highlighting the importance of a tailored go-to-market strategy across stakeholder segments.

This comprehensive research report categorizes the Tablet Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Coating Material

- Application

- End User

- Sales Channel

Mapping the Unique Regional Drivers and Market Dynamics Shaping Tablet Coatings Adoption Across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics play a pivotal role in shaping the competitive landscape and adoption rates of tablet coatings technologies. In the Americas, particularly the United States, stringent regulatory frameworks and a strong emphasis on quality by regulatory bodies drive demand for premium coating solutions that ensure batch-to-batch consistency and full compliance with updated continuous manufacturing guidelines. North America’s robust pharmaceutical and nutraceutical industries provide a mature environment for advanced coating applications, fostering early adoption of digital process controls and eco-friendly solvent alternatives.

In Europe, Middle East & Africa, a heterogeneous mix of markets presents both opportunities and challenges. Western European markets prioritize sustainable production practices and patient-centric formulations, while emerging markets in Eastern Europe, the Middle East, and Africa focus on improving access to cost-effective generics and nutraceutical products. Local regulatory harmonization with guidelines set by supranational entities encourages investment in modular coating lines that can adapt to regional variations. Meanwhile, Asia-Pacific exhibits explosive growth driven by expanding healthcare infrastructure, surging demand for over-the-counter supplements, and a growing veterinary sector. Rapid industrialization and favorable government incentives in countries such as India and China catalyze investment in high-throughput coating equipment and next-generation materials, making this region a focal point for global supply chain diversification.

This comprehensive research report examines key regions that drive the evolution of the Tablet Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Industry Players Driving Innovation and Competitive Advantage Through Advanced Formulations and Strategic Partnerships

Leading industry players are leveraging proprietary technologies, strategic acquisitions, and collaborative partnerships to maintain a competitive edge in the evolving tablet coatings landscape. Colorcon has continued to pioneer film-forming polymer innovations, focusing on bioresorbable and customizable release-rate solutions that address the complexity of modern active ingredients. Evonik stands out for its advanced excipient portfolio, combining functional polymers with performance-enhancing additives to meet stringent regulatory requirements and simplify formulation processes. Roquette, with its deep expertise in plant-based polymers, has expanded its presence in sustainable coating materials, tapping into growing consumer demand for clean-label and eco-friendly solutions.

Additionally, major chemical conglomerates such as BASF have integrated advanced analytics and digital services into their coating systems, offering predictive maintenance and real-time process monitoring to optimize throughput and reduce waste. Signet Chemical has strengthened its footprint in emerging markets through regional manufacturing partnerships, ensuring local supply continuity and responsive technical support. Continuous investments in research and development, along with strategic alliances across the supply chain, underscore the importance of end-to-end collaboration in addressing raw material volatility, technological complexity, and regulatory evolution. As competitive dynamics intensify, these leading players set the benchmark for innovation, quality, and customer-centric service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tablet Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Ashland Global Holdings Inc.

- BASF SE

- Colorcon, Inc.

- DFE Pharma GmbH & Co. KG

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- JRS Pharma GmbH & Co. KG

- Kerry Group plc

- Merck KGaA

- Roquette Frères S.A.

- Sensient Technologies Corporation

- The Lubrizol Corporation

Implementing Forward-Looking Initiatives to Elevate Product Differentiation, Compliance, and Supply Chain Resilience Across the Tablet Coatings Sector

Industry leaders must adopt a proactive stance to capitalize on emerging trends and mitigate market uncertainties. First, prioritizing investment in flexible coating platforms that support multiple technologies-from aqueous to solvent-free processes-will enable rapid response to regulatory shifts and sustainability mandates. By standardizing modular equipment configurations and implementing process analytical technologies, manufacturers can streamline technology transfer between sites and accelerate time-to-market for new formulations. In parallel, forging strategic alliances with key polymer suppliers and contract development organizations will secure critical raw material access and foster co-development of next-generation coating solutions.

Second, enhancing digital capabilities across the value chain-such as integrating predictive analytics, digital twins, and end-to-end process control systems-will improve decision-making, reduce operational downtime, and reinforce quality assurance measures. Embracing data-driven process optimization not only safeguards regulatory compliance but also uncovers opportunities for cost reduction and yield improvement. Finally, aligning product development roadmaps with sustainability goals, including the transition to solvent-free coatings and renewable polymer sources, will resonate with end users and regulators alike. By embedding circular economy principles into strategic planning, organizations can achieve environmental targets while unlocking new revenue streams in both established and high-growth regions.

Applying a Robust and Transparent Mixed-Methods Research Framework for Comprehensive Analysis of Tablet Coatings Market Trends and Stakeholder Perspectives

This report is grounded in a rigorous mixed-methods approach that combines quantitative data analysis with qualitative insights from industry stakeholders. Secondary research formed the foundation, encompassing regulatory filings, patent databases, peer-reviewed literature, and technical white papers to map the historical evolution of coating technologies and material innovations. Trade associations, conference proceedings, and sustainability reports provided additional context on emerging trends and best practices. Primary research was then conducted through structured interviews with formulation scientists, regulatory experts, and supply chain executives, ensuring a comprehensive view of the operational challenges and strategic priorities shaping the market.

Quantitative modeling incorporated regression analysis and scenario planning to evaluate the impact of tariff changes and regional growth trajectories. Supply chain mapping techniques were utilized to identify critical nodes, potential bottlenecks, and risk mitigation strategies. Furthermore, a validation workshop with senior industry leaders provided feedback on preliminary findings and refined the report’s strategic recommendations. Together, these methodologies ensure that the report’s conclusions are both robust and actionable, offering stakeholders a reliable framework for decision-making amidst a rapidly evolving tablet coatings environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tablet Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tablet Coatings Market, by Product Type

- Tablet Coatings Market, by Technology

- Tablet Coatings Market, by Coating Material

- Tablet Coatings Market, by Application

- Tablet Coatings Market, by End User

- Tablet Coatings Market, by Sales Channel

- Tablet Coatings Market, by Region

- Tablet Coatings Market, by Group

- Tablet Coatings Market, by Country

- United States Tablet Coatings Market

- China Tablet Coatings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Decision-Making in the Rapidly Evolving Tablet Coatings Industry and Future Directions

The analysis presented in this report underscores the multifaceted nature of the tablet coatings market, where technological innovation, regulatory evolution, and geopolitical factors intersect to shape strategic imperatives. Key findings reveal that advanced polymer engineering and digital process controls are not only enhancing product performance but also driving operational efficiencies and sustainability milestones. Regional insights highlight the critical role of localization strategies in mitigating tariff impacts and meeting diverse regulatory requirements across the Americas, EMEA, and Asia-Pacific.

As the industry moves forward, decision-makers must balance near-term cost pressures with long-term innovation investments. Strategic partnerships, supply chain resilience, and digital transformation emerge as essential pillars for securing competitive positioning and capturing growth opportunities. By synthesizing these insights, organizations can chart a clear path toward enhanced compliance, product differentiation, and market expansion. The future of tablet coatings will be defined by those who seamlessly integrate material science breakthroughs with agile, data-driven processes-setting the standard for efficacy, safety, and environmental stewardship in the pharmaceutical, nutraceutical, and veterinary sectors.

Engage Directly with Ketan Rohom to Secure the Detailed Market Research Report and Gain Competitive Advantage with Cutting-Edge Tablet Coatings Insights

To access the in-depth analysis, proprietary data sets, and strategic frameworks outlined in this report, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By consulting with Ketan Rohom, you will gain tailored guidance on how to leverage these insights for your organization’s unique objectives. This direct collaboration ensures you receive personalized support on interpreting key findings, identifying high-impact opportunities, and implementing best practices that drive innovation and competitive advantage within the tablet coatings sector. Reach out today to secure your copy of the comprehensive market research report and embark on a path to accelerated growth and enhanced market positioning.

- How big is the Tablet Coatings Market?

- What is the Tablet Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?