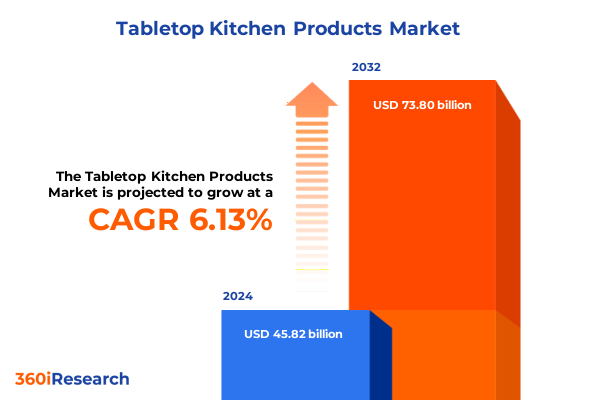

The Tabletop Kitchen Products Market size was estimated at USD 48.52 billion in 2025 and expected to reach USD 51.39 billion in 2026, at a CAGR of 6.17% to reach USD 73.80 billion by 2032.

Exploring the Evolving Tabletop Kitchen Products Landscape Amidst Consumer Demand Shifts and Operational Challenges Across Global Markets

Over recent years, the tabletop kitchen products sector has experienced a period of dynamic change influenced by evolving consumer lifestyles as well as global supply chain complexities. Within this multifaceted environment, stakeholders have had to adapt to shifting preferences for materials, design aesthetics, and purchasing channels. Simultaneously, manufacturers and distributors are encountering headwinds as they navigate regulatory adjustments and tighter inventory management practices. Amid these variables, the intersection of technology-enabled customization and heightened demand for sustainable solutions has fostered new avenues for competitive differentiation.

As consumer priorities continue to branch out from basic utility toward experiences that blend functionality and self-expression, the role of tabletop kitchenware has expanded beyond the simple act of serving food. Today, these products are integral to defining brand identities for hospitality operators, creating emotional resonance in residential kitchens, and meeting rigorous hygienic standards. Against this backdrop, market participants are exploring innovative materials, digital printing capabilities for personalized designs, and collaborative partnerships between designers and manufacturers. Consequently, understanding these foundational shifts is essential to recognizing where strategic opportunities lie in this increasingly complex global market landscape.

Identifying Fundamental Transformations in Production, Design, and Consumer Behavior that Are Redefining Tabletop Kitchen Market Norms

The landscape of tabletop kitchen products is undergoing fundamental transformations in production methods, design paradigms, and consumer behaviors. Where mass-production once reigned supreme, companies are now integrating lean manufacturing techniques and advanced automation to deliver more nimble, on-demand production runs. This pivot not only reduces inventory risk but also accelerates time-to-market for limited-edition and seasonal collections. At the same time, evolving design philosophies are blurring the lines between artisan craftsmanship and industrial precision. Artisanal techniques are being scaled through hybrid manufacturing platforms, enabling greater consistency without sacrificing quality.

Simultaneously, consumer behavior is shifting toward deeper involvement in the design process. Digital tools for 3D visualization and online configurators have empowered end users and hospitality buyers to co-create patterns, colors, and textures, resulting in stronger brand loyalty and lower rates of product obsolescence. As sustainability considerations continue to influence purchase decisions, manufacturers are adopting closed-loop and cradle-to-cradle frameworks, embedding recycled inputs and designing for product end-of-life recovery. These intersecting forces are not only redefining product lifecycles but are also generating new business models centered on circularity and shared value creation.

Assessing the Compounding Effects of 2025 United States Tariffs on Import Costs, Supply Chains, and Price Strategies in Tabletop Kitchen Products

The reinstatement of broad-based tariffs by the United States in 2025 has had a deep ripple effect across the tabletop kitchen products value chain. On one hand, raw material surcharges on key imports such as specialized glass and cast aluminum have driven manufacturers to reconsider their sourcing strategy. Many producers of glassware and serveware have absorbed portions of these levies to remain price-competitive, while a significant share has implemented incremental price adjustments for end users. This dynamic has reshaped cost models, often compelling businesses to reevaluate their supplier portfolios and to explore near-shore or domestic alternatives to mitigate tariff exposure.

Furthermore, the new steel and aluminum duties of 25 percent imposed in March 2025 have directly influenced component costs for certain items, such as flatware and cutlery, where stainless steel alloys prevail. In response, several high-volume importers have expedited applications for product exclusions or sought tariff relief through trade remedy provisions. A number of smaller import-dependent brands have chosen to shift production to countries with more favorable trade terms, including Vietnam and India, to preserve margin integrity and ensure supply continuity. As these tariff measures evolve, product strategies and pricing frameworks will need to remain adaptable in order to balance competitive positioning with regulatory compliance.

Uncovering Critical Segmentation Perspectives That Illuminate Product Types, Materials, Design Preferences, End Users, and Distribution Dynamics

Segmentation analysis reveals a rich tapestry of product offerings and market behaviors within the tabletop kitchen domain. In terms of product type, the buffet category sees consistent demand among foodservice operators seeking durable, high-capacity serveware, while dinnerware remains foundational for both residential and hospitality use, across bowls, cups & saucers, and plates. Drinkware finds its anchor in barware and glass collections for upscale venues, with pitchers & carafes catering to casual dining. Flatware continues to diversify through forks, knives, spoons, and specialized serving utensils, reflecting a widening emphasis on aesthetic unity across tabletop settings.

Material preferences delineate clear consumer priorities, with ceramic and glass holding enduring appeal for their non-porous qualities and visual versatility, metal offering strength and heft that underscore premium positioning, and wood and certain plastics catering to niche demands for sustainability or outdoor application. Design typologies range from the relaxed, free-spirited motifs of Bohemian style to the clean lines of Contemporary aesthetics, the tactile warmth of Rustic pieces, and the familiar forms of Traditional collections. End-user segmentation bifurcates between commercial environments-where airlines, railways, cafes, catering, hospitality institutions, and hotels demand resilient, standardized assortments-and residential consumers seeking uniqueness and convenience. Finally, distribution channels split between offline specialty stores and large grocery or hypermarkets, and the expanding online sphere via brand websites and e-commerce platforms, which increasingly drive direct-to-consumer engagement.

This comprehensive research report categorizes the Tabletop Kitchen Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Design Type

- End User

- Distribution Channel

Analyzing Distinct Regional Market Patterns in the Americas, Europe Middle East and Africa, and Asia Pacific Tabletop Kitchen Segments

Across the Americas, the tabletop kitchen products market is characterized by an enduring appetite for casual dinnerware and barware that balances craftsmanship with accessibility. Latin American influences, such as vibrant color palettes and hand-painted motifs, are being integrated into mainstream collections. In North America, the fusion of rustic organic textures with digital personalization platforms has driven multi-generational engagement in both residential and commercial sectors.

In Europe, the Middle East, and Africa region, premium hospitality and luxury dining experiences are fueling demand for high-end porcelain, crystal, and plated flatware, while regulatory incentives around single-use plastics in several European markets are bolstering biodegradable and compostable alternatives. The Middle East’s burgeoning event-hosting sector favors statement serveware and bespoke collections, and Africa’s growth corridors are open to cost-efficient yet design-forward imports.

The Asia-Pacific arena remains a focal point for manufacturing innovation and price competitiveness. Many companies are leveraging regional production hubs in Southeast Asia to serve both local consumption and export channels. Meanwhile, domestic players in markets such as India are strengthening supply chains and benefiting from evolving consumer preferences for homegrown brands that offer reliability and cultural resonance.

This comprehensive research report examines key regions that drive the evolution of the Tabletop Kitchen Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players Driving Innovation, Sustainability, and Brand Differentiation in the Tabletop Kitchen Products Space

Market leadership in tabletop kitchen products is held by a diverse array of global and regional champions. Corelle Brands, rooted in tempered glass innovation and known for its Corningware and Pyrex portfolios, continues to leverage brand trust and iconic patterns to drive omnichannel retail penetration across major grocery and specialty chains. Instant Brands has capitalized on the multicooker revolution, extending its strong digital presence from small appliances to matching serveware and accessories that complement its Instant Pot ecosystem.

Lenox Corporation stands out for its mastery in fine china and giftware, combining heritage bone china craftsmanship with strategic acquisitions of Oneida flatware and Gorham silverware to serve both traditional and millennial-driven gifting occasions. Zwilling J.A. Henckels exemplifies excellence in cutlery and specialized cookware, sustaining a nearly 300-year heritage that underscores premium German engineering and robust global distribution. Meanwhile, the Fiesta Tableware Company, with its Art Deco–inspired ceramic line, has captured the imagination of collectors and everyday users alike, demonstrating how brand nostalgia can be leveraged for contemporary revival and sustained growth.

Together, these leaders are shaping product innovation, distribution strategies, and consumer expectations, while a cohort of agile regional players and emerging disruptors is testing new business models around rental, subscription services, and full-service product customization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tabletop Kitchen Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arc Group International

- Bormioli Luigi S.p.A.

- BSH Hausgeräte GmbH

- Emile Henry S.A.S.

- General Electric company

- Groupe SEB

- HENDI B.V.

- Le Creuset

- Lenox Corporation

- Libbey Glass LLC

- Mepra S.p.A.

- Pinti Inox S.p.A.

- Riedel Glas GmbH & Co. KG

- Rosenthal GmbH

- Royal Doulton by Fiskars Group

- Sambonet Paderno Industrie S.p.A.

- Samsung Electronics Co., Ltd.

- SCHOTT AG

- Steelite International Limited

- The Vollrath Company, LLC

- Versuni Holding B.V.

- Villeroy & Boch AG

- Waterford Wedgwood UK Ltd.

- Zalto Glas GmbH

- Zwiesel Kristallglas AG

- Zwilling J.A. Henckels AG

Offering Strategic Actionable Guidance for Industry Leaders to Capitalize on Emerging Trends and Mitigate Market Disruptions in Tabletop Kitchen Products

Industry leaders can harness these insights to create differentiated value propositions. First, by deepening investments in digital co-creation platforms, brands can turn end users into collaborators, reducing time-to-market for seasonal or limited-edition collections and increasing customer loyalty. In parallel, adopting modular production frameworks will enable rapid adjustments to raw material cost fluctuations, particularly in response to tariff shifts, by switching between local and global supplier pools as needed.

Next, embedding sustainability as a core design principle-through recyclable packaging, post-consumer recovery programs, and partnerships with certified eco-material suppliers-will resonate across all segments, from high-end hospitality institutions seeking green certifications to eco-conscious residential consumers. Simultaneously, nurturing cross-channel consistency between offline showrooms and online storefronts, underpinned by robust inventory visibility systems, will support seamless omnichannel experiences and unlock incremental revenue through direct-to-consumer upselling.

Finally, forging strategic alliances with technology providers to incorporate smart features-such as temperature-sensitive coatings or RFID-enabled inventory tracking-can offer hospitality clients tangible operational benefits. By combining these targeted actions with ongoing market monitoring, companies will be well positioned to capitalize on emerging trends and to outmaneuver potential market disruptions.

Detailing the Comprehensive Research Approach Combining Primary Insights and Secondary Data Sources to Ensure Robust Analysis

The research approach integrated a blend of primary and secondary methodologies to ensure comprehensive coverage and analytical rigor. Secondary research commenced with a systematic review of publicly available trade publications, company annual reports, regulatory filings, and industry news releases. These sources provided historical context, competitive positioning, and regulatory developments affecting tariffs, sustainability mandates, and design trends.

Primary research involved in-depth interviews with senior executives at leading manufacturers, design studios, and distribution channels, as well as consultations with procurement heads of hospitality institutions. These qualitative discussions yielded first-hand perspectives on supply chain adjustments, product development roadmaps, and go-to-market pivots. Additionally, structured surveys were administered to end users-both commercial and residential-to gauge evolving preferences for material composition, design typologies, and purchasing channels.

All collected data underwent rigorous triangulation against publicly disclosed company metrics and macroeconomic indicators. The combined evidence base was synthesized using a bottom-up framework that aligns consumer demand patterns with manufacturer supply constraints and distribution channel potential. This multifaceted methodology underpins the report’s robust insights and strategic recommendations, ensuring relevance and practical applicability for market stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tabletop Kitchen Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tabletop Kitchen Products Market, by Product Type

- Tabletop Kitchen Products Market, by Material

- Tabletop Kitchen Products Market, by Design Type

- Tabletop Kitchen Products Market, by End User

- Tabletop Kitchen Products Market, by Distribution Channel

- Tabletop Kitchen Products Market, by Region

- Tabletop Kitchen Products Market, by Group

- Tabletop Kitchen Products Market, by Country

- United States Tabletop Kitchen Products Market

- China Tabletop Kitchen Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Critical Findings and Implications That Illuminate Future Directions for Tabletop Kitchen Products Industry Stakeholders

This analysis illuminates how consumer demands for sustainability, personalization, and operational efficiency are reshaping the tabletop kitchen products landscape. The interplay between rising tariff pressures and agile sourcing strategies underscores the need for dynamic production models and dual-market supplier networks. Segmentation and regional insights reveal that while design preferences and price sensitivities vary across product types and geographies, the underlying themes of quality, authenticity, and user involvement remain universal.

Leading companies are already demonstrating the strategic dividends of innovation-whether through digital customization platforms, eco-material partnerships, or integrated omnichannel journeys. Yet, the market remains ripe for further disruption by agile entrants capable of leveraging data-driven customer insights and emerging technologies. As the sector continues to evolve, stakeholders equipped with forward-looking intelligence and targeted action plans will be positioned to achieve sustainable growth and to forge deeper connections with both commercial and residential consumers.

Connect with Ketan Rohom for Tailored Insights and Secure Your Access to the Comprehensive Tabletop Kitchen Products Market Research Report

To explore the full depth of data, trends, and strategic insights outlined in this report, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive copy. Ketan brings a wealth of experience in guiding executives and decision-makers through tailored presentations of market intelligence, ensuring that your organization can act on the most relevant findings, customized segmentation analysis, and region-specific perspectives. By engaging directly with Ketan, you will gain access to detailed appendices, executive-level summaries, and bespoke consulting opportunities designed to support your unique business objectives in the tabletop kitchen products market. Reach out today to begin a conversation about how this research can empower your next phase of growth.

- How big is the Tabletop Kitchen Products Market?

- What is the Tabletop Kitchen Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?