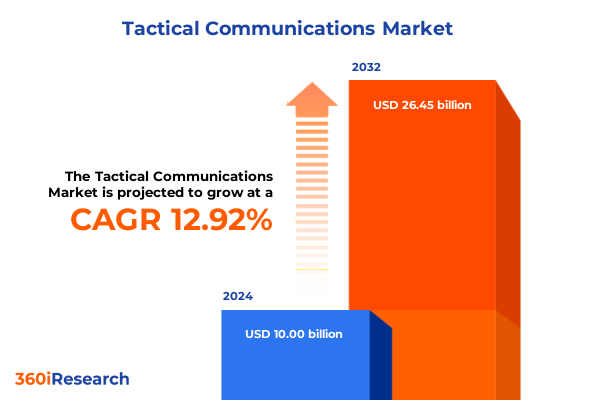

The Tactical Communications Market size was estimated at USD 11.21 billion in 2025 and expected to reach USD 12.59 billion in 2026, at a CAGR of 13.04% to reach USD 26.45 billion by 2032.

Setting the Stage for Next-Generation Tactical Communication Innovations and Strategic Imperatives in an Increasingly Complex and Mission-Critical Operational Environment

In the face of rapidly evolving operational demands, the landscape of tactical communications has become increasingly complex. Military, public safety, and critical infrastructure stakeholders are no longer satisfied with basic voice transmission; they require integrated, data-driven solutions that enable real-time situational awareness and secure information exchange across diverse platforms. As a result, the focus has shifted toward converged networks, software-centric architectures, and resilient connectivity models that support mission-critical operations under contested conditions.

Moreover, emerging threats and the proliferation of asymmetric risks have intensified the urgency for interoperable communication systems. Modern theaters of operation demand seamless coordination between land, air, sea, and space assets, as well as joint civilian authorities, necessitating robust network management and adaptive waveform technologies. In addition, recent advances in edge computing and artificial intelligence are paving the way for predictive analytics and autonomous network optimization, further elevating the strategic value of communications infrastructure.

Against this backdrop, this executive summary lays the groundwork for understanding how next-generation innovations, operational imperatives, and regulatory factors converge to shape the future of tactical communications. The ensuing sections unravel transformative shifts, tariff impacts, segmentation insights, and regional nuances to equip decision-makers with a holistic view of opportunities and challenges. By clarifying these core drivers, organizations can make informed strategic investments and accelerate their journey toward network superiority.

Unpacking Transformative Technological and Operational Shifts Reshaping the Tactical Communications Landscape and Stakeholder Expectations Worldwide

Recent years have witnessed a fundamental transformation in the tactical communications arena, as legacy analog systems give way to digital, network-centric architectures. The transition to software-defined radios and layered IP infrastructures has unlocked new levels of flexibility, enabling operators to switch frequencies, waveforms, and encryption protocols on the fly. Furthermore, convergence between broadband cellular technologies and private narrowband networks has introduced push-to-talk over LTE and 5G solutions, extending reach beyond line-of-sight constraints and enhancing interoperability with commercial devices.

In parallel, virtualization and cloud-native frameworks are redefining the very concept of a base station, allowing network functions to be deployed as virtual instances wherever capacity is needed. This shift not only reduces reliance on fixed-site hardware but also enables rapid scalability in response to surge requirements. Additionally, artificial intelligence–driven analytics have begun to automate spectrum management, intrusion detection, and network resilience tasks, providing situational awareness at speeds unattainable by manual processes.

Equally significant is the rise of mesh networking and ad hoc connectivity for dismounted forces and emergency responders. These decentralized models facilitate self-healing networks that maintain connectivity in denied or degraded environments. As a result, tactical communication stakeholders are rethinking system architectures, moving from monolithic deployments toward distributed, software-centric ecosystems. Taken together, these transformative shifts are setting a new baseline for performance, resilience, and collaborative operations in mission-critical contexts.

Assessing the Cumulative Economic, Operational, and Strategic Consequences of 2025 US Trade Tariffs on Tactical Communication Equipment and Ecosystems

With the implementation of new United States trade tariffs in 2025, procurement costs for critical communication hardware have risen sharply. Equipment manufacturers and defense integrators are facing increased component pricing pressures, driving them to reassess sourcing strategies and supplier contracts. At the same time, supply chain volatility has been amplified as localized manufacturing capacity becomes a strategic imperative to mitigate tariff burdens and avoid workflow interruptions.

Furthermore, these levies have spurred a wave of nearshoring initiatives, as organizations seek to bring production closer to end-users in order to reduce transit times, minimize exposure to geopolitical risks, and stabilize input costs. Although this shift yields long-term resilience benefits, the immediate retraining of labor forces and retooling of production lines has created transitional budgetary strains for both original equipment manufacturers and subsystem vendors.

In addition, the ripple effects of tariff-induced price adjustments are now influencing capital expenditure cycles within defense and public safety agencies. End-user organizations are delaying planned upgrades or favoring modular, upgradeable solutions that allow for staggered investments. As a result, the cumulative impact of the 2025 U.S. trade measures is fostering a more cautious procurement landscape, where affordability and supply chain security have risen to equal importance with performance and feature sets.

Deriving Actionable Insights from Component, Deployment Mode, Technological and End-Use Segmentations to Navigate Tactical Communication Market Dynamics Effectively

An examination of system components reveals that while hardware solutions remain integral, software platforms are rapidly gaining prominence as the orchestrators of network functionality. Within hardware, accessories such as power amplifiers and antenna assemblies continue to underpin radio link performance, whereas repeaters and terminals serve as critical nodes in extended coverage scenarios. On the software side, command and control applications are increasingly tasked with unifying disparate data streams, while network management suites automate lifecycle maintenance and quality-of-service monitoring.

Turning to deployment models, fixed network installations still form the backbone of secure operations, anchoring communication backbones within command centers and infrastructure hubs. Simultaneously, mobile network solutions are essential for on-the-move units requiring uninterrupted connectivity across shifting theaters, and portable network kits now empower rapid establishment of local communication meshes during emergency deployments or expeditionary missions.

Regarding technology, analog systems continue to serve as reliable fallbacks for legacy interoperability, but the digital shift is irreversible, driven by enhanced encryption, higher spectral efficiency, and the integration of data-centric features. Lastly, in end-use sectors, defense applications emphasize electronic warfare resilience and comprehensive surveillance and reconnaissance capabilities. Public safety agencies prioritize seamless coordination among emergency medical services and fire service units. Transportation stakeholders invest in aerospace, land transport, and maritime communication links to maintain logistical precision. Utilities operators secure electricity grids, oil and gas pipelines, and water distribution networks through robust communication channels.

This comprehensive research report categorizes the Tactical Communications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Technology

- End Use

Revealing Distinct Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Tactical Communication Markets

Across the Americas, the emphasis on defense modernization and public safety network expansion continues to drive demand for integrated tactical communication systems. North American agencies are accelerating upgrades to digital broadband networks, while Latin American partners prioritize interoperable, cost-effective solutions to address border security and disaster response challenges. As a result, the region is witnessing a blend of high-end strategic programs and emerging market-led adoption of portable and mobile network platforms.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of market drivers. NATO members and allied nations in Europe are investing heavily in cross-border interoperability, cyber-hardened infrastructures, and secure cloud frameworks to support joint operations. In the Middle East, large-scale projects focus on force protection and urban operations, prompting interest in ruggedized, deployable systems. Across Africa, public safety modernization and critical infrastructure protection initiatives are elevating the need for scalable, low-power communication solutions.

In the Asia-Pacific corridor, rapid digital transformation and rising defense budgets are accelerating the deployment of advanced tactical communication networks. Regional powers are integrating 5G-enabled private networks with traditional radio systems, fostering hybrid models that leverage both broadband and narrowband capabilities. Furthermore, collaboration between public safety agencies and commercial operators is unlocking innovative service bundles tailored for disaster management and community resilience.

This comprehensive research report examines key regions that drive the evolution of the Tactical Communications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Profiles and Competitive Approaches of Leading Companies Driving Innovation, Integration, and Market Expansion in Tactical Communications

Leading companies in the tactical communications domain are pursuing a multifaceted approach to maintain technological leadership and market presence. Hardware specialists continue to refine radio transceiver design, focusing on increased power efficiency, wider frequency coverage, and miniaturized form factors. At the same time, software innovators are enhancing data fusion capabilities and integrating artificial intelligence tools to automate network optimization and predictive maintenance.

Strategic partnerships and alliances have emerged as critical levers for extending solution portfolios. System integrators are teaming with cybersecurity firms to embed end-to-end encryption protocols, while collaborative R&D initiatives between semiconductor manufacturers and radio vendors are accelerating the adoption of software-defined radio architectures. Moreover, mergers and acquisitions are reshaping the competitive landscape, turning point-product providers into full-system suppliers.

From a go-to-market perspective, established incumbents leverage longstanding defense contracts to pilot next-generation communication suites, whereas agile newcomers differentiate through software-as-a-service models, subscription licensing, and on-demand network management offerings. This dual-track evolution underscores the need for incumbents to embrace software monetization strategies, while challengers must ensure rigorous compliance with rigorous security and interoperability standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tactical Communications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BAE Systems plc

- Barrett Communications Pty Ltd.

- Bittium Corporation

- Codan Limited

- EFJohnson Technologies by JVCKENWOOD Group

- Elbit Systems Ltd.

- Frequentis AG

- General Dynamics Corporation

- Hytera Communications Corporation Limited

- Indra Sistemas, S.A.

- Iridium Communications Inc.

- L3Harris Technologies, Inc.

- Leonardo SpA

- Lockheed Martin Corporation

- Motorola Solutions, Inc.

- Northrop Grumman Corporation

- QinetiQ plc

- Raytheon Technologies Corporation

- Rohde & Schwarz GmbH & Co. KG

- Tait Communications Limited

- Thales S.A.

- Ultra Electronics Holdings plc

- ViaSat by Targa Telematics S.p.A..

Presenting Targeted, Evidence-Based Recommendations to Empower Industry Leaders and Stakeholders in Advancing Tactical Communication Strategies and Investments

Industry leaders should adopt a holistic digital transformation strategy that integrates software-defined radio platforms with cloud-native network management tools. By standardizing on open architecture frameworks, organizations can future-proof their investments and accelerate the integration of emerging technologies such as 5G private networks and edge analytics. Furthermore, embracing modular hardware designs will enable incremental upgrades that mitigate upfront capital burdens, thereby fostering more predictable budgeting cycles.

To navigate tariff-induced cost pressures, supply chain diversification is essential. Establishing strategic partnerships with regional manufacturers and investing in flexible production capabilities will reduce exposure to trade policy shifts. Simultaneously, incorporating lifecycle cost analysis into procurement decisions will ensure that total cost of ownership considerations guide technology selection.

On the operational front, strengthening cybersecurity protocols and embedding continuous monitoring frameworks will safeguard mission-critical communications against evolving threats. Investments in workforce training and cross-domain interoperability exercises will enhance user proficiency and readiness. Finally, stakeholders should explore public-private collaboration opportunities to co-develop resilient networks that serve both defense and civilian use cases, thereby maximizing value from shared infrastructure.

Explaining the Comprehensive, Multi-Method Research Methodology Ensuring Rigorous Data Integrity, Analytical Depth, and Strategic Relevance

This study is grounded in a rigorous research framework that combines primary interviews with defense decision-makers, public safety officials, and system integrators alongside in-depth dialogues with technology vendors and subject-matter experts. Secondary data sources were meticulously reviewed, encompassing government procurement records, technical white papers, and peer-reviewed journals. Triangulation of qualitative and quantitative inputs ensures the highest level of analytical credibility.

Additionally, vendor mapping exercises and competitive benchmarking were conducted to profile product portfolios, R&D investments, and strategic initiatives. The research team employed a stage-gate validation approach, encompassing data integrity checks, cross-source corroboration, and scenario stress testing. Geographic breakdowns and segmentation analyses were refined through iterative workshops with regional specialists to capture localized market nuances.

Finally, the findings were subject to an expert review panel, comprising former military communications officers, cybersecurity practitioners, and infrastructure planners. This multi-tiered methodology affords a 360-degree view of the tactical communications ecosystem, delivering insights that are both deeply informed and highly actionable for senior leadership.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tactical Communications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tactical Communications Market, by Component

- Tactical Communications Market, by Deployment Mode

- Tactical Communications Market, by Technology

- Tactical Communications Market, by End Use

- Tactical Communications Market, by Region

- Tactical Communications Market, by Group

- Tactical Communications Market, by Country

- United States Tactical Communications Market

- China Tactical Communications Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing Core Insights and Strategic Imperatives to Elevate Tactical Communication Capabilities and Strengthen Operational Readiness

Bringing together technological evolution, policy shifts, and market segmentation yields a cohesive narrative of tactical communications today. Digital migration, software-centric architectures, and the fusion of broadband with narrowband networks have redefined what constitutes mission-critical connectivity. At the same time, the cumulative effects of 2025 trade tariffs have underscored the importance of supply chain resilience and cost management in procurement strategies.

Segmentation insights reveal divergent priorities across components, deployment models, technology types, and end-use sectors, emphasizing the need for tailored solutions that balance performance, interoperability, and affordability. Regional analyses further highlight distinct growth drivers, from defense modernization in the Americas to interoperability imperatives in EMEA and hybrid network adoption in Asia-Pacific. Competitive dynamics are evolving as legacy incumbents pivot toward software monetization and emerging vendors carve out niches with as-a-service models.

Taken together, these insights point toward a future in which agility, digital interoperability, and strategic partnerships will determine success. Organizations that proactively realign their technology roadmaps, supply chains, and talent investments will be best positioned to capitalize on emerging opportunities and safeguard operational readiness.

Engage Directly with Ketan Rohom to Unlock Exclusive Access to the Definitive Tactical Communications Market Research Insights and Drive Strategic Advantage

The definitive analysis of tactical communications is at your fingertips, offering deep insights into market dynamics, strategic shifts, and actionable guidance to drive superior outcomes. This report synthesizes comprehensive segmentation, regional patterns, tariff implications, and company profiles to equip decision-makers with a clear roadmap for innovation and competitive advantage. By tapping into the latest intelligence, organizations can optimize procurement strategies, enhance operational resilience, and capitalize on emerging technology trends before competitors adapt.

To secure the full tactical communications market research report, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan Rohom stands ready to guide you through the report highlights, customize access to the data sets most relevant to your priorities, and facilitate a seamless purchase process to ensure your organization gains an immediate strategic edge.

- How big is the Tactical Communications Market?

- What is the Tactical Communications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?