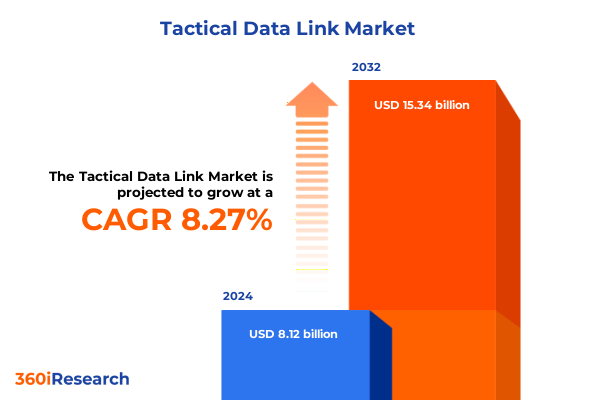

The Tactical Data Link Market size was estimated at USD 8.73 billion in 2025 and expected to reach USD 9.39 billion in 2026, at a CAGR of 8.38% to reach USD 15.34 billion by 2032.

Envisioning Secure Real-Time Battlefield Connectivity That Unifies Diverse Military Assets Into an Integrated Command and Control Ecosystem

Tactical data links serve as the foundational communication backbone for modern military operations, facilitating secure, high-speed exchanges of critical information across air, land, and sea platforms. These advanced systems employ standardized message and transmission formats to ensure interoperability among diverse unit types, enabling real-time situational awareness and coordinated responses in complex environments. By integrating robust encryption protocols and dynamic routing capabilities, tactical data links safeguard data integrity against electronic warfare threats while maintaining resilient connectivity among disparate assets.

Beyond mere data conduits, these networks underpin network-centric warfare strategies by unifying ground control stations, airborne platforms, and maritime vessels into a cohesive operational picture. Innovations such as mesh networking provide decentralization benefits, allowing units to communicate directly and reroute signals autonomously in contested settings. Consequently, commanders can synchronize targeting, surveillance, and command tasks with unprecedented speed and precision, translating raw sensor inputs into actionable intelligence across coalition forces.

Embracing Software-Defined Radios Artificial Intelligence and Mesh Network Architectures to Revolutionize Tactical Data Exchange Across Battlefronts

The evolution of tactical data links is propelled by software-defined radio (SDR) technologies that grant unprecedented agile reconfiguration of waveforms and frequencies without hardware modifications. SDR platforms enable forces to adapt communication parameters in response to dynamic threat environments, ensuring uninterrupted data flow even under jamming or signal interference. Simultaneously, the incorporation of artificial intelligence and machine learning algorithms into link management software optimizes spectrum allocation, automates anomaly detection, and prioritizes mission-critical data streams. These AI-driven enhancements reduce operator workload and accelerate decision loops, empowering networks to self-heal and maintain robust connectivity in austere conditions.

Mesh network architectures further reinforce tactical data link resiliency by establishing peer-to-peer connections that dynamically reconfigure as nodes join or depart the network. This decentralized framework mitigates single points of failure, allowing units to seamlessly route around degraded links while preserving end-to-end encryption and low latency. The convergence of these technological shifts is complemented by heightened cybersecurity measures, including quantum-resistant encryption and secure key management, safeguarding data exchanges against adversarial cyber threats. As military doctrines increasingly emphasize multi-domain operations, these innovations collectively transform tactical data exchange into a resilient, adaptive ecosystem that meets the demands of future battlefields.

Assessing the Far-Reaching Operational Disruptions Effects of U.S. Trade Tariffs on Defense Supply Chains and Tactical Data Link Program Viability Into 2025

By 2025, U.S. tariffs on imported defense materials-including a doubling of steel and aluminum levies to 50 percent-have inflicted cumulative financial pressures on prime contractors, leading one major defense conglomerate to forecast a $500 million impact in the current fiscal year. These tariff-driven cost escalations have reverberated through production budgets for tactical data link hardware components, prompting firms to absorb inflationary expenses or renegotiate supplier agreements to mitigate margin erosion.

In addition to steel and aluminum duties, targeted tariffs impose a 25 percent duty on aircraft transmission components and 20 percent on advanced composite materials, while defense electronics parts face levies of 10 to 15 percent. These measures have elevated procurement costs for high-frequency and ultra-high-frequency radio sets, modems, and encryption modules, compelling contractors to explore alternative sourcing from allied nations or accelerate domestic manufacturing initiatives. Supply chain realignment efforts also include strategic hub shifts to Southeast Asia and Mexico to circumvent tariff exposure and preserve program schedules.

Amid these disruptions, policy exemptions for national security-critical systems have been uneven, leading to delays in contract awards and delivery timelines for secure radios and link management software. Stakeholders warn that prolonged tariff uncertainty risks undermining international defense partnerships and could drive procurement strategies toward adversary-friendly suppliers if resolution mechanisms remain elusive. Industry advocates continue to press for targeted carve-outs to balance trade policy objectives with operational readiness imperatives.

Unveiling Critical Market Segmentation Insights Spanning Hardware Components Platforms Frequencies Deployments and Application Domains

Market segmentation reveals a nuanced landscape where hardware components-ranging from controllers and modems to terminals and transceivers-coexist alongside specialized software offerings, such as interoperability and integration platforms, link management suites, and simulation tools, all supported by comprehensive service ecosystems. This tripartite breakdown underscores the critical interplay between physical assets, digital architectures, and after-market support that dictates system performance and lifecycle value.

Platforms further diversify the tactical data link footprint into air-based, land-based, sea-based, and weapon-integrated deployments. Fixed and rotary wing aircraft, unmanned aerial and ground vehicles, naval surface vessels, submarines, and embedded weapons systems each impose distinct environmental and networking requirements, driving tailored hardware form factors and frequency considerations.

Frequency allocation itself is bifurcated between high and ultra-high bands, optimizing trade-offs between transmission range, data throughput, and resistance to signal degradation. Fixed installations and mobile units constitute the deployment dimension, with static command centers offering robust infrastructure and mobile nodes demanding compact, resilient designs. Finally, application domains span command and control operations, electronic warfare engagements, and intelligence, surveillance, and reconnaissance missions, linking segmentation directly to mission imperatives and system design choices.

This comprehensive research report categorizes the Tactical Data Link market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Platform

- Frequency

- Deployment

- Application

Examining the Complex Regional Dynamics Driving Tactical Data Link Adoption and Capability Development Across the Americas EMEA and Asia-Pacific Theaters

In the Americas, sustained investment in advanced communications infrastructure-anchored by the United States’ focus on network-centric and All-Domain Command and Control (JADC2)-continues to drive demand for tactical data link solutions. The region’s integrated defense budgets, which account for roughly 40 percent of global military expenditure, create a fertile environment for the adoption of high-throughput data links, software-defined radios, and AI-enabled networking systems tailored to joint and coalition force interoperability.

Europe, the Middle East, and Africa collectively experienced a steep rise in defense outlays, with European spending surging by nearly 17 percent due to ongoing security tensions and Middle Eastern budgets climbing above 15 percent year-over-year in select nations. These increases have catalyzed modernization initiatives for maritime and land-based data link networks, bolstering regional command centers and expeditionary units. Emphasis on local industry partnerships and pan-European procurement frameworks has accelerated deployments of unified communication systems across NATO and allied forces.

Across the Asia-Pacific theater, a strategic mix of major powers and smaller nations is fueling robust growth in tactical communications. Regional security concerns have prompted a collective rise in procurement and R&D spending, with nations augmenting their fleets of unmanned systems and modernizing air and naval data link networks. Collaborative defense ventures between local governments and global suppliers are enhancing sovereign capabilities, yet dependence on key imports persists amid efforts to localize critical subsystem production.

This comprehensive research report examines key regions that drive the evolution of the Tactical Data Link market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Defense Industry Players Portfolio Strengths Contract Wins and Strategic Moves Shaping the Tactical Data Link Ecosystem

Thales recently revised its sales growth outlook upward, citing strong defense demand-particularly for secure communications and battlefield networking solutions that include advanced tactical data link systems. The company’s performance reflects growing European and allied requirements for encrypted, multi-network interoperable radios and data management platforms, reinforcing its position among prime contractors. This momentum underscores the strategic value of modular, upgradeable data link offerings in multinational exercises and coalition operations.

Meanwhile, major U.S. primes are navigating tariff-induced cost pressures while expanding their tactical link portfolios. One conglomerate forecast a significant financial impact from doubled steel and aluminum duties, yet invested in reshoring and supply chain diversification to sustain production of radio sets and link controllers. Another leading firm is accelerating its CJADC2 interoperability software initiatives, leveraging open-architecture frameworks and AI-enhanced translation services to streamline data exchange across legacy and next-generation platforms. Collaborative ventures with allied suppliers and continued R&D in mesh networking further position these companies at the forefront of tactical data link innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tactical Data Link market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Atlas Elektronik GmbH

- BAE Systems PLC

- BERTEN DSP S.L.

- Comint Systems and Solutions Pvt. Ltd.

- CS GROUP

- Cubic Corporation

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- General Dynamics Corporation

- Havelsan Inc.

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MITRE Corporation

- Naval Group

- Northrop Grumman Corporation

- Rapid Mobile (Pty) Ltd.

- Rohde & Schwarz GmbH & Co. KG

- RTX Corporation

- Saab AB

- Terma Group

- Thales Group

- TUALCOM ELEKTRONİK A.Ş.

Delivering Strategic Recommendations to Bolster Resilience Innovation and Interoperability for Defense Communication Technology Leaders

Industry leaders must prioritize investments in software-defined radio and AI-driven link management capabilities to maintain communication resilience and operational agility. By adopting modular, open-architecture frameworks, organizations can accelerate integration with evolving waveform standards and rapidly deploy enhancements across diverse platforms. Strengthening partnerships across the defense supply chain-particularly with small- and medium-sized enterprises-will further ensure access to specialized componentry and software expertise, enabling quicker adaptation to shifting threat profiles.

Simultaneously, executives should champion diversified sourcing strategies and regional manufacturing footprints that mitigate tariff exposures and supply chain bottlenecks. Proactive engagement with policymakers to secure targeted exemptions for national security-critical systems can preserve program schedules and budget stability. Intensifying focus on cybersecurity through quantum-resistant encryption and rigorous compliance testing will safeguard data link networks against hybrid warfare tactics. Finally, supporting interoperable standards development in multinational forums will enhance coalition readiness and maximize the strategic value of tactical data link deployments.

Outlining a Rigorous Mixed Methodology Incorporating Primary Expert Insights Secondary Data Analysis Data Triangulation and Quality Assurance Measures

This research employs a structured mixed-methodology approach, combining qualitative expert interviews with quantitative secondary data analysis. Initial desk research captured comprehensive information from industry publications, defense agency reports, and regulatory filings to establish a foundational understanding of market segmentation, technology trends, and regional dynamics. These insights guided the development of interview protocols and survey instruments used to engage subject-matter experts across defense primes, government procurement offices, and technology providers.

Primary research involved in-depth discussions with senior engineers, program managers, and policy advisors, facilitating granular insights into product roadmaps, procurement drivers, and supply chain considerations. Responses were rigorously validated against published company announcements and defense spending databases to ensure accuracy. Data triangulation across multiple sources-inclusive of publicly available budgetary statistics and proprietary defense analytics-afforded robust reliability. The methodology also incorporates quality assurance measures such as peer review of findings and cross-stakeholder consensus panels, ensuring the report’s recommendations are grounded in both strategic relevance and operational practicality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tactical Data Link market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tactical Data Link Market, by Component

- Tactical Data Link Market, by Platform

- Tactical Data Link Market, by Frequency

- Tactical Data Link Market, by Deployment

- Tactical Data Link Market, by Application

- Tactical Data Link Market, by Region

- Tactical Data Link Market, by Group

- Tactical Data Link Market, by Country

- United States Tactical Data Link Market

- China Tactical Data Link Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing the Strategic Imperatives Technological Evolution and Operational Imperatives Driving Tactical Data Link Adoption in Modern Warfare

The evolution of tactical data links reflects a convergence of technological breakthroughs and strategic imperatives that redefine battlefield communications. From the advent of software-defined radios and AI-driven network management to the resilience afforded by mesh architectures, these systems now underpin multi-domain operations and coalition interoperability. As defense budgets ebb and flow under geopolitical pressures, the continuous modernization of link hardware, software, and frequency allocations will remain a top priority across major theaters.

Key segmentation across components, platforms, frequencies, deployment modes, and application domains highlights the market’s complexity and underscores the necessity for tailored solutions. Regional trajectories in the Americas, EMEA, and Asia-Pacific reveal both common drivers-such as network-centric warfare and unmanned integration-and unique procurement imperatives shaped by local security landscapes. Leading industry players are balancing cost, innovation, and supply chain resilience to deliver interoperable data link ecosystems that meet evolving mission requirements.

Looking forward, aligning technological innovation with strategic partnerships and supportive trade policies will be essential for sustaining operational readiness. Stakeholders who can seamlessly integrate advanced encryption, modular architectures, and AI-enhanced functionalities will secure a decisive edge in modern warfare scenarios, positioning themselves to lead the next wave of tactical communications evolution.

Taking the Next Step to Secure Comprehensive Tactical Data Link Insights and Customized Market Intelligence by Engaging with Ketan Rohom for Your Report Purchase

To explore tailored insights into tactical data link technology and stay ahead of emerging developments, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan will unlock personalized access to comprehensive analysis, competitive positioning data, and segmentation breakdowns aligned to your strategic objectives. By connecting with a dedicated expert, you will receive customized guidance on leveraging the report’s findings for procurement, product planning, and alliance building. Secure your copy of this market research report today to empower decision-makers with the granular intelligence needed to navigate the evolving defense communications landscape

- How big is the Tactical Data Link Market?

- What is the Tactical Data Link Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?