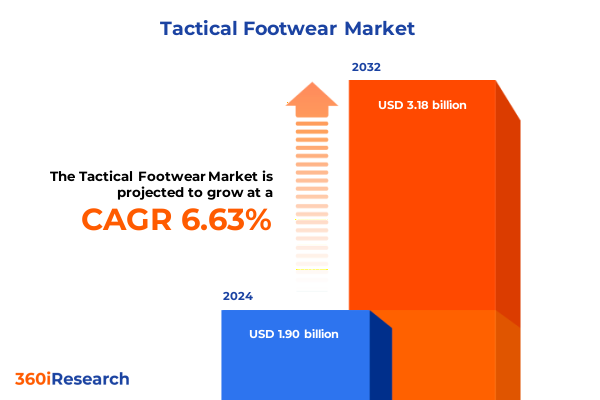

The Tactical Footwear Market size was estimated at USD 2.03 billion in 2025 and expected to reach USD 2.17 billion in 2026, at a CAGR of 6.61% to reach USD 3.18 billion by 2032.

Unveiling the Evolution of Tactical Footwear Through Cutting-Edge Material Innovations, Enhanced Performance, and Evolving User-Driven Design Requirements

The landscape of tactical footwear has evolved from purely protective gear into a sophisticated convergence of performance, technology, and user experience. As end users demand greater durability and ergonomic support in challenging environments, manufacturers are integrating advanced materials, ergonomic design principles, and data-driven customization options. This evolution reflects a broader shift in operational requirements across security forces, military units, law enforcement agencies, and outdoor professionals.

This executive summary serves as a guiding compass through the pivotal trends shaping the tactical footwear domain. It contextualizes how rising consumer expectations, technological breakthroughs, and regulatory dynamics coalesce to redefine the design, production, and distribution of tactical footwear. By examining key market drivers, obstacles, and growth opportunities, this overview provides industry leaders and decision-makers with a panoramic understanding of emerging imperatives and strategic levers in a rapidly transforming market.

Revolutionary Innovations in Materials, Connected Intelligence, and Collaborative Design Are Redefining Performance for Modern Tactical Footwear

In recent years, the tactical footwear sector has experienced transformative shifts fueled by the convergence of material science advancements and user-centric innovation. Pioneering developments in polymer composites and breathable textiles have ushered in lighter, more resilient designs that optimize flexibility without compromising on protection. Simultaneously, predictive analytics and wearable sensors embedded into outsoles and insoles enable real-time monitoring of gait dynamics, temperature, and impact absorption.

Interoperability with uniform systems and integrated load-bearing equipment has also become a focal priority, driving collaborations between footwear designers and tactical gear manufacturers. These partnerships aim to streamline weight distribution and minimize fatigue during prolonged missions. Moreover, sustainability has emerged as a critical consideration, with bio-based synthetics and recyclable rubbers gaining traction in production pipelines. This shift toward eco-conscious materials not only aligns with corporate responsibility goals but also meets the rising demand among environmental stakeholders. Collectively, these radical innovations are forging a new paradigm for tactical footwear, where high performance, user safety, and sustainable practices coexist harmoniously.

Navigating the 2025 Tariff Landscape as Cost Pressures Reshape Supply Chains and Catalyze Domestic Production Opportunities

The imposition of additional import duties in 2025 has had a cumulative impact on the tactical footwear industry, reshaping supply chain strategies and cost structures for manufacturers and distributors alike. Tariffs on key components-including specialized polymers, reinforced textiles, and metal hardware-have elevated production expenses, prompting stakeholders to reassess procurement geographies and vendor partnerships. This fiscal pressure has catalyzed a search for alternative sources, with some producers relocating assembly lines to tariff-exempt countries or investing in domestic manufacturing capabilities to mitigate added costs.

End users have felt the ripple effects through modest price uplifts and altered inventory cycles, while original equipment manufacturers have accelerated the pursuit of leaner operations. Consolidation among suppliers and strategic alliances with raw material innovators are emerging as defensive responses to safeguard margin resilience. Despite these challenges, the tariff-driven realignment is also fostering opportunities for regional suppliers to capture market share and for forward-thinking brands to capitalize on localized production narratives. Consequently, the tariff landscape of 2025 is not merely a disruptive force but a catalyst for reinvigorating supply chain agility and competitive differentiation.

Insights into Distinctive Consumer Demands Revealed by Comprehensive Analysis of Product Categories, Materials, Pricing, Applications, and Distribution Channels

Segmentation analysis reveals nuanced consumer preferences across product categories, material choices, price tiers, usage scenarios, gender orientations, distribution pathways, and end-user profiles. In terms of product types, the market spans from robust high-cut, mid-cut, and low-cut boots to versatile sneakers, shoes, and sandal-style options, each calibrated to address specific operational demands. Materially, stakeholders balance the durability and premium appeal of full-grain, split, and top-grain leather against the lightweight resilience of rubber, synthetic blends, and advanced textile reinforcements.

Price segmentation underscores the coexistence of economy-focused models designed to meet budgetary constraints alongside mid-range options that blend performance and value, and premium offerings that integrate cutting-edge materials and bespoke design features. Application-driven preferences vary significantly between combat operations, rigorous hiking expeditions, deployment in hostile environments, and intensive training regimens. Gender differentiation is evident through tailored design considerations for men, women, and unisex profiles, ensuring fit and ergonomic alignment. Distribution channels range from brand-managed digital storefronts and third-party online retailers to specialized brick-and-mortar specialty shops and sporting goods outlets, while the end-use spectrum covers law enforcement personnel, military units, and dedicated outdoor enthusiasts.

This comprehensive research report categorizes the Tactical Footwear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- Gender

- Distribution Channel

- End User

Divergent Growth Trajectories Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Highlight Regional Supply Chain and Innovation Imperatives

Regional dynamics in the tactical footwear market underscore divergent growth drivers and operational nuances across the Americas, Europe, Middle East & Africa, and Asia-Pacific. The Americas continue to lean heavily on domestically sourced raw materials and advanced manufacturing hubs, benefiting from established logistics networks and robust R&D investments. Within Europe, Middle East & Africa, fragmentation in regulatory standards and procurement protocols prompts localized customization, with brands forging strategic alliances to navigate complex compliance landscapes.

In Asia-Pacific, rapid urbanization and expanding defense budgets fuel demand for scalable production, driving investments in automation and high-throughput assembly lines. Moreover, evolving security concerns in geopolitically sensitive corridors prompt bespoke design solutions and strategic stockpiling. Interregional trade policies and bilateral agreements further modulate supply chain flow, compelling industry players to adopt agile planning frameworks. Collectively, these regional trends illustrate a mosaic of strategic imperatives, from innovation-centric ecosystems in North America to cost-effective manufacturing clusters in Asia-Pacific, all coalescing to shape the global tactical footwear narrative.

This comprehensive research report examines key regions that drive the evolution of the Tactical Footwear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Manufacturers Forge Strategic Alliances, Divest Non-Core Assets, and Emphasize Consumer Engagement to Drive Leadership in Tactical Footwear

Key corporate players are leveraging distinct strategic playbooks to fortify their market positions, blending organic growth tactics with targeted acquisitions and technology partnerships. Leading manufacturers prioritize R&D alliances with material science startups to secure first-mover advantages in bio-based polymers and sensor-embedded textiles. Concurrently, some incumbent brands are expanding direct-to-consumer digital channels to enhance brand loyalty and gather actionable user insights.

Strategic mergers and joint ventures are also shaping the competitive terrain, with collaborations aimed at scaling production capacity and penetrating emerging end-user segments. Portfolio rationalization is evident as companies divest non-core product lines to concentrate resources on high-margin tactical offerings. Meanwhile, enhanced after-sales services-such as on-demand repair programs and extended performance warranties-are differentiating market leaders by reinforcing durability claims and elevating the total value proposition. This mosaic of corporate maneuvers underscores an industry in flux, where agility, innovation, and customer-centric strategies dictate long-term success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tactical Footwear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 5.11 Tactical

- Adidas AG

- Altama Footwear Co

- ASICS Corporation

- Bates Footwear

- Belleville Boot Company

- BLACKHAWK!

- Columbia Sportswear Company

- Danner

- Garmont International S.r.l.

- HAIX Group

- KEEN Footwear

- LaCrosse Footwear

- LOWA Sportschuhe GmbH

- Maelstrom Footwear

- Magnum Boots International

- McRae Industries

- Meindl Boots

- Merrell

- New Balance Athletics Inc.

- Nike Inc.

- Original S.W.A.T.

- PUMA SE

- Rocky Brands Inc.

- Salomon Group

- Smith & Wesson Footwear

- Under Armour Inc.

- VF Corporation

- Wolverine World Wide Inc

Leverage Integrated Innovation Strategies, Localized Manufacturing, Digital Engagement, and Sustainability Initiatives to Strengthen Market Positioning

To capitalize on shifting market dynamics, industry leaders should prioritize integrated innovation roadmaps that align material science breakthroughs with immersive user feedback loops, establishing continuous improvement cycles. Cultivating partnerships with local suppliers and contract manufacturers in tariff-advantaged jurisdictions can hedge against import duty volatility and enhance supply chain resilience. Organizations would benefit from investing in predictive analytics platforms to optimize inventory management and reduce obsolescence risks driven by operational tempo fluctuations.

Furthermore, elevating consumer engagement through interactive digital experiences-such as virtual fitting tools and real-time performance dashboards-can deepen brand loyalty and capture nuanced usage data. Sustainability should be embedded into product life cycles via take-back schemes and modular design frameworks that facilitate component reuse and end-of-life recyclability. Finally, fostering cross-industry collaborations with uniform and load-bearing equipment suppliers can deliver cohesive ecosystem solutions, reinforcing market differentiation and unlocking synergistic revenue streams.

Robust Multi-Source Intelligence Integrated with Field Observations and Stakeholder Interviews to Ensure Comprehensive Tactical Footwear Insights

This analysis synthesizes insights derived from a rigorous research methodology grounded in both primary and secondary inquiry. Primary research encompassed structured interviews with procurement officers, field end users, and supply chain managers, alongside direct observation of product performance under simulated operational conditions. Complementary secondary research involved systematic reviews of industry white papers, academic journals, and patent filings related to advanced materials and ergonomic design.

Data triangulation was achieved through cross-validation of supplier financial disclosures, trade association reports, and conference proceedings from major defense and outdoor gear expos. Geographic coverage included stakeholder engagement across North America, Europe, the Middle East, Africa, and Asia-Pacific to capture regional idiosyncrasies. This methodological framework ensures that conclusions and recommendations are underpinned by robust, multi-source intelligence and reflect contemporary operational realities in the tactical footwear sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tactical Footwear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tactical Footwear Market, by Product Type

- Tactical Footwear Market, by Material

- Tactical Footwear Market, by Application

- Tactical Footwear Market, by Gender

- Tactical Footwear Market, by Distribution Channel

- Tactical Footwear Market, by End User

- Tactical Footwear Market, by Region

- Tactical Footwear Market, by Group

- Tactical Footwear Market, by Country

- United States Tactical Footwear Market

- China Tactical Footwear Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing End-User Demands, Tariff-Driven Supply Chain Realignments, and Innovation Imperatives to Illuminate Paths to Sustainable Competitive Advantage

The tactical footwear market stands at the intersection of functional necessity and technological ingenuity, propelled by evolving user demands, strategic tariff considerations, and region-specific imperatives. As the sector adapts to cost pressures and environmental expectations, innovation in materials, connected intelligence, and sustainable practices will define competitive differentiation. Decision-makers equipped with a nuanced understanding of segmentation dynamics, regional complexities, and corporate strategies are best positioned to navigate volatility and capture emerging opportunities.

Ultimately, sustained success hinges on a balanced approach that harmonizes operational agility with long-term investment in R&D, strategic supply chain diversification, and customer-centric value propositions. This executive summary encapsulates the critical insights and strategic imperatives necessary to thrive in a market where durability, performance, and adaptability converge.

Empower Your Strategic Decisions by Connecting with Ketan Rohom to Secure the Definitive Tactical Footwear Market Research Report

To gain unparalleled access to comprehensive insights and strategic analysis on the tactical footwear market, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to explore how this research can inform your decisions, support your growth strategies, and provide you with a competitive advantage. Partner now to secure your copy of the full market research report and transform data into actionable intelligence for your organization.

- How big is the Tactical Footwear Market?

- What is the Tactical Footwear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?