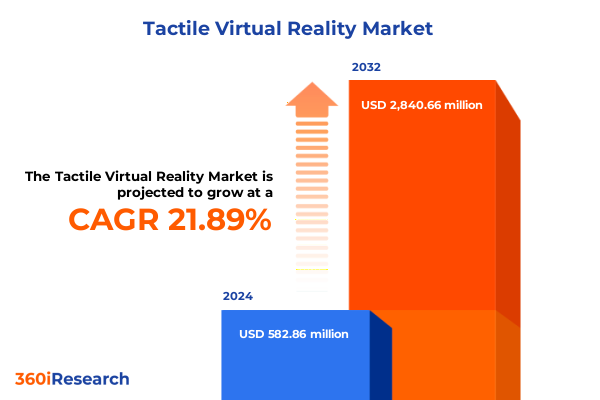

The Tactile Virtual Reality Market size was estimated at USD 712.01 million in 2025 and expected to reach USD 870.78 million in 2026, at a CAGR of 22.45% to reach USD 2,940.66 million by 2032.

Revolutionizing Human-Computer Interaction: Unveiling the Emergence and Potential of Tactile Virtual Reality Technologies Across Industries

The digital era has ushered in an unprecedented convergence of sensory technologies, paving the way for tactile virtual reality to emerge as a transformative force in human-computer interaction. By integrating precise haptic feedback with immersive visual and auditory cues, this technology extends beyond traditional VR boundaries to create experiences that resonate physically and emotionally. The growing appetite for lifelike virtual simulations, fueled by applications ranging from advanced gaming to realistic training modules, underscores the importance of tactile enhancements in elevating engagement and retention. As developers and hardware manufacturers refine sensor arrays, actuators, and software algorithms, the quality and granularity of haptic output have reached levels that promise to redefine user expectations.

Building on the momentum of recent breakthroughs in miniaturization and materials science, tactile virtual reality is poised to bridge the gap between imagination and tangible sensation. This introduction outlines the core concepts, evolution, and strategic significance of haptic integration within VR ecosystems. It sets the stage for a detailed exploration of how emerging form factors-from exoskeleton gloves to mid-air ultrasound arrays-are paving the way for more intuitive interfaces. By understanding this foundational landscape, stakeholders can better appreciate the intricate tapestry of technological, regulatory, and competitive considerations that drive adoption and shape the market’s trajectory.

Navigating the Confluence of Technological Breakthroughs and User Expectations Driving the Next Frontier of Immersive Haptic Experiences

As hardware precision and software intelligence converge, the tactile virtual reality landscape has undergone a remarkable transformation. Early iterations relied on rudimentary vibration motors and static force feedback, which offered limited immersion. Today’s solutions leverage advanced haptic controllers with variable force fields, ultra-sensitive exoskeleton gloves that map individual finger articulation, and full-body suits that simulate pressure, temperature, and texture with unprecedented fidelity. Parallel advances in mid-air haptics-using ultrasonic arrays and directed air jets-allow users to perceive touch sensations without physical attachments, while wearable devices such as vests and belts provide localized feedback that integrates seamlessly with wireless VR headsets.

These technological breakthroughs have been matched by evolving user expectations. Mainstream consumers now demand multisensory experiences that blur the lines between virtual and real, while enterprises seek simulation platforms that drive measurable outcomes in training, design, and clinical contexts. Consequently, development roadmaps now prioritize interoperability, content creation toolkits, and standardized feedback protocols to streamline integration. This section delves into the confluence of innovation cycles, shifting end-user requirements, and ecosystem collaborations that are propelling tactile virtual reality into its next phase of maturity.

Assessing How the 2025 U.S. Tariff Landscape Is Reshaping Supply Chains, Component Costs, and Competitive Dynamics in Tactile Virtual Reality

The implementation of new U.S. tariffs in 2025 has introduced a complex layer of cost and operational considerations for tactile virtual reality suppliers and integrators. Many core components-high-precision actuators, custom microcontrollers, and specialized polymers-originate from tariff-impacted regions. As duties on electronic subassemblies and advanced materials climbed, manufacturers faced elevated import expenses that rippled through the supply chain. In response, several hardware providers have reevaluated their assembly footprints, exploring near-shoring opportunities in Mexico and Canada to alleviate duty burdens, while others are diversifying supplier bases across Southeast Asia to spread risk.

These shifts have redefined competitive dynamics. Firms that successfully negotiated long-term contracts or secured tariff exemptions for R&D equipment have gained cost advantages, allowing them to reinvest in product refinement and user experience enhancements. On the other hand, smaller startups and niche component specialists have navigated tighter margins by adopting leaner design approaches and passing incremental costs to early adopters willing to pay a premium for novelty. This section assesses how the 2025 tariff environment has reshaped sourcing strategies, prompted regional manufacturing realignments, and influenced the strategic calculus of emerging versus established players in the tactile VR domain.

Unveiling Critical Segmentation Insights that Illuminate Distinct Product and Application Pathways Shaping Tactile Virtual Reality Adoption

A nuanced understanding of product and application segmentation reveals critical pathways for tailoring tactile virtual reality offerings to distinct user cohorts. Within the hardware domain, haptic controllers-encompassing both game controllers and VR wands-remain the primary gateway for mainstream consumers seeking enhanced immersion. The modular design of these interfaces enables seamless integration with both console and PC gaming platforms, while firmware updates continue to refine force-feedback profiles. Meanwhile, data gloves and exoskeleton gloves serve enterprise and research markets that demand granular finger-level force mapping for surgical training and rehabilitation simulations. Full-body suits and partial suits, on the other hand, cater to high-fidelity simulation environments in industrial design, quality control, and military applications, where realistic pressure distribution is paramount.

On the application front, education and training ecosystems leverage tactile VR to facilitate corporate upskilling, higher education labs, and K-12 interactive learning modules that hinge on embodied cognition principles. Gaming spans console, mobile, and PC segments, each with unique ergonomic and cost considerations driving device preference. In healthcare, rehabilitation programs, surgical procedural training, and remote telemedicine consultations harness haptic feedback to accelerate skill acquisition and patient engagement. Industrial and manufacturing use cases extend to design prototyping, real-time quality inspection, and remote maintenance support, while military and defense simulations integrate command-and-control scenarios, drone operation interfaces, and battlefield rehearsals. This section synthesizes how these diverse segmentation layers inform product development roadmaps and content creation strategies.

This comprehensive research report categorizes the Tactile Virtual Reality market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Application

- Application

Exploring Regional Dynamics and Growth Drivers Across the Americas, EMEA, and Asia-Pacific for Tactile Virtual Reality Innovations

Regional dynamics exert a profound influence on the pace and character of tactile virtual reality adoption. In the Americas, strong consumer appetite for immersive gaming, bolstered by a robust entertainment software industry and expansive high-speed network infrastructure, has driven early hardware adoption. Additionally, significant investment in advanced training simulators across aerospace, automotive, and energy sectors has further incentivized localized manufacturing hubs and strategic partnerships between technology developers and academic institutions.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing data privacy and industrial safety have fostered demand for simulation-driven training in healthcare compliance and industrial protocols. Collaborative research initiatives funded by the European Union are accelerating mid-air haptic research, while emerging defense projects in the Middle East are integrating full-body feedback solutions for mission rehearsal. In Africa, pilot programs in educational institutions are leveraging low-cost wearable devices to enhance STEM learning outcomes, illustrating how cost-effective deployment models can bridge resource gaps.

In the Asia-Pacific region, aggressive government incentives for digital transformation, coupled with a thriving electronics manufacturing ecosystem, have created fertile ground for both homegrown startups and global corporations. Countries such as South Korea and Japan are pioneering tactile augmented reality applications, blending haptic feedback with intelligent robotics for advanced industrial training. Simultaneously, India’s growing startup ecosystem is focusing on lightweight exoskeleton gloves to address healthcare workforce challenges and remote diagnostics.

This comprehensive research report examines key regions that drive the evolution of the Tactile Virtual Reality market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players and Their Strategic Initiatives Steering the Evolution of Tactile Virtual Reality Technologies

Several leading companies are defining the competitive contours of the tactile virtual reality landscape through focused R&D investments, strategic acquisitions, and cross-industry collaborations. Pioneers in ultrasonic mid-air haptics have broadened their technology licensing agreements to integrate their arrays into leading VR headsets, capitalizing on the trend toward attachment-free devices. Meanwhile, specialist firms in exoskeleton glove design have entered into partnerships with medical device manufacturers to co-develop rehabilitation and surgical training solutions that comply with stringent healthcare certifications.

Major hardware vendors have also established innovation labs that co-create bespoke haptic modules with game developers, simulation software providers, and enterprise clients, ensuring tight synergy between hardware capabilities and content requirements. Several players have secured multi-year supply agreements with aerospace and defense contractors, embedding their full-body suits into pilot training and mission planning environments. At the same time, consumer electronics giants are exploring bolt-on haptic accessories, betting on retrofit adoption among existing VR headset owners. These diverse corporate strategies highlight the importance of ecosystem orchestration, intellectual property management, and targeted use case development in maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tactile Virtual Reality market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- bHaptics Inc.

- ByteDance Ltd.

- Dexta Robotics Limited

- GoTouch VR Inc

- HaptX Inc.

- HTC Corporation

- Immersion Corporation

- Manus VR B.V.

- Meta Platforms, Inc.

- Neosensory Inc.

- Noitom International Co., Ltd.

- Samsung Electronics Co., Ltd.

- SenseGlove B.V.

- Sony Group Corporation

- SUBPAC Inc.

- TESLASUIT Technologies Ltd

- UltraLeap Ltd

- Valve Corporation

- Woojer Ltd.

Crafting Strategic Imperatives and Best Practices to Drive Competitive Advantage in the Tactile Virtual Reality Ecosystem

To secure a sustainable leadership position, industry stakeholders should prioritize the development of open interoperability standards that facilitate seamless integration of haptic modules across diverse VR platforms, thereby reducing adoption barriers and accelerating developer uptake. Concurrently, forging partnerships with content creators and vertical solution providers enables tailored experience libraries that resonate with specific end-user needs, from medical educators to enterprise maintenance crews. By co-investing in content pipelines, organizations can generate recurring revenue streams and cultivate user communities that advocate for further innovation.

Supply chain resilience must also be a focal point. Companies should diversify component sourcing through multi-regional manufacturing partnerships, establish strategic safety stocks for critical actuators and sensing elements, and explore near-shore assembly to mitigate tariff exposure. A proactive approach to regulatory engagement-particularly in medical and defense applications-will streamline certification processes and expedite go-to-market timelines. Lastly, allocating resources to user experience research-capturing real-world feedback on ergonomics, latency, and haptic fidelity-will inform iterative design enhancements, ensuring that products remain aligned with evolving customer expectations.

Detailing a Robust Research Methodology Combining Comprehensive Primary Interviews and Rigorous Secondary Analysis to Ensure Data Integrity

This research report is grounded in a dual-phase methodology that combines comprehensive secondary analysis with targeted primary investigations. The secondary research phase involved an exhaustive review of industry publications, patent filings, regulatory documents, and technical white papers to map historical technology trajectories and identify emerging innovation clusters. Publicly available financial filings and corporate presentations were analyzed to ascertain strategic priorities and competitive positioning.

Complementing the secondary research, the primary phase comprised in-depth interviews with over 25 senior executives, product managers, and R&D specialists across hardware manufacturers, software integrators, and end-user organizations. Additional data was gathered through custom surveys distributed to a cross-section of enterprise adopters in healthcare, education, and defense, ensuring a representative mix of strategic perspectives. Findings from both phases were triangulated to validate insights, mitigate bias, and achieve a nuanced view of market challenges, growth drivers, and technological inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tactile Virtual Reality market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tactile Virtual Reality Market, by Product Type

- Tactile Virtual Reality Market, by Component

- Tactile Virtual Reality Market, by Application

- Tactile Virtual Reality Market, by Application

- Tactile Virtual Reality Market, by Region

- Tactile Virtual Reality Market, by Group

- Tactile Virtual Reality Market, by Country

- United States Tactile Virtual Reality Market

- China Tactile Virtual Reality Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Summarizing the Strategic Imperatives and Forward-Looking Perspectives Shaping the Future of Tactile Virtual Reality Adoption and Innovation

Tactile virtual reality stands at the intersection of cutting-edge hardware engineering and human perceptual science, and its continued evolution hinges on the ability of industry players to synchronize innovation with user demands and regulatory landscapes. The interplay between advanced haptic form factors, shifting supply chain dynamics, and diverse application requirements underscores the need for adaptive strategies that balance technological ambition with operational pragmatism.

By integrating the key insights outlined-from transformative shifts in haptic feedback mechanisms to the nuanced impact of U.S. tariffs, segmentation intricacies, regional growth patterns, and corporate strategies-stakeholders can chart a deliberate course toward market leadership. The recommendations provided serve as a blueprint for navigating complexity, fostering collaboration, and capitalizing on emerging opportunities. As tactile VR moves from early adoption to mainstream deployment, decision-makers equipped with these strategic imperatives will be uniquely positioned to define the future of immersive experiences.

Connect with Ketan Rohom to Secure Your Comprehensive Tactile Virtual Reality Market Research Report for Strategic Market Positioning

For an in‐depth exploration of how tactile virtual reality is transforming user engagement across diverse sectors, reach out to Ketan Rohom, whose expertise aligns research insights with strategic market planning. As the Associate Director of Sales & Marketing at 360iResearch, Ketan will guide you to the tailored report package that addresses your competitive challenges, technological priorities, and growth objectives. Don’t miss this opportunity to equip your organization with actionable intelligence that accelerates innovation, mitigates supply chain uncertainties, and unlocks new revenue streams. Contact Ketan today to secure your definitive market research report and position your company at the forefront of tactile virtual reality advancements.

- How big is the Tactile Virtual Reality Market?

- What is the Tactile Virtual Reality Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?