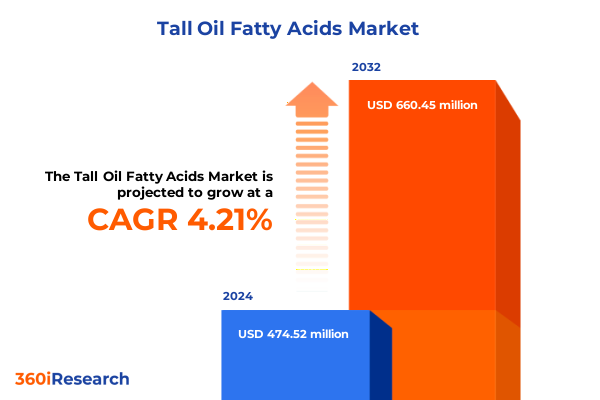

The Tall Oil Fatty Acids Market size was estimated at USD 494.79 million in 2025 and expected to reach USD 519.40 million in 2026, at a CAGR of 4.87% to reach USD 690.45 million by 2032.

Unveiling the Dynamics of Tall Oil Fatty Acids: Strategic Pillars Shaping the Global Bio-Based Oleochemicals Frontier Defining Tomorrow’s Sustainable Solutions

Tall Oil Fatty Acids (TOFA) represent a critical bio-based feedstock derived from the distillation of crude tall oil, itself a byproduct of kraft pulping operations in softwood paper mills. Throughout the value chain, TOFA contributes to a spectrum of applications-ranging from asphalt additives enhancing road durability to specialty coatings and personal care products where fatty acid derivatives deliver performance and sustainability credentials. In recent years, rising demand for renewable materials, coupled with heightened regulatory scrutiny around petrochemical derivatives, has elevated TOFA from a niche industrial input to a strategic oleochemical of consequence.

Market participants have responded by integrating sustainability mandates into sourcing and production, with several leading chemical companies forging partnerships to secure feedstock from responsibly managed forests. At the same time, R&D investments are accelerating efforts to tailor TOFA fractions-crude, distilled, and hydrogenated-for application-specific performance, fostering innovation in lubricants, metalworking fluids, and detergents.

Amid this backdrop, stakeholders are navigating both opportunities and challenges: feedstock availability remains closely tied to pulp and paper industry cycles, while the push for greener chemistries creates openings for differentiated, high-purity grades. As we embark on this exploration, the following sections will illuminate transformative shifts, tariff implications, segmentation dynamics, regional variations, and strategic imperatives shaping the TOFA landscape today and into 2025.

Navigating the Transformational Currents Redefining Tall Oil Fatty Acids Through Sustainability Mandates and Technological Breakthroughs

The Tall Oil Fatty Acids market is undergoing transformative shifts driven by mounting sustainability mandates and the rapid deployment of process intensification technologies. In jurisdictions across North America and Europe, regulatory frameworks-such as renewable content targets and restrictions on hazardous chemicals-are compelling manufacturers to adopt bio-based feedstocks, positioning TOFA as a preferred alternative to synthetic fatty acids. Company executives are increasingly forging cross-sector collaborations with pulp producers to secure raw materials certified under forest stewardship programs, reflecting a broader industry pivot toward traceable, low-carbon supply chains.

Simultaneously, digitalization and advanced analytics are reshaping TOFA production and application development. Real-time monitoring across distillation units, enabled by IoT-enabled sensors, allows producers to optimize fractionation yields and tailor fatty acid profiles with unprecedented precision. This integration of Industry 4.0 capabilities is complemented by ongoing R&D in hydrogenation and transesterification processes to expand the product portfolio into high-purity grades suitable for pharmaceuticals and cosmetics.

As cost pressures tighten and consumer expectations for transparency rise, producers are also exploring novel process intensification approaches-including microwave-assisted distillation and membrane separation-to improve energy efficiency and reduce water usage. These innovations are not only lowering operational costs but also enhancing the environmental footprint of TOFA production. The convergence of regulatory drivers, technological breakthroughs, and shifting customer preferences underscores a pivotal moment, transforming TOFA from a byproduct commodity into a catalyst for sustainable growth.

Assessing the Multi-Year Consequences of United States Tariffs on Tall Oil Fatty Acids Through 2025: Trade, Costs, and Strategic Adaptations

Since the imposition of new U.S. tariffs on certain chemical imports in early 2025, trade flows and cost structures in the Tall Oil Fatty Acids market have been significantly reshaped. On February 1, 2025, the U.S. government implemented a 25% duty on imports from Canada and Mexico, alongside a 10% levy on imports from China, targeting a broad range of chemical feedstocks and materials critical to downstream industries. These measures aimed to safeguard domestic producers and address policy concerns but have introduced volatility for companies reliant on cross-border raw material sourcing.

Industry analysts highlight that pine chemical shipments from China and Southeast Asia have increasingly been redirected to alternative markets in response to higher U.S. tariffs, while exporters in Europe and Latin America seek to capitalize on tariff differentials. Such shifts have led to logistical inefficiencies and upward pressure on freight rates, particularly for rosin esters and CTO fractions. Notably, several U.S. tackifier producers have paused capacity expansions amid uncertainty over retaliatory tariffs and the evolving policy landscape.

In response, major TOFA processors have adopted strategic adaptations: they are diversifying supplier portfolios, renegotiating long-term contracts with pulping companies, and revising costing models to accommodate tariff-inclusive pricing. Moreover, some domestic refiners are scaling up hydrogenation capacity and investing in localized distillation capabilities to mitigate dependency on imported intermediates. These cumulative tariff effects underscore the importance of agile supply chain management and targeted investments in domestic value-add infrastructure.

Unlocking Market Potential Through Granular Segmentation Insights Across Applications, Product Types, Industries, Grades, and Distribution Channels

A granular look at market segmentation reveals diverse performance drivers and untapped potential across applications, product types, end-use industries, grades, and distribution channels. In applications, coatings have emerged as a leading end use for TOFA derivatives, with architectural and industrial coatings demanding fatty acid esters for improved film formation and corrosion resistance. Within industrial coatings, decorative paints leverage TOFA for enhanced pigment dispersion, while powder and protective coatings benefit from its renewable content. Simultaneously, asphalt additives are gaining traction as sustainability-focused infrastructure projects prioritize bio-based modifiers to improve pavement durability and reduce lifecycle emissions.

Product types-namely crude, distilled, and hydrogenated TOFA-exhibit distinct characteristics and market positioning. Crude TOFA offers cost advantages for metalworking fluids and soaps, whereas distilled TOFA commands premiums in lubricant formulations that require precise fatty acid profiles. Hydrogenated TOFA is increasingly adopted in high-purity personal care products, where oxidative stability and compliance with pharmacopeial standards are critical.

Across end-use industries, construction and automotive drive robust demand for TOFA-based additives; the automotive sector’s aftermarket and OEM segments both utilize corrosion inhibitors derived from fatty acids, and commercial and residential construction projects continue to integrate TOFA-based sealants and coatings. Technical, industrial, and pharma grades further delineate quality tiers, aligning with regulatory requirements in cosmetics and food-contact applications.

Finally, distribution channels shape market access and cost structures: direct sales empower large-scale consumers with integrated logistics, while distributors serve regional manufacturers and specialty users. Emerging online platforms, though nascent, are facilitating sample procurement and small-batch orders, signaling a shift toward more digitalized ordering processes that enhance responsiveness for niche applications.

This comprehensive research report categorizes the Tall Oil Fatty Acids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Grade

- Applications

- End Use Industry

- Distribution Channel

Decoding Regional Dynamics to Reveal Distinct Trends Driving Tall Oil Fatty Acids Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics profoundly influence supply availability, regulatory compliance, and market development in the Tall Oil Fatty Acids sector. In the Americas, the United States remains the largest consumption hub, driven by robust construction and automotive markets and buoyed by domestic pulp production in the Southeastern states. Canada supplies a significant share of crude tall oil, facilitating integrated supply chains for refiners in the Gulf Coast. Meanwhile, Latin American producers are exploring export opportunities to mitigate the impact of U.S. tariffs and diversify end-use partnerships in the chemicals and personal care segments.

Europe, the Middle East, and Africa (EMEA) encompass diverse demand patterns and regulatory environments. Northern European countries have intensified sustainability standards, elevating demand for certified bio-based TOFA derivatives in industrial coatings and detergents. The European Chemicals Agency’s REACH framework drives rigorous safety assessments, prompting refiners to ensure full compliance for TOFA-based intermediates. In the Middle East, expanding petrochemical clusters are forging joint ventures to integrate oleochemical production, whereas some African nations are unlocking forestry resources to develop localized TOFA processing, targeting both domestic and export markets.

In the Asia-Pacific region, pulp and paper capacity in China, Indonesia, and Malaysia underpins a large-scale supply of crude tall oil. Local refiners have steadily upgraded distillation and hydrogenation assets, addressing domestic demand for personal care and detergent ingredients. Simultaneously, growing infrastructure investments in Southeast Asia are fueling demand for bio-based asphalt modifiers. Regulatory momentum toward circular economy policies in Australia and New Zealand further accelerates adoption of renewable oleochemical inputs, positioning the region as both a production powerhouse and a catalyst for application innovation.

This comprehensive research report examines key regions that drive the evolution of the Tall Oil Fatty Acids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Partnerships, and Sustainability in the Competitive Tall Oil Fatty Acids Landscape

Industry leaders are advancing a range of strategies to maintain competitiveness and capture value in the evolving Tall Oil Fatty Acids market. Eastman Chemical has prioritized expansion of its hydrogenation capacity, targeting high-purity fractions for personal care and pharmaceutical intermediates. Ingevity continues to leverage its integration in the pulp sector, securing long-term supply agreements that ensure feedstock consistency and cost predictability.

Kraton Corporation has diversified its product portfolio by introducing novel fatty acid esters tailored for advanced lubricant and metalworking fluid formulations, while integrating certifications for sustainable forestry to meet end-user environmental criteria. Arizona Chemical, now part of a leading forest products group, has focused on process optimization across its global refining sites, enhancing energy efficiency and reducing water usage per ton of TOFA produced.

Smaller, specialized players are also carving niche positions: certain regional refiners in Europe and Latin America are capitalizing on flexible batch operations to serve custom demand for decorative coatings and technical grades. Major distributors are layering analytics-driven inventory management tools to optimize delivery cycles, while digital platforms are emerging to facilitate small-volume purchases and technical consultations. Collectively, these company-level initiatives illustrate a competitive landscape shaped by operational excellence, vertical integration, and a relentless commitment to sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tall Oil Fatty Acids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arizona Chemical Co.

- Ataman Kimya

- ChemCeed LLC

- Chemical Associates Inc.

- Eastman Chemical Company

- Forchem

- Forchem Oyj

- Foreverest Resources Ltd.

- G.C. Rutteman & Co. B.V.

- Georgia Pacific LLC

- Harima Chemicals Group, Inc.

- Ilim Group

- Imperial Industrial Minerals Company

- Ingevity

- KRATON CORPORATION

- Lascaray S.A.

- MeadWestvaco Corporation

- Pasand Speciality Chemicals

- Pine Chemical Group

- Segezha Pulp and Paper Mill

- Segezha-Group

- Shaxian Lixin Resin Co. Ltd.

- Silver Fern Chemicals Inc

- Torgoviy Dom Lesokhimik

- UNIVAR SOLUTIONS

Implementing Strategic Recommendations to Enhance Competitiveness and Resilience in the Tall Oil Fatty Acids Value Chain Operations

To thrive in this dynamic environment, industry stakeholders should consider several strategic actions. First, investing in flexible refining and fractionation infrastructure will enable rapid response to evolving application requirements and mitigate supply disruptions arising from pulp mill cycles. Establishing modular distillation units or mobile hydrogenation skids can provide the agility needed to capture emerging high-value opportunities in specialty segments.

Second, diversifying feedstock sources-through alliances with certified forestry programs, pulp and paper producers, and emerging biorefineries-can reduce exposure to tariff fluctuations and logistical bottlenecks. Negotiating long-term supply agreements with performance-based pricing will also help stabilize margins amid trade policy uncertainties.

Third, enhancing product differentiation through targeted R&D in process intensification and green chemistry will unlock new application domains. Collaborations with academic institutions and specialty chemical consortia can accelerate development of proprietary fatty acid derivatives optimized for adhesion, corrosion inhibition, and foam control.

Finally, implementing digital supply chain solutions-including predictive analytics for demand forecasting, real-time tracking, and e-commerce integration-will strengthen customer engagement and streamline order-to-delivery cycles. By harnessing data-driven decision-making, companies can optimize inventory levels, reduce lead times, and deliver more personalized service across diverse customer segments.

Detailing a Rigorous Research Methodology Combining Primary Interviews, Secondary Data, and Triangulated Analysis for Reliable Insights

This research integrates both primary and secondary methodologies to ensure comprehensive and reliable insights. The secondary research phase involved extensive review of public filings, technical journals, and regulatory documents-including REACH dossiers, EPA filings, and customs tariff schedules-to map market drivers, trade policies, and environmental regulations. Trade association publications and industry news portals were analyzed to contextualize recent developments such as tariff announcements and sustainability certifications.

Primary research comprised structured interviews with key stakeholders across the value chain, including senior executives at pulp and paper companies, specialty chemical producers, distributors, and major end users in coatings and personal care industries. These conversations provided qualitative perspectives on supply chain challenges, product innovation priorities, and tariff mitigation strategies. Detailed discussions with tariffs and trade policy experts further informed our assessment of duty structures and cumulative impacts.

Data triangulation techniques were applied to reconcile quantitative findings-such as production capacity, feedstock flows, and regional consumption patterns-with qualitative insights from industry insiders. This blended approach ensures that projections and strategic recommendations are grounded in both empirical evidence and real-world expertise. Throughout the research process, rigorous validation protocols, including cross-referencing multiple data sources and peer review by subject matter experts, were implemented to uphold analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tall Oil Fatty Acids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tall Oil Fatty Acids Market, by Product Type

- Tall Oil Fatty Acids Market, by Grade

- Tall Oil Fatty Acids Market, by Applications

- Tall Oil Fatty Acids Market, by End Use Industry

- Tall Oil Fatty Acids Market, by Distribution Channel

- Tall Oil Fatty Acids Market, by Region

- Tall Oil Fatty Acids Market, by Group

- Tall Oil Fatty Acids Market, by Country

- United States Tall Oil Fatty Acids Market

- China Tall Oil Fatty Acids Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights Highlighting Critical Trends and Future Outlook in the Evolving Tall Oil Fatty Acids Market Landscape

In summary, Tall Oil Fatty Acids have evolved from an ancillary byproduct to a cornerstone of sustainable oleochemical formulations, driven by regulatory imperatives, technological innovation, and shifting customer preferences. The market’s trajectory is shaped by transformative sustainability mandates, strategic tariff adaptations, and granular segmentation dynamics that open diverse application avenues-from advanced coatings to eco-friendly lubricants and personal care products.

Regional variations underscore the importance of localized approaches: North America’s integrated pulp-chemical supply chains, EMEA’s stringent regulatory frameworks, and Asia-Pacific’s manufacturing scale each present unique opportunities and challenges. Leading producers are leveraging capacity expansions, feedstock partnerships, and process optimization to reinforce competitiveness, while smaller players exploit flexibility to serve niche requirements.

Looking ahead, success will hinge on agility in refining operations, proactive tariff risk management, and sustained investment in green chemistry. Companies that align strategic priorities with digital supply chain excellence and circular economy principles will be well-positioned to capture the full potential of this dynamic market. The insights outlined herein provide a strategic roadmap for stakeholders seeking to navigate the complexities of the Tall Oil Fatty Acids landscape and secure long-term value creation.

Download the Comprehensive Tall Oil Fatty Acids Market Report Today by Engaging with Ketan Rohom to Drive Informed Strategic Decisions

If you are ready to deepen your understanding of the Tall Oil Fatty Acids landscape and leverage actionable insights tailored to your strategic objectives, consult directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in market dynamics and emerging applications will guide you through key findings across supply chain optimization, tariff impacts, and segmentation-driven growth opportunities. Engage with Ketan to secure your copy of the full market research report, unlocking detailed analyses, company profiles, and bespoke recommendations to inform confident, data-driven decisions that position your organization for sustained competitiveness in the evolving oleochemical sector.

- How big is the Tall Oil Fatty Acids Market?

- What is the Tall Oil Fatty Acids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?