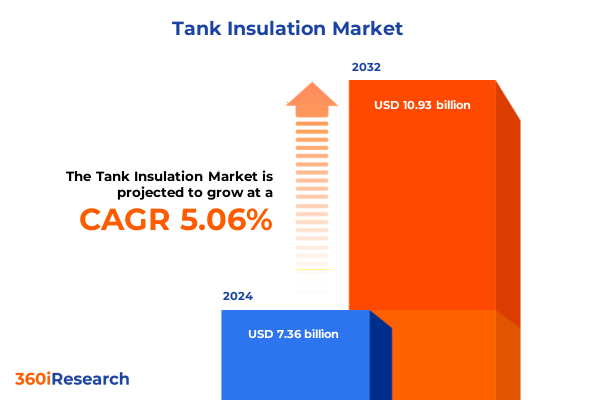

The Tank Insulation Market size was estimated at USD 7.74 billion in 2025 and expected to reach USD 8.14 billion in 2026, at a CAGR of 6.38% to reach USD 11.93 billion by 2032.

Unveiling the Critical Role of Advanced Tank Insulation Technologies in Ensuring Operational Efficiency and Thermal Management Across Industries

In an era defined by escalating energy costs and heightened environmental imperatives, tank insulation has evolved from a basic engineering consideration into a critical strategic priority for industries worldwide. Organizations that adopt advanced insulation technologies can significantly reduce thermal losses, minimize operational expenditure, and bolster compliance with increasingly stringent greenhouse gas regulations. This evolving focus extends across a wide spectrum of sectors, including chemical processing, food and beverage production, oil and gas operations, and pharmaceutical manufacturing, each grappling with unique thermal management challenges.

Against this backdrop, the present executive summary offers a concise yet comprehensive introduction to the multifaceted realm of tank insulation. Drawing on expert interviews, proprietary data analysis, and rigorous validation protocols, this document will guide readers through transformative technological innovations, emerging geopolitical influences, and critical segmentation dynamics. Along the way, it will illuminate how market participants can align their strategic agendas with both current demands and future opportunities.

By delving into emerging materials, regulatory developments, and regional growth differentials, this introduction aims to establish a clear foundation for subsequent discussions. Stakeholders will gain clarity on why effective insulation remains a cornerstone of process optimization and sustainability, setting the stage for nuanced explorations of market shifts and actionable recommendations.

Exploring How Innovations and Market Dynamics Are Redefining the Tank Insulation Landscape to Drive Sustainability and Competitive Advantage

The tank insulation landscape is undergoing a profound transformation driven by breakthroughs in material science, regulatory realignments, and shifting industry priorities. Phase change materials are being integrated into foam systems to achieve dynamic thermal buffering, while vacuum-insulated panel technologies are expanding the envelope of viable applications by offering ultra-low thermal conductivity in compact form factors. At the same time, novel aerogel composites are gaining traction for their combination of thermal performance and mechanical resilience.

Complementing these material advances, digital innovations such as embedded temperature sensors and predictive analytics platforms are enabling real-time monitoring of insulation integrity. Industry stakeholders are leveraging these capabilities to preempt maintenance needs, optimize energy consumption profiles, and extend asset life cycles. Moreover, the convergence of sustainability mandates and circular economy principles has prompted manufacturers to explore recyclable and bio-based insulation solutions that reduce end-of-life waste without compromising performance.

Taken together, these shifts underscore a broader move toward holistic thermal management strategies. Forward-thinking organizations are not only evaluating individual product attributes but also integrating insulation design into overarching energy and emissions reduction roadmaps. This convergence of technological, regulatory, and ecological factors is reshaping competitive dynamics and opening new avenues for differentiation within the tank insulation market.

Assessing the Broad Repercussions of the New United States Tariff Policies on Tank Insulation Supply Chains and Cost Structures in 2025

In early 2025, new tariff measures imposed by the United States government introduced significant duty increases on imported insulation materials including select foams, specialty glass products, and mineral wools. This policy shift has reverberated across the supply chain, elevating landed costs for original equipment manufacturers and end users alike. As a result, procurement teams have had to revisit sourcing agreements, negotiate long-term contracts to hedge against price volatility, and accelerate the qualification of alternative domestic suppliers.

Consequently, some market participants have moved production closer to end markets or diversified their raw material base to mitigate exposure. Others have pursued strategic alliances with local compounders to secure preferential access to key components. These adaptive strategies have, in turn, influenced pricing structures for cryogenic, pressure, process, and storage tanks, prompting downstream purchasers to reassess total cost of ownership calculations and lifecycle maintenance budgets.

Looking ahead, the cumulative impact of these tariffs will continue to evolve as manufacturers optimize cross-border logistics and engage in policy advocacy. Stakeholders that proactively manage tariff-induced disruptions-through flexible manufacturing footprints, dynamic inventory models, and collaborative supplier relationships-will be best positioned to preserve margin integrity and maintain service levels during this period of regulatory flux.

Deriving Strategic Insights from Multifaceted Segmentation of Material Types Tank Configurations and End User Industry Verticals

A nuanced exploration of tank insulation demand reveals that material selection plays a defining role in performance, cost efficiency, and regulatory compliance. Cellular glass remains prized for its compressive strength and long-term thermal stability, while expanded polystyrene continues to serve cost-sensitive applications due to its ease of installation and favorable insulation properties. Within the mineral wool category, glass wool and rock wool each offer distinct advantages: the former features superior tensile strength and moisture resistance, whereas the latter provides exceptional high-temperature tolerance. Polyurethane foam further bifurcates into rigid polyurethane panels, valued for their structural integrity, and spray-applied variants that conform to complex geometries and expedite installation schedules.

Transitioning from material science to application context, tank types exert a strong influence on insulation requirements and design considerations. Cryogenic tanks, encompassing both LNG and LOX containment systems, demand extremely low thermal conductivity to curb boil-off losses. Pressure vessels, whether cylindrical or spherical, introduce unique mechanical stress profiles that necessitate reinforcement layers and specialized joint treatments. Process tanks used for heating or mixing operations require insulation solutions capable of withstanding rapid temperature cycling, while storage tanks oriented horizontally or vertically call for tailored support structures to prevent thermal bridging and minimize structural deformation.

Finally, end-user industry verticals further refine market segmentation insights. Within the chemical sector, inorganics and organics divisions exhibit divergent process temperatures and corrosivity parameters, guiding insulation chemistry choices. The food and beverage industry, split between brewery and dairy operations, prioritizes hygienic coatings and diffuse heat retention. Oil and gas markets navigate downstream, midstream, and upstream contexts, each presenting distinct pressure, flow, and ambient considerations. Meanwhile, pharmaceutical applications in both API production and formulation stages demand stringent validation protocols and trace heating capabilities to safeguard product integrity.

This comprehensive research report categorizes the Tank Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Tank Type

- Construction

- End User Industry

Unearthing Regional Nuances Shaping Demand and Innovation Trends for Tank Insulation Across the Americas EMEA and Asia Pacific Markets

Geographically, demand drivers for tank insulation demonstrate marked variability across the Americas, Europe, the Middle East and Africa (EMEA), and Asia-Pacific. In the Americas, strong investment in oil and gas infrastructure, burgeoning biofuels projects, and a resurgence of cold storage facilities have reinforced the need for robust insulation solutions. Regulatory frameworks addressing energy efficiency and greenhouse gas emissions further amplify the impetus for advanced thermal management, encouraging adoption of next-generation materials and retrofitting initiatives.

Meanwhile, the EMEA region is characterized by a dual focus on decarbonization and industrial modernization. Mature markets in Western Europe are accelerating plant upgrades to comply with stringent emissions targets, driving demand for recyclable and low-carbon insulation products. At the same time, emerging economies in the Middle East and North Africa are expanding petrochemical complexes, leveraging insulation technologies to optimize process efficiency under harsh environmental conditions.

In Asia-Pacific, rapid industrialization and the expansion of LNG import and export terminals have positioned the region as a key battleground for cryogenic insulation providers. Additionally, robust growth in food processing and pharmaceutical manufacturing hubs has heightened requirements for hygiene-compliant and trace-heating systems. Stakeholders operating across these diverse regional landscapes must therefore tailor product portfolios and partnership strategies to address local regulatory, environmental, and economic nuances.

This comprehensive research report examines key regions that drive the evolution of the Tank Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation Quality and Strategic Collaborations in the Tank Insulation Sector

Leading companies in the tank insulation sector continue to differentiate through targeted investments in research and development, vertical integration, and strategic collaborations. Several market participants have established dedicated innovation centers focused on next-generation aerogel composites and high-performance foam chemistries, while others have acquired niche providers to broaden their product portfolios and enhance in-house manufacturing capabilities. Quality assurance remains a critical competitive lever, with advanced nondestructive testing and thermal imaging protocols adopted to validate product performance under extreme conditions.

Collaborative ventures are also on the rise, as firms partner with engineering consultants, equipment OEMs, and research institutions to co-develop turnkey insulation solutions. These alliances enable faster time to market and facilitate the integration of digital monitoring platforms, aligning with end-user demands for predictive maintenance and energy analytics. Beyond technology partnerships, several companies have pursued strategic joint ventures in key regions to establish local production footprints, thereby mitigating tariff exposure and accelerating customer responsiveness.

In parallel, sustainability credentials have become a cornerstone of corporate positioning. From sourcing recycled feedstocks to implementing closed-loop manufacturing processes, leading players are embedding environmental stewardship into their operational blueprints. This strategic emphasis not only resonates with regulatory imperatives but also unlocks new opportunities in green financing and ESG-driven procurement programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tank Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International S.A.

- BASF SE

- Cabot Corporation

- Compagnie de Saint-Gobain S.A.

- Corrosion Resistant Technologies, Inc.

- Covestro AG

- Dunmore

- Firwin Corporation

- Gilsulate International, Inc.

- Gulf Cool Therm Factory Ltd.,

- Huntsman International LLC

- J.H. Ziegler GmbH

- Johns Manville

- Kingspan Group

- Knauf Insulation

- Mayes Coatings & Insulation

- nVent

- Omkar PUF Insulation Pvt. Ltd.

- Owens Corning

- PolarClad Tank Insulation

- ROCKWOOL Danmark A/S

- Synavax

- T.F. Warren Group

- The Dow Chemical Company

Implementing Targeted Strategies to Enhance Thermal Efficiency Optimize Costs and Foster Sustainable Growth in Tank Insulation Operations

To capitalize on emerging opportunities, industry leaders should prioritize investment in advanced material research aimed at enhancing thermal efficiency while lowering embodied carbon. By allocating resources toward the development of hybrid insulation systems that combine aerogels with bio-based formulations, organizations can address both performance and sustainability objectives. Concurrently, diversifying supplier networks and establishing regional manufacturing hubs will mitigate the impact of trade regulations and logistical disruptions, ensuring uninterrupted access to critical materials.

In addition, integrating digital monitoring solutions across the asset lifecycle can transform maintenance strategies from reactive to predictive. Companies should deploy wireless sensor arrays and AI-driven analytics platforms to detect early signs of insulation degradation and optimize maintenance schedules, thereby reducing unplanned downtime. To further strengthen competitive positioning, collaborative partnerships with OEMs and engineering service providers can facilitate the development of turnkey, value-added offerings that go beyond commodity insulation products.

Finally, leadership teams must embed sustainability metrics into core decision-making processes and pursue continuous workforce upskilling programs. Equipping installation and maintenance personnel with advanced training in energy-conscious installation practices and digital toolsets will enhance execution quality and foster a culture of continuous improvement. By implementing these targeted strategies, organizations will be poised to deliver superior thermal performance, robust cost control, and long-term environmental benefits.

Detailing a Robust Research Methodology Integrating Comprehensive Data Collection Analysis and Validation Protocols for Market Insights

This research engaged a multi-tiered methodology to ensure the credibility and depth of insights presented. The process began with a comprehensive secondary research phase, encompassing industry publications, technical white papers, regulatory filings, and patent databases to map the competitive and technological landscape. This foundational layer established the contextual parameters and identified key innovation trends in material science, design engineering, and digital integration.

Building on this secondary analysis, a series of primary research interviews were conducted with C-level executives, product development leaders, procurement specialists, and end users across chemicals, food and beverage, oil and gas, and pharmaceutical sectors. These semi-structured conversations elicited qualitative insights into market priorities, procurement challenges, and adoption drivers, enabling the identification of emerging patterns and strategic inflection points.

Subsequently, data triangulation techniques were applied to cross-validate qualitative findings against proprietary shipment records, trade data, and performance benchmarks sourced from third-party testing facilities. Statistical reconciliation and trend analysis were performed to ensure internal consistency and to uncover hidden correlations. Finally, a panel of external experts reviewed the methodology and key findings to validate assumptions and refine strategic recommendations. This rigorous approach underpins the reliability of the insights and supports informed decision-making across stakeholder groups.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tank Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tank Insulation Market, by Type

- Tank Insulation Market, by Tank Type

- Tank Insulation Market, by Construction

- Tank Insulation Market, by End User Industry

- Tank Insulation Market, by Region

- Tank Insulation Market, by Group

- Tank Insulation Market, by Country

- United States Tank Insulation Market

- China Tank Insulation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings and Strategic Implications to Illuminate the Future Trajectory of the Global Tank Insulation Market

The analysis confirms that the tank insulation market stands at a pivotal juncture defined by rapid technological innovation, evolving regulatory landscapes, and shifting geopolitical dynamics. Key findings highlight the growing prominence of next-generation materials such as aerogel composites and bio-based foams, alongside the acceleration of digital monitoring solutions that facilitate predictive maintenance. Furthermore, the implementation of new tariff policies has underscored the importance of supply chain agility and local manufacturing capabilities, prompting strategic realignments among leading players.

Strategic implications are clear: organizations that can integrate advanced materials development, digital analytics, and sustainability considerations into coherent action plans will secure competitive advantage. Companies must adopt a holistic thermal management perspective that transcends individual product performance and encompasses lifecycle cost optimization, emissions reduction, and asset longevity. Embracing collaborative innovation-whether through joint ventures, OEM partnerships, or research alliances-will be critical to accelerating time to market and capturing emerging demand segments.

Looking forward, maintaining market leadership will require continuous monitoring of regulatory developments, proactive engagement with policy stakeholders, and flexible operational models capable of responding to tariff fluctuations. By synthesizing these imperatives into a strategic blueprint, stakeholders can navigate the complexities of the 2025 landscape and shape the future trajectory of the global tank insulation market.

Seize Exclusive Access to the Comprehensive Tank Insulation Market Research Report by Connecting with Ketan Rohom to Unlock Strategic Insights

To gain unparalleled visibility into market trajectories and leverage detailed strategic insights, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By securing this comprehensive market research report, you will access proprietary data on emerging thermal management technologies, region-specific adoption patterns, and competitive benchmarking analyses crafted to empower decision-makers. This report is designed to equip your organization with the foresight needed to optimize material selection, refine supply chain strategies, and capitalize on regulatory shifts in 2025 and beyond.

Connecting with Ketan Rohom ensures personalized support tailored to your unique business objectives. Whether you seek customized segmentation deep dives, scenario modeling for tariff impacts, or specialized workshops on sustainability integration, this engagement will streamline your path from insight to impact. Reach out today to transform high-level analysis into actionable plans that drive operational efficiency, cost optimization, and long-term growth. Secure your copy now and position your organization at the forefront of the tank insulation sector’s next growth wave.

- How big is the Tank Insulation Market?

- What is the Tank Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?