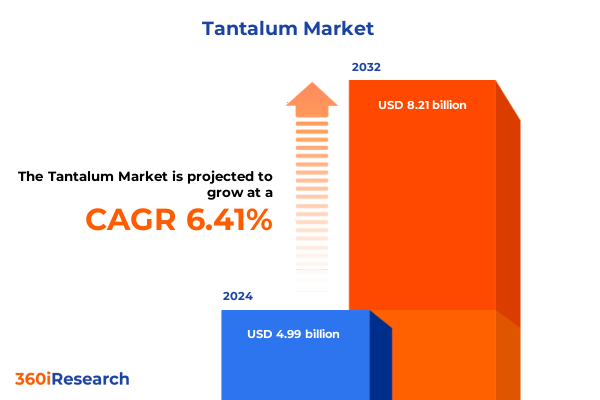

The Tantalum Market size was estimated at USD 5.30 billion in 2025 and expected to reach USD 5.64 billion in 2026, at a CAGR of 6.43% to reach USD 8.21 billion by 2032.

Exploring the Critical Role of Tantalum in High-Tech Manufacturing Clean Energy Solutions and Defense Applications Shaping Tomorrow’s Industrial Landscape

Tantalum has emerged as a keystone metal in the assembly of modern high-performance devices, blending exceptional corrosion resistance, remarkable capacitance properties, and resilience at elevated temperatures. In the context of semiconductor manufacturing, tantalum capacitors enable compact, energy-efficient designs that drive miniaturization and enhanced reliability across consumer electronics. Concurrently, aerospace and defense sectors rely on tantalum’s high melting point and ductility for critical engine components and heat-shield systems. Moreover, the accelerating global energy transition has elevated tantalum as an enabler of next-generation batteries, fuel cells, and renewable energy storage solutions, underscoring its strategic importance in decarbonization pathways.

Against this backdrop, stakeholder attention has shifted toward securing resilient supply chains, balancing geopolitical considerations, and fostering sustainable sourcing. As end-user segments diversify, industry participants must navigate a complex interplay of raw material availability, processing capabilities, and evolving regulatory frameworks. This introduction provides a detailed overview of tantalum’s core properties, the driving forces behind surging demand, and the fundamental challenges shaping market trajectories, laying the groundwork for an in-depth exploration of transformative industry shifts and strategic imperatives.

Examining the Transformative Shifts Redefining the Tantalum Market Through Technological Innovation Sustainable Sourcing and Geopolitical Supply Chain Strategies

Over the past decade, the tantalum market has witnessed profound shifts driven by rapid technological breakthroughs and mounting sustainability pressures. Innovations in powder metallurgy and additive manufacturing have enabled the production of complex geometries and near-net-shape components, elevating performance while reducing material waste. Simultaneously, advances in closed-loop recycling frameworks have enhanced recovery rates of tantalum from electronic waste and manufacturing scrap, reflecting a growing emphasis on circular economy principles. This technological convergence is reshaping supplier strategies, prompting investments in downstream value-added processing and integrated recovery facilities.

Geopolitical tensions have further accelerated diversification efforts, with market participants seeking alternative sources beyond traditional West African deposits. Emerging mines in Australia, Brazil, and domestic recycling hubs are playing an increasingly prominent role, bolstered by regulatory incentives and strategic alliances. In parallel, digitalization initiatives such as blockchain-enabled traceability and real-time telemetry for mineral flows are fostering greater transparency across multi-tiered supply chains. Taken together, these transformations underscore a strategic pivot toward resilience, sustainability, and innovation, setting the stage for new competitive dynamics and collaborative opportunities within the tantalum ecosystem.

Assessing the Cumulative Impact of United States Tariffs on Tantalum Supply Chains and Costs Following the 2025 Section 301 Critical Minerals Tariff Increases

The introduction of Section 301 tariffs on critical minerals has significantly altered the cost structure and sourcing strategies for tantalum importers. In September 2024, the United States applied a 25% duty to imports of Chinese-origin tantalum powders, unwrought metals, and related compounds, underscoring a broader policy effort to reinforce domestic supply chain resilience and counteract perceived strategic vulnerabilities. As these additional duties took effect on September 27, 2024, procurement teams faced steep adjustments in landed costs, compelling many downstream fabricators to pivot toward alternative suppliers in Australia, Brazil, and recycled sources.

As of early 2025, the cumulative impact of these tariffs is manifesting through price inflation at key processing nodes, extended lead times, and a reconfiguration of established trading relationships. While the policy has catalyzed increased domestic investment in recycling infrastructure, it has also generated short-term supply constraints and margin compression for capacitor manufacturers and aerospace component producers. Looking ahead, companies must weigh the trade-off between immediate sourcing flexibility and long-term strategic alignment with reshored production and circular economy initiatives.

Revealing Key Segmentation Insights Highlighting the Diverse Product Types Material Forms End-User Verticals and Strategic Sales Channels in the Tantalum Market

A comprehensive view of market segmentation reveals nuanced demand patterns that merit close attention. Product differentiation spans from high-purity elemental tantalum used in capacitors to multi-component alloys engineered for elevated strength and corrosion resistance, and further to refractory tantalum carbide grades tailored for ultra-high temperature applications. Material form also plays a pivotal role, as granules and pellets offer superior feedstock handling in powder metallurgy processes, whereas ultrafine powders drive additive manufacturing and thin-film capacitor production.

Demand drivers diverge across end-user verticals: aerospace and defense benefit from tantalum’s thermal stability and mechanical integrity, building and construction leverage anticorrosion attributes for specialty coatings, and the carbide and chemicals sector incorporates tantalum into wear-resistant tooling and catalyst systems. The energy and utility segment utilizes tantalum electrodes in electrochemical cells, while healthcare and pharmaceuticals adopt biocompatible tantalum for surgical implants and filtration media. Machinery and equipment manufacturers integrate tantalum alloys into high-load environments, and semiconductor and electronics producers rely on precision film deposition for next-generation microchips.

Sales channel preferences also shape distribution dynamics. B2B direct agreements often secure large volumes for strategic projects, direct sales models enable tailored service and technical support, and specialized distributors deliver agility for emerging applications, ensuring market participants can align procurement strategies with evolving consumption patterns.

This comprehensive research report categorizes the Tantalum market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Form

- End-User

- Sales Channel

Unveiling Key Regional Perspectives Mapping Growth Drivers Resource Endowments and Demand Trends Across the Americas EMEA and Asia-Pacific Tantalum Markets

Regional dynamics in the tantalum market underscore the interplay between resource endowments, domestic policies, and sector-specific demand profiles. In the Americas, the United States and Canada are amplifying recycling capabilities and downstream processing to reduce foreign dependence, while strategic partnerships with Brazil are strengthening raw material pipelines. North American defense modernization programs and the proliferation of renewable energy infrastructure are driving consistent growth, with localized refining assets enabling greater supply chain control.

Across Europe, the Middle East, and Africa, African mining jurisdictions continue to expand tantalum extraction capacity, even as European processing hubs focus on creating closed-loop recovery systems and enhancing traceability through digitized frameworks. Middle Eastern investment is directed toward advanced ceramics and aerospace component production, leveraging regional logistics networks to serve global markets.

In the Asia-Pacific region, demand from China, Japan, South Korea, and Taiwan for tantalum capacitors and semiconductor wafers continues to dominate consumption trends. Concurrently, emerging economies in Southeast Asia are investing in nodule recovery and metallurgical facilities, contributing to an increasingly diversified supply base that supports both electronics manufacturing and specialized industrial applications.

This comprehensive research report examines key regions that drive the evolution of the Tantalum market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Tantalum Industry Players and Their Strategic Initiatives in Capacity Expansion Innovation Sustainability and Vertical Integration

Competitive intensity in the tantalum landscape is rising as leading participants pursue vertically integrated strategies and capacity expansions. Several major firms have augmented their global footprint through joint ventures in mining concessions across central Africa and by establishing value-added processing plants in proximity to preeminent manufacturing clusters. At the same time, a number of specialist refiners have differentiated through proprietary recycling technologies that reclaim tantalum from scrap electronics and machining chips, addressing both sustainability mandates and cost pressures.

Research and development investments are concentrated on enhancing product reliability in extreme environments and on developing novel alloy compositions tailored to next-generation turbine engines, medical implants, and high-frequency electronics. Meanwhile, strategic alliances with downstream integrators are providing critical market intelligence and facilitating co-development of application-specific solutions. In parallel, firms are bolstering digital capabilities to optimize supply chain visibility, inventory management, and regulatory compliance, underscoring a collective shift toward agile, data-driven operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tantalum market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Admat Inc.

- Advanced Engineering Materials Limited

- Alliance Mineral Assets Limited.

- AMG Advanced Metallurgical Group N.V.

- Andrada Mining Limited

- Avalon Advanced Materials Inc.

- CNMC Ningxia Orient Group Co., Ltd.

- Fort Wayne Metals Research Products, LLC

- Global Advanced Metals Pty Ltd

- Jiangxi Tungsten Industry Holding Group Co., Ltd.

- JX Metals Corporation

- Luoyang Combat Tungsten & Molybdenum Materials Co., Ltd.

- Lynas Rare Earths Ltd

- Marula Mining PLC

- Materion Corporation

- Merck KGaA

- Minsur S.A.

- Mitsubishi Corporation

- Neo Performance Materials Inc.

- Ningxia Orient Tantalum Industry Co., Ltd.

- Noah Chemicals Corporation

- Pella Resources Limited

- Pilbara Minerals Limited

- Plansee SE

- Power Resources International Ltd.

- Strategic Minerals Europe Corp.

- Tantalex Lithium Resources Corporation

- Tantalum Mining Corp. of Canada Ltd

- Tantec GmbH

- Treibacher Industrie AG

- U.S. Titanium Industry Inc.

- Ultra Minor Metals Ltd

- Ultramet

- Usha Resources Ltd.

Delivering Actionable Recommendations for Industry Leaders to Strengthen Tantalum Supply Chains Enhance Resilience and Drive Sustainable Innovation in a Dynamic Market Environment

To thrive in this evolving landscape, industry leaders should urgently diversify their sourcing networks by establishing multi-jurisdictional supply agreements and investing in strategic stocks of recycled feedstocks. By integrating closed-loop recovery systems and scaling recycling partnerships, companies can mitigate exposure to geopolitical risks and tariff fluctuations. Additionally, forging collaborative alliances with downstream OEMs and research institutions will accelerate the development of next-generation tantalum alloys and powder formulations that meet stringent performance criteria.

Furthermore, organizations should leverage digital supply chain platforms and blockchain traceability to assure end users and regulators of ethical sourcing and material provenance. Engaging proactively with policymakers and standards bodies will enable the shaping of favorable regulatory frameworks, particularly around critical minerals classification and environmental permitting. Leaders are also advised to conduct rigorous scenario-based risk assessments that incorporate tariff trajectories, currency shifts, and potential supply interruptions. By adopting an agile operating model that aligns procurement, R&D, and commercial strategies, companies can transform volatility into a competitive advantage and position themselves at the forefront of tantalum innovation.

Outlining a Robust Research Methodology Combining Primary Interviews Secondary Data Analysis and Advanced Market Segmentation to Deliver Accurate Tantalum Industry Insights

This analysis draws on an extensive research methodology combining primary and secondary data sources to deliver a comprehensive view of the tantalum market. Primary research included structured interviews with supply chain executives, procurement specialists, materials scientists, and regulatory experts, enabling triangulation of key market drivers and validation of emerging trends. Secondary research encompassed an exhaustive review of industry publications, technical journals, trade association reports, and government databases to contextualize historical developments and benchmark competitive landscapes.

Quantitative insights were derived via advanced data analytics, encompassing tariff schedules, trade flows, and end-use demand indices, while qualitative assessments were informed by expert panels and stakeholder workshops. Market segmentation was rigorously applied across product types, material forms, end-user applications, and distribution channels, ensuring depth and precision in identifying growth pockets. Data integrity was maintained through cross-verification and continuous refinement against real-world case studies, culminating in a robust framework that underpins the strategic imperatives articulated throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tantalum market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tantalum Market, by Product

- Tantalum Market, by Form

- Tantalum Market, by End-User

- Tantalum Market, by Sales Channel

- Tantalum Market, by Region

- Tantalum Market, by Group

- Tantalum Market, by Country

- United States Tantalum Market

- China Tantalum Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Critical Findings and Emphasizing the Strategic Imperatives for Stakeholders to Navigate Complexity and Capitalize on Emerging Opportunities in the Tantalum Market

In sum, tantalum stands at an inflection point defined by accelerating demand for high-performance materials, evolving trade policies, and a growing imperative for sustainability. Technological innovations and recycling initiatives are poised to reshape supply chains, even as tariff regimes and geopolitical shifts redefine cost structures and sourcing strategies. The interplay of segmentation dynamics across product types, forms, end-user industries, and sales models underscores the importance of tailored approaches to value creation.

Looking ahead, stakeholders that proactively align procurement, R&D, and operational frameworks with emerging market realities will secure a strategic advantage. By embracing transparency, digitalization, and collaborative innovation, market participants can navigate complexity, mitigate risk, and capture new opportunities. The findings presented herein offer a strategic blueprint for companies committed to leadership in the global tantalum ecosystem.

Connect with Ketan Rohom to Secure the Comprehensive Tantalum Market Research Report and Unlock Strategic Insights for Business Growth

If you’re ready to gain a competitive edge with unparalleled insights into tantalum market dynamics, connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the comprehensive report. Ketan Rohom will guide you through the breadth of analysis, from supply chain evolutions and tariff implications to segmentation deep dives and strategic recommendations. Whether you need tailored data for decision-making or wish to explore bespoke consulting options, Ketan Rohom offers personalized support to ensure you extract maximum value from this research. Reach out today to unlock the strategic intelligence that will empower your organization to navigate market complexity, anticipate emerging trends, and accelerate growth in the global tantalum landscape

- How big is the Tantalum Market?

- What is the Tantalum Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?