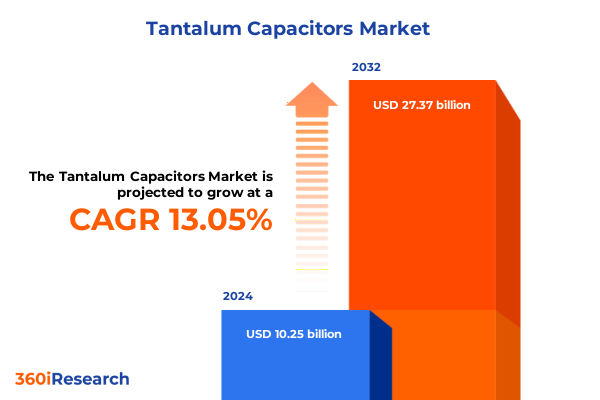

The Tantalum Capacitors Market size was estimated at USD 11.41 billion in 2025 and expected to reach USD 12.70 billion in 2026, at a CAGR of 13.31% to reach USD 27.37 billion by 2032.

Illuminating the Pivotal Function of Tantalum Capacitors in Enabling Miniaturized High-Reliability Electronic Applications

Tantalum capacitors represent a cornerstone in modern electronic design, prized for their high volumetric efficiency, superior reliability, and stable electrical performance under diverse operating conditions. These components deliver precise capacitance with minimal footprint, making them indispensable in high-density circuit applications across consumer electronics, automotive systems, and telecommunications infrastructure. Their inherent ability to maintain performance under temperature extremes and high-frequency operation has solidified their role in critical systems where failure is not an option, such as medical devices and aerospace controls.

As electronic devices continue to shrink in size while demanding ever-greater power efficiency and signal integrity, tantalum capacitors have emerged as a preferred solution for designers seeking compact, high-reliability components. Technological advancements in tantalum powder refinement, pellet processing, and conductive polymer formulations have further enhanced performance metrics, driving wider adoption in applications from portable medical monitors to next-generation 5G radios. The synergy between evolving end-market requirements and material innovations underscores the ongoing relevance of tantalum capacitors as a vital enabler of electronic miniaturization and robust performance.

Revolutionary Technological and Regulatory Forces Reshaping the Tantalum Capacitor Ecosystem for Next-Generation Electronics

The tantalum capacitors landscape is undergoing a transformative realignment driven by a convergence of technological imperatives and market demands. On one hand, the relentless drive toward miniaturization has spurred breakthroughs in dielectric purity, enabling thinner anode layers and smaller pellet sizes without sacrificing capacitance. Simultaneously, rising adoption of 5G networks has intensified requirements for capacitors capable of operating at higher frequencies with minimal losses, prompting manufacturers to refine conductive polymer chemistries and optimize electrode interfaces.

At the same time, the automotive sector’s accelerated shift toward electrification and advanced driver assistance systems has elevated the importance of capacitors that combine exceptional temperature tolerance with long-term stability. In parallel, heightened regulatory scrutiny around lead-free and RoHS-compliant materials has compelled suppliers to innovate environmentally sustainable alternatives without compromising electrical performance. Moreover, the proliferation of IoT devices has created a fragmented demand landscape in which ultra-low leakage and high-cycle-life capacitors are critical for battery-powered applications. Together, these forces are reshaping production processes, supply chain strategies, and R&D investment priorities across the tantalum capacitor ecosystem.

Analyzing How 2025 U.S. Tariff Measures on Tantalum Components Catalyze Supply Chain Diversification and Innovation

The cumulative impact of U.S. tariffs imposed in 2025 on tantalum capacitors and related raw materials has reverberated across global supply chains, prompting manufacturers and distributors to reevaluate sourcing strategies and cost structures. Following the announcement of increased duties under Section 301, many domestic and international producers experienced immediate cost escalations on imported precursors and finished components. This shift has accelerated the exploration of alternative sourcing regions and the expansion of localized manufacturing capabilities within North America.

In response to tariff pressures, several major capacitor manufacturers have announced strategic investments in U.S.-based production facilities to mitigate duty exposure and strengthen supply chain resilience. Meanwhile, end users have been compelled to renegotiate supplier agreements, absorb transitional cost burdens, or implement component redesigns to maintain budgetary constraints. Although these adjustments have introduced short-term complexity and expense, they have also spurred innovation in material substitution and process optimization. Over time, the realignment triggered by tariff measures is poised to create a more diversified manufacturing footprint and reduce overreliance on any single geographic source for critical tantalum materials.

Unveiling Detailed Insights into Product Type, Mounting, Application, Voltage, and Packaging Dynamics Influencing Tantalum Capacitor Demand

The tantalum capacitor market’s segmentation framework reveals nuanced performance and value propositions across distinct product categories. When examining types, solid anode capacitors continue to dominate applications requiring robust reliability and high capacitance density, while wet tantalum variations offer unique advantages in pulse discharge scenarios and high-voltage platforms. Mounting preferences further differentiate demand patterns, as surface-mount devices become essential for miniaturized consumer electronics whereas through-hole components retain relevance in industrial and legacy systems requiring mechanical robustness.

Diving into application segments highlights diverse requirements, with audio circuitry and timing networks emphasizing low equivalent series resistance and minimal leakage, while coupling and decoupling use cases drive demand for stable capacitance under dynamic load conditions. Power supply filtering demands remain significant, spanning both Dc-Dc converter modules that require tight ripple suppression and voltage regulator circuits that rely on capacitors to ensure steady output under varying loads. Voltage ratings also contribute critical distinctions, as low-voltage (<10V) parts address portable battery-operated devices, medium-voltage (10–50V) capacitors serve general industrial and automotive electronics, and high-voltage (>50V) variants cater to power electronics and specialized industrial applications. Finally, packaging formats influence procurement and assembly strategies, with bulk cartons favored by contract manufacturers, tape and reel enabling high-volume automated pick-and-place operations, and tray packaging supporting smaller volume runs and prototyping activities.

This comprehensive research report categorizes the Tantalum Capacitors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Mounting Type

- Voltage Rating

- Packaging

- Application

Exploring Regional Production Capacities, End-Market Drivers, and Regulatory Influences Across Americas, EMEA, and Asia-Pacific

Regional dynamics in the tantalum capacitor sector reflect the intersection of manufacturing capabilities, end-market demand, and trade policies across three key geographies. In the Americas, North American manufacturers have accelerated capacity expansions in response to reshoring incentives and tariff-driven cost pressures, while consumer electronics and automotive OEMs drive consistent demand for high-reliability components. Latin American markets, although smaller, demonstrate growing interest in power electronics and renewable energy applications, presenting new opportunities for capacitor suppliers focusing on grid-tied inverters and automotive electrification.

Across Europe, the Middle East, and Africa, stringent environmental regulations and advanced manufacturing ecosystems in Western Europe sustain robust demand for enhanced performance capacitors. The Middle East’s strategic investments in digital infrastructure and data centers create niche requirements for high-frequency filtering solutions, whereas Africa’s expanding telecommunications networks foster incremental uptake of mid-voltage and high-reliability variants. Meanwhile, the Asia-Pacific region remains the largest production hub, with established supply chains in East Asia and Southeast Asia catering to both local OEMs and global export markets. Rapid adoption of IoT devices in markets such as China, India, and Southeast Asia continues to stimulate demand for ultra-miniature surface-mount capacitors, while Japan and South Korea maintain leadership in advanced material innovations and high-end automotive electronics.

This comprehensive research report examines key regions that drive the evolution of the Tantalum Capacitors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing How Leading Suppliers and Agile Specialists Leverage Material Science, Strategic Partnerships, and M&A to Capture Market Leadership

The competitive landscape of the tantalum capacitor industry is shaped by established global suppliers and nimble specialists alike, each leveraging distinct strengths in technology, scale, or niche focus. Key leaders in the market have invested heavily in advanced material science, securing proprietary tantalum powder refining techniques and patented conductive polymer formulations that enhance performance under demanding operating conditions. These companies maintain broad product portfolios spanning diverse voltage ratings and packaging options, supported by extensive manufacturing footprints across North America, Europe, and Asia.

In parallel, specialized suppliers have carved out competitive advantages by targeting high-growth application segments, such as automotive electrification and aerospace systems, where tailored capacitor designs must meet rigorous qualification standards. Strategic partnerships between component producers and OEMs are increasingly common, aimed at co-developing next-generation solutions that integrate seamlessly with novel circuit architectures. Additionally, mergers and acquisitions activity has fortified the capabilities of certain players, enabling them to expand production capacity and broaden geographical reach. As the market evolves, differentiation through technical excellence, supply chain agility, and customer collaboration will remain critical success factors for industry participants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tantalum Capacitors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cornell Dubilier Electronics, Inc.

- Exxelia SAS

- Hongda Electronics Co., Limited

- Hunan Huadan New Materials Co., Ltd.

- Hunan Xiangyee Electronic Technology Co., Ltd.

- Kingtronics International Company

- KYOCERA AVX Components Corporation

- Mallory Sonalert Products, Inc.

- Matsuo Electric Co.,Ltd.

- NIC Components Corp.

- Panasonic Holdings Corporation

- Quantic Electronics, LLC

- RFE International, Inc.

- Samsung Electro-Mechanics Co., Ltd.

- Semec Technology Company Limited

- Shanghai Green Tech Co.,Ltd.

- Shanghai Jinpei Electronics Co., Ltd.

- Shenzhen Be-Top Electronic Components Co., Ltd.

- Shenzhen Lichip Electronic Co., Ltd.

- Shenzhen Sunlord Electronics Co.,Ltd.

- Sino Capacitors Industrial Co., Ltd.

- Suntan Technology Company Limited

- Suntsu Electronics, Inc.

- Synton-Tech Corporation

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Topdiode Manufacturing Company Limited

- Venkel Ltd.

- Vicor Corporation

- Vishay Intertechnology, Inc.

- Welon Electronic Enterprise Corp.

- Yageo Corporation

- ZXcompo

Implementing Integrated Strategies in Manufacturing Localization, R&D Investment, and Collaboration for Sustainable Competitive Advantage

To navigate the evolving tantalum capacitor ecosystem effectively, industry leaders should prioritize strategies that balance cost, innovation, and supply chain resilience. Investing in localized manufacturing or strategic partnerships with regional fabricators can mitigate tariff impacts and reduce lead times, while pursuing vertical integration opportunities in tantalum powder production enhances control over raw material quality and availability. Simultaneously, allocating resources to R&D in next-generation dielectric and polymer technologies will enable differentiation through improved performance metrics, addressing the increasingly stringent requirements of 5G, automotive electrification, and aerospace applications.

Collaboration with end customers on joint application development can accelerate product validation cycles and ensure capacitor designs align with emerging circuit topologies. Furthermore, implementing robust regulatory compliance frameworks for environmental standards and traceability strengthens market credibility and minimizes risk exposure in highly regulated industries. Finally, developing data-driven demand forecasting and inventory management tools will enable companies to respond dynamically to market fluctuations, reducing excess stock and optimizing production schedules. By integrating these actionable approaches, organizations can build a resilient, innovation-focused strategy that delivers sustainable competitive advantage in the tantalum capacitor sector.

Combining Executive Interviews, Technical Publications, and Supply Chain Mapping to Ensure Rigorous and Reliable Market Insights

This research synthesizes insights from a comprehensive multi-phase approach combining primary and secondary data sources. The primary phase entailed in-depth interviews with senior executives at capacitor manufacturers, raw material suppliers, and key end users across automotive, telecommunications, and consumer electronics sectors. These qualitative discussions provided nuanced perspectives on supply chain challenges, R&D priorities, and regulatory compliance strategies.

Concurrently, the secondary phase encompassed rigorous analysis of industry publications, technical white papers, patent filings, and publicly disclosed corporate presentations. Data triangulation techniques were employed to validate findings across information streams, ensuring consistency and reliability. In addition, bespoke supply chain mapping was conducted to identify critical nodes and potential bottlenecks, while segmentation analyses drew on proprietary usage data and application-specific performance benchmarks. The integration of qualitative and quantitative methodologies underpins the robustness of this study’s conclusions and supports informed decision-making for stakeholders in the tantalum capacitor market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tantalum Capacitors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tantalum Capacitors Market, by Type

- Tantalum Capacitors Market, by Mounting Type

- Tantalum Capacitors Market, by Voltage Rating

- Tantalum Capacitors Market, by Packaging

- Tantalum Capacitors Market, by Application

- Tantalum Capacitors Market, by Region

- Tantalum Capacitors Market, by Group

- Tantalum Capacitors Market, by Country

- United States Tantalum Capacitors Market

- China Tantalum Capacitors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Technological, Regulatory, and Strategic Perspectives to Guide Future-Focused Decisions in the Tantalum Capacitor Industry

This executive summary has illuminated the dynamic forces shaping the tantalum capacitor industry, from technological breakthroughs and tariff-induced supply chain realignments to detailed segmentation and regional demand patterns. By understanding how solid and wet tantalum types, mounting configurations, application requirements, voltage ratings, and packaging formats interact across global geographies, stakeholders can identify high-opportunity niches and anticipate areas of supply risk. The ongoing transformation driven by miniaturization, 5G proliferation, automotive electrification, and sustainability imperatives underscores the necessity of strategic agility.

Moving forward, companies that invest in localized capabilities, nurture collaborative R&D partnerships, and deploy advanced data analytics for forecasting will be well-positioned to thrive. As the industry continues to evolve, maintaining a balanced focus on innovation, operational excellence, and regulatory compliance will be essential. This synthesized analysis provides a comprehensive foundation for informed decision-making and strategic planning, empowering organizations to harness the full potential of the tantalum capacitor landscape.

Contact Ketan Rohom for Exclusive Access to a Comprehensive Tantalum Capacitors Market Report and Unlock Strategic Growth Opportunities

Elevate strategic decision-making and secure unparalleled insights by reaching out to Ketan Rohom, whose expertise in sales and marketing can guide you toward integrating the most comprehensive analysis available in the tantalum capacitors sector into your organization’s growth trajectory. Empower your team with an in-depth understanding of how emerging shifts, regulatory landscapes, segmentation nuances, and regional dynamics intersect to influence supply chains, product development cycles, and customer adoption trends. By partnering with Ketan Rohom, you will unlock exclusive access to detailed qualitative interviews, proprietary supply chain intelligence, and actionable strategic frameworks that will position your company to capitalize on market opportunities and mitigate potential risks. Don’t miss the chance to transform raw data into a cohesive, actionable playbook curated to your unique organizational needs. Connect with Ketan Rohom today to acquire the full market research report and begin charting a path toward sustainable competitive advantage in the evolving tantalum capacitor industry

- How big is the Tantalum Capacitors Market?

- What is the Tantalum Capacitors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?